Fringe Benefit Tax On Motor Vehicles Fringe benefits Right of use of motor vehicle Reference to the Act Paragraph 2 b and 7 of the 7th Schedule Meaning A taxable benefit shall be deemed to have been granted where an employee is granted the right of use of any motor vehicle for private or domestic purposes The cash equivalent of the value of the taxable benefit shall be

AMENDMENT OF REGULATIONS ON PAYMENT OF FRINGE BENEFITS TAX FBT The Malawi Revenue Authority MRA is informing employers and employees of the amendment of regulations on the payment of Fringe Benefits Tax FBT with effect from 19th May 2023 The following are the amended regulations 1 If your business makes a vehicle available for employees including shareholder employees and their associated persons to use privately you may need to pay fringe benefit tax FBT You may be liable to pay FBT even if they do not actually use it

Fringe Benefit Tax On Motor Vehicles

Fringe Benefit Tax On Motor Vehicles

https://www.infonews.co.nz/photos/600-09A3858A-DDB4-48FA-8061F92C465B49CC.jpg

Fringe Benefits Tax On Motor Vehicles Changes In 2021 2022 Moore

https://www.moore-australia.com.au/getmedia/9652caff-9ec3-4267-b1db-06eeadaac08c/MA-blog-FBT-Car-Fringe-Benefits?width=712&height=300&ext=.jpg

Fringe Benefits Tax On Motor Vehicles In The Philippines Employer

https://imgv2-2-f.scribdassets.com/img/document/432310559/original/121aa39c4d/1702625994?v=1

