Form For Child Care Tax Credit To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income tax return In

Go to www irs gov Form2441 for instructions and the latest information You can t claim a credit for child and dependent care expenses if your filing status is married filing separately unless If Dependent Care Benefits are listed in Box 10 of a Form W 2 Wage and Tax Statement then the taxpayer MUST complete Form 2441 Child and Dependent Care Expenses If Form 2441

Form For Child Care Tax Credit

Form For Child Care Tax Credit

https://www.sittercity.com/wp-content/uploads/2020/02/GettyImages-1180592592-1-scaled-e1581105297103.jpg

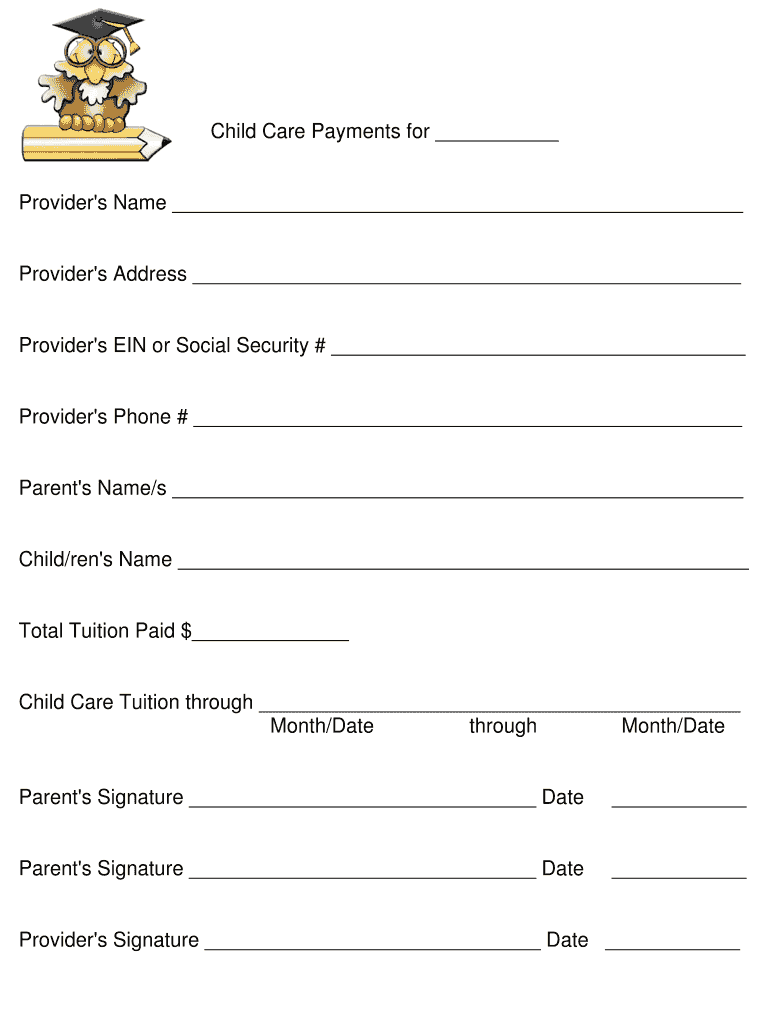

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Tuition

https://i.etsystatic.com/23403566/r/il/69a95f/3736849799/il_1588xN.3736849799_qvr5.jpg

The Child Tax Credit ZOBUZ

https://i0.wp.com/zobuz.com/wp-content/uploads/2020/05/The-Child-Tax-Credit.jpg

The child and dependent care tax credit is temporarily expanded for 2021 The expenses are increased to 8 000 in the case of one qualifying individual and to 16 000 if there are two or Form 2441 is an IRS form used to report child or dependent care expenses on your US expat tax return Using this form you can claim a tax credit for costs paid to a caregiver or

To claim the credit taxpayers must complete Form 2441 a two page document that reports child and dependent care expenses as part of a federal income tax return and is used to determine the amount of child and Do you pay someone to care for your child or another dependent while you work or look for work If so you could qualify for the Child and Dependent Care Credit CDCC a tax break that can help you offset the cost

