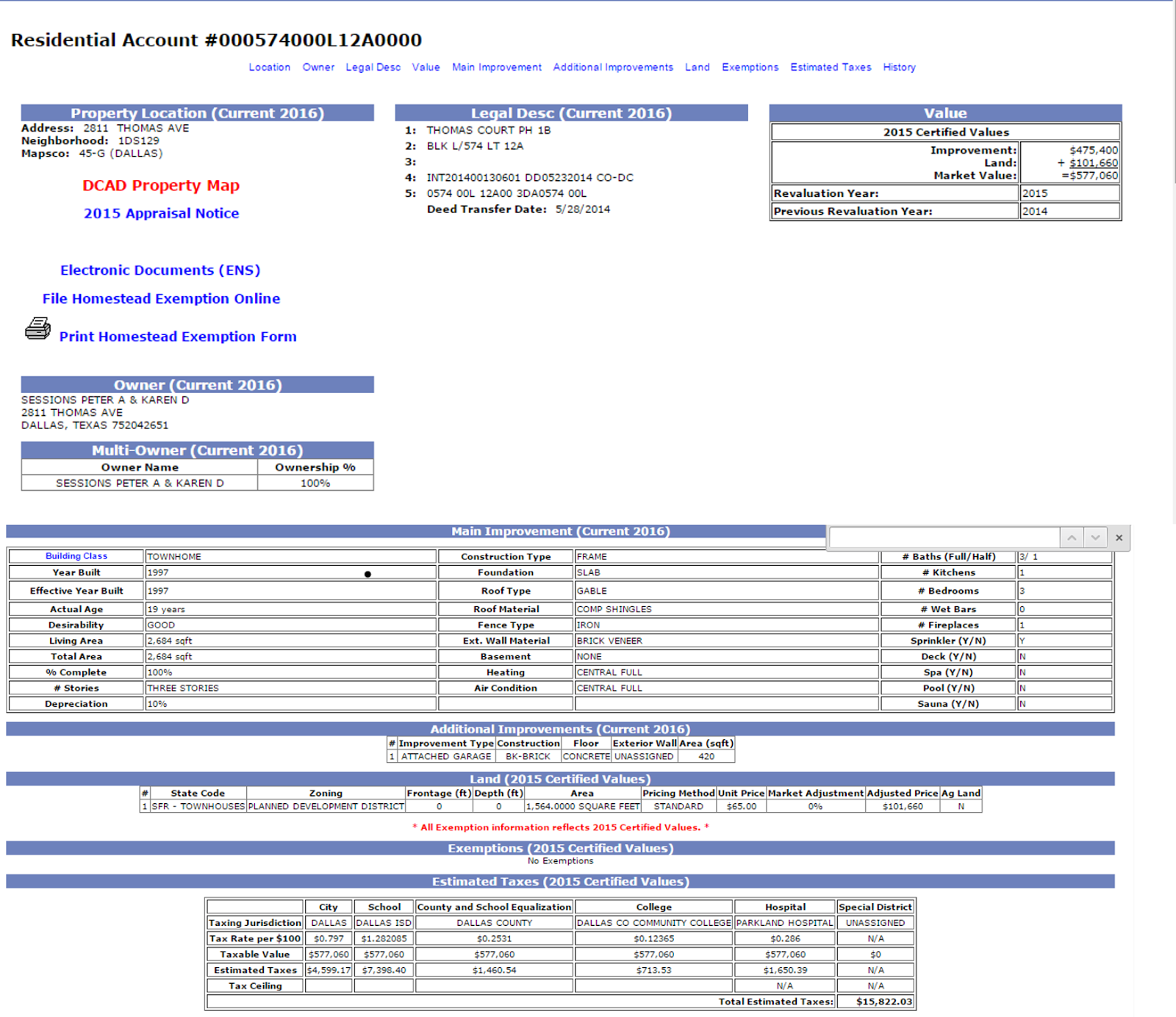

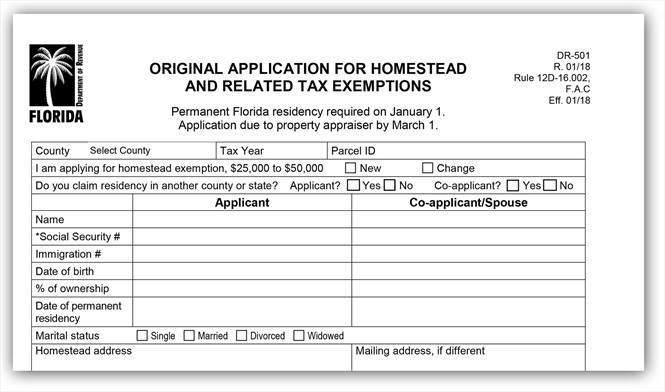

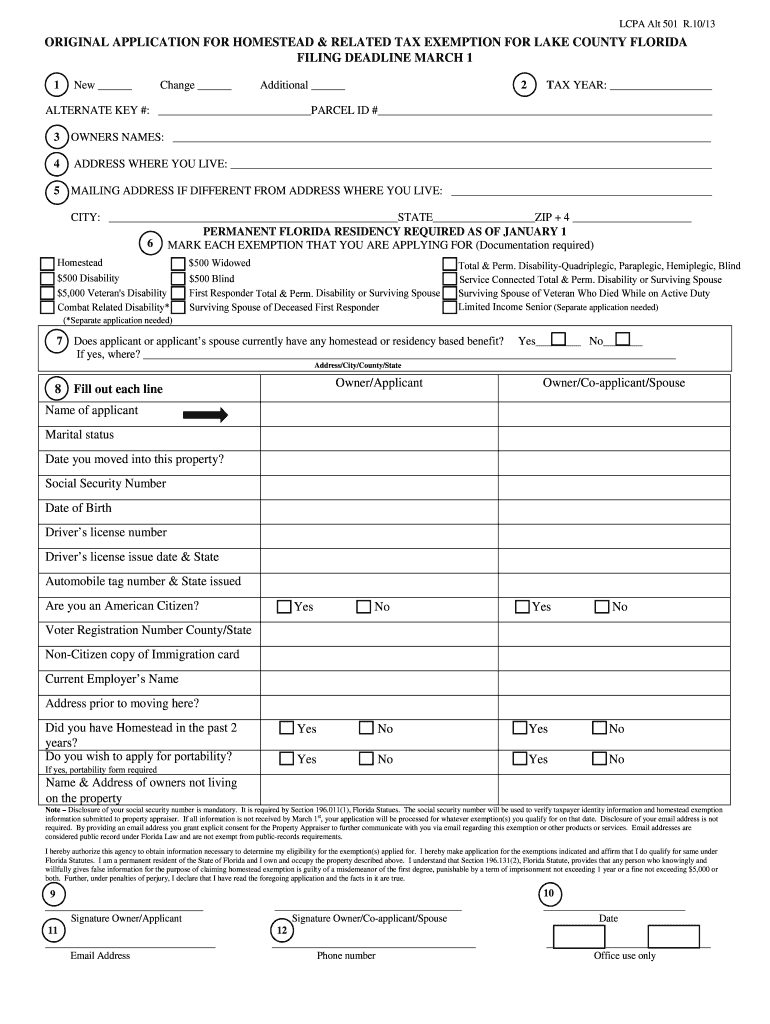

Florida Homestead Exemption Application Deadline When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption up to 50 000 The first 25 000 applies to all property taxes including school district taxes

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year This application is known as the Transfer of Homestead Assessment Difference and the annual deadline to file for this benefit and any other property tax exemption is March 1st First time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference Portability can file online

Florida Homestead Exemption Application Deadline

Florida Homestead Exemption Application Deadline

https://i.ytimg.com/vi/QXPFtfP_0fU/maxresdefault.jpg

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

https://lakelandfloridaliving.com/wp-content/uploads/2021/09/Things-To-Know-About-Florida-Homestead-Exemption-663x1024.png

