Fringe Benefits Reduce Employer Tax Rebatable Web The car fringe benefits are type 1 benefits because they are GST taxable supplies with an entitlement to a GST credit Mark s car fringe benefit calculated using the statutory

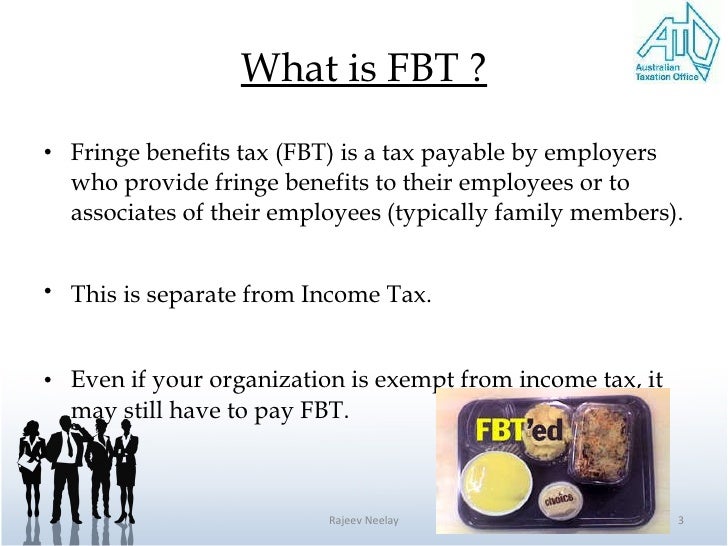

Web If you receive fringe benefits with a total taxable value of more than 2 000 in a fringe benefits tax FBT year 1 April to 31 March your employer will report this amount to Web 10 mars 2022 nbsp 0183 32 They can provide fringe benefits without incurring an FBT liability up to a cap FBT rebatable employers include non profit non government schools Fringe benefits they provide initially incur the

Fringe Benefits Reduce Employer Tax Rebatable

Fringe Benefits Reduce Employer Tax Rebatable

https://image.slidesharecdn.com/fringe-benefits-tax-1233306520106712-3/95/fringe-benefits-tax-3-728.jpg?cb=1233285149

