Fuel Mileage Claim Rates Updated 26 March 2024 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for

The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances What is the mileage claim rate for 2022 The mileage claim rate for 2022 is 45p per mile for the first 10 000 miles and 25p per mile after that For motorcycles the rate is 24p per mile and for bicycles

Fuel Mileage Claim Rates

.jpg)

Fuel Mileage Claim Rates

https://uploads-ssl.webflow.com/60882c80d0ef9737f2ee0911/619bf8a437e9d4afa8e8ab4e_3 (3).jpg

Does Properly Inflating Your Tires Increase Gas Mileage Insurance

https://www.insurancenavy.com/images/does-properly-inflating-your-tires-increase-gas-mileage.png

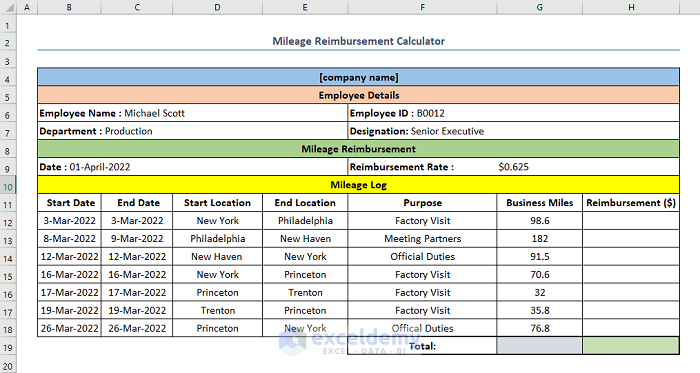

How To Calculate Mileage Claim In Malaysia Karen Rutherford

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-mileage-reimbursement-in-excel-2.png

Use the provided HMRC mileage claim calculator to determine how much you can receive in reimbursement for your business driving To calculate this you will Currently HMRC mileage rates are set at 45p per mile for the first 10 000 miles for cars and vans After 10 000 miles the amount that businesses can claim back

What the 2024 HMRC mileage rates and what journeys can employees claim This is covered in TravelPerk s short guide to mileage allowance in the UK The mileage allowance will be tax free if it does not exceed HMRC s approved mileage allowance payment AMAP rates which are currently as follows Cars and vans first

Download Fuel Mileage Claim Rates

More picture related to Fuel Mileage Claim Rates

How To Calculate Mileage Claim In Malaysia Karen Rutherford

https://www2.deloitte.com/content/dam/Deloitte/nz/Images/infographics/tax alert/tax-alert-infographics-June-2021.JPG

Updates To Company Car Mileage Rates In 2022

https://b2355905.smushcdn.com/2355905/wp-content/uploads/2022/10/8-1080x675.png?lossy=1&strip=1&webp=1

18 Mileage Expense Worksheets Worksheeto

https://www.worksheeto.com/postpic/2013/05/gas-mileage-log-sheet-printable_557927.png

The current advisory mileage allowance rates per mile are 45p for cars and vans for the first 10 000 miles After 10 000 miles the rate changes to 25p per mile 24p View HMRC s advisory fuel rates Employee uses their car for business travel If an employee including office holders uses their own car for business travel then the

What mileage rate can I claim You can claim 45p per mile for the first 10 000 miles and 25p per mile after that for cars For motorcycles you can claim 24p What are mileage rates With mileage rates you can get reimbursed for costs related to business trips whether they were made with a personal vehicle or a

