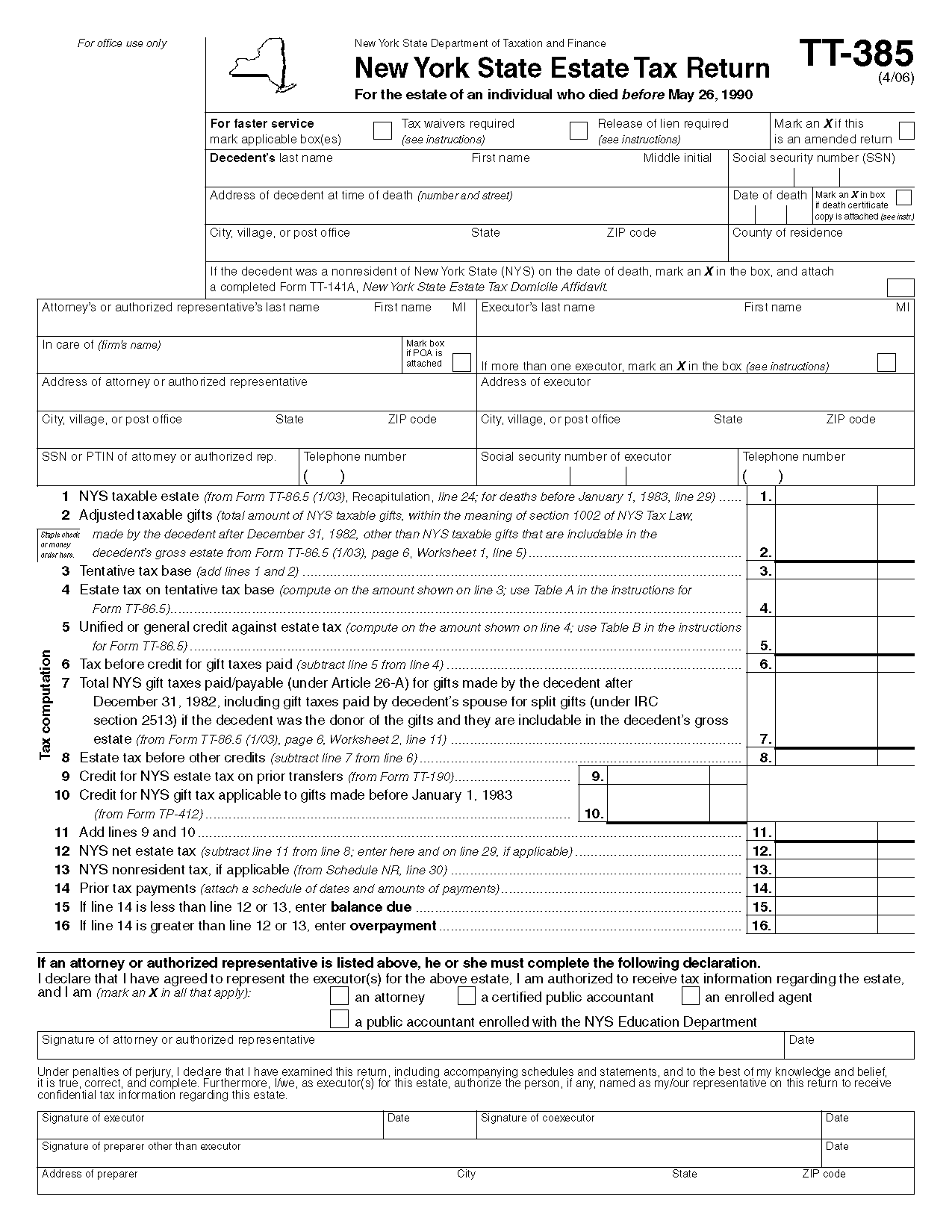

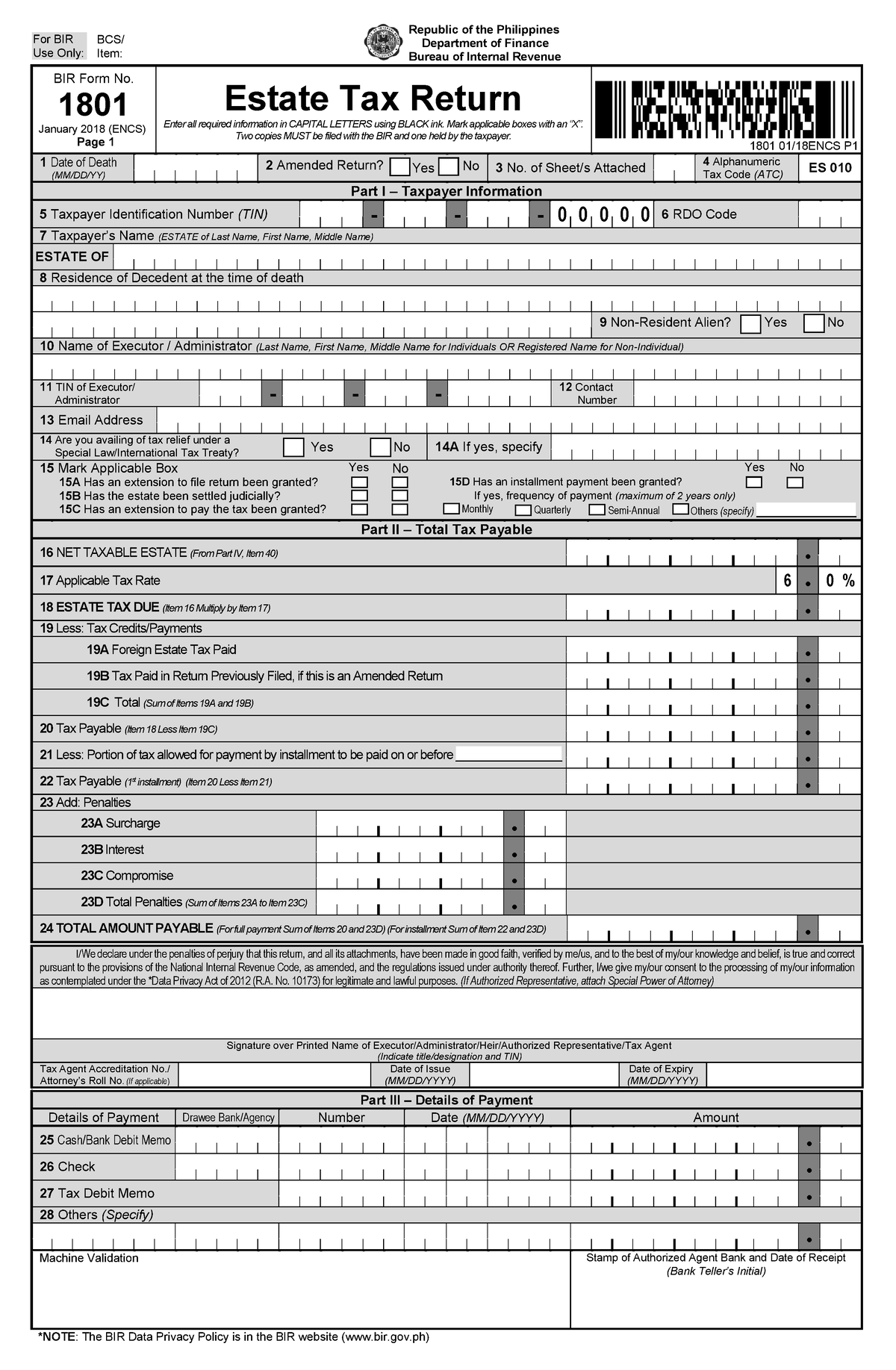

Form For Estate Tax Return Information about Form 706 United States Estate and Generation Skipping Transfer Tax Return including recent updates related forms and instructions on how to file Form

Information about Form 1041 U S Income Tax Return for Estates and Trusts including recent updates related forms and instructions on how to file Form 1041 is used by a IRS Form 706 also known as the United States Estate and Generation Skipping Transfer Tax Return is used to report the value of a deceased individual s

Form For Estate Tax Return

Form For Estate Tax Return

https://www.lumina.com.ph/assets/news-and-blogs-photos/A-Beginners-Guide-to-Estate-Tax/A-Beginners-Guide-to-Estate-Tax.webp