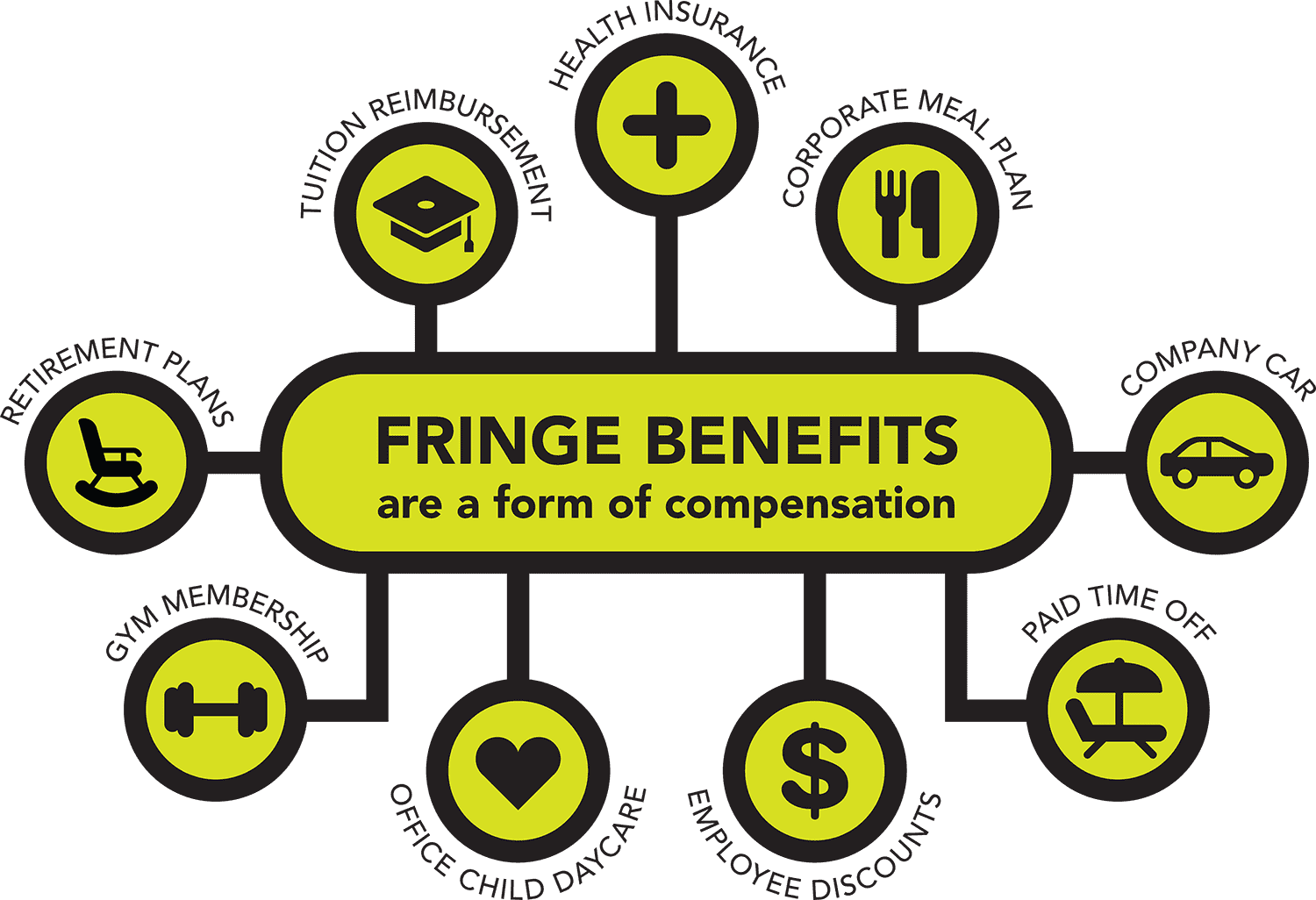

All About Fringe Benefits For Employees CohaiTungChi Tech

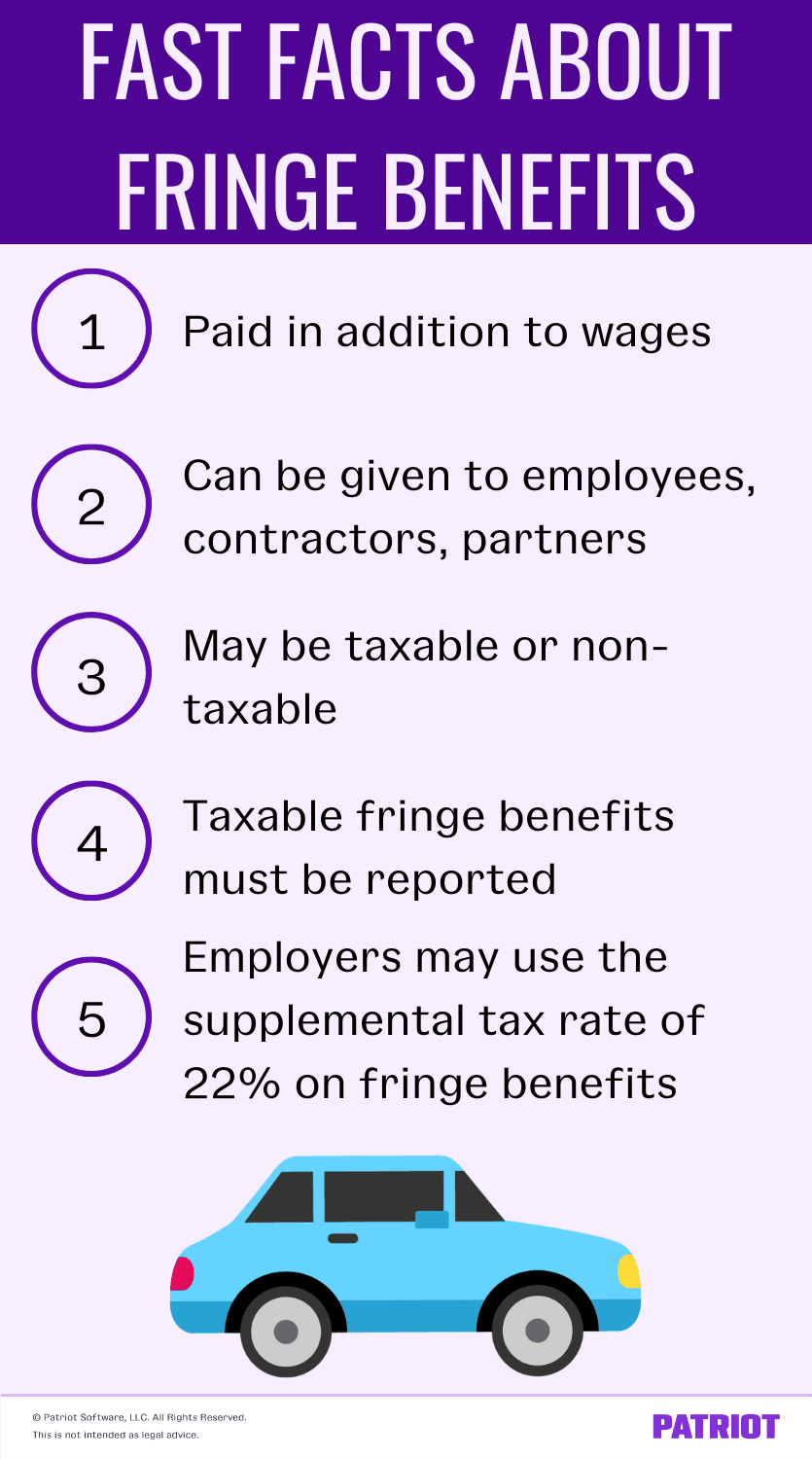

https://www.patriotsoftware.com/wp-content/uploads/2017/05/fringe-benefits-1.png

What Are Taxable Fringe Benefits

https://image.slidesharecdn.com/fringebenefitstaxrajeevfinal-091116160958-phpapp02/95/fringe-benefits-tax-rajeev-final-6-728.jpg?cb=1258387862

