Fringe Benefit Tax Calculation Example Fringe Benefit Tax Low interest benefit is considered as fringe benefit extended to an employee and is taxable at a rate of 30 The actual benefit savings that employee makes is what is chargeable and not the loan or installment

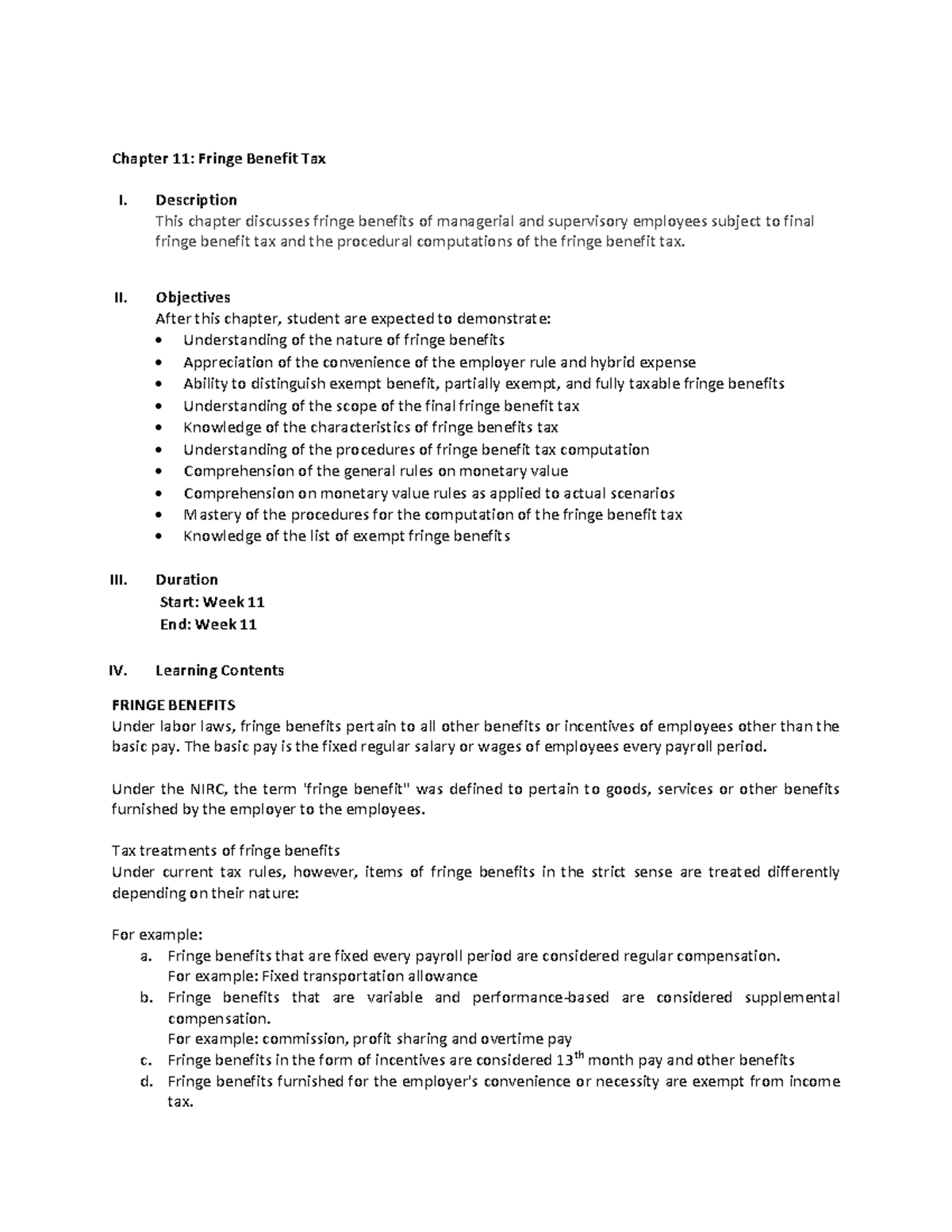

The objective of this ooklet is to explain the system of deductin income tax from employees emoluments It does NOT therefore in an wa modif or replace the General Legislation Income Tax Act Cap 470 and the Tax Procedures Act 2015 The Guide is available on the KRA website NOTE I Fringe benefit tax is payable by every employer in respect of a loan provided to an employee director or their relatives at an interest rate lower than the market interest rate

Fringe Benefit Tax Calculation Example

Fringe Benefit Tax Calculation Example

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8b71089f8c1a9b7f1103bf6c5ed846ad/thumb_1200_1553.png

Fringe Benefit Tax Bartleby

https://cms-media.bartleby.com/wp-content/uploads/sites/2/2021/06/03144420/Fringe-Benefit-Tax-2-1024x769.jpg

