Franking Credits Tax Return 2022 Complete an Application for refund of franking credits 2023 if you re a resident and don t need to lodge a tax return Last updated 24 May 2023 Print or Download

Instructions for completing sections A B C the payment slip and declaration of the Franking account tax return Lodgment and payment requirements How to lodge the You must be an Australian resident for tax purposes for the whole period 1 July 2021 to 30 June 2022 to apply for a refund of franking credits We work out your residency

Franking Credits Tax Return 2022

Franking Credits Tax Return 2022

https://www.flagshipinvestments.com.au/wp-content/uploads/2021/02/pexels-alesia-kozik-6770610-min-scaled-1.jpg

Get A Tax REFUND On Franking Credits With Australian Dividends YouTube

https://i.ytimg.com/vi/zxG7QzpeIAI/maxresdefault.jpg

Help Where Is My Amended Return Refund How To Check Your IRS Tax

https://i.ytimg.com/vi/rFVZRBVko04/maxresdefault.jpg

You can apply for your 2022 refund of franking credits any time after 1 July 2022 either by phone or by post To apply for a refund fill in one of the applications at the back of this publication Application for refund of franking credits for individuals 2022 2022 1 July 2021 to 30 June 2022 For individuals who do not need to lodge a tax return You must read the

Franking credits can be very valuable to those investors who have tax free incomes like charities or retirees with pension phase superannuation balances of less than Franking account tax return The Franking account tax return 2022 applies to the 2021 22 income year An early or late balancing corporate tax entity will need to specify the

Download Franking Credits Tax Return 2022

More picture related to Franking Credits Tax Return 2022

Franking Credit Refund 2023 Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2021/11/franking-credit-calculators.jpg

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

How Do Franking Credits Work Melior Accounting

https://www.melior.com.au/wp-content/uploads/2016/09/money-1012622__1801-1024x596.jpg

