Form To Claim Recovery Rebate Credit Web 17 f 233 vr 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit The

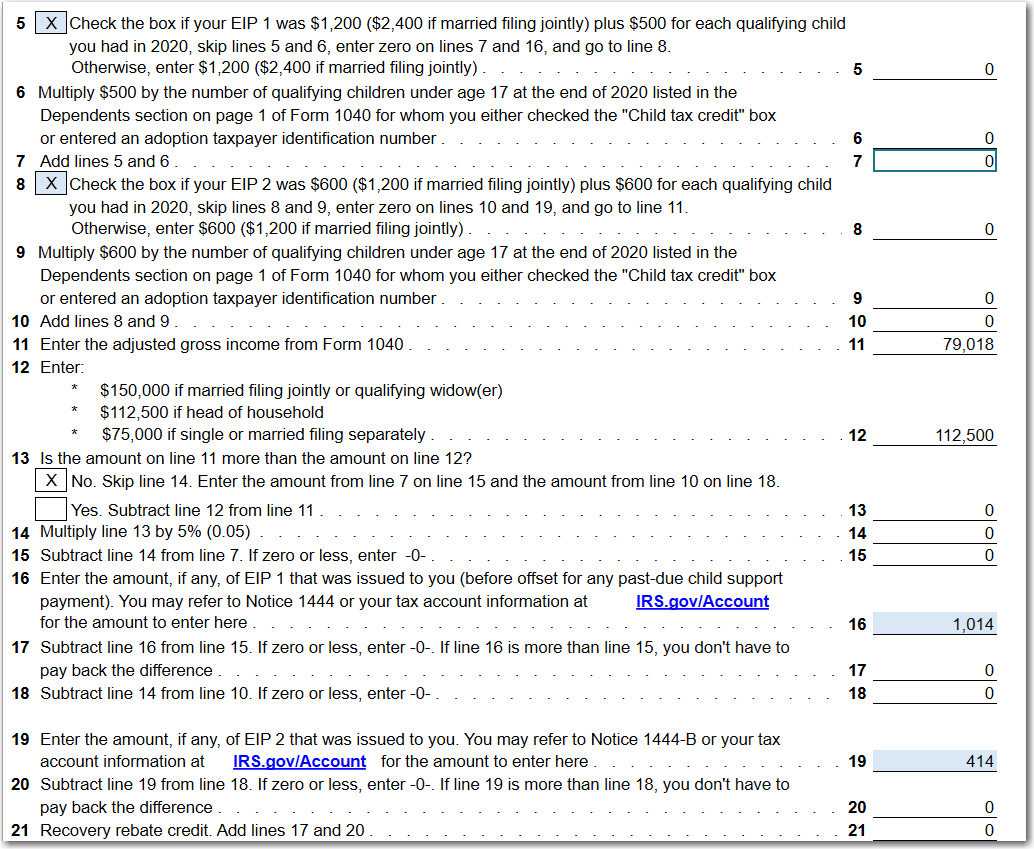

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form Web 13 janv 2022 nbsp 0183 32 Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR

Form To Claim Recovery Rebate Credit

Form To Claim Recovery Rebate Credit

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

IRS CP 12R Recovery Rebate Credit Overpayment

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

IRS CP 11R Recovery Rebate Credit Balance Due

https://www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Web 13 janv 2022 nbsp 0183 32 You ll claim the 2021 Recovery Rebate Credit when you file your 2021 tax return If your income is 73 000 or less you can file your federal tax return electronically Web 10 d 233 c 2021 nbsp 0183 32 When calculating the 2020 Recovery Rebate Credit using tax prep software or the 2020 Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040

Web 8 mars 2022 nbsp 0183 32 When filing your tax return you will use Line 30 of Form 1040 or Form 1040 SR to claim the Recovery Rebate Credit You will find instructions for how to calculate Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the

Download Form To Claim Recovery Rebate Credit

More picture related to Form To Claim Recovery Rebate Credit

Recovery Rebate Credit Taking Forever Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-credit-printable-rebate-form-4.png?w=670&h=627&ssl=1

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/recovery-rebate-credit-worksheet-atx-line-30-covid-19-atx-community.jpg

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Web 10 d 233 c 2021 nbsp 0183 32 A1 Yes if your 2020 has been processed and you didn t claim the credit on your original 2020 tax return you must file an Amended U S Individual Income Tax Web 21 janv 2023 nbsp 0183 32 Individuals who didn t receive the full amount of stimulus funds can still claim rebate credits for recovery for their taxes in 2020 In order to be eligible they ll

Web If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Web 15 janv 2021 nbsp 0183 32 Recovery Rebate Credit and other benefits IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/le-cdn.hibuwebsites.com/6795e9d01eed4352a64d15f170ad49ae/dms3rep/multi/opt/Recovery+Rebate2020-1920w.jpeg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-d...

Web 17 f 233 vr 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit The

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-a...

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Account Recovery Form Editable Forms

Federal Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Fill Free Fillable TheTaxBook PDF Forms Recovery Rebate

10 Recovery Rebate Credit Worksheet

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Hurricane Recovery Rebate Form Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Form To Claim Recovery Rebate Credit - Web 31 janv 2023 nbsp 0183 32 January 31 2023 by tamble Irs Form To Claim Recovery Rebate Credit Taxpayers can receive a tax rebate through the Recovery Rebate program This