Franking Credits Tax Deduction Only Australian resident taxpayers can claim a tax offset for a franking credit attached to a distribution For non residents a distribution is exempt from withholding tax to the extent that it s franked

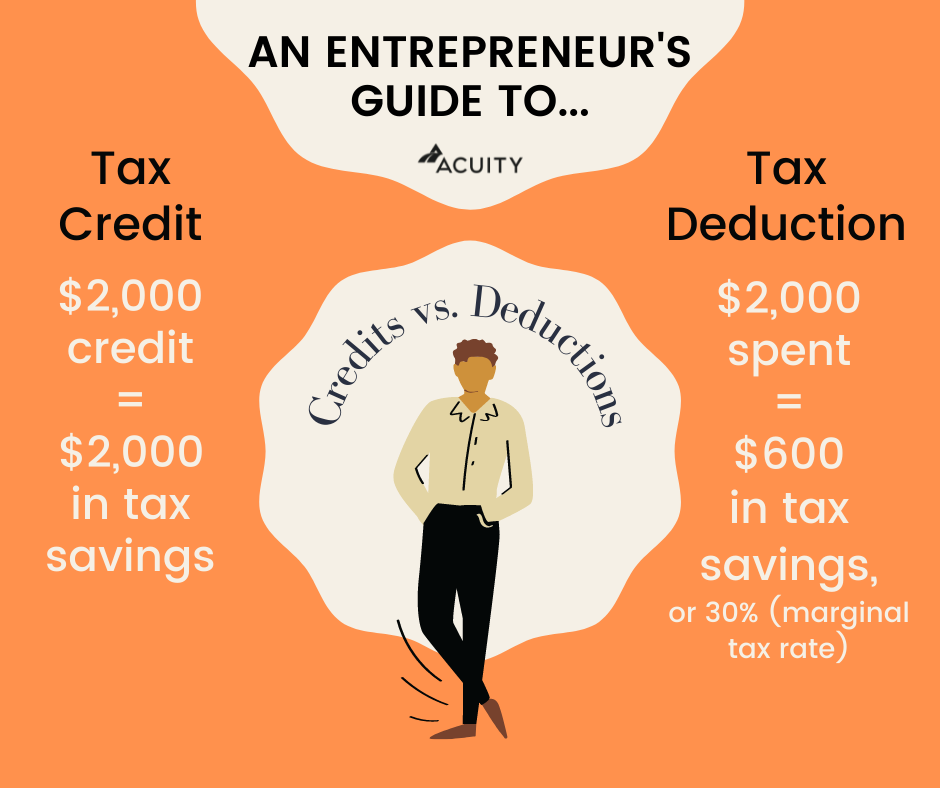

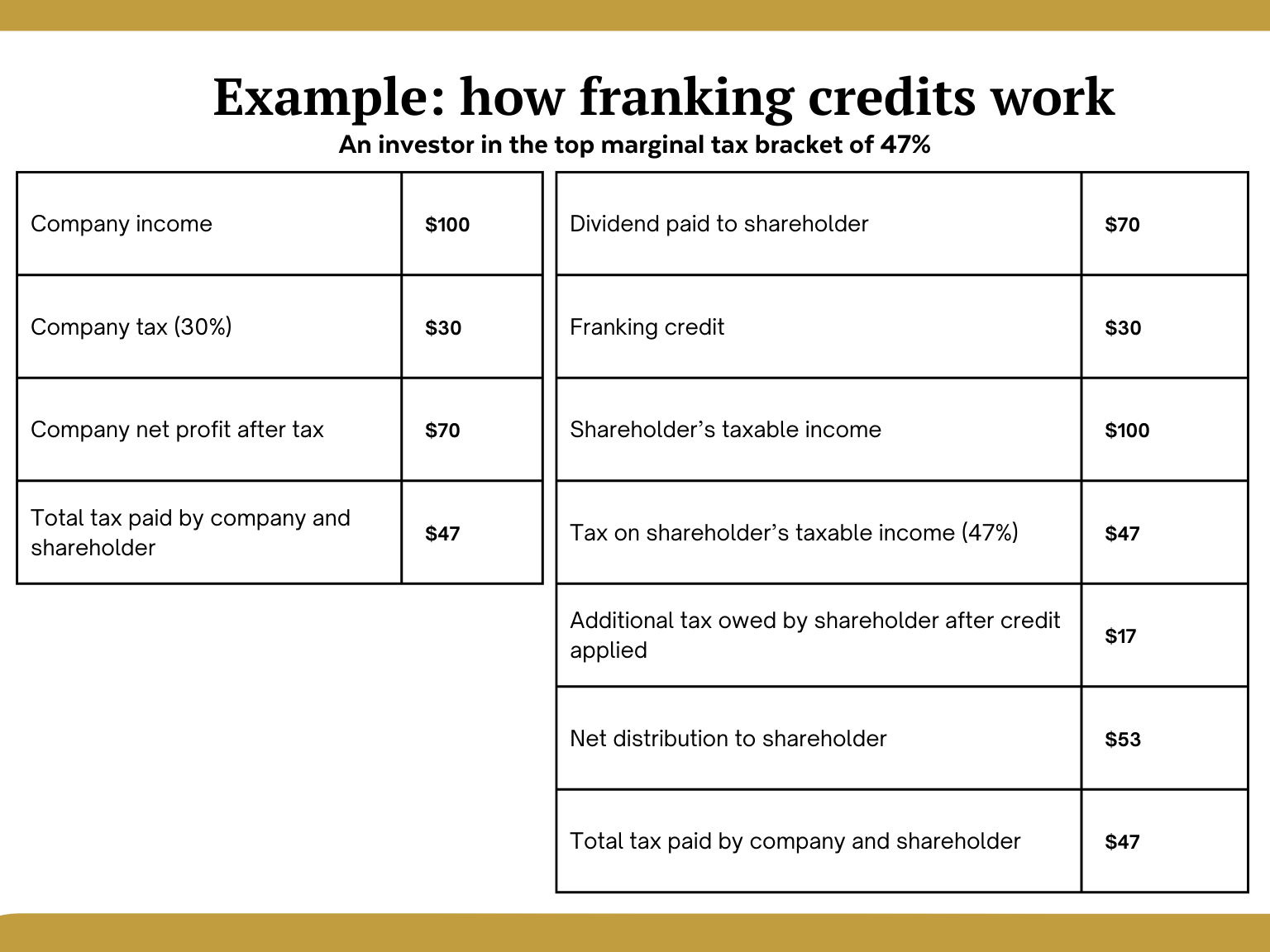

You receive a tax credit for the value of the franking credit which can be offset against other income Remember the company tax rate is 30 If your personal tax rate is 30 dividends are pretty much tax free as you get credit for the 30 tax the company has already paid Claiming your franking tax offset when you do not need to lodge a tax return If you are eligible to claim a franking tax offset for 2022 23 but you are not otherwise required to lodge a tax return see Application for refund of franking credits for individuals 2023

Franking Credits Tax Deduction

Franking Credits Tax Deduction

https://www.cwfphilly.org/wp-content/uploads/2020/01/credits-deductions-1094458358.jpg