Real Estate Agents Self Employment Tax Blog OvernightAccountant

https://overnightaccountant.com/images/uploads/misc_files/tax-return.jpg

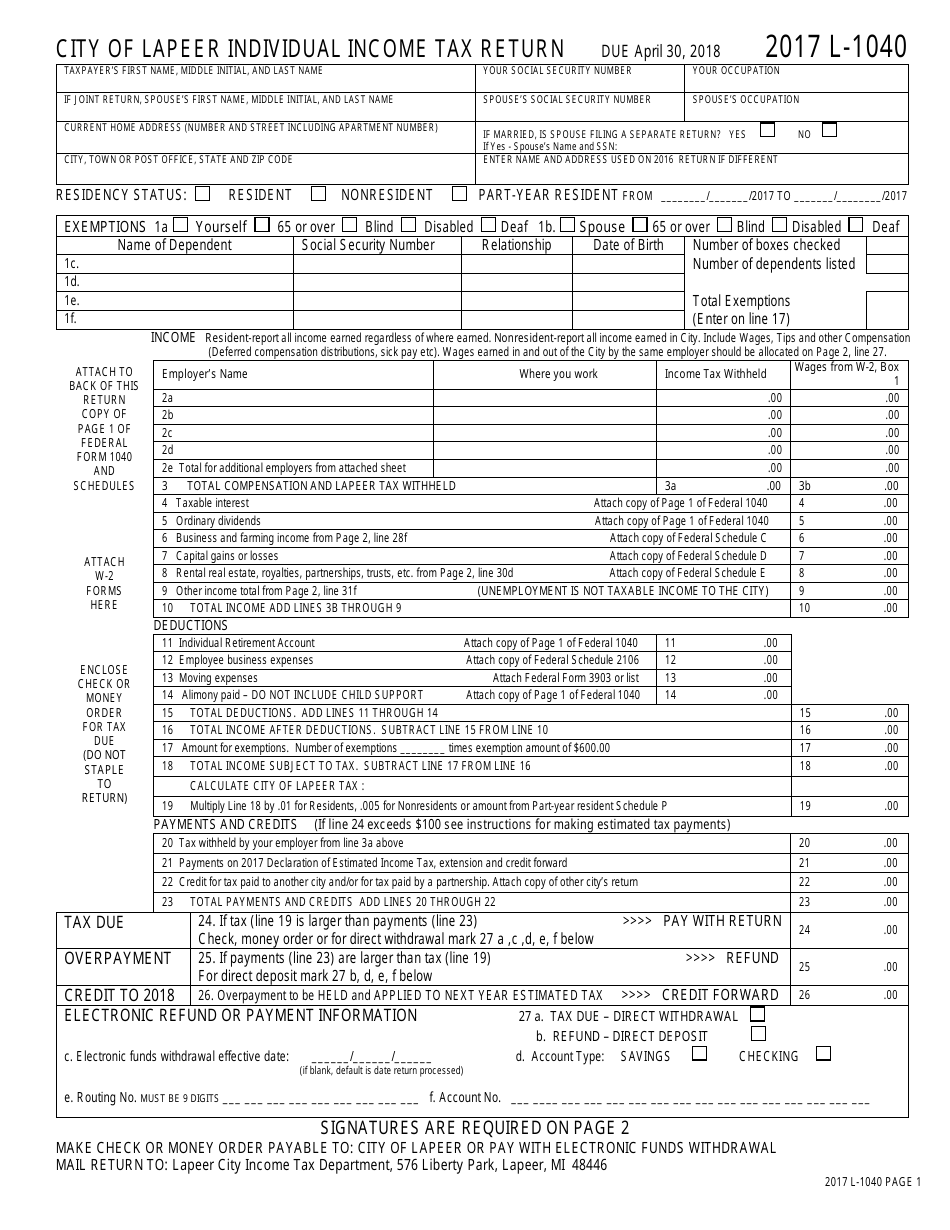

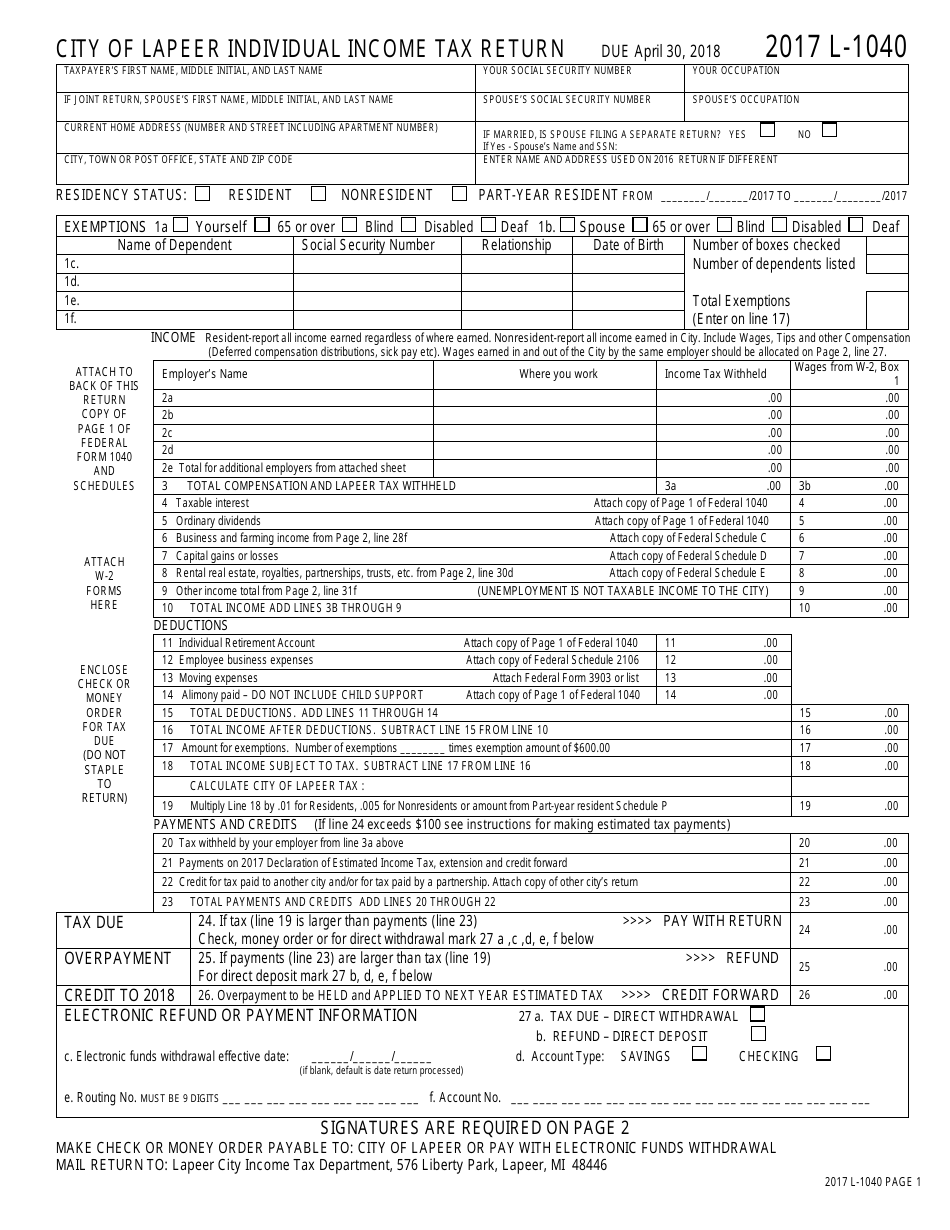

SOLUTION US Individual Income Tax Return Form Studypool

https://sp-uploads.s3.amazonaws.com/uploads/services/1990912/20210729221930_61032972c63ec_2020_taxreturn__6_page0.png

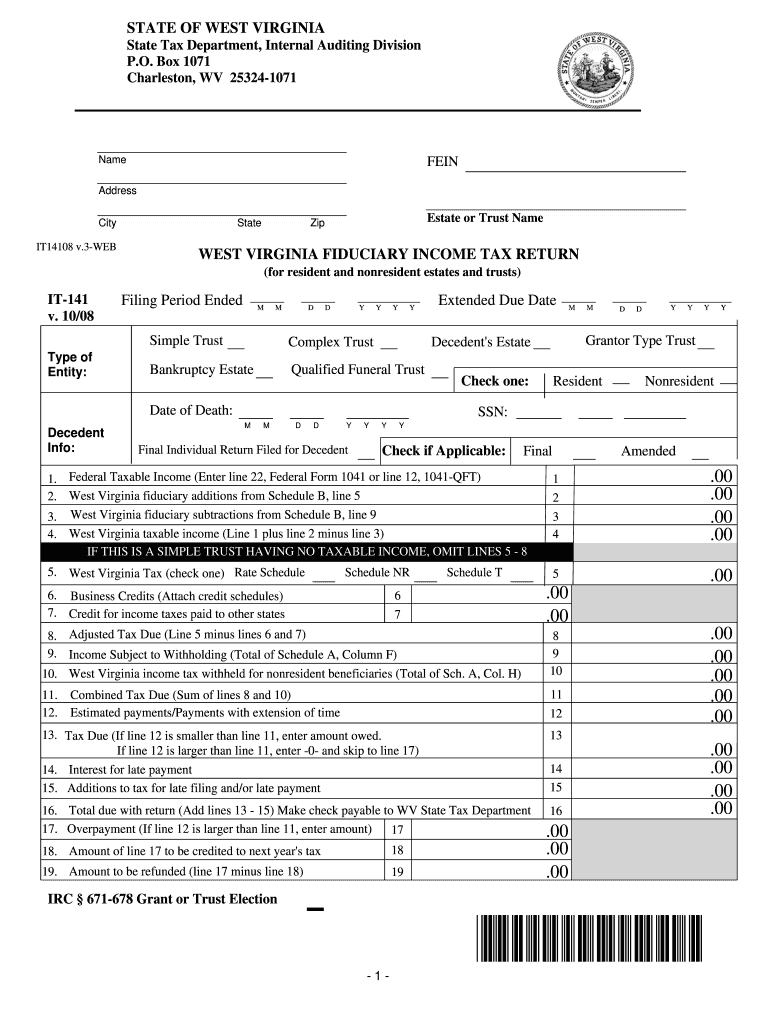

Find out how to send your Self Assessment tax return online Include any relevant supplementary pages with your SA900 Trust and Estate Tax Return Email Form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries The executor

For income year 4 and later income years you must lodge a trust tax return if the deceased estate earns any income including capital gains You can lodge a trust IRS Form 1041 is used to declare the income of an estate or trust but it s not a substitute for filing personal income taxes on behalf of a deceased person