Download Form For Child Care Tax Credit

More picture related to Form For Child Care Tax Credit

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

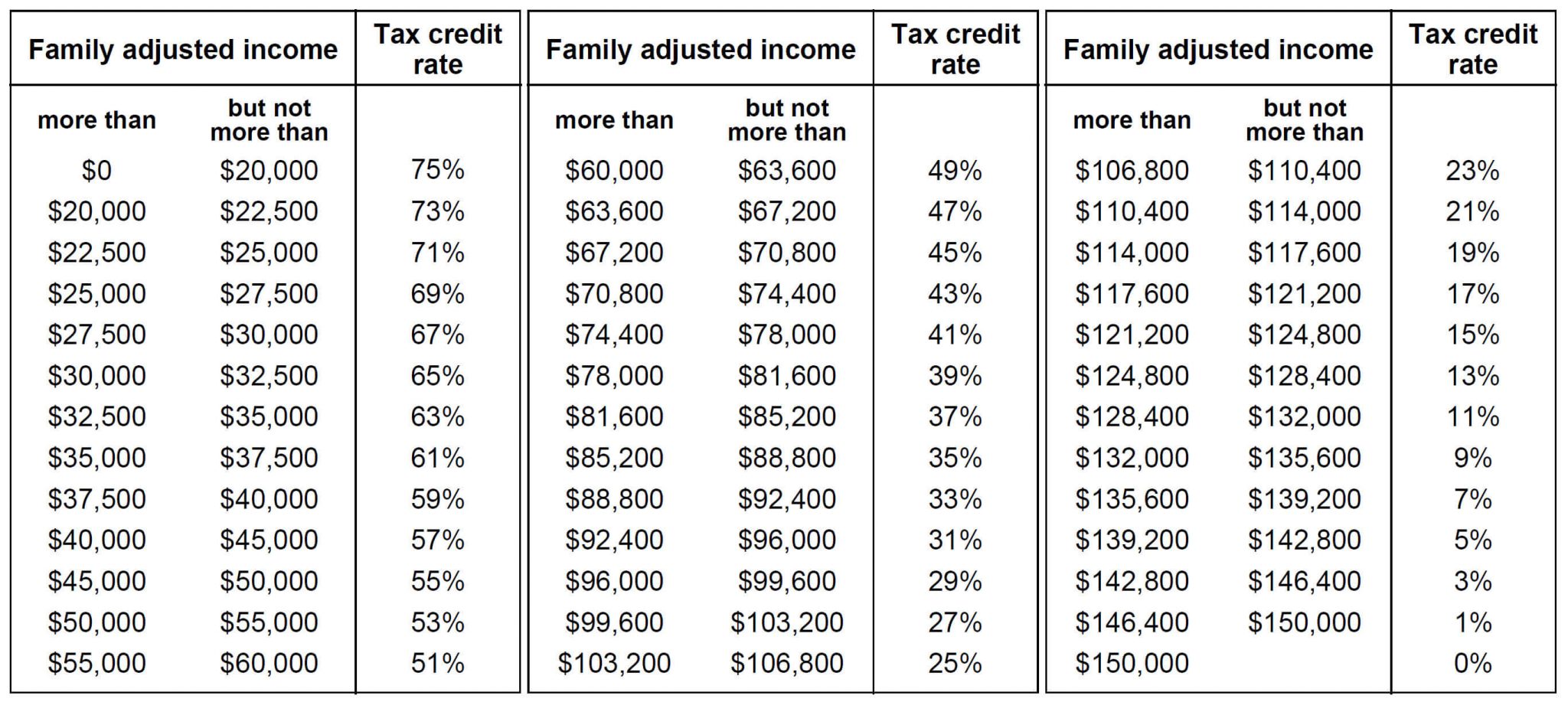

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://cdn.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-2048x917.jpg

FSA Or Tax Credit Which Is Best To Save On Child Care

https://blog.havenlife.com/wp-content/uploads/2018/06/FSA-or-tax-credit_-Which-is-best-to-save-on-child-care_.jpg