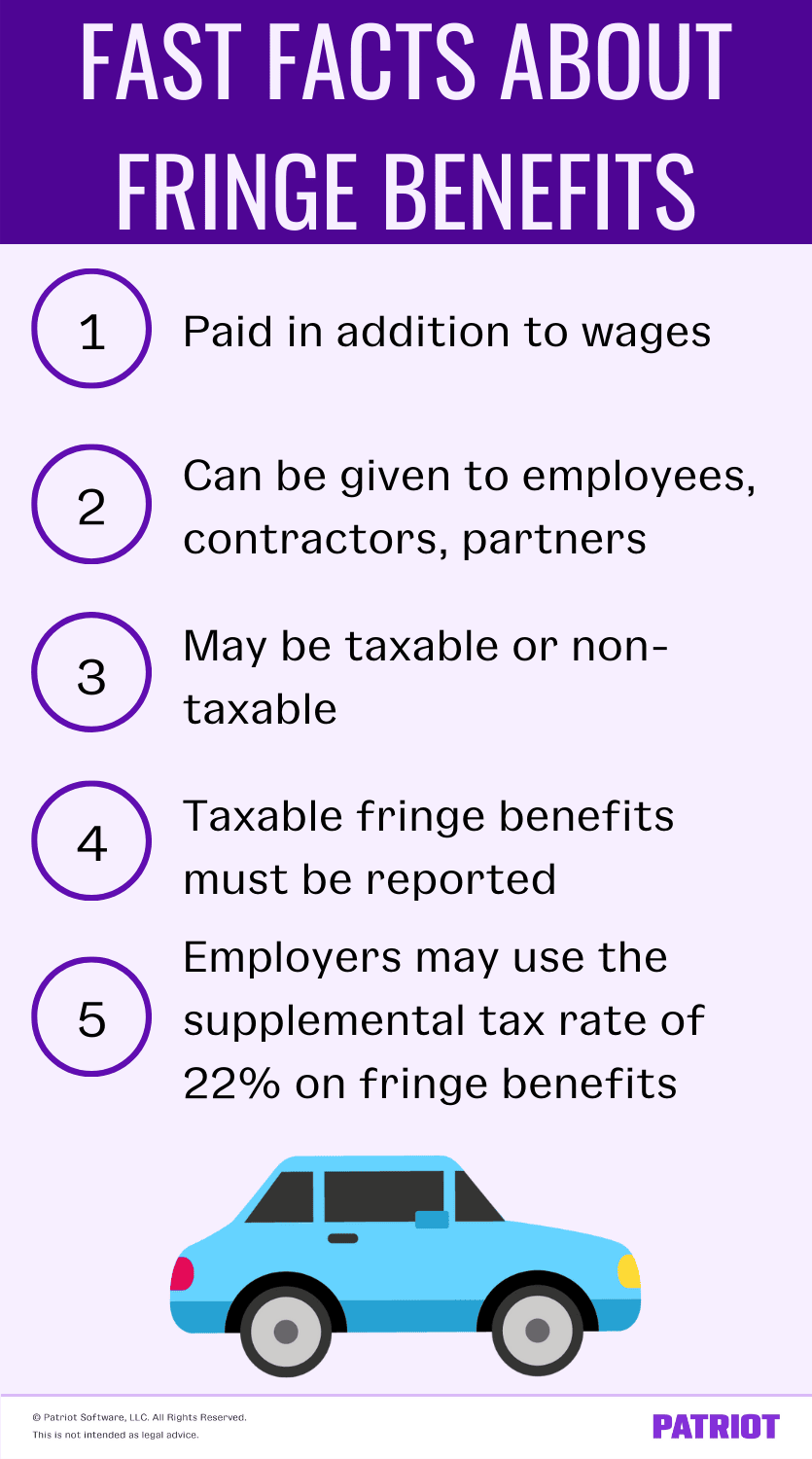

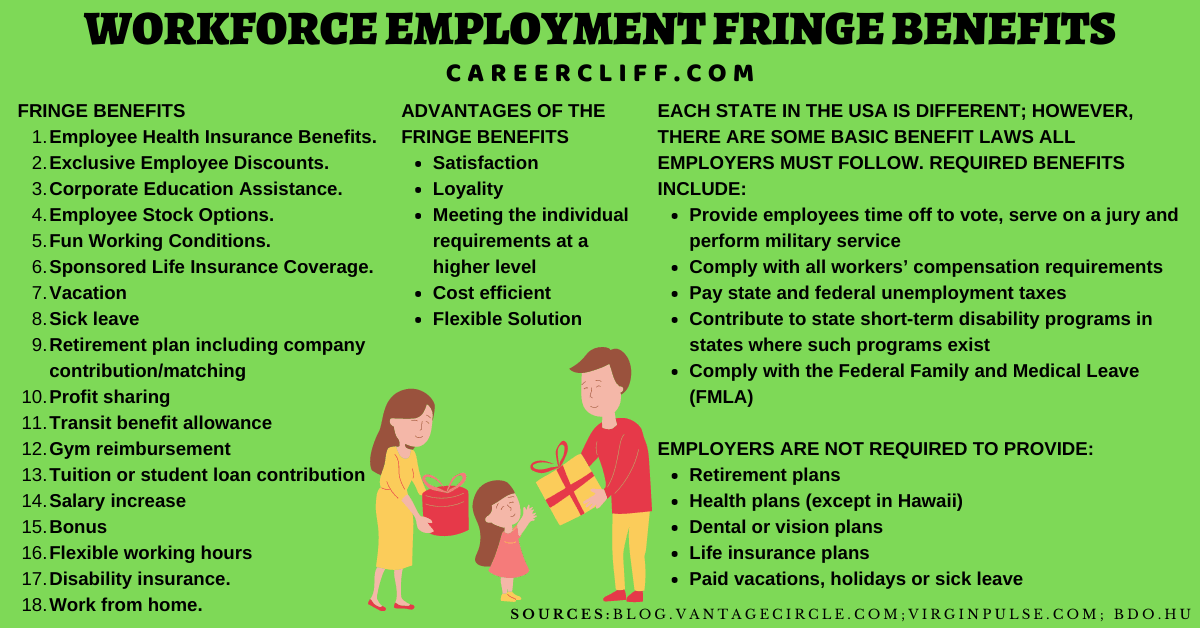

Web The changes to the method for calculating the amount of the rebate will improve the equity of the tax system while recognising the special needs of the rebatable employers who Web 12 mars 2022 nbsp 0183 32 Fringe benefits are generally considered taxable income if the employer pays them to their employees in cash So bonuses or reimbursements for expenses paid

Web Your aggregate non rebatable amount is the total grossed up taxable value of the fringe benefits you provide to an individual employee exceeding 30 000 You are entitled to a Web collecting the tax The Act is quite separate from the income tax assessment Acts Fringe Benefits Tax Act 1986 imposes tax on t he taxable value of fringe benefits Any

