Foreigner Need To Pay Tax In Malaysia Web You are non resident under Malaysian tax law if you stay less than 182 days in Malaysia in a year regardless of your citizenship or nationality Non resident individual is taxed at a different tax rate on income earned received from Malaysia

Web 3 Apr 2023 nbsp 0183 32 Foreigners who qualify as tax residents follow the same tax guidelines progressive tax rate and relief as Malaysians and are required to file income tax under Form B Non residents are taxed a flat rate based on their types of income How to file your income tax Non residents filing for income tax can do so using the same method as Web 30 Dez 2022 nbsp 0183 32 What is a Tourism Tax Tourism Tax TTx is referred to as a tax charged for all foreign passport holders at accommodations premises collected by the operators effective from 1st September 2017 in Malaysia It is

Foreigner Need To Pay Tax In Malaysia

Foreigner Need To Pay Tax In Malaysia

https://static.wixstatic.com/media/34b1e8_6f4fdad3abb44f32a67a2d8f26f8748a~mv2.png/v1/fill/w_980,h_980,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/34b1e8_6f4fdad3abb44f32a67a2d8f26f8748a~mv2.png

Do Foreigners Need To Pay Tax In Malaysia

https://static.wixstatic.com/media/34b1e8_2ba2324f698a4d93826567c7ccaf75d7~mv2.png/v1/fill/w_980,h_980,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/34b1e8_2ba2324f698a4d93826567c7ccaf75d7~mv2.png

Do Foreigners Need To Pay Tax In Malaysia

https://static.wixstatic.com/media/34b1e8_efffde243c834ee3ac92bd96a59f2158~mv2.jpg/v1/fill/w_1000,h_733,al_c,q_85,usm_0.66_1.00_0.01/34b1e8_efffde243c834ee3ac92bd96a59f2158~mv2.jpg

Web 27 Jan 2022 nbsp 0183 32 Today we will answer some of the recurring questions about whether foreigners need to pay income tax in Malaysia The answer is YES but do note that there are 5 categories of tax structure with varying tax rates depending on the entity and income type Check out what are the 5 categories below Have more questions on this topic Web 15 M 228 rz 2023 nbsp 0183 32 Do You Need To Pay Income Tax Image Bloomberg Anyone earning more than RM34 000 per annum about RM2 833 33 per month after EPF deductions will need to register as a taxpayer with a tax file

Web 9 Feb 2022 nbsp 0183 32 If taxable you are required to fill in M Form Foreigners with a non resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income As a non resident you re are also not eligible for any tax deductions Web 29 Apr 2022 nbsp 0183 32 Foreign source income budget 2022 announcement Does my residency status impact where I pay tax Malaysian tax residents what income is taxable Getting paid in a foreign currency from a company overseas Getting paid in a foreign currency remitting money to MYR Save 3x on conversion fees when paid abroad Wise

Download Foreigner Need To Pay Tax In Malaysia

More picture related to Foreigner Need To Pay Tax In Malaysia

Do Foreigners Need To Pay Tax In Malaysia

https://static.wixstatic.com/media/34b1e8_e8fc8ff60b8a47bab2be88e96212d358~mv2.png/v1/fill/w_980,h_980,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/34b1e8_e8fc8ff60b8a47bab2be88e96212d358~mv2.png

Do Foreigners Need To Pay Tax In Malaysia

https://static.wixstatic.com/media/34b1e8_6f19508183a14449b65c91749a687005~mv2.png/v1/fill/w_980,h_980,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/34b1e8_6f19508183a14449b65c91749a687005~mv2.png

PTA Tax Price On IPhone 14 Series For March 2023

https://dnd.com.pk/wp-content/uploads/2023/03/Apple-Event-2022-iphone-14-pro-price-jpg.webp

Web 5 1 Foreign income received in Malaysia by a resident 5 1 1 Effective from 1 January 2022 generally all types of foreign income received in Malaysia by a resident is subject to tax 5 1 2 The list of foreign income which is subject to this tax treatment according to Section 4 of the ITA 1967 are as follows Web Malaysian professionals returning from abroad to work in Malaysia would be taxed at a rate of 15 for the first five consecutive years following the professional s return to Malaysia under the Returning Expert Programme REP

Web 22 Sept 2022 nbsp 0183 32 If you are a foreigner who has stayed and worked in Malaysia for more than 182 days during the calendar year you have a resident status and your income will be taxable under normal Malaysian tax laws This also apples to local employees Expatriates who are categorized as a resident for tax purposes will pay the progressive tax Web 10 M 228 rz 2022 nbsp 0183 32 Do foreigners who are working in Malaysia need to pay tax Yes like Malaysian nationals all foreigners who have been employed in Malaysia for over 182 days are eligible to be taxed under standard Malaysia income tax laws and rates