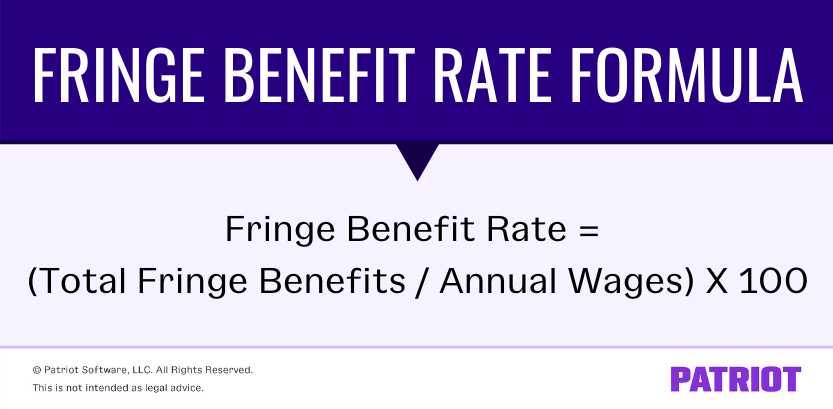

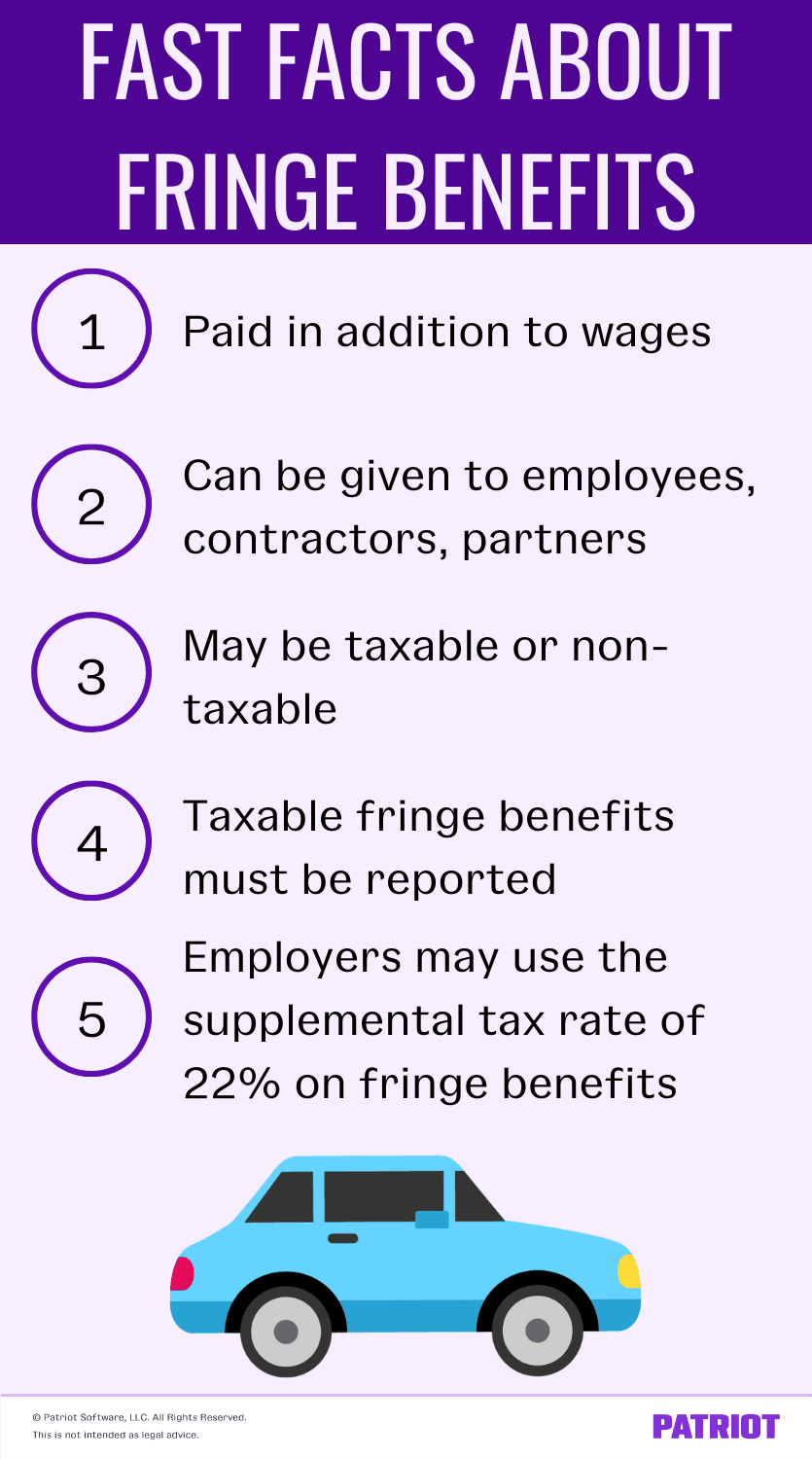

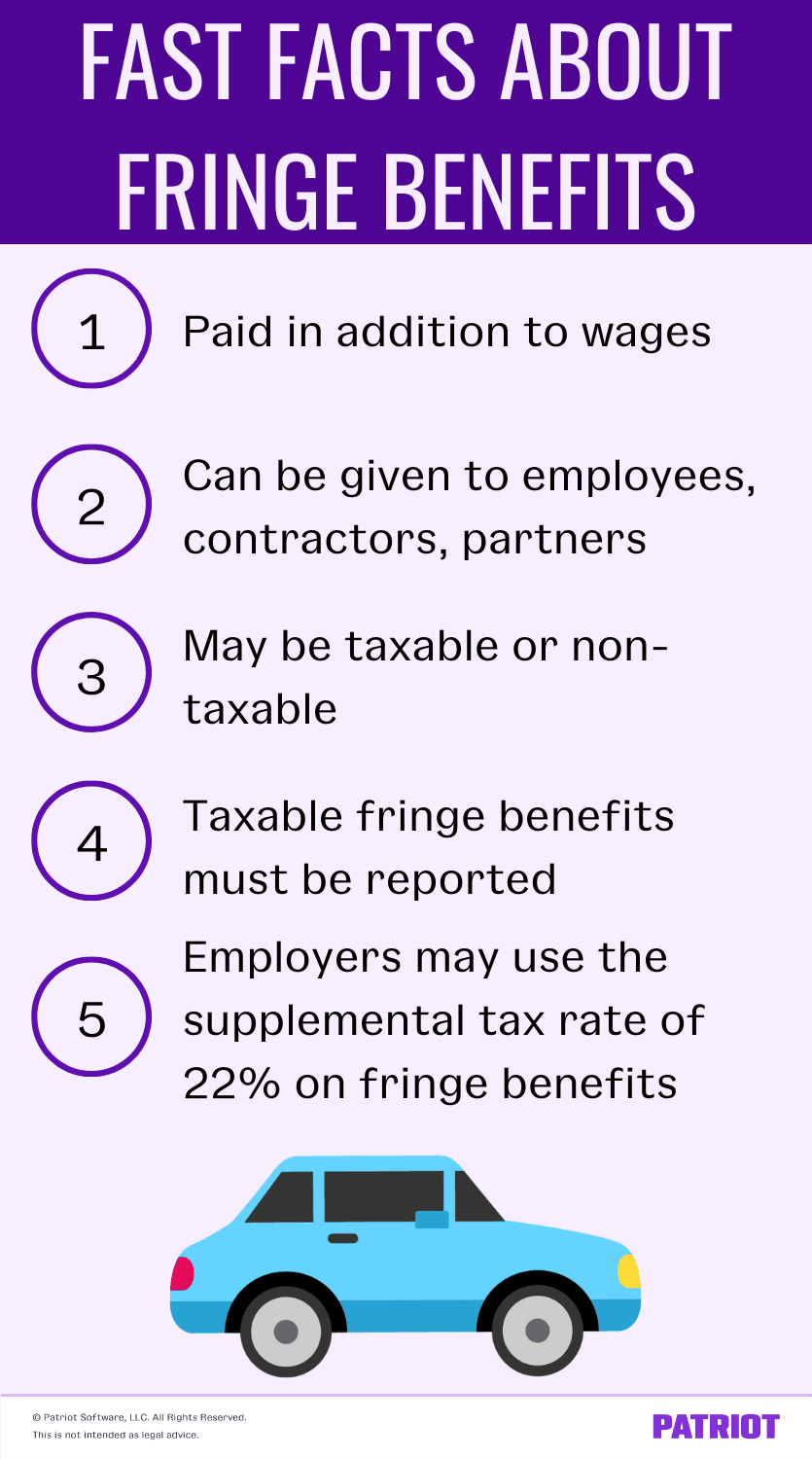

How To Calculate Fringe Benefit Tax

https://www.patriotsoftware.com/wp-content/uploads/2020/11/fringe-benefit-rate.png

