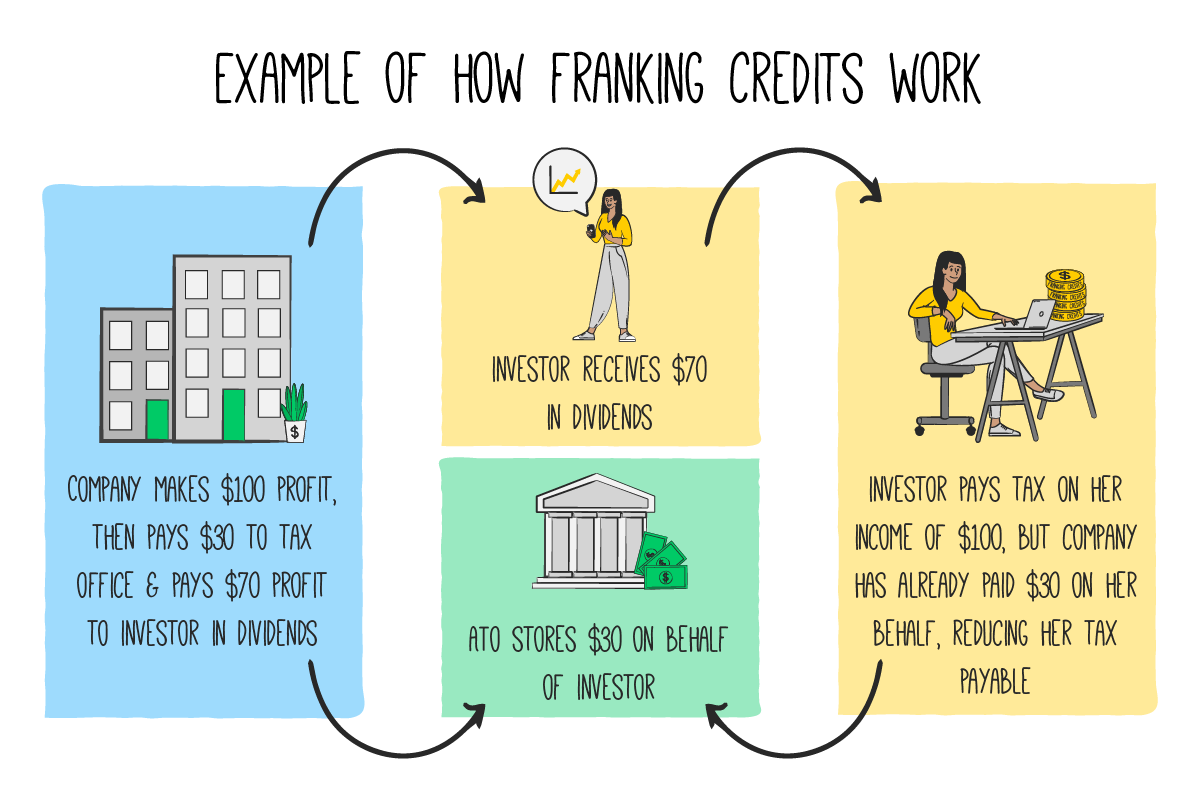

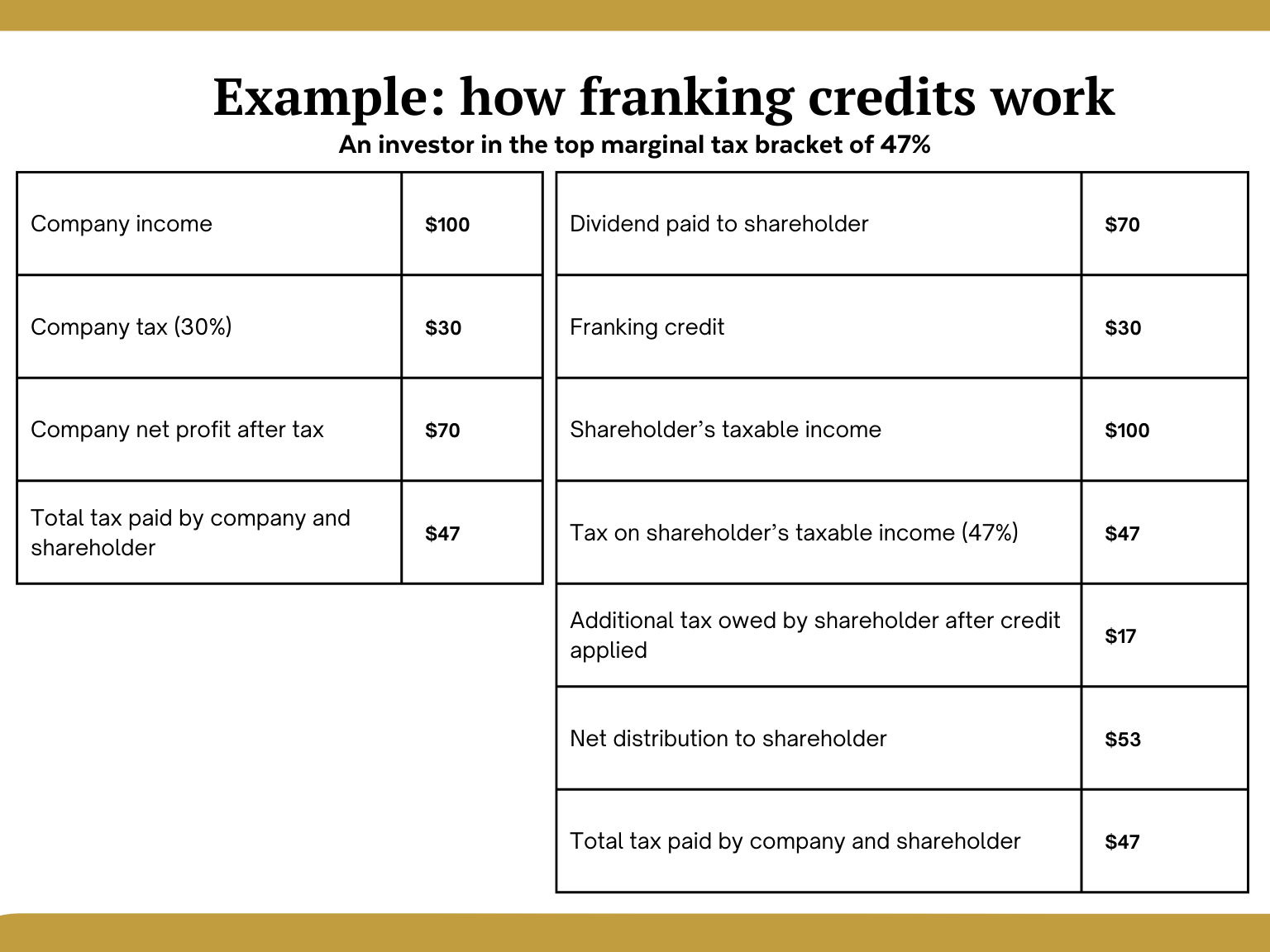

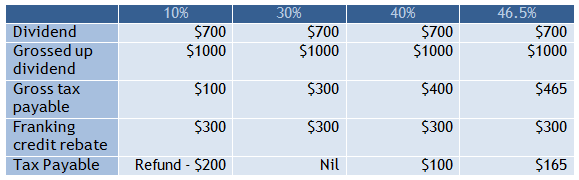

Franking Credits Definition Ato Web 12 Juni 2017 nbsp 0183 32 Franking credits arise for shareholders when certain Australian resident companies pay income tax on their taxable income and distribute their

Web A corporate tax entity allocates franking credits to shareholders by attaching the credits to the distributions they make The maximum franking credit that can be allocated to a Web 20 Juni 2022 nbsp 0183 32 Distribution statement Franking credit A franking credit is an amount of imputed company tax In essence it relates to income tax paid by a company on its

Franking Credits Definition Ato

Franking Credits Definition Ato

https://s3-ap-southeast-2.amazonaws.com/finspecweb/wp-content/uploads/2019/03/17030142/Franking-credits-resized.png

ATO Franking Credits Explained Rask Media

https://www.raskmedia.com.au/wp-content/uploads/2021/09/franking-credits-guide-calculator-1024x576.png

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

Web 3 Juli 2023 nbsp 0183 32 If you are paid or credited franked dividends or non share dividends that is they carry franking credits for which you are entitled to claim franking tax offsets your Web 29 Juni 2023 nbsp 0183 32 Maximum franking credits When to apply the lower company tax rate and how to work out franking credits There are changes to the company tax rates The full

Web 29 Juni 2023 nbsp 0183 32 You are eligible for a refund of excess franking credits if all of the following apply You receive franked dividends on or after 1 July 2000 either directly or through a Web 28 Juli 2020 nbsp 0183 32 A franking credit also known as an imputation credit is a type of tax credit paid by corporations to their shareholders along with their dividend payments Australia and several other

Download Franking Credits Definition Ato

More picture related to Franking Credits Definition Ato

Franking Credits Explained Plus 1 Group

https://plus1group.com.au/wp-content/uploads/2021/10/franking-credit.png

Franking Credits 101

https://assets.website-files.com/5dfab795d6da96ad7da843ed/5e1d089773c54c0feec39431_franking.jpeg

How Do Franking Credits Work Melior Accounting