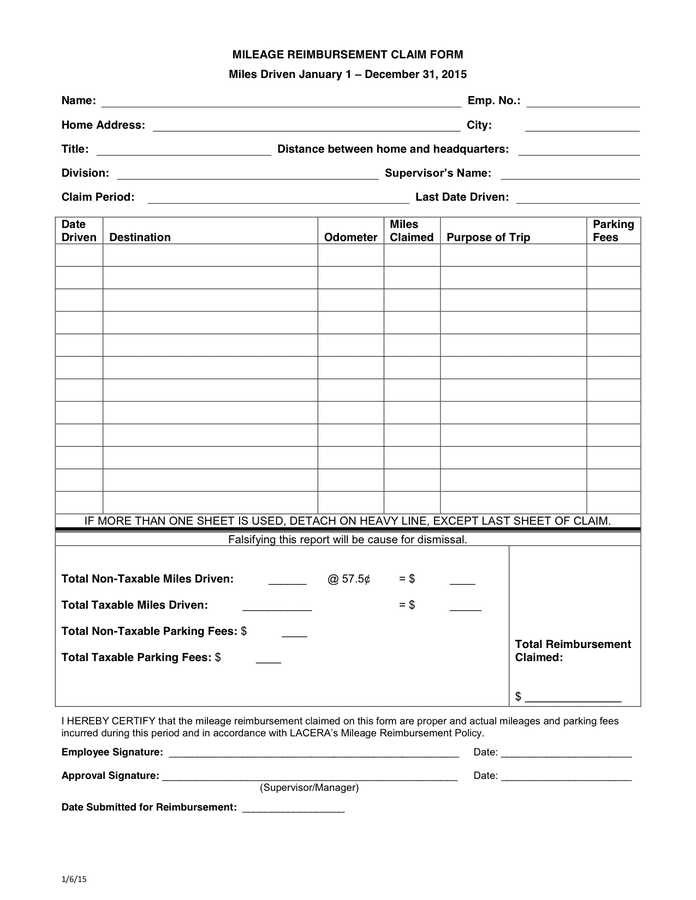

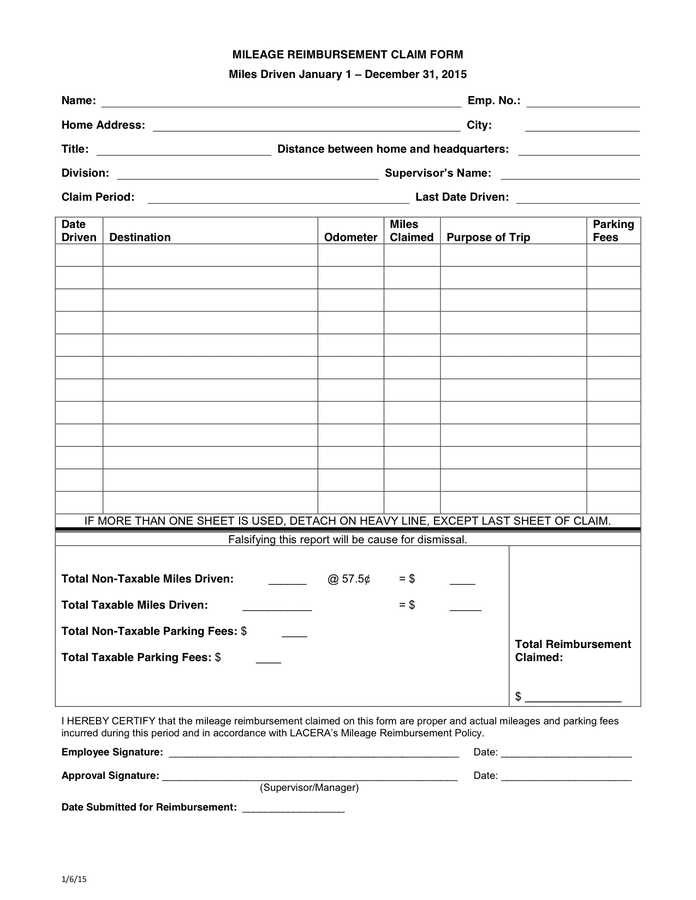

Per Diem Policy Template

http://static.dexform.com/media/docs/1864/mileage-reimbursement-claim-form_1.png

Company Car Mileage Rates Update Holden Associates

https://holdenassociates.co.uk/wp-content/uploads/2020/07/Mileage-claim.jpg

.jpg?w=186)

https://www.gov.uk/.../travel-mileage-and-fuel-rates-and-allowances

Updated 26 March 2024 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for

https://www.gov.uk/government/publications/rates...