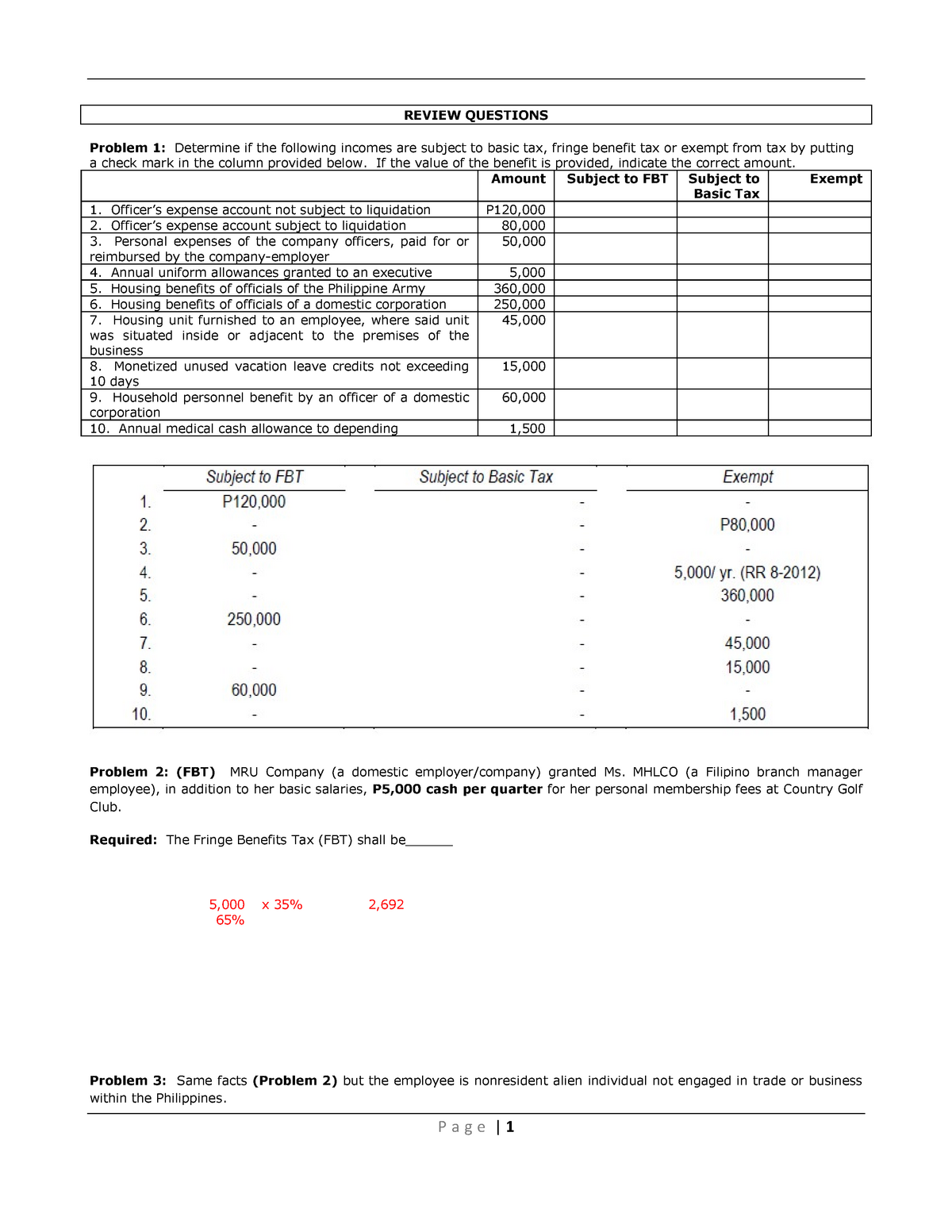

The prevailing personal income tax rate is used to calculate the applicable tax rate for fringe benefits which is based on the employee s total taxable income Employee Taxation The value of fringe benefits is added to the employee s taxable income and is subject to personal income taxation Fringe benefit tax is provided under section 12B of the Income Tax Act which became effective from 12th June 1998 in respect of loans provided to an employee director or their relatives at an interest rate lower than the market interest rate

How you work out the taxable value of a fringe benefit varies according to the type of benefit If the cost of the fringe benefit included GST include this in the taxable value If you provided car fringe benefits you can use the FBT car calculator to work out the taxable value of those benefits FBT car calculator 7 minutes Fringe benefit tax quarterly calculator Use this calculator to work out FBT on all benefits provided when you file quarterly FBT returns Select the rate and add GST exempt or zero rated fringe benefits Select either the standard rate or alternate rate Add any GST exempt or zero rated fringe benefits

Download Fringe Benefit Tax Calculation Example

More picture related to Fringe Benefit Tax Calculation Example

Fringe Benefit Tax Bartleby

https://cms-media.bartleby.com/wp-content/uploads/sites/2/2021/06/03144326/Fringe-Benefit-Tax-1.jpg

7 Lessons I Learned From An Accidental Millionaire

http://www.danieledelnero.com/wp-content/uploads/2020/07/types-of-employee-benefits-and-perks-2060433-Final-65c1c14d22de4e10b4f4ea85af6bd187.png