Download Fringe Benefits Reduce Employer Tax Rebatable

More picture related to Fringe Benefits Reduce Employer Tax Rebatable

The Comprehensive Guide To Fringe Benefits AttendanceBot

https://blog.attendancebot.com/wp-content/uploads/2021/06/Fringe-Benefits-Examples-min.png

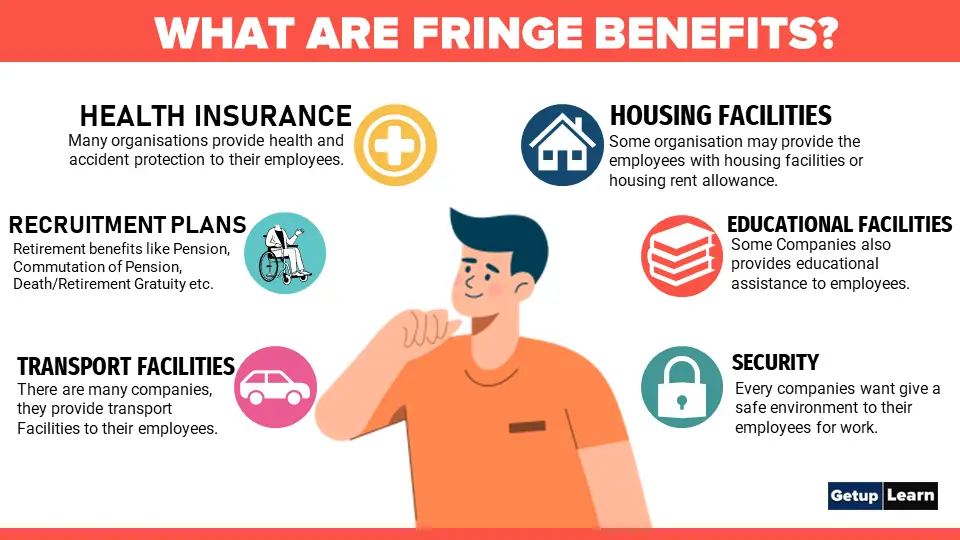

Fringe Benefit Kimberlie Hancock

https://getuplearn.com/wp-content/uploads/2022/05/What-are-Fringe-Benefits.png

Employee Fringe Benefits How To Use Them To Reduce Your Taxes

https://media.licdn.com/dms/image/C5612AQEOfoRmJkc0Qw/article-cover_image-shrink_600_2000/0/1563636350209?e=2147483647&v=beta&t=NgxKyBS1bpAuc3s8l4d-7RgBKYxRtZo2-u2ZGlEKo1Y