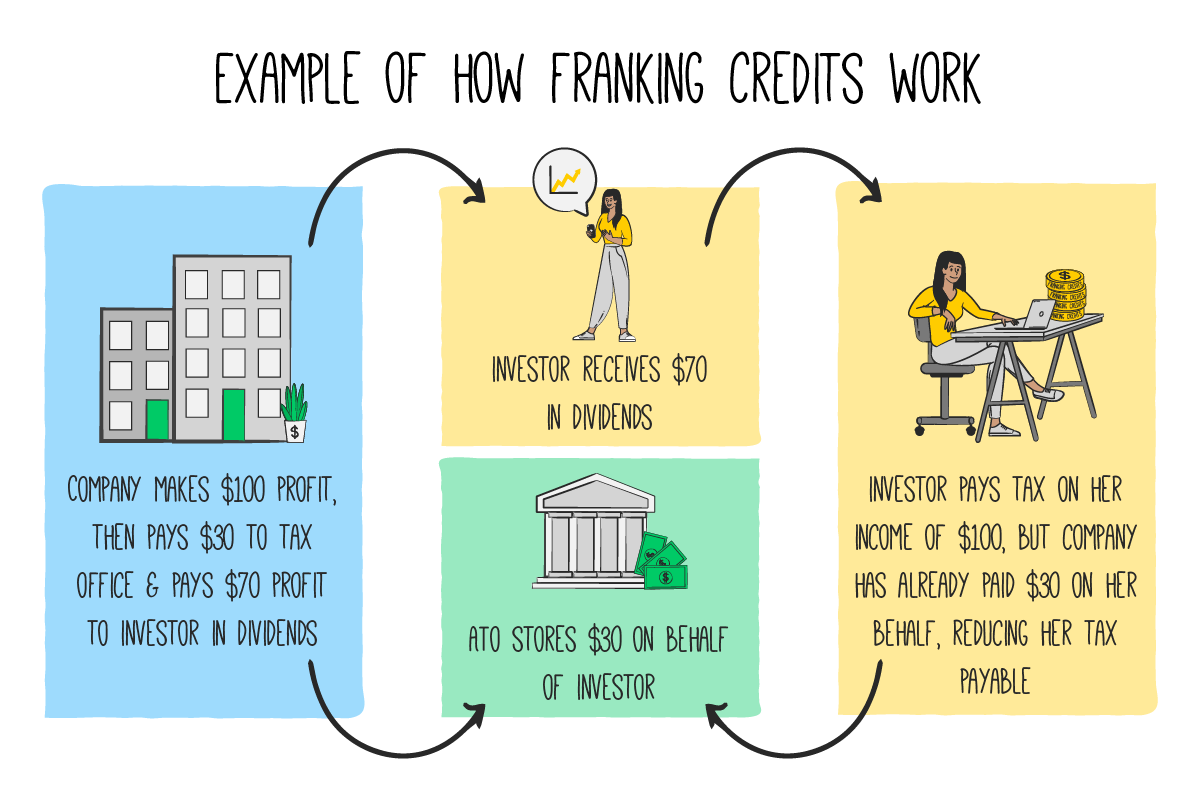

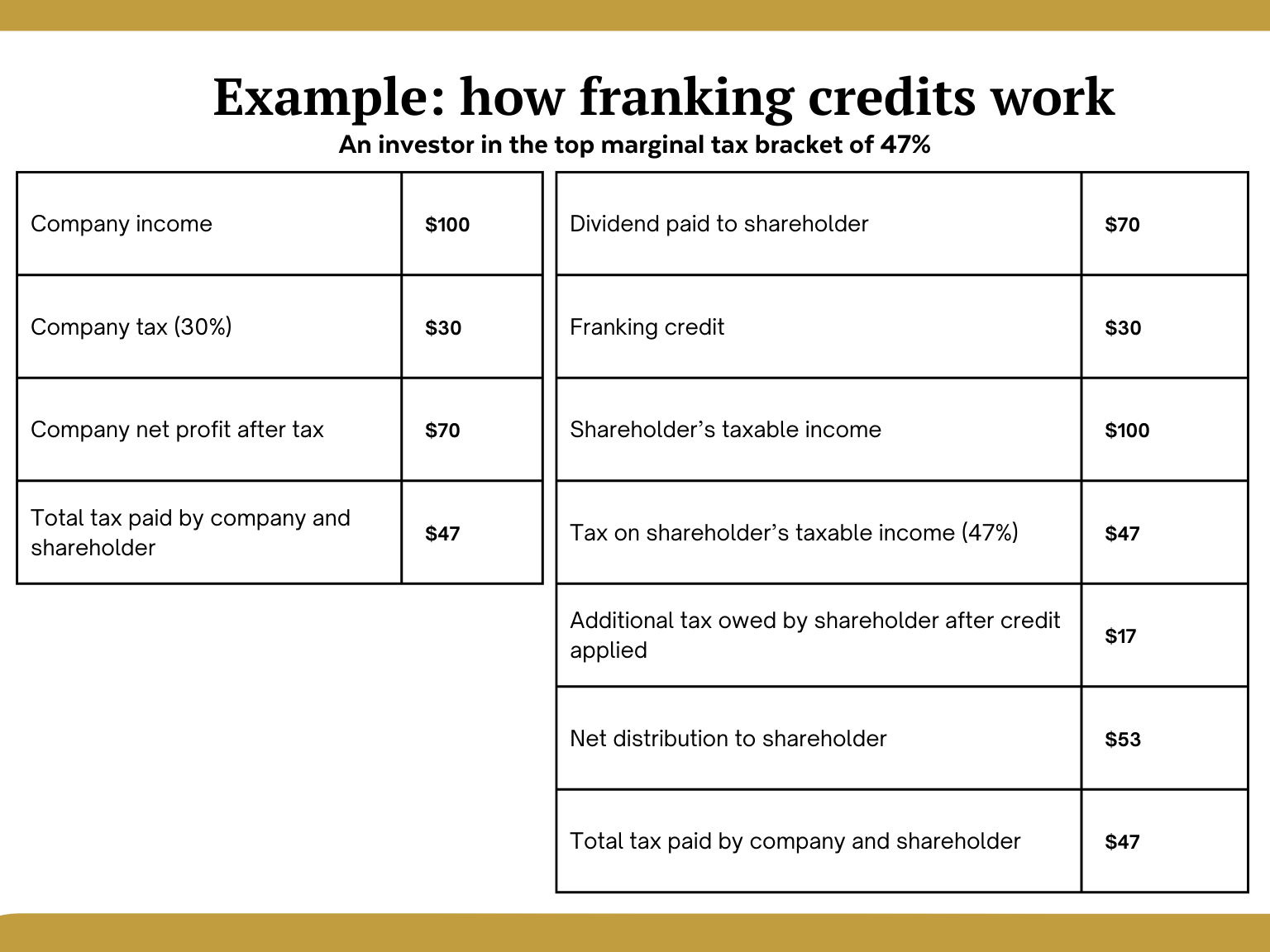

There will be tax payable the extent of tax due for 2022 can a franked dividend be paid in September Currently there are no credits available in the franking account balance Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax liability at the

These refundable franking credits boosted the post tax returns of the investment For those members in the pension phase where their income is exempt the The deceased had a share portfolio with franked dividends Some dividends were paid in 2022 financial year and the portfolio was sold in March 2022 Franking credits refunded

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/Hg0fOlxqHpU/maxresdefault.jpg

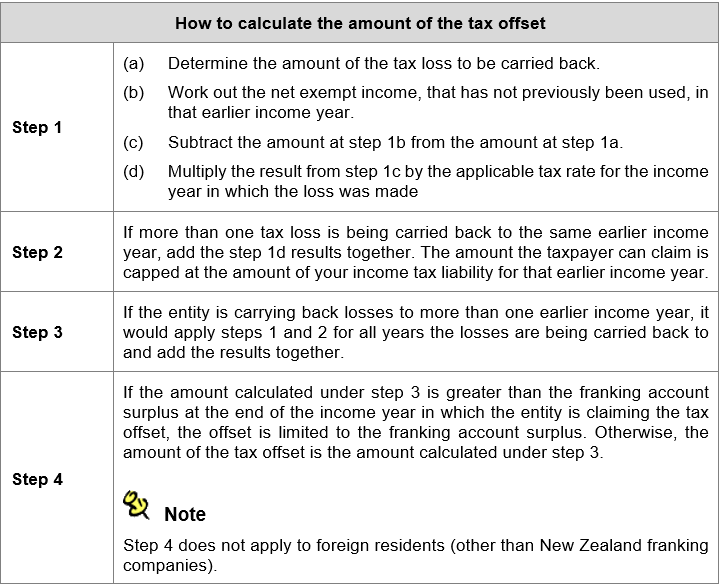

Company Loss Carry Back Offset Claims For 2021 TaxBanter Pty Ltd

https://taxbanter.com.au/wp-content/uploads/2022/11/table-2-4.png

https://www.ato.gov.au/forms-and-instructions/...

Complete an Application for refund of franking credits 2023 if you re a resident and don t need to lodge a tax return Last updated 24 May 2023 Print or Download

https://www.ato.gov.au/forms-and-instructions/...

Instructions for completing sections A B C the payment slip and declaration of the Franking account tax return Lodgment and payment requirements How to lodge the

PPT Franking Account Tax Return And Instructions 2022 PowerPoint

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

What Are Franking Credits And How Do They Work Financial Autonomy

2022 2023 Federal Budget Omura Wealth Advisers

.png)

The Divide nd Of Income How To Invest For Franking Credits Sara

Search Publication

Search Publication

Franking Credits 101

Tax Return Franking Credits Means You Can Make 558 000 Extra News

Block ASX SQ2 Share Price Jumps 10 On Strong 2022 Third Quarter

Franking Credits Tax Return 2022 - You can claim a tax refund if the franking credits you receive exceed the tax you have to pay This is a refund of excess franking credits You may receive a refund of the full