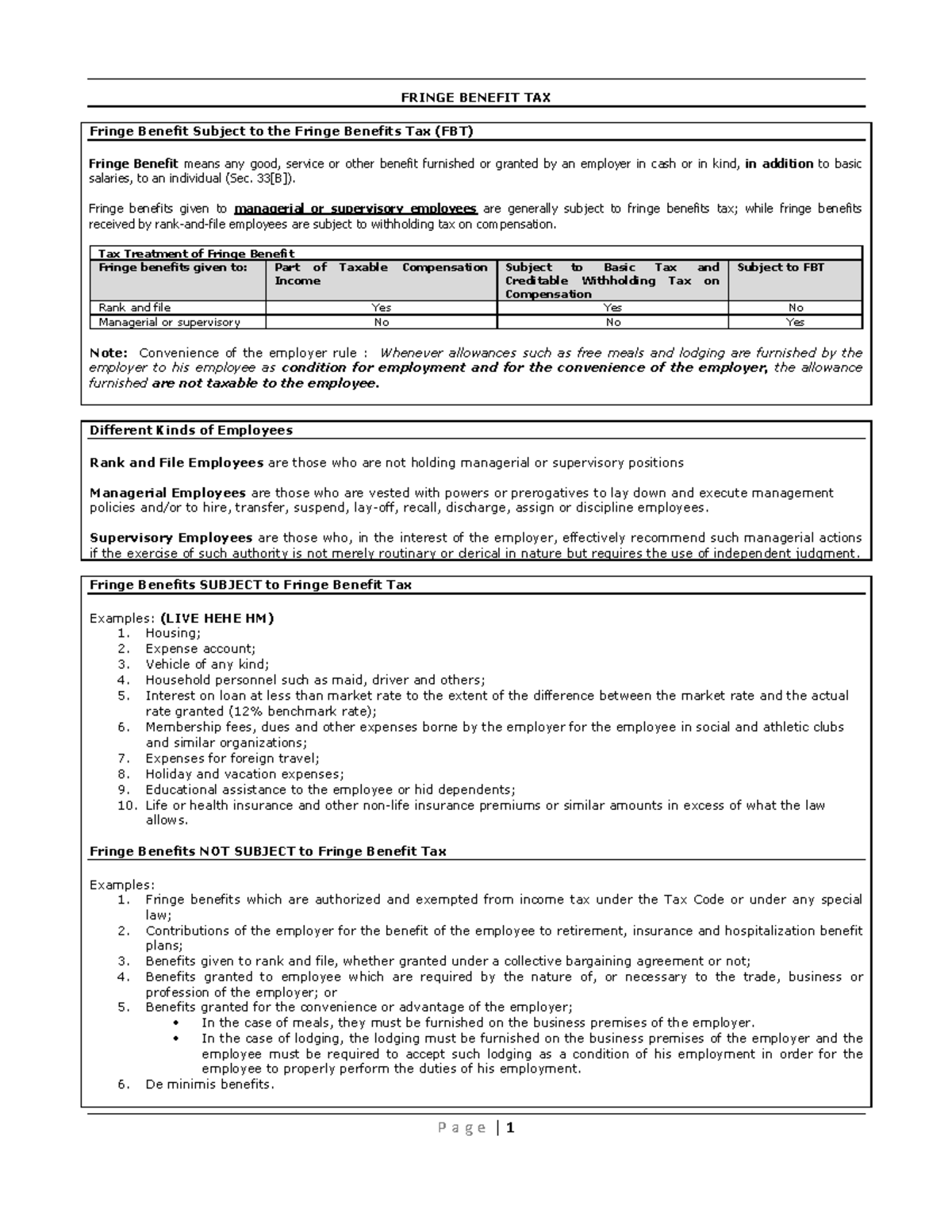

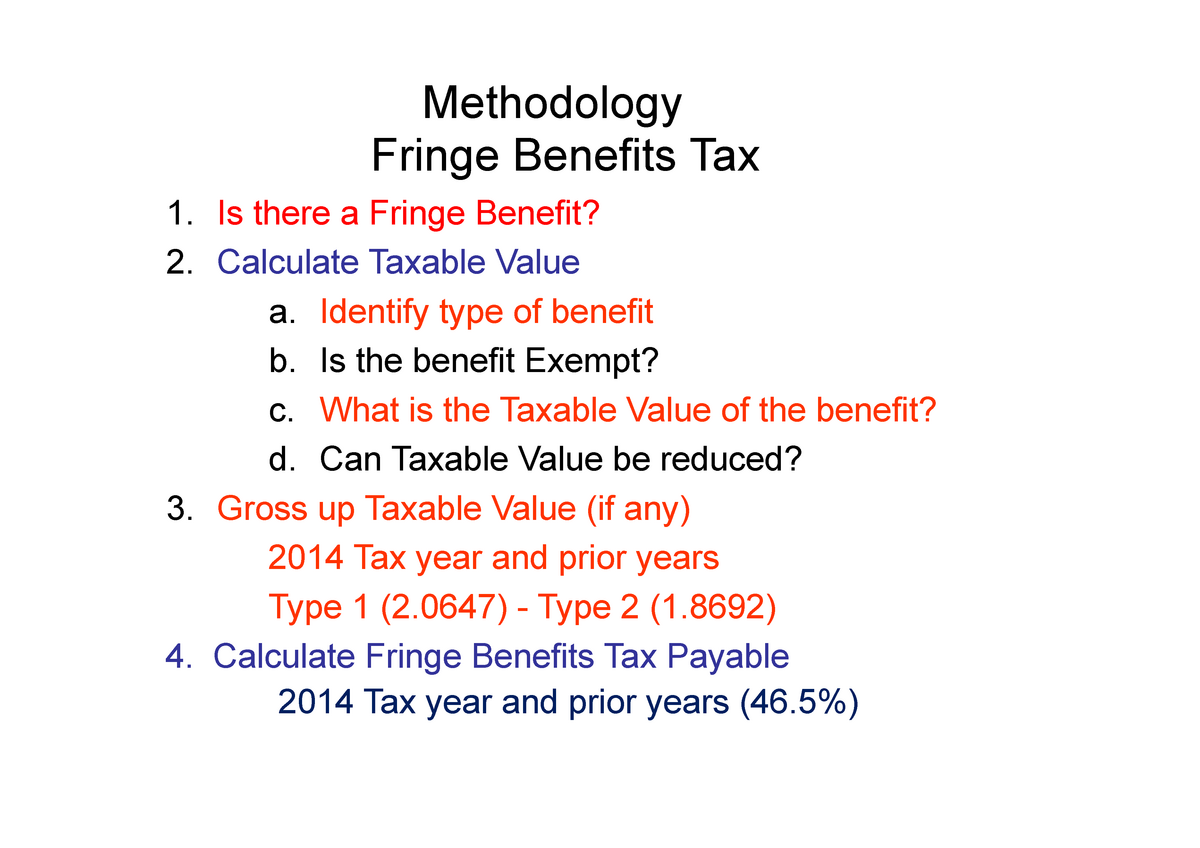

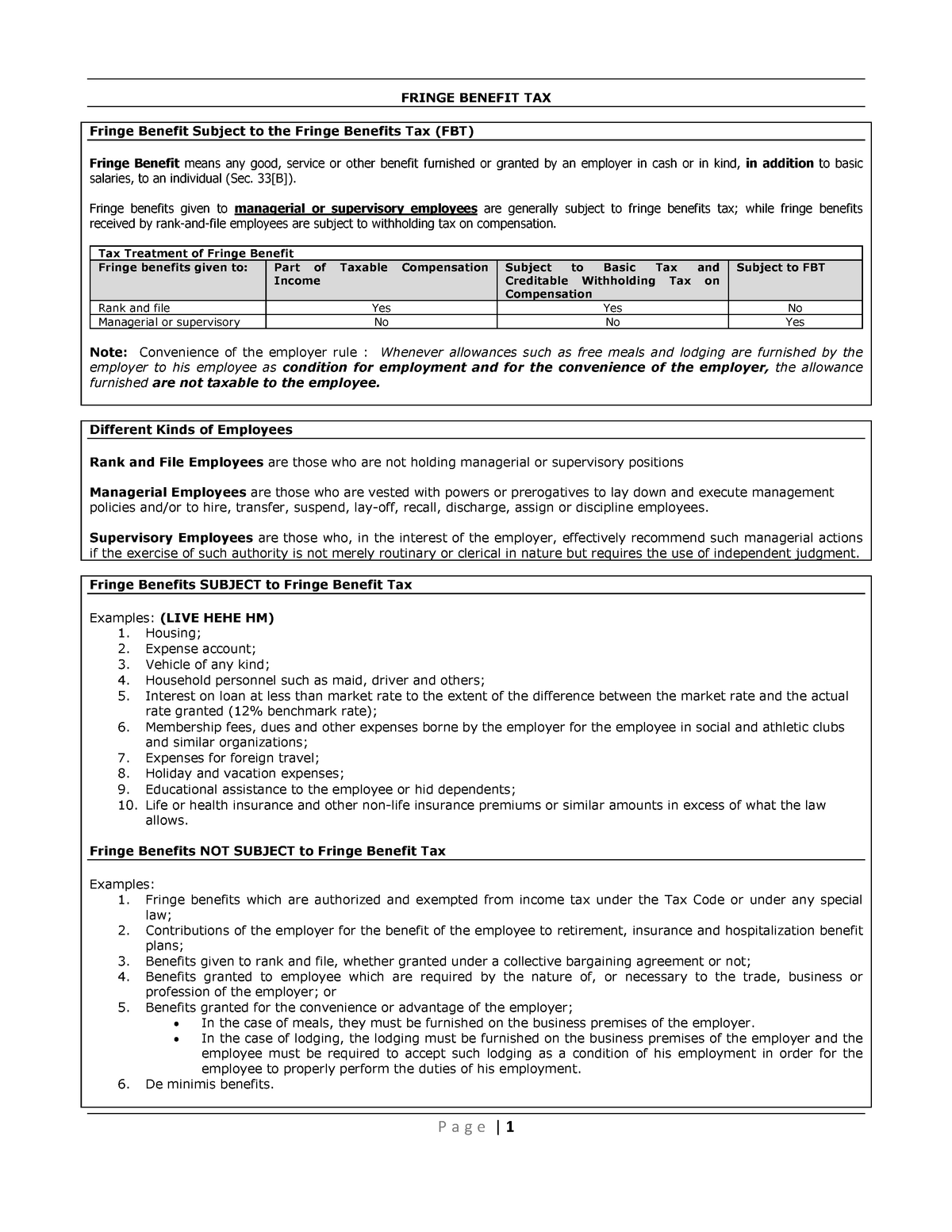

Lecture Summary For Fringed Benefits Tax Methodology Fringe

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/e08a6fb4e3bb5cc6ea5a2f53d6a5a696/thumb_1200_848.png

FBT is put mostly in place to ensure that employees pay taxes on the whole value of their compensation from employers not just their salaries Taxing fringe benefits helps prevents employees from obtaining non monetary compensation not subject to tax FRINGE BENEFIT TAX For the purposes of Section 12B of the Income Tax Act the Market Interest Rate is 7 This rate shall be applicable for the three months of January February and March 2020 DEEMED INTEREST RATE For purposes of section 16 5 the prescribed rate of interest is 7

[desc-10] [desc-11]

IRS Calculation For Fringe Benefit Valuation Rules Tax Hive

https://taxhive.com/wp-content/uploads/IRS-Calculation-for-Fringe-Benefit-Valuation-Rules.jpg