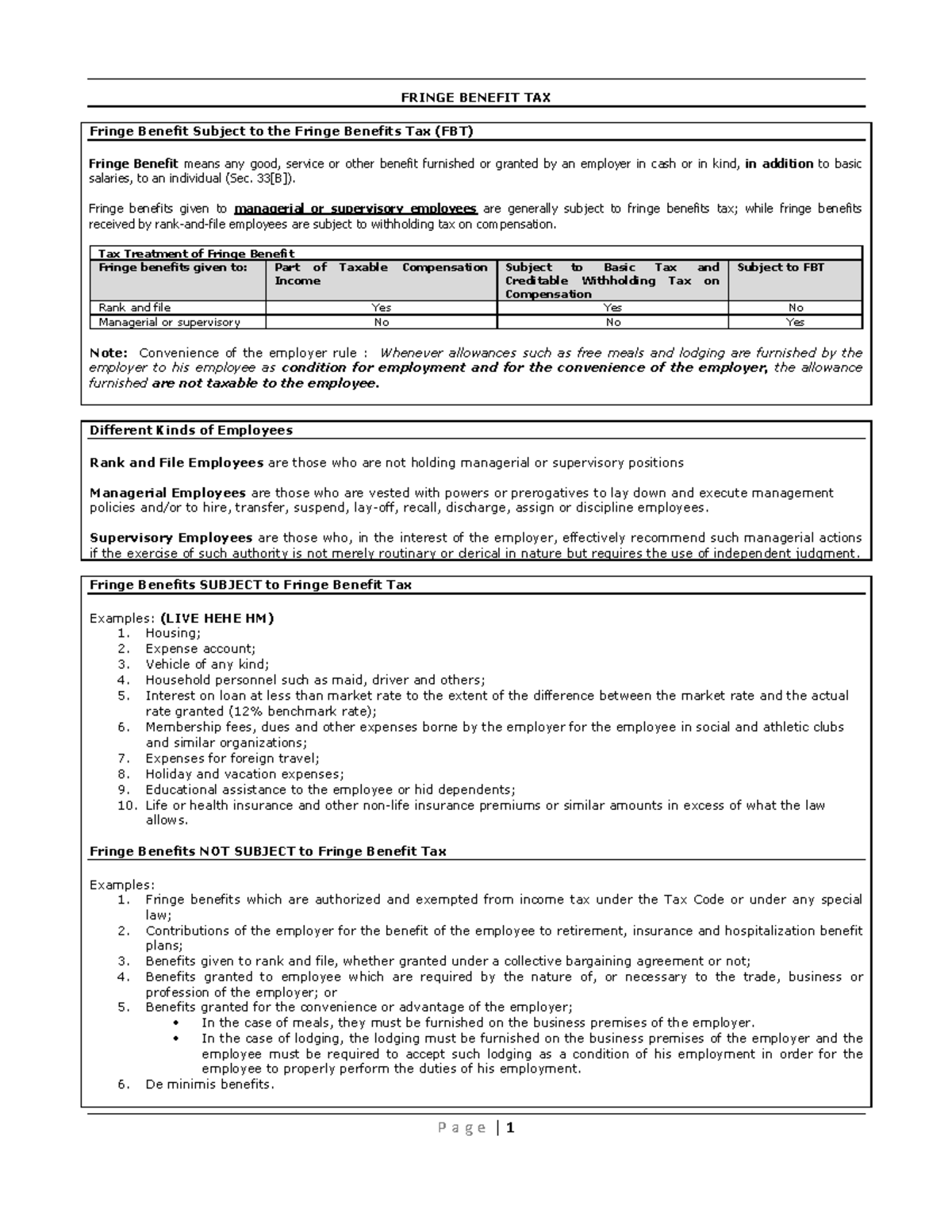

You can use the fringe benefits tax FBT car calculator to work out the taxable value of a car fringe benefit and to work out the amount of FBT to pay You can use either the statutory method or operating cost method Cars and FBT How FBT applies to cars private versus business use car leasing and calculating the value of a car fringe benefit Exempt use of eligible vehicles Your employee s limited private use of a ute van or other eligible vehicle may be exempt from FBT Electric cars exemption

Cars or motor vehicles is a common fringe benefit of employers to managerial and supervisory employees in the Philippines Usual executive compensation package would provide a car plan under varying terms Fringe benefit tax income year calculator Use this calculator to work out FBT on all benefits provided when you file income year FBT returns Print Last updated 31 Mar 2023 How to work out the taxable value of a motor vehicle

Download Fringe Benefit Tax On Motor Vehicles

More picture related to Fringe Benefit Tax On Motor Vehicles

Fringe Benefits Tax Business Fitness Help Support

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/5143001953/original/f9FE9VgRjEMVtq9AnbiknIL-SZsaREt8sg.png?1635114176

Fringe Benefits Tax Time Connolly Associates

https://connollysbs.com.au/wp-content/uploads/2023/03/fringe-benefits-tax-time.jpg

Motor Vehicles And Fringe Benefit Tax

https://play.vidyard.com/xR2Zmdnkx3GtxBxSJxZDCg.jpg

FBT exemption for eligible vehicles There is no fringe benefits tax FBT when an employee uses your vehicle if it is an eligible vehicle and private use of the vehicle is limited There is a separate exemption for eligible electric cars MALAWI REVENUE AUTHORITY INCOME TAX DIVISION FRINGE BENEFIT TAX REGISTRATION FORM 1 Name of Employer

[desc-10] [desc-11]

