Franklin County Ohio Property Tax Homestead Exemption Verkko The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens or a surviving spouse on the dwelling that is that individual s principal place of residence and up to one acre of land of which an eligible individual is an owner

Verkko Overview The homestead exemption is a statewide program which allows qualified senior citizens and permanently and totally disabled homeowners to reduce their property tax burden by shielding some of the auditor s appraised value of Verkko The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25 000 of the market value of their homes from all local property taxes For example through the homestead exemption a home with a market value of 100 000 is billed as if it is worth 75 000

Franklin County Ohio Property Tax Homestead Exemption

Franklin County Ohio Property Tax Homestead Exemption

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

Franklin County Property Tax Bills Are Being Sent Out Soon Prepare To

https://media.tegna-media.com/assets/WBNS/images/f29217a7-6f9b-4c89-a5bf-b940714ac6b2/f29217a7-6f9b-4c89-a5bf-b940714ac6b2_1920x1080.jpg

Franklin County Property Tax Columbus Ohio STAETI

https://lh6.googleusercontent.com/proxy/98h2BJOcPjYYCOBYkb0sdbBAwhKr_WUC5FMwXMVcYtgcOBmLzERRte9KIcqoQgPYlVHSVCWs0aq6rv7Lnp0y3t5Y05IEUVuJQBY29Yi_Oaa5MsACN5TX_9qn7RrAWW47_lhP7YvdOw7m7Q=w1200-h630-p-k-no-nu

Verkko The homestead exemption is a statewide program which allows qualified senior citizens and permanently and totally disabled homeowners to reduce their property tax burden by shielding some of the market value of their home from taxation The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to Verkko Homestead Exemption for Senior Citizens Disabled Persons and Surviving Spouses DTE 105A The Homestead Exemption program assists senior and disabled citizens in Franklin County by providing tax savings on the real estate or manufactured home taxes Learn more here DTE 105A form HOMESTEAD EXEMPTION FOR

Verkko Charges by your city or the county to cover the cost of improvements or services HOMESTEAD EXEMPTION A reduction in property taxes available to senior citizens and disabled homeowners with limited incomes Verkko Owner Occupied Tax Reduction Find out how homeowners can receive a reduction in property taxes for their principal place of residence Homestead Exemption Find out how senior citizens or the disabled may reduce

Download Franklin County Ohio Property Tax Homestead Exemption

More picture related to Franklin County Ohio Property Tax Homestead Exemption

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

2019 2021 Form TX HCAD 11 13 Fill Online Printable Fillable Blank

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/2019-2021-form-tx-hcad-11-13-fill-online-printable-fillable-blank-20.png

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

https://itrfoundation.org/wp-content/uploads/2023/02/33-States.jpg

Verkko Franklin County Auditor Homestead Forms Real Estate gt Homestead gt Homestead Forms DTE 105 A Homestead Exemption Application for Senior Citizens and Disabled Persons Electronic Filing DTE 105 E Certificate of Disability for the Homestead Exemption DTE 105 G Addendum to the Homestead Exemption Application Verkko OWNER OCCUPIED TAX REDUCTION The Owner Occupied Tax Reduction is a reduction of up to 2 5 in the taxes charged by qualified levies The reduction is applied against real property taxes and manufactured home taxes on

Verkko Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses For real property file on or before December 31 of the year for which the exemption is sought For manufactured or mobile homes this form must be filed on or before December 31 of the year prior to the year for which the exemption is sought Verkko Ohio Department of Taxation Menu Home Resources for Individuals Resources for Businesses Resources How do I apply for the homestead exemption Web Content Viewer Actions Web Content Viewer Actions tax quick access links heading FAQs Self Help eLibrary Ohio Taxes Help Center Information Releases Online Notice Response

Duval County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/homestead-exemption-for-duval-county-florida.jpg