Download Form For Estate Tax Return

More picture related to Form For Estate Tax Return

Income Tax Return

https://filipiknow.net/wp-content/uploads/2020/01/income-tax-return-3.jpg

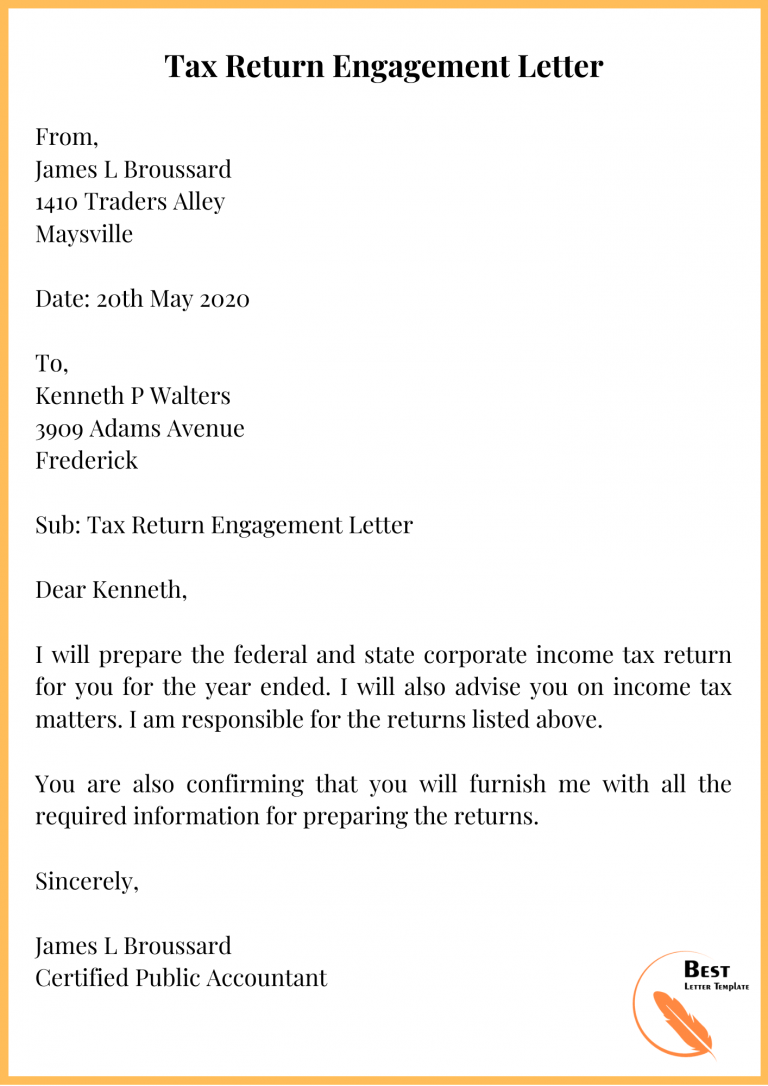

Tax Letter Template Format Sample And Example In PDF Word

https://bestlettertemplate.com/wp-content/uploads/2020/10/Tax-Return-Engagement-Letter-768x1086.png