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

Startup Tax Credits Deductions You Might Be Missing

https://acuity.co/wp-content/uploads/2021/01/credits-vs-deductions.png

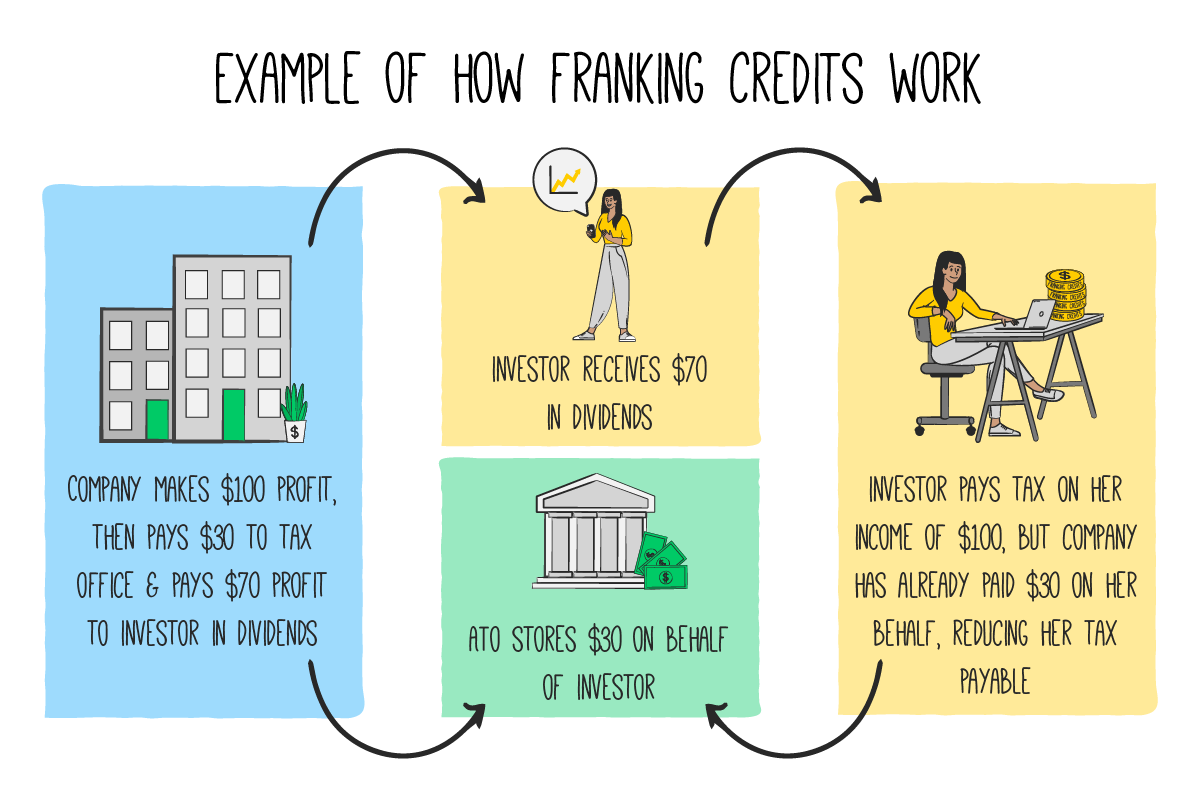

Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax liability at the end of the financial year and can result in an ATO refund When a company distributes its after tax profits to shareholders in the form of a dividend franking credits can be attached that serve as a pre paid tax voucher which shareholders receive along with dividends