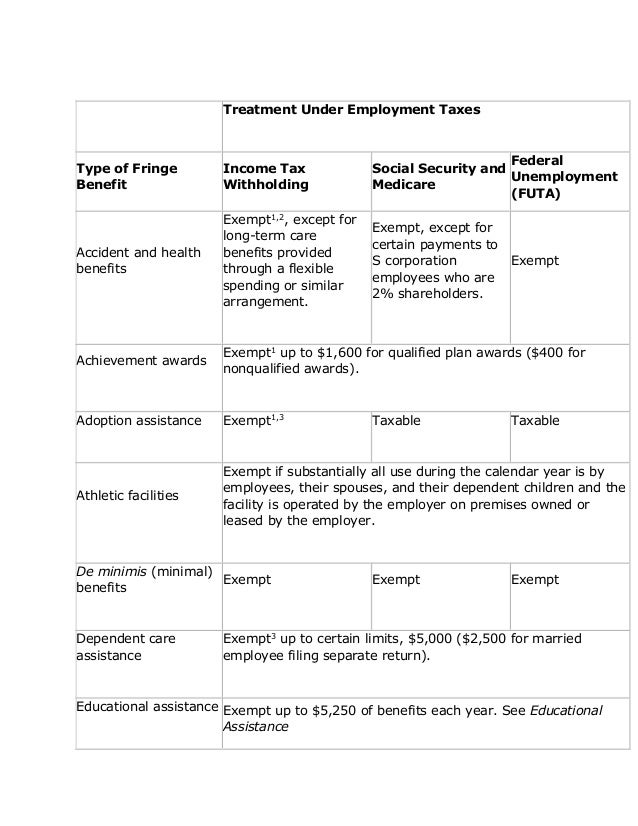

Web Fringe benefits for employees are taxable wages unless specifically excluded by a section of the IRC IRC Sections 61 61 a 1 3121 3401 More than one IRC section may apply Web FBT rebatable employers e g certain societies associations or clubs are subject to a 30 000 cap on the amount of fringe benefits which are eligible for an FBT rebate they

Web Example Calculated fringe benefits taxable amounts for a rebatable employer A rebatable employer provides fringe benefits to 10 of their employees The employer pays all 10 employees children s school Web In the case of a FBT rebatable organisation FBT will be payable but at a reduced amount These limits essentially mean that if you work for a not for profit organisation which has a