https://www.melior.com.au/wp-content/uploads/2016/09/money-1012622__1801-1024x596.jpg

Web 14 Juli 2023 nbsp 0183 32 A franking credit or imputation credit stands for the tax a business or a company has already paid on the profits Shareholders of the company may use Web Franking Credits auch als Imputationskredite bekannt sind ein einzigartiges Merkmal des australischen Steuersystems Sie vertreten die Steuer die ein Unternehmen f 252 r seine

Web Apply for a refund Dividends and franking credits Dividends paid to shareholders by Australian resident companies are taxed under a system known as imputation This is Web Franking credits Incorrect claims poor governance increases in or refund of credits through a concessional tax rate raises concerns

How Do Franking Credits Work Stimulate Accounting

https://stimulateaccounting.com.au/wp-content/uploads/2021/05/franking-credits-imputation.jpg

Franking Credit Refund 2023 Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2021/11/franking-credit-calculators.jpg

https://www.ato.gov.au/.../franking-credits

Web 12 Juni 2017 nbsp 0183 32 Franking credits arise for shareholders when certain Australian resident companies pay income tax on their taxable income and distribute their

https://www.ato.gov.au/.../allocating-franking-credits

Web A corporate tax entity allocates franking credits to shareholders by attaching the credits to the distributions they make The maximum franking credit that can be allocated to a

Franking Credits Explained Where Are We Now

How Do Franking Credits Work Stimulate Accounting

What Are Franking Credits And How Do They Work Financial Autonomy

.png)

How Much Tax Do I Pay On Fully Franked Dividends Leia Aqui How Much

Dividend Imputation System Franking Credits Explained Calculations

Refund Of Franking Credits BAN TACS

Refund Of Franking Credits BAN TACS

ATO Franking Credits Explained Rask Media

ATO Franking Credits Explained Rask Media

What Are Franking Credits Definition And Formula For Calculation

Franking Credits Definition Ato - Web A franking account records the amount of tax paid that a franking entity can pass on to its members as a franking credit Each entity that is or has ever been a corporate tax