Fuel Allowance Tax Return 45p per mile is the tax free approved mileage allowance for the first 10 000 miles in the financial year it s 25p per mile thereafter If a business chooses to pay employees an amount towards the mileage

1 Car Allowance with a Fuel Card or Fuel Reimbursement A fuel card or fuel reimbursement is precisely as it sounds money provided to cover the cost of fuel for Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits

Fuel Allowance Tax Return

Fuel Allowance Tax Return

http://www.picpedia.org/handwriting/images/tax-return.jpg

Five Grown up Ways To Spend Your Tax Return

https://apexadvice.com.au/wp-content/uploads/sites/137/2023/09/202309-5-ways-to-spend-tax-return-copy.jpeg

John Paul O Shea Fuel Allowance Expansion Update John Paul O Shea

https://johnpauloshea.ie/wp-content/uploads/2022/12/Fuel-Allowance-2023-2.jpg

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5 cents mile Charities 14 cents mile Medical 22 cents mile Moving military only 22 The total of all expenses you report in this category must be reduced by two percent of your adjusted gross income or AGI For example if your only

Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 58 5 cents per mile driven for business A Tax Guide 2023 When employers provide automobiles to employees to help them perform their employment duties or instead give allowances or expense reimbursements the tax implications can be remarkably

Download Fuel Allowance Tax Return

More picture related to Fuel Allowance Tax Return

Tax Return Highway Sign Image

http://www.picpedia.org/highway-signs/images/tax-return.jpg

I Amended My Tax Return Now What

https://optimataxrelief.com/wp-content/uploads/2023/03/2023-optima-amended-tax-return-now-what.jpg

Delay In Fuel Allowance Payment To 3 000 People

https://img.rasset.ie/00066268-1600.jpg

The mileage rates for 2023 are 45p per mile for the first 10 000 miles for cars and vans 25p per mile after that for cars and vans 24p per mile for motorcycles 20p per mile for cycles Use the mileage allowance Medical mileage can be deducted sometimes Lower mileage rates apply in different circumstances The IRS rate is 18 cents a mile for the first half of 2022 and 22 cents a mile for the second

When using your personal vehicle for work you could claim tax relief on the approved mileage rate explained below that covers the cost of owning and running it The mileage tax deduction rules generally allow you to claim 0 655 per mile in 2023 if you are self employed You may also be able to claim a tax deduction for mileage in a few

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

https://www.thebalance.com/thmb/n0qY5_o0VzoZ5tk64K_PBHbmHrs=/1333x1000/smart/filters:no_upscale()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif

https://www.gosimpletax.com/blog/car-allowa…

45p per mile is the tax free approved mileage allowance for the first 10 000 miles in the financial year it s 25p per mile thereafter If a business chooses to pay employees an amount towards the mileage

https://taxsharkinc.com/car-allowance-taxed

1 Car Allowance with a Fuel Card or Fuel Reimbursement A fuel card or fuel reimbursement is precisely as it sounds money provided to cover the cost of fuel for

Withholding Tax Return

Prepare And File Form 2290 E File Tax 2290

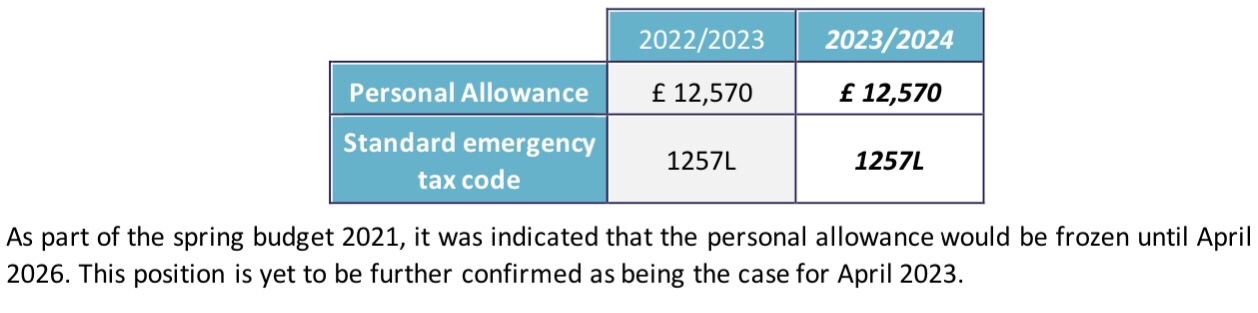

Tax Year 2023 2024 Resources PAYadvice UK

4 Smart Investments Using Your Tax Return

The Prescribed Travel Rate Per KM Increases And The Determined Travel

The Prescribed Travel Rate Per KM Increases And The Determined Travel

How To Use Aadhaar Card For Electronic Tax Return Verification

Fuel Allowance Form 2 Free Templates In PDF Word Excel Download

Tax Return And Tax Investigators Stock Photo Alamy

Fuel Allowance Tax Return - If your employer reimburses you under the approved amount of mileage allowance you are entitled to claim tax relief for the tax year on the unused amount of