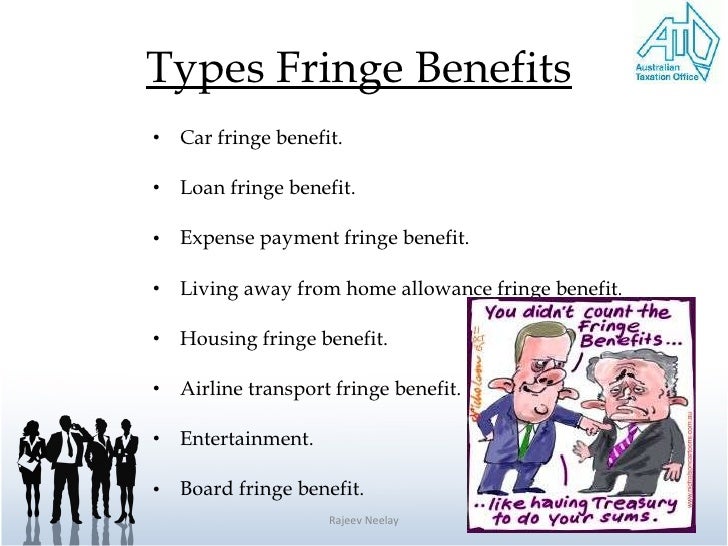

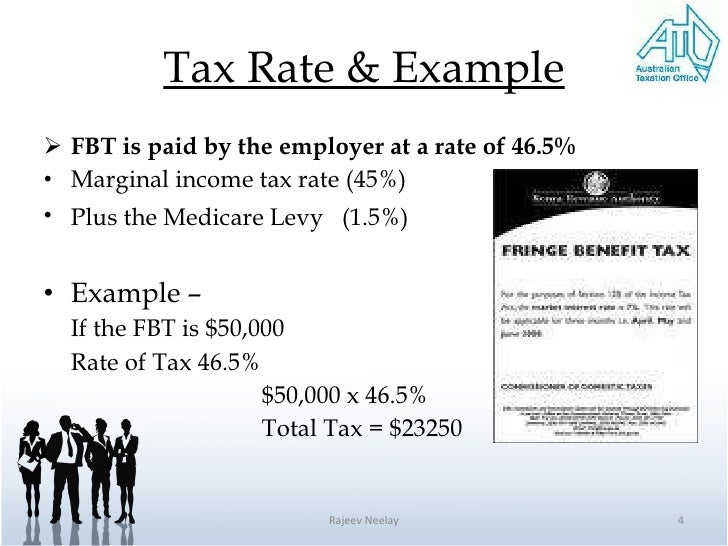

Fringe Benefits Tax Rajeev Final

https://image.slidesharecdn.com/fringebenefitstaxrajeevfinal-091116160958-phpapp02/95/fringe-benefits-tax-rajeev-final-3-728.jpg?cb=1258387862

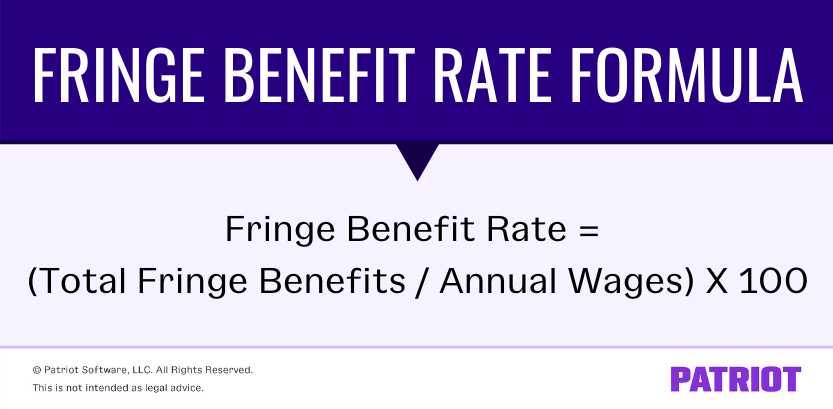

How To Calculate Fringe Benefit Tax

https://www.patriotsoftware.com/wp-content/uploads/2020/11/fringe-benefit-rate.png

https://www.ato.gov.au/Forms/2021-Fringe-benefits-tax-return...

Web The car fringe benefits are type 1 benefits because they are GST taxable supplies with an entitlement to a GST credit Mark s car fringe benefit calculated using the statutory

https://www.ato.gov.au/Individuals/Jobs-and-employment-types/Working...

Web If you receive fringe benefits with a total taxable value of more than 2 000 in a fringe benefits tax FBT year 1 April to 31 March your employer will report this amount to