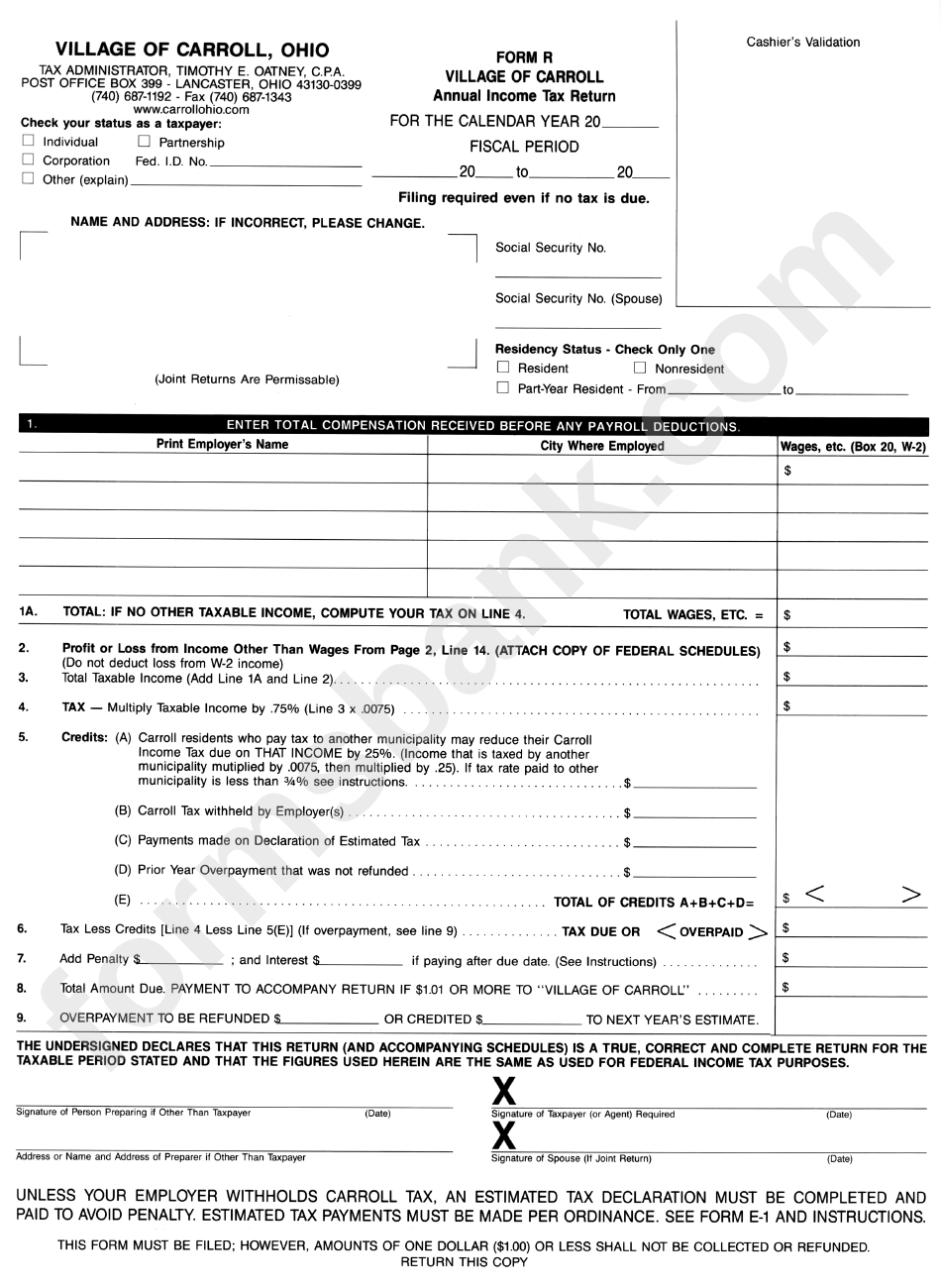

Form R Annual Income Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/289/2895/289578/page_1_bg.png

Fill in a Trust and Estate Tax Return form SA900 and post it to HMRC by the 31 October of the following tax year send a return online using tax software that supports SA900 Do You Need to File an Income Tax Return for the Estate The executor must file a federal income tax return Form 1041 if the estate has gross income for the

Therefore if the decedent had sufficient income before death to trigger a filing obligation the fiduciary will need to file an IRS Form 1040 and corresponding state income tax return for the period starting on If their estate is valued over a certain threshold you ll be responsible for filing a regular return and a complex return called an estate tax return Here s what you

Tax Return Printable Form

https://data.templateroller.com/pdf_docs_html/1729/17292/1729256/form-l-1040-2017-individual-income-tax-return-city-lapeer-michigan_print_big.png