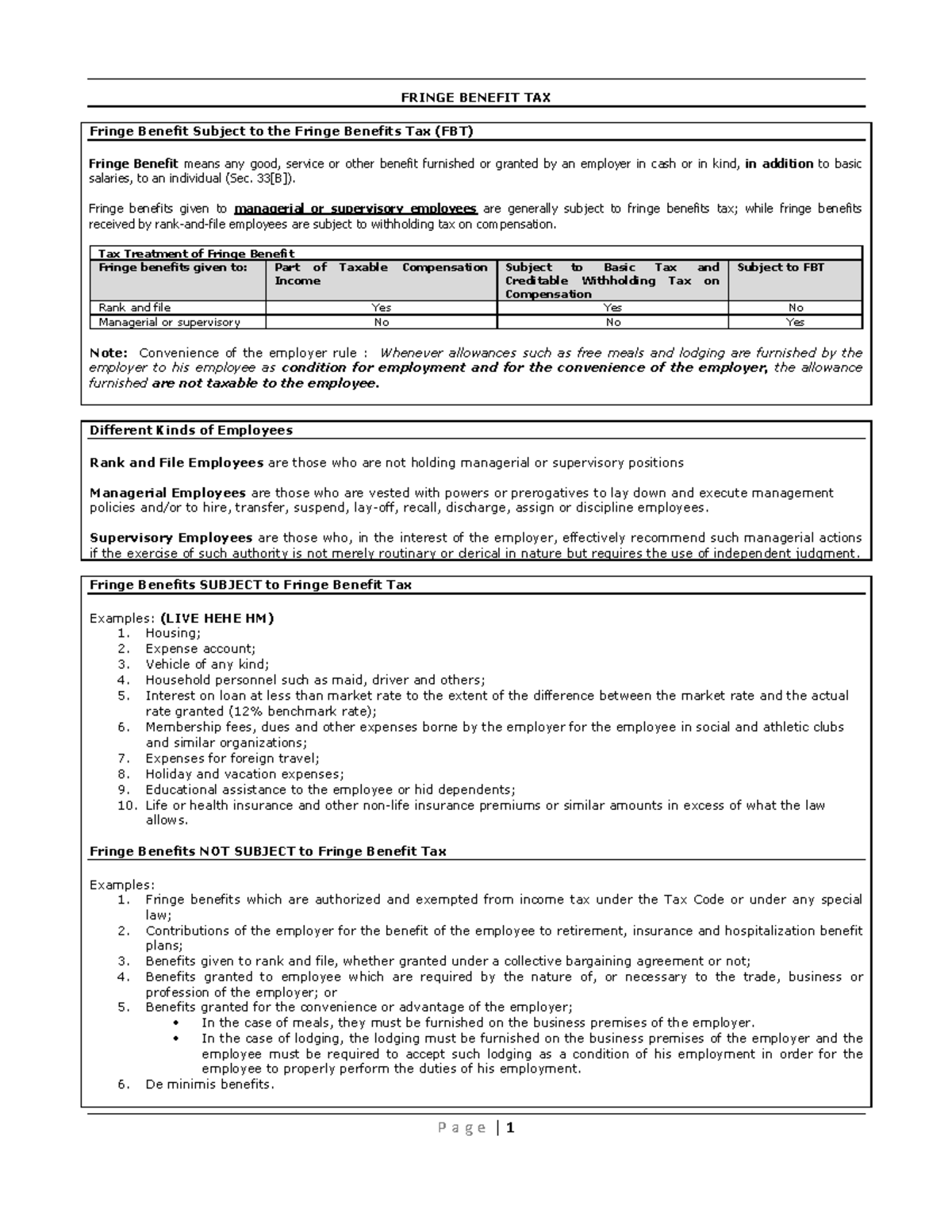

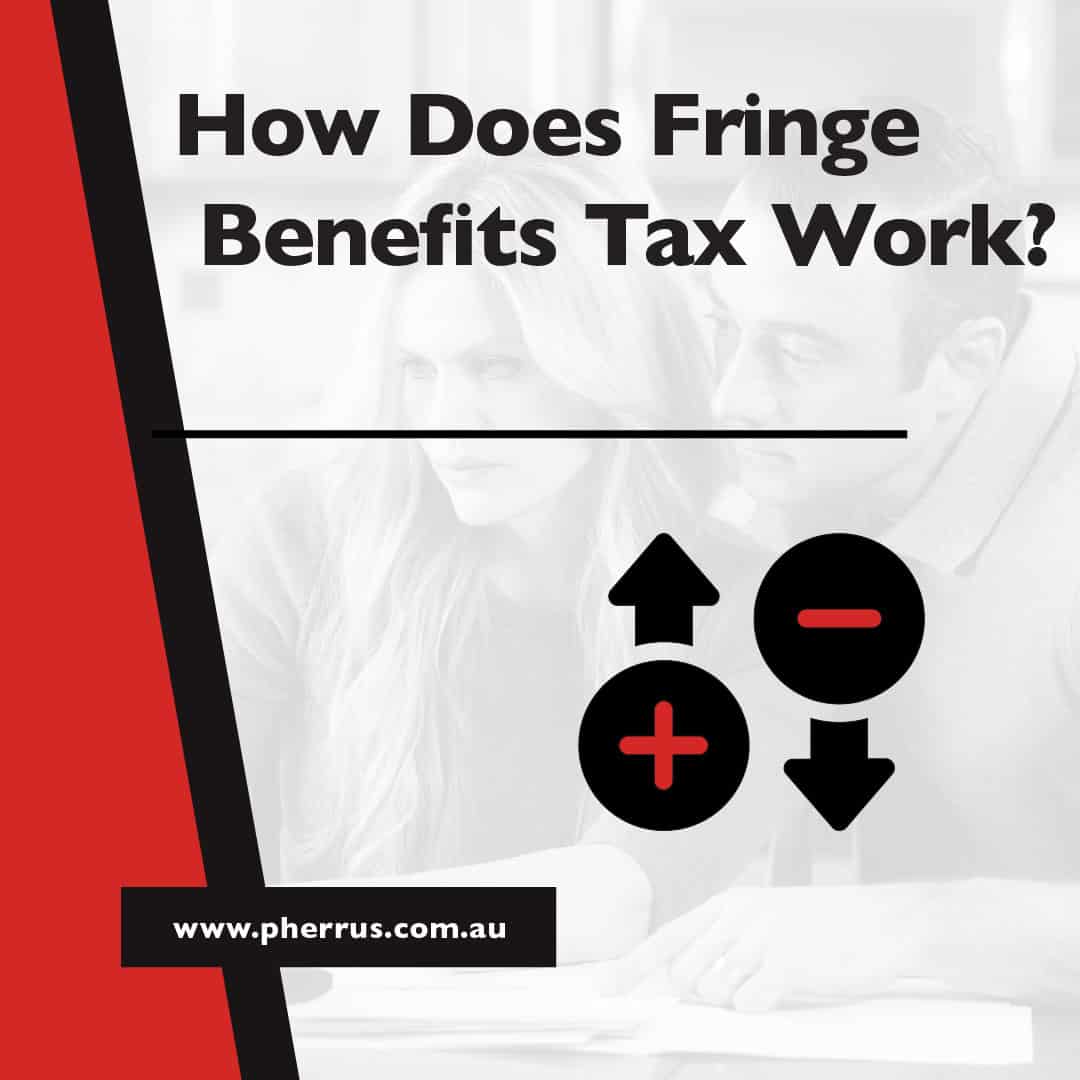

5 Fringe Benefit Tax PSBA FRINGE BENEFIT TAX Fringe Benefit Subject

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8b71089f8c1a9b7f1103bf6c5ed846ad/thumb_1200_1553.png

.png#keepProtocol)

Fringe Benefit Tax Update 2022

https://blog.agredshaw.com.au/hubfs/Fringe Benefit Tax Update - 2022 (v2).png#keepProtocol

https://www.sataxguide.co.za/fringe-benefits-right...

Fringe benefits Right of use of motor vehicle Reference to the Act Paragraph 2 b and 7 of the 7th Schedule Meaning A taxable benefit shall be deemed to have been granted where an employee is granted the right of use of any motor vehicle for private or domestic purposes The cash equivalent of the value of the taxable benefit shall be

https://www.mra.mw/press-releases/amendment-of...

AMENDMENT OF REGULATIONS ON PAYMENT OF FRINGE BENEFITS TAX FBT The Malawi Revenue Authority MRA is informing employers and employees of the amendment of regulations on the payment of Fringe Benefits Tax FBT with effect from 19th May 2023 The following are the amended regulations 1