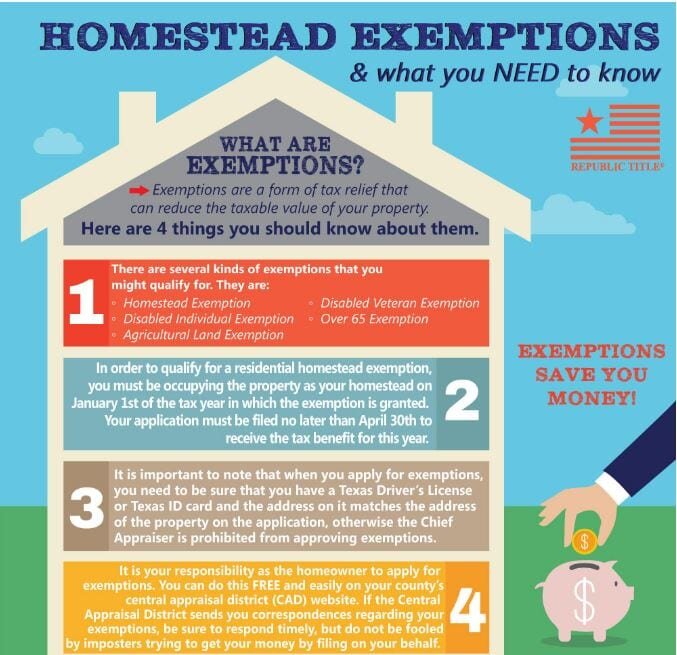

Homestead Exemptions What You Need To Know Rachael V Peterson

http://static1.squarespace.com/static/5a8e3375b7411c86343f7044/5ab132d6f950b73eb9dfdf8d/5e12345a1683ea216c87c434/1578253520393/homestead-exempt-1-1+photo+for+exemption+article.jpg?format=1500w

https://homestead.franklincountyohio.gov

Verkko The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens or a surviving spouse on the dwelling that is that individual s principal place of residence and up to one acre of land of which an eligible individual is an owner

https://www.franklincountyauditor.com/real-estate/homestead

Verkko Overview The homestead exemption is a statewide program which allows qualified senior citizens and permanently and totally disabled homeowners to reduce their property tax burden by shielding some of the auditor s appraised value of