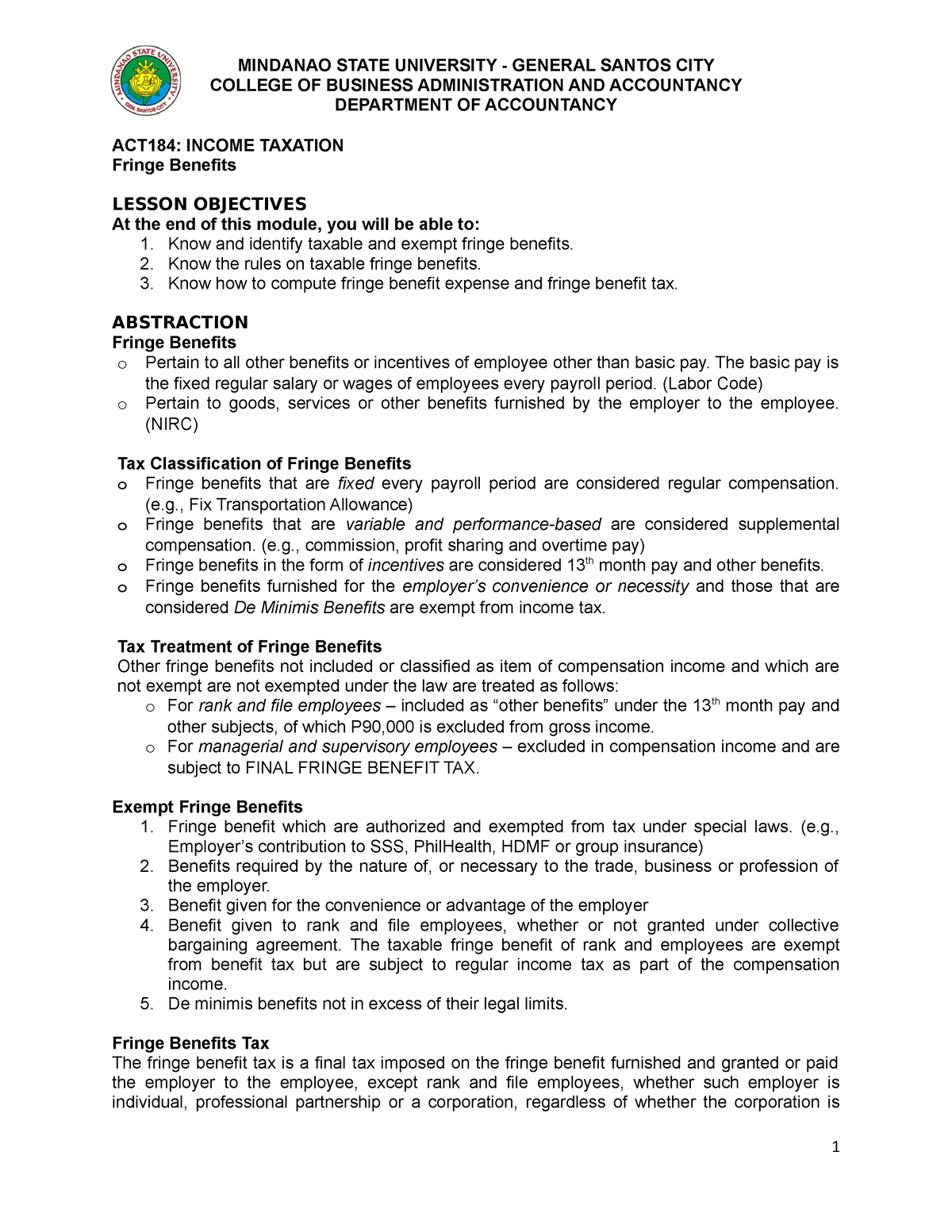

Chapter 11 Taxation Chapter 11 Fringe Benefit Tax I Description

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/5ff96bb8d5e19136d73e493263b563a9/thumb_1200_1553.png

https://apps.wingubox.com/fringe-benefit-tax-calculator-kenya

Fringe Benefit Tax Low interest benefit is considered as fringe benefit extended to an employee and is taxable at a rate of 30 The actual benefit savings that employee makes is what is chargeable and not the loan or installment

https://www.kra.go.ke/images/publications/PAYE_Guide-2.pdf

The objective of this ooklet is to explain the system of deductin income tax from employees emoluments It does NOT therefore in an wa modif