You Have Grown Up Record Slideshow

Fringe Benefits Tax Rajeev Final

SME Guide To Fringe Benefits Tax Noteworthy At Officeworks

Fringe Benefit

Fringe Benefits Tax Rajeev Final

FRINGE BENEFITS TAX AND EMPLOYEE WITHHOLDING 2014 ARIVA Academy

FRINGE BENEFITS TAX AND EMPLOYEE WITHHOLDING 2014 ARIVA Academy

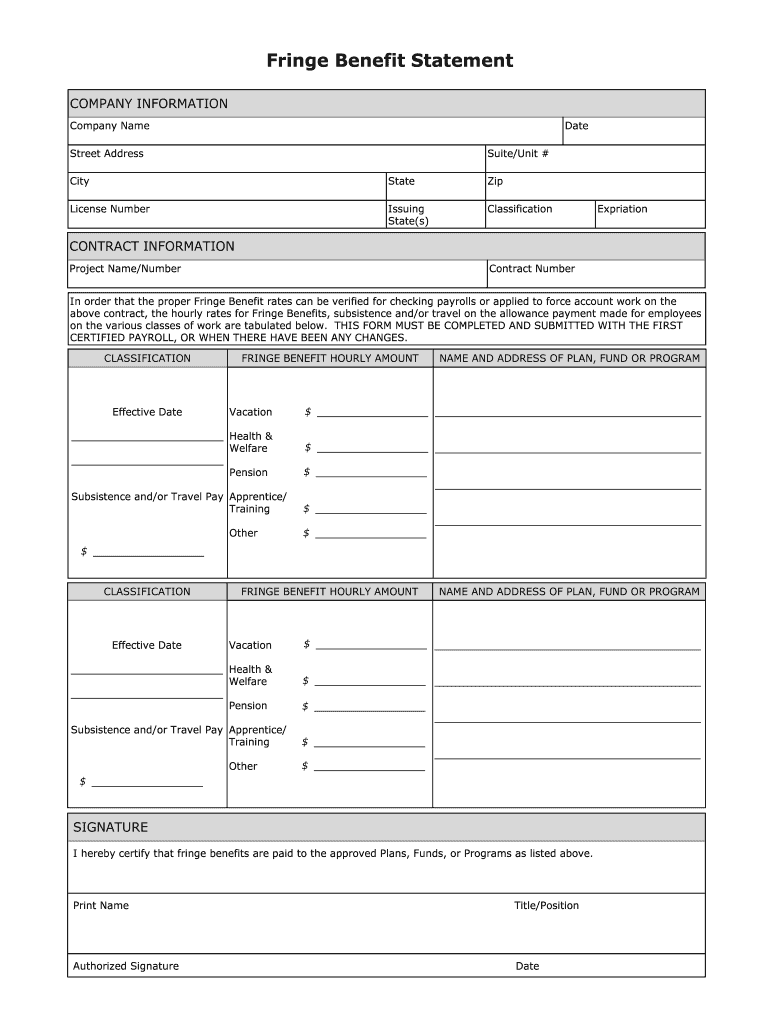

Statement Fringe Benefit Fill Online Printable Fillable Blank

Fringe Benefit

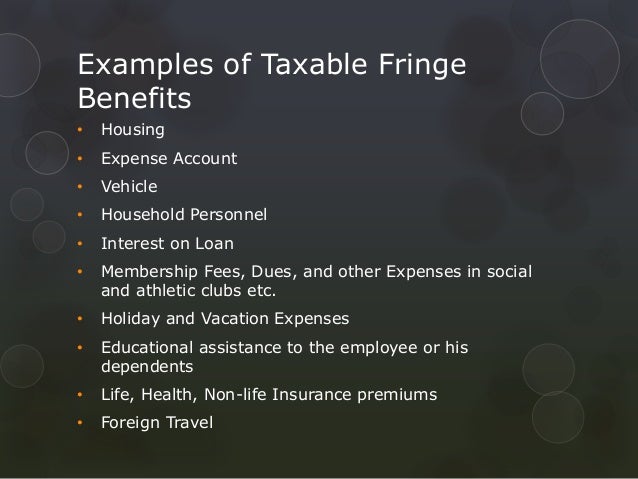

Taxable Fringe Benefits

Fringe Benefits Reduce Employer Tax Rebatable - Web 12 mars 2022 nbsp 0183 32 Fringe benefits are generally considered taxable income if the employer pays them to their employees in cash So bonuses or reimbursements for expenses paid