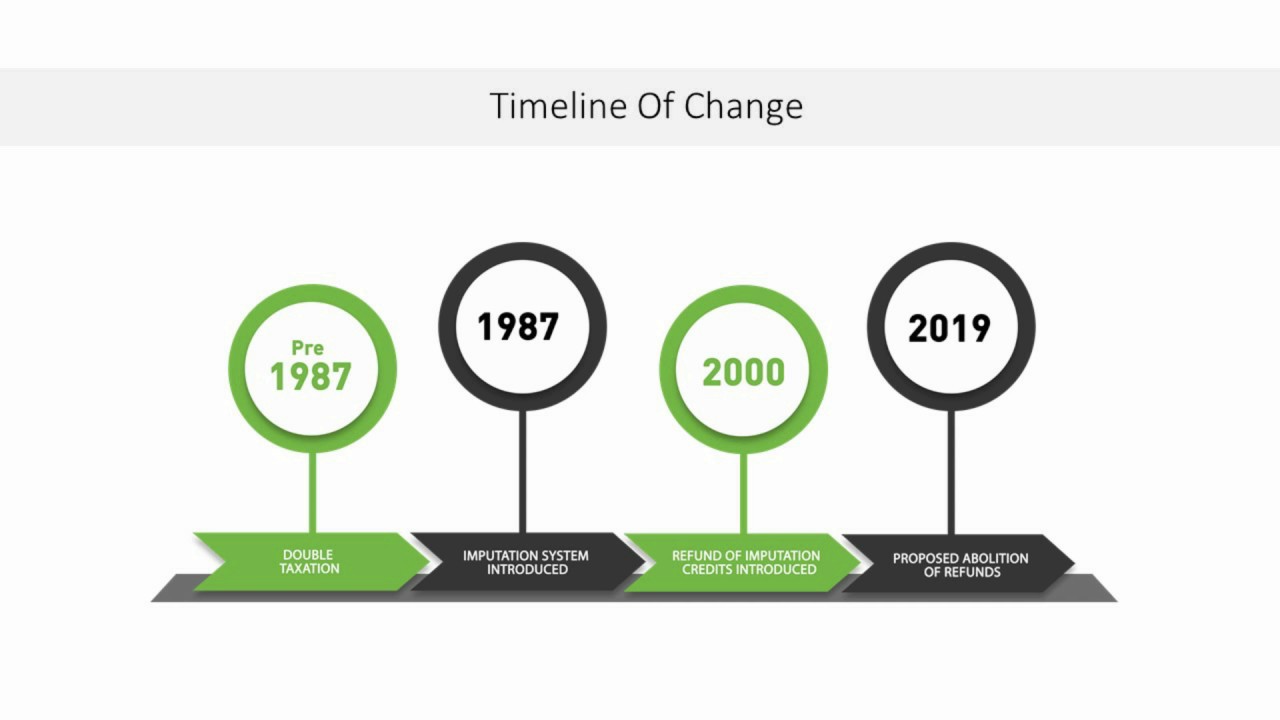

Franking credits are a reflection of tax already paid at the corporate level Attaching franking credits to dividends avoids double taxation of corporate profits distributed as dividends Franking credits are an income tax deduction that refunds the portion of the dividend where the company has paid tax Also known as an imputation credit shareholders use franking credits to offset tax and prevent income from being taxed twice

Download Franking Credits Tax Deduction

More picture related to Franking Credits Tax Deduction

Franking Credits And Proposed Changes Guide Financial Spectrum

https://s3-ap-southeast-2.amazonaws.com/finspecweb/wp-content/uploads/2019/03/17030142/Franking-credits-resized.png

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1588xN.5462529921_cvyy.jpg

How Do Franking Credits Work Melior Accounting

https://www.melior.com.au/wp-content/uploads/2016/09/money-1012622__1801-1024x596.jpg

A franking credit also known as an imputation credit is a type of tax credit that allows the company s income tax to flow through to its shareholders It is a system in place to avoid or eliminate doubling taxing dividends Double taxing is when tax is paid twice on the same income or profit The impact of franking credits on your take home income depends on multiple things the percentage of franking your tax bracket and of course the dividend amount This article explains what franking credits are how to calculate franking credits and how our franking credits calculator works

A flat tax rate of 15 is applied to the fund s total income except for that earned on behalf of those who are retired and drawing a pension Investment earnings for retired members with assets below the transfer balance cap currently 1 9 million are exempt from tax What are franking credits A franked dividend is when a company pays out their after tax income to investors with a tax credit When it comes to tax time the investor only needs to pay tax on that dividend to the extent that their own marginal tax rate exceeds the rate of tax the company has already paid on that dividend income

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

https://www.creativefabrica.com/wp-content/uploads/2021/07/17/Tax-Deduction-Planner-Graphics-14848059-3.jpg

https://www.ato.gov.au/businesses-and...

Only Australian resident taxpayers can claim a tax offset for a franking credit attached to a distribution For non residents a distribution is exempt from withholding tax to the extent that it s franked

https://www.etax.com.au/franked-dividends-franking-credits

You receive a tax credit for the value of the franking credit which can be offset against other income Remember the company tax rate is 30 If your personal tax rate is 30 dividends are pretty much tax free as you get credit for the 30 tax the company has already paid

.png)

The Divide nd Of Income How To Invest For Franking Credits Sara

What Is The Difference Between A Tax Credit And Tax Deduction

What Are Franking Credits And How Do They Work Financial Autonomy

What Is A Tax Credit Vs Tax Deduction Do You Know The Difference

Labor s Proposed Tax Changes 4 5 Franking Credits YouTube

What Will My Tax Deduction Savings Look Like The Motley Fool

What Will My Tax Deduction Savings Look Like The Motley Fool

What Are Pre tax Deductions Before Tax Deduction Guide

Search Publication

Franking Credits Explained What Are They And How Do They Work

Franking Credits Tax Deduction - Franking credits act as a tax offset reducing the amount of income tax payable They are used to offset your individual tax liability resulting in a lower overall tax bill or an increased refund Example Suppose you receive a partially franked dividend of 1 per share with 20 cents in franking credits