If you hire someone to care for a dependent or your disabled spouse and you report income from employment or self employment on your tax return you may be able to take the credit for child and dependent care Form 2441 is used to calculate and claim the Child and Dependent Care Credit This credit is designed to help taxpayers with the costs of childcare or care for other dependents allowing them to work look for employment or attend

Complete Form 2441 Child and Dependent Care Expenses and attach it to your Form 1040 to claim the Child and Dependent Care Credit When you claim the CDCC on your tax return you If you paid someone to care for your child or other qualifying person so you or your spouse if filing jointly could work or look for work in 2024 you may be able to take the credit for child

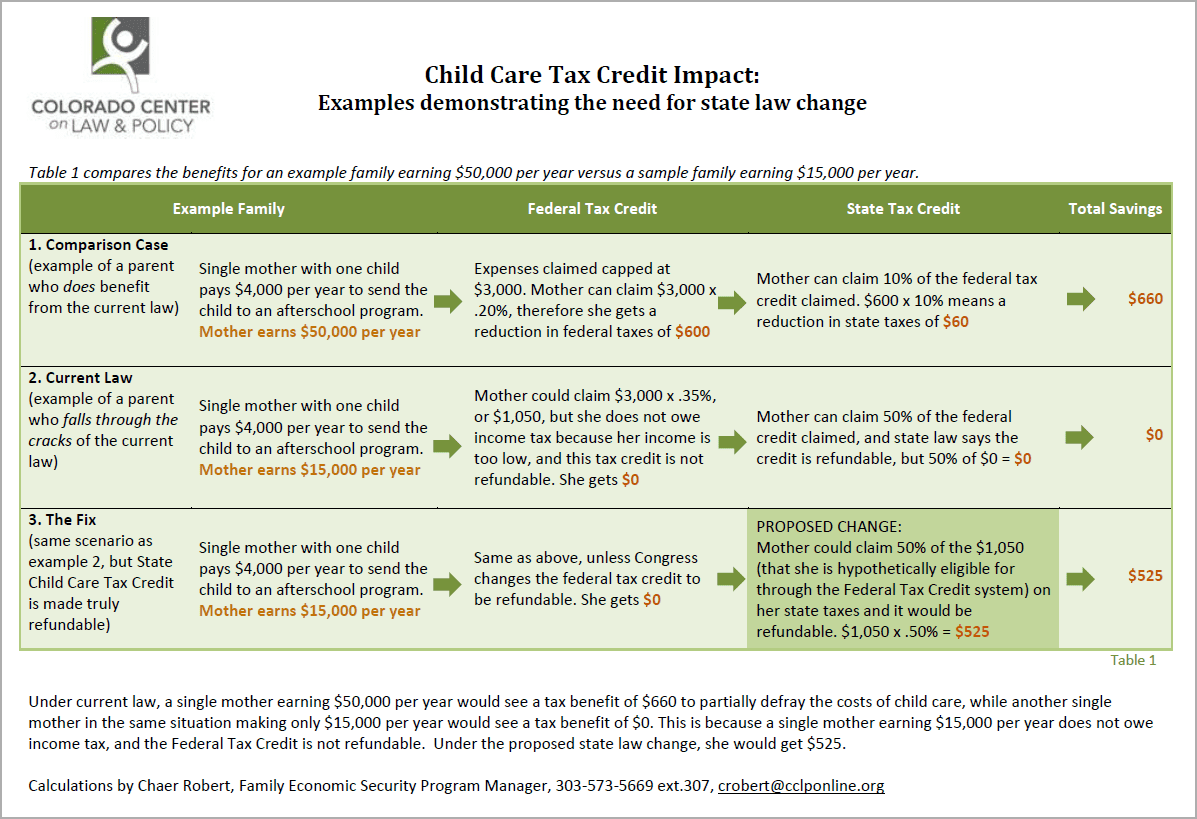

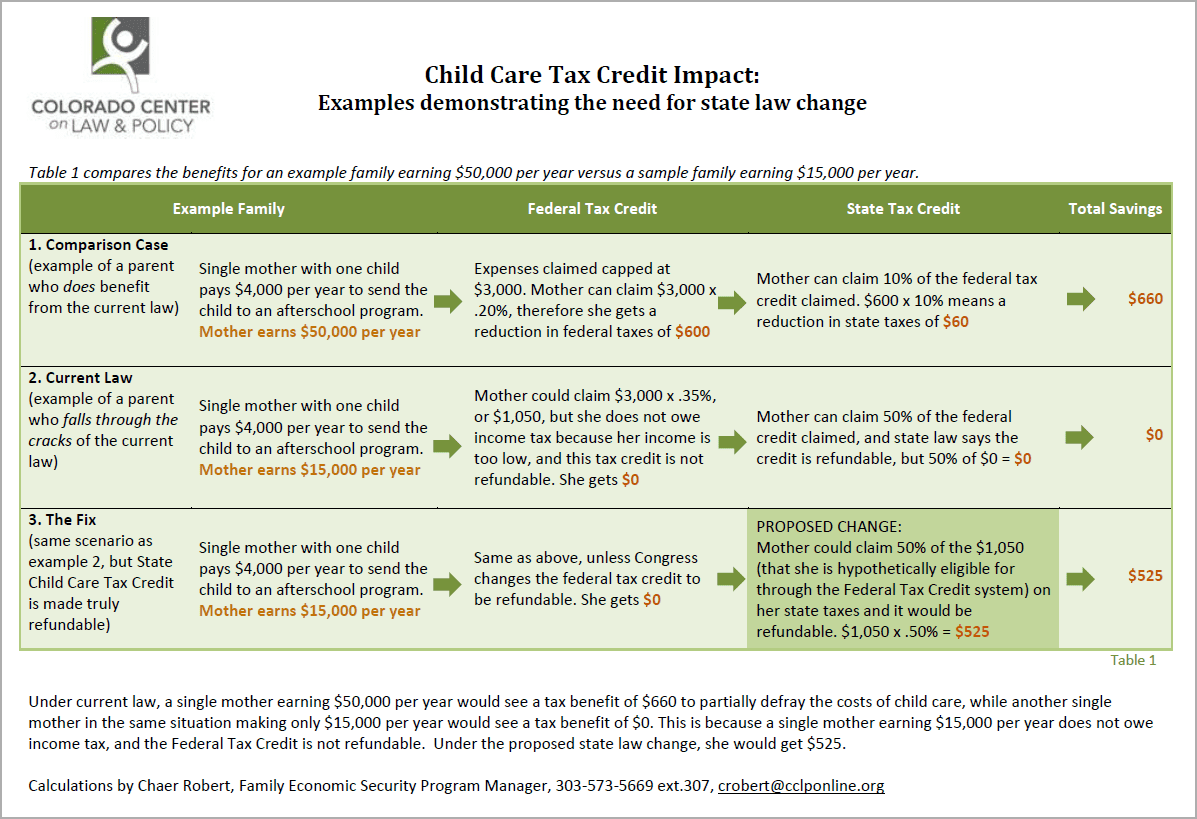

Fixing The Child Care Tax Credit EOPRTF CCLP

http://cclponline.org/wp-content/uploads/2014/02/Child-Chare-Tax-Credit-Impact-Chart.png

Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

https://www.irs.gov › newsroom › child-and-dependent-care-credit-faqs

To claim the credit you will need to complete Form 2441 Child and Dependent Care Expenses and include the form when you file your Federal income tax return In

https://www.irs.gov › pub › irs-pdf

Go to www irs gov Form2441 for instructions and the latest information You can t claim a credit for child and dependent care expenses if your filing status is married filing separately unless

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

Fixing The Child Care Tax Credit EOPRTF CCLP

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

Dependent And Child Care Credits Tax Policy Center

Daycare Tax Statement PDF Form Fill Out And Sign Printable PDF

Child And Dependent Care Credit LO 7 3 Calculate Chegg

Child And Dependent Care Credit LO 7 3 Calculate Chegg

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

Do I Get Child Tax Credit If I Don t Work Leia Aqui Can A Stay At

What Is The Phase Out For Dependent Care Credit Latest News Update

Form For Child Care Tax Credit - Form 2441 is filed with your federal tax return to claim credits and report expenses related to child and dependent care This form is essential for taxpayers who incur costs caring for