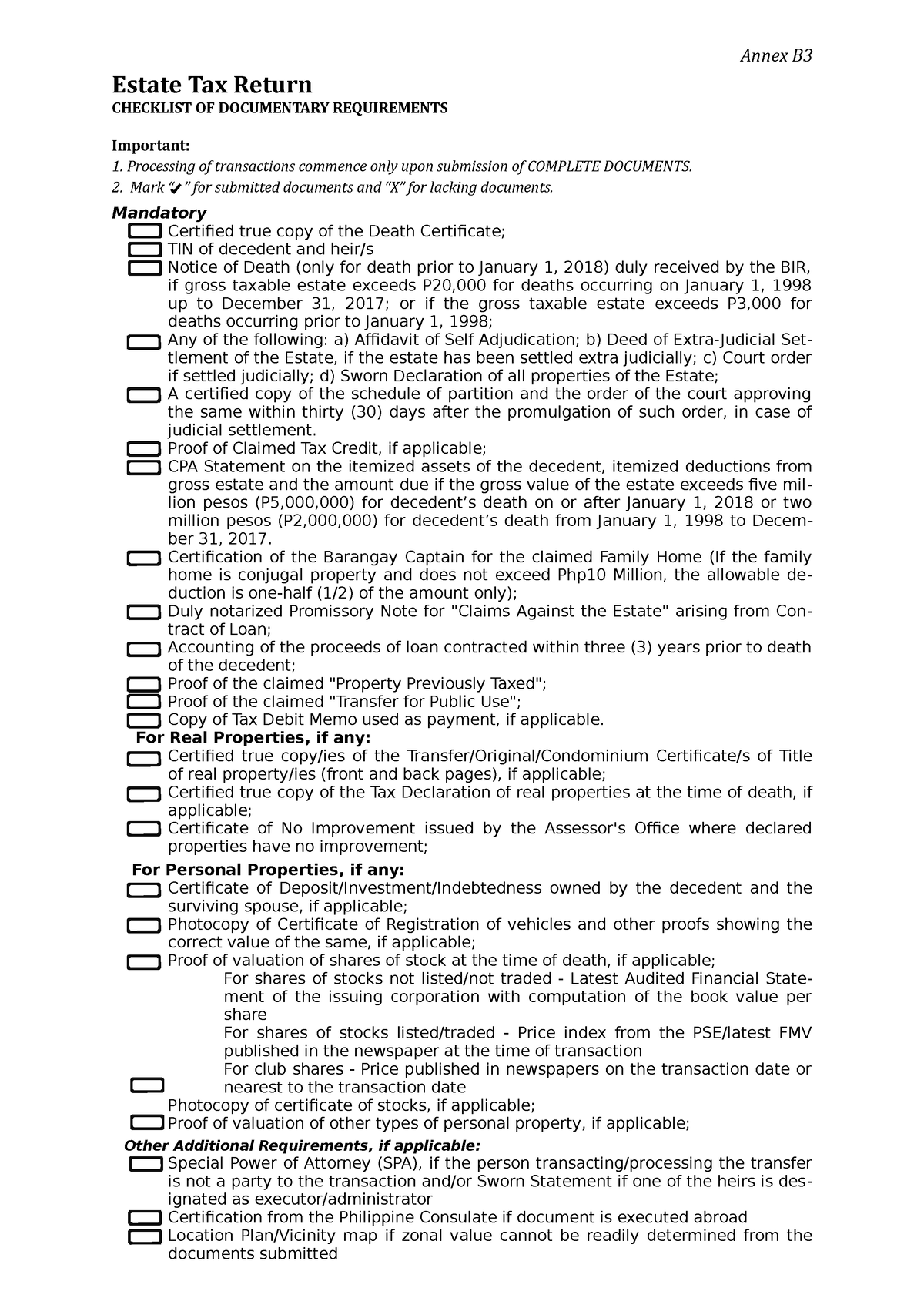

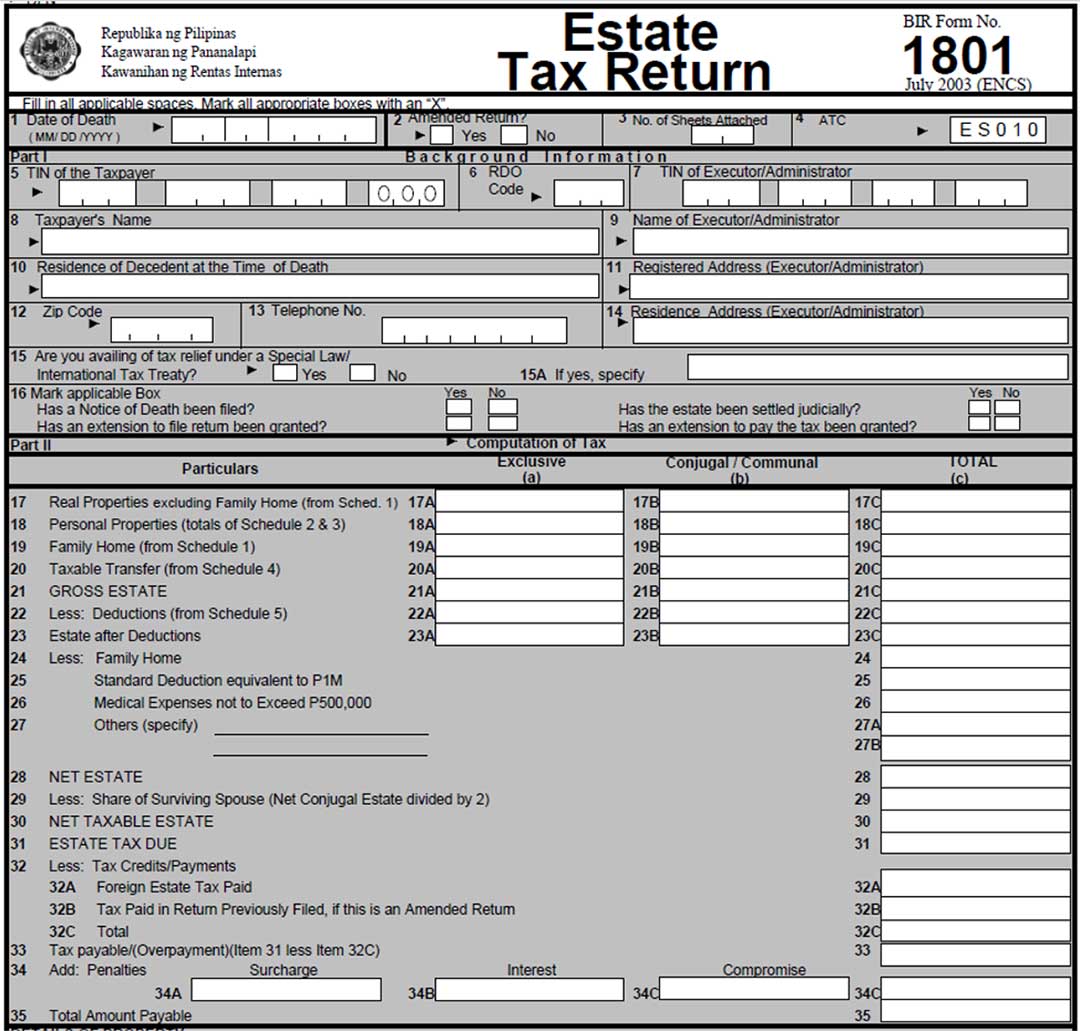

Annex B3 2022 Form Very Useful Annex B Estate Tax Return CHECKLIST OF

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/60c48548e8fd799260caacc43fc785f1/thumb_1200_1698.png

https://www.irs.gov/forms-pubs/about-form-706

Information about Form 706 United States Estate and Generation Skipping Transfer Tax Return including recent updates related forms and instructions on how to file Form

https://www.irs.gov/forms-pubs/about-form-1041

Information about Form 1041 U S Income Tax Return for Estates and Trusts including recent updates related forms and instructions on how to file Form 1041 is used by a

Attorney At Law It s Not Too Late To Elect Portability TBR News Media