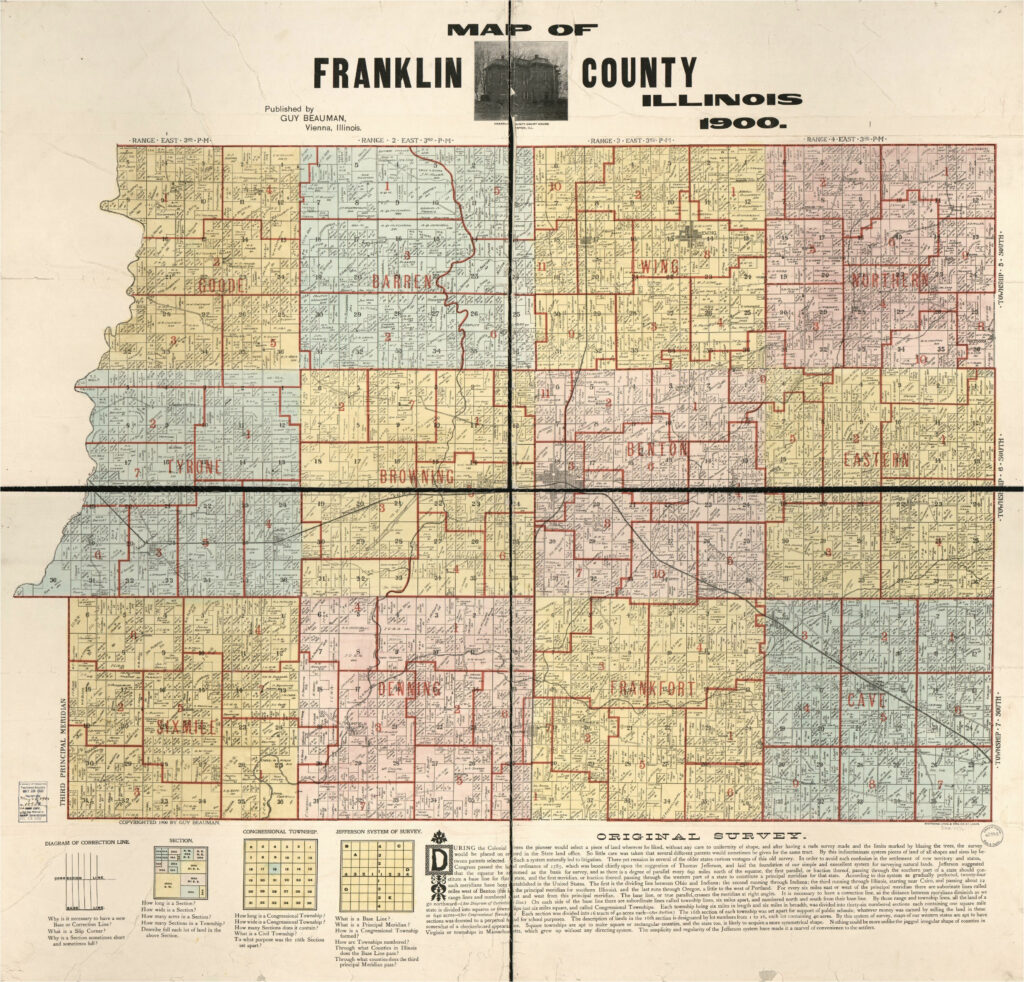

Franklin County Ohio Township Map Maps Of Ohio

Duval County Homestead Exemption Form ExemptForm

Texas Homestead Tax Exemption

Franklin County Ohio Property Taxes Understanding The Tax Increases

Compare Property Tax Rates In Greater Cleveland And Akron Many Of

Ohioans Are Spending More Money On Taxable Things This Year Including

Ohioans Are Spending More Money On Taxable Things This Year Including

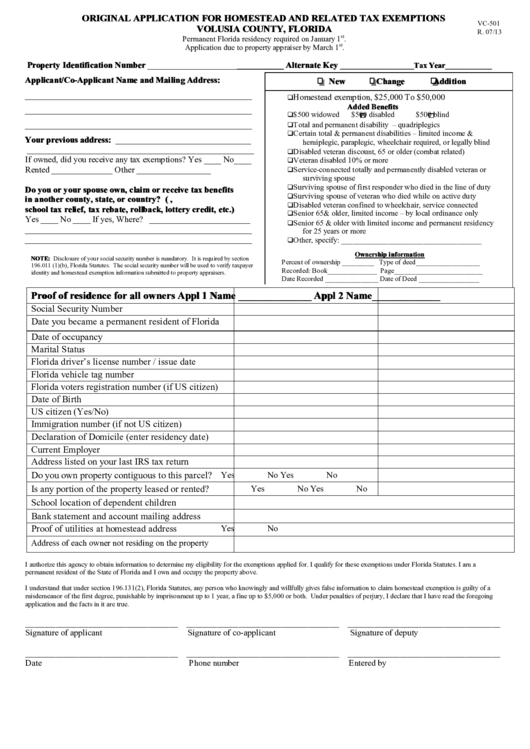

Florida Homestead Tax Exemption Form ExemptForm

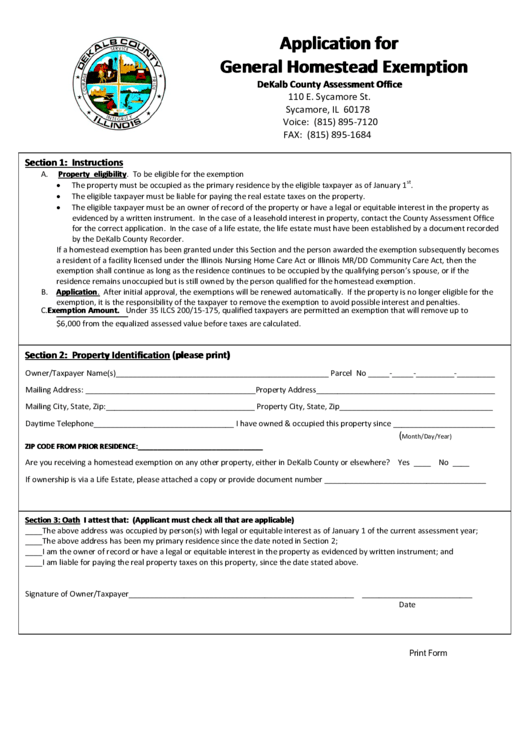

Ingham County Property Homestead Exemption Form ExemptForm

Miami Dade Homestead Exemption Form Fill Online Printable Fillable

Franklin County Ohio Property Tax Homestead Exemption - Verkko Homestead Exemption for Senior Citizens Disabled Persons and Surviving Spouses DTE 105A The Homestead Exemption program assists senior and disabled citizens in Franklin County by providing tax savings on the real estate or manufactured home taxes Learn more here DTE 105A form HOMESTEAD EXEMPTION FOR