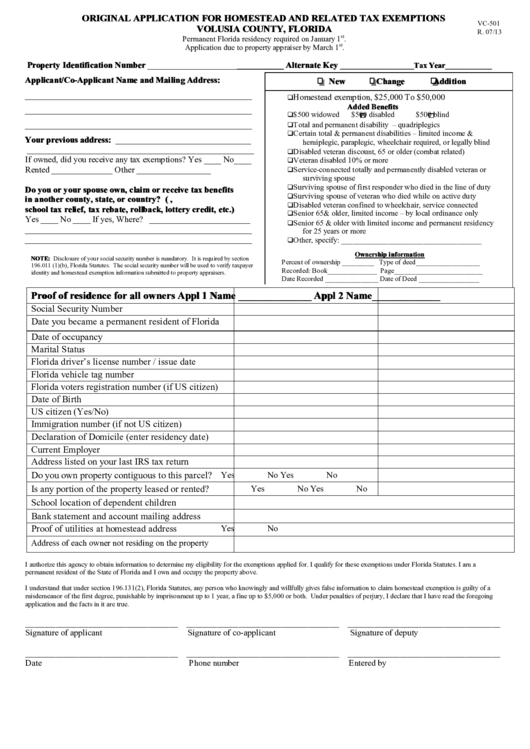

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

The application for Homestead Exemption can be completed electronically on the Hillsborough County Property Appraiser s website To apply homeowners must establish Hillsborough County as their legal domicile and reside on the property as If you own and occupy property as your primary residence as of January 1 2025 you may qualify for an exemption The deadline to file a 2025 exemption application is March 1 2025 Click Here To Apply for Homestead and Other Exemptions Online

The deadline to submit a homestead and all exemption applications is March 1 following the year of your home purchase After March 1 you must also complete the Property Tax Exemption Extenuating Circumstances form along with the application Our online exemption application login process has changed as of February 1 2021 If you currently are in possession of a username and password you will no longer need it to start your online application Please see below for the new login process involving Parcel ID number and email address

Download Florida Homestead Exemption Application Deadline

More picture related to Florida Homestead Exemption Application Deadline

-1920w.jpg)

Florida Homestead Exemption What You Should Know

https://lirp.cdn-website.com/17d53756/dms3rep/multi/opt/Homestead+exemption+(2)-1920w.jpg

Homestead Reminder Shayla Twit

https://www.sarasotarealestatesold.com/wp-content/uploads/2021/12/GaY66es9TaScia2JjL6t_DONT-Forget.png

Florida Homestead Exemption Form Broward County ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/befuddled-by-the-clowns-pete-sessions-the-florida-homesteader-1.png

April 20 2021 Share this article Understanding Florida s Homestead Exemption Laws By Blake F Deal III Esq for Florida Realtor magazine Florida s homestead laws are one of the many attractive features of living in the Sunshine State Here s what you need to know about how they work The deadline to file an exemption application is March 1 Am I Eligible to File for Homestead Exemption In order to be eligible for a Homestead Exemption you must meet the following requirements as of January 1 Legal or beneficial title to the property recorded in the Oficial Records of Orange County Reside on the property

Last Updated March 5 2023 Approved The homestead exemption in Florida can save you hundreds of dollars in property taxes if you are a permanent Florida resident If you qualify you can reduce the assessed value of your homestead up to 50 000 You may file anytime during the year but before the state s deadline of March 1 for the tax year in which you wish to qualify However you are urged to file as soon as possible once you own occupy and make that home your legal residence

What Are The Filing Requirements For The Florida Homestead Exemption

https://usdaloanpro.com/wp-content/uploads/2020/12/What-are-the-filing-requirements-for-the-Florida-Homestead-Exemption-1024x536.jpg

Homestead Exemption Deadline Is March 1

https://i.pinimg.com/originals/88/53/84/88538491669e6a4264010dd64356a3cb.png

https://floridarevenue.com/property/documents/pt113.pdf

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption up to 50 000 The first 25 000 applies to all property taxes including school district taxes

https://floridarevenue.com/property/pages/taxpayers_exemptions.aspx

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year

The Fund 2019 Florida Homestead Exemption

What Are The Filing Requirements For The Florida Homestead Exemption

How To Apply For A Homestead Exemption In Florida 15 Steps

Florida Homestead Tax Exemption Form ExemptForm

Florida Property Tax Homestead Exemption Form ExemptForm

Homestead Exemption Florida Oppenheim Law

Homestead Exemption Florida Oppenheim Law

Florida Homestead Exemption Explained YouTube

Application For Homestead Exemption Form Seminole County Property

Florida Homestead Exemptions Some Interesting Facts About Florida

Florida Homestead Exemption Application Deadline - Dates to apply Applications are taken year round The statutory filing deadline is March 1 with late filed applications taken up to the 25th day after the mailing of the yearly Notice of Proposed Property Taxes TRIM which is typically mailed in August