The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances

Denmark Increases Mileage Rates Due To Rising Fuel Prices Graphs

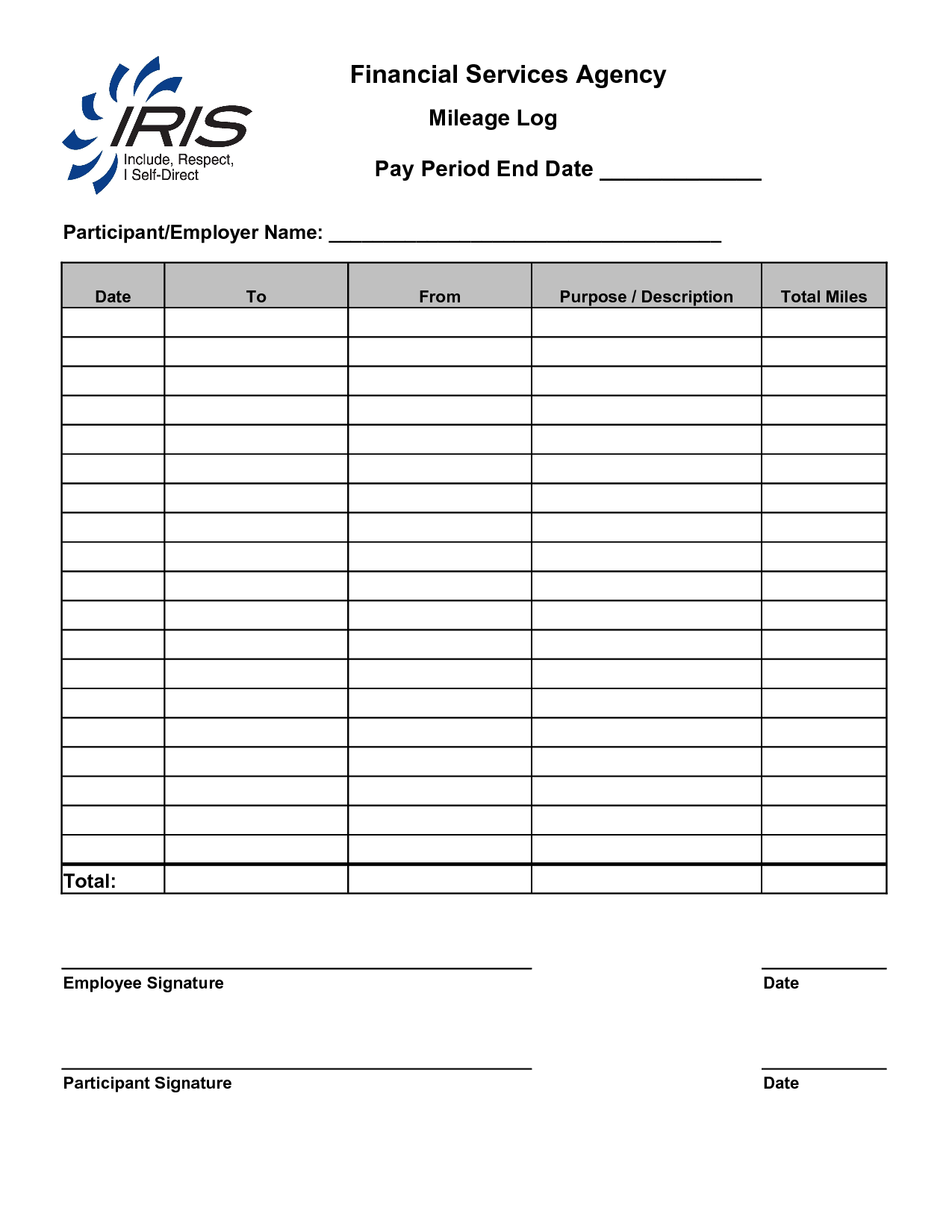

Per Diem Policy Template

2023 Mileage Reimbursement Form Printable Forms Free Online

Mileage Log Template 2024 Free Excel And PDF Log Book Driversnote

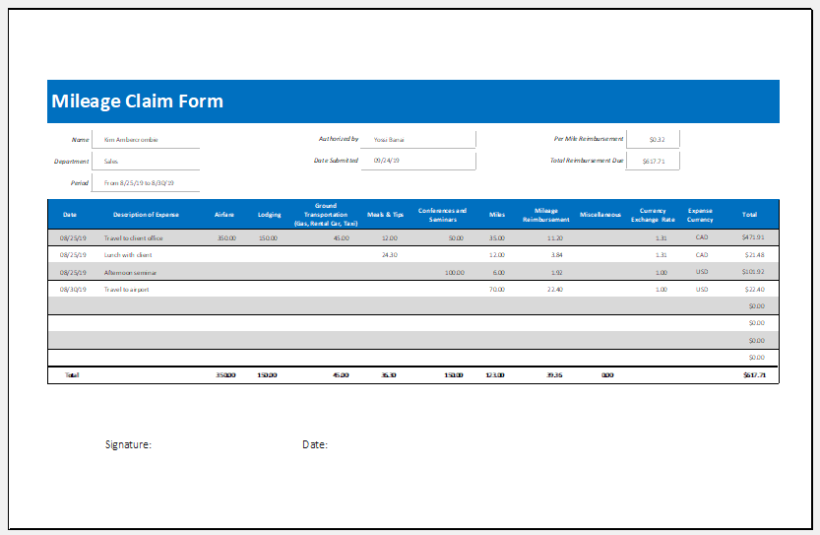

Mileage Claim Form Template

How To Get The Best Fuel Mileage Of Your Car And Save Gas Money By

How To Get The Best Fuel Mileage Of Your Car And Save Gas Money By

Normal Fuel Mileage Cummins Diesel Forum

Mileage Claim Form Template For Excel Excel Templates

Hmrc Private Mileage Claim Form Erin Anderson s Template

Fuel Mileage Claim Rates - The current mileage rates are used for both mileage relief for employees and mileage deductions for self employed The rates for 2023 are as follows Cars and vans 45p