Fuel Rebate Calculator 2024 Home IRS issues standard mileage rates for 2024 mileage rate increases to 67 cents a mile up 1 5 cents from 2023 IR 2023 239 Dec 14 2023

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit Second generation biofuel producer credit IR 2024 16 Jan 19 2024 WASHINGTON The Internal Revenue Service and the Department of the Treasury today issued Notice 2024 20 PDF to provide guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit and to announce the intent to propose regulations for the credit The Inflation Reduction Act amended the credit for qualified alternative fuel

Fuel Rebate Calculator 2024

Fuel Rebate Calculator 2024

https://fuelingtomorrowtoday.com/wp-content/uploads/2021/12/Residential-appliance-chart-1.jpg

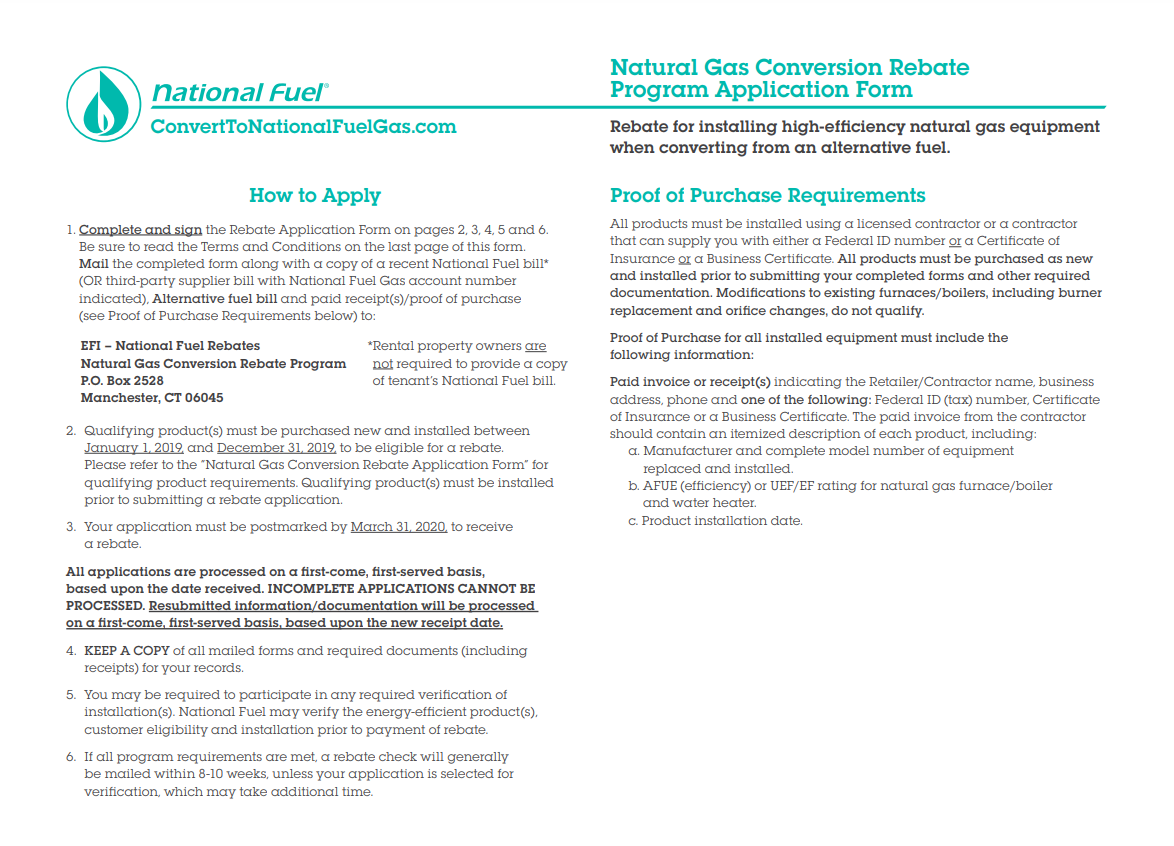

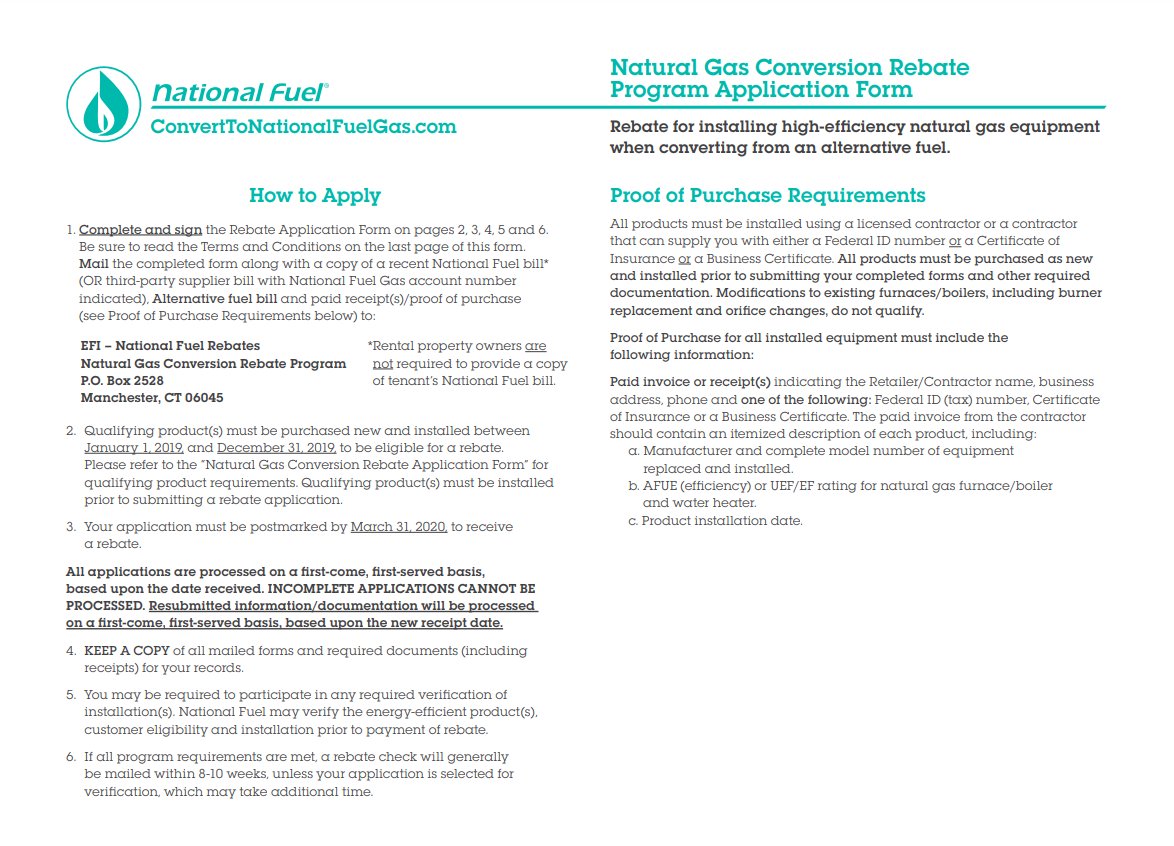

National Fuel Rebate Form 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/National-Fuel-Rebate-Form.png

Planet Or Profit The Red Fuel Rebate Brewster Brothers

https://www.brewsterbros.com/wp-content/uploads/2022/02/Red-Fuel-Rebate.jpg

2024 Federal Motor Fuel Income Tax