or replace the General Legislation Income Tax Act Cap 470 and the Tax Procedures Act 2015 The Guide is available on the KRA website NOTE I

How To Calculate Tax On Salary Wholesale Deals Save 40 Jlcatj gob mx

IRS Calculation For Fringe Benefit Valuation Rules Tax Hive

Fringe Benefit Tax Company Doctors

Module 3 Fringe Benefit Tax COLLEGE OF BUSINESS ADMINISTRATION AND

Fringe Benefit Tax Explained QC Accountants

Sharell Ferrara

Sharell Ferrara

Fringe Benefits Tax Business Fitness Help Support

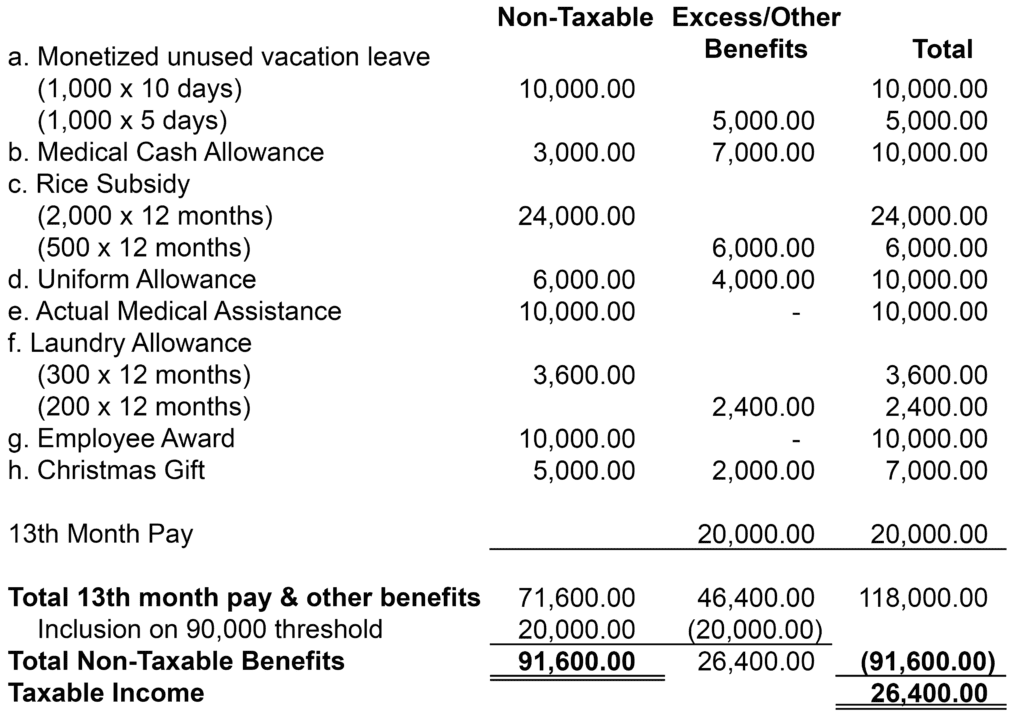

What Are De Minimis Benefits AccountablePH

5 Fringe Benefit Tax problems And Solution PSBA PSBA REVIEW

Fringe Benefit Tax Calculation Example - [desc-13]