What Is Fringe Benefit Tax

5 Fringe Benefit Tax PSBA FRINGE BENEFIT TAX Fringe Benefit Subject

Fringe Benefit Tax Bartleby

TOPIC 20 FRINGE BENEFITS Exemption Of Rank and File Employees From

Are You Complying With Your Fringe Benefits Tax Liability Of Up To 47

How Does Fringe Benefits Tax Work Pherrus

How Does Fringe Benefits Tax Work Pherrus

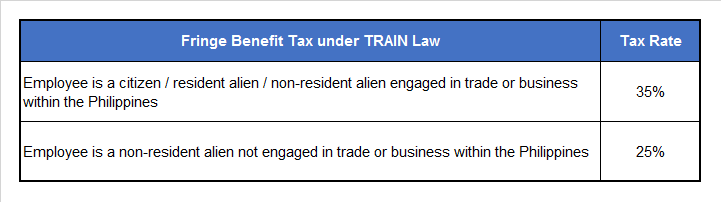

What Is The Tax Rate For Fringe Benefits

Chapter 11 Taxation Chapter 11 Fringe Benefit Tax I Description

HMRC Company Car Tax Rates 2020 21 Explained

Fringe Benefit Tax On Motor Vehicles - Cars and FBT How FBT applies to cars private versus business use car leasing and calculating the value of a car fringe benefit Exempt use of eligible vehicles Your employee s limited private use of a ute van or other eligible vehicle may be exempt from FBT Electric cars exemption