Tax Return Printable Form

What Form Is The State Tax Return TaxesTalk

State Trust And Estate Income Tax Return Checklist

Filing An Estate Income Tax Return In Wv Fill Out Sign Online DocHub

Estate Tax Returns By Taxable Estate Tax Policy Center

Estate Tax Returns By Taxable Estate Tax Policy Center

How To Transfer Land Title To Heirs In The Philippines Extrajudicial

Estate Tax Return Form Sample For BIR Use Only BCS Item BIR Form

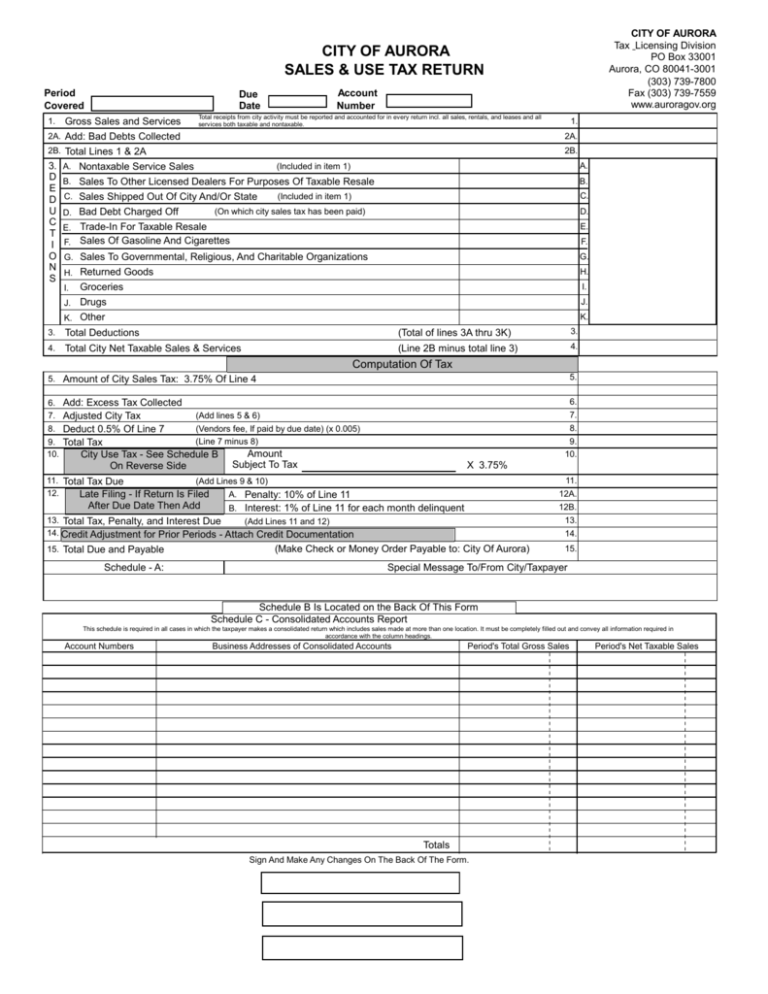

Sales And Use Tax Return Form

Form For Estate Tax Return - An estate tax return also known as IRS Form 706 is required when the total value of the decedent s estate exceeds the federal estate tax exemption In 2023 for example if the