Do Expats Pay Tax In Malaysia YouTube

https://i.ytimg.com/vi/hWXS8tkpfOU/maxresdefault.jpg

Do Students Pay Tax Think Student

https://thinkstudent.co.uk/wp-content/uploads/2022/11/pexels-nataliya-vaitkevich-6863248-1-1024x682.jpg

https://www.hasil.gov.my/en/international/non-resident

Web You are non resident under Malaysian tax law if you stay less than 182 days in Malaysia in a year regardless of your citizenship or nationality Non resident individual is taxed at a different tax rate on income earned received from Malaysia

https://www.imoney.my/.../income-tax-guide-malaysia/income-tax-foreigner

Web 3 Apr 2023 nbsp 0183 32 Foreigners who qualify as tax residents follow the same tax guidelines progressive tax rate and relief as Malaysians and are required to file income tax under Form B Non residents are taxed a flat rate based on their types of income How to file your income tax Non residents filing for income tax can do so using the same method as

Png PNGEgg

Do Expats Pay Tax In Malaysia YouTube

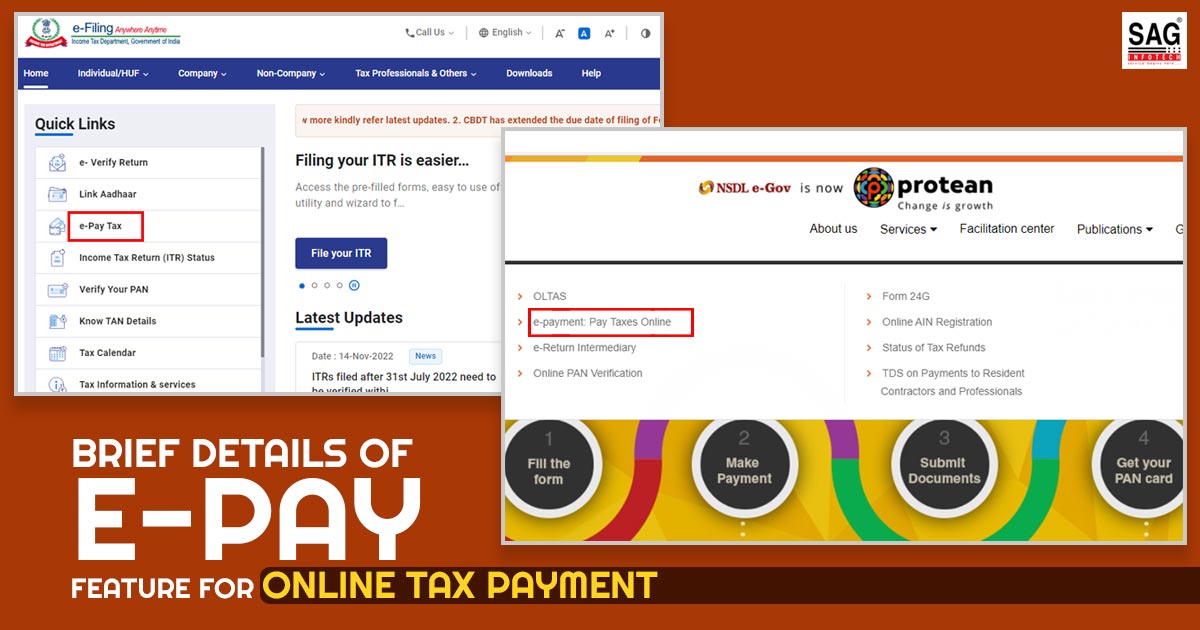

All About E pay Tax Feature With Online Payment Procedure

Window To Enjoy Tax Reliefs Closing CN Advisory

Ilustraci n De Icono 3d De Impuestos 11107351 PNG

How To Transfer Money From Prepaid Card To Bank Account

How To Transfer Money From Prepaid Card To Bank Account

How Long Does The IRS Give You To Pay What You Owe Leia Aqui How Long

Tax Rules For Charities And Not For Profit Organisations By Rajesh

No Tax WPT Cambodia 2024

Foreigner Need To Pay Tax In Malaysia - Web 23 Dez 2021 nbsp 0183 32 Under the Finance Bill FSI received in Malaysia between Jan 1 2022 until June 30 2022 by all tax residents including individuals and companies will be taxed at 3 on a gross basis The tax rate on FSI received after this period will be the prevailing tax rates for resident individuals and companies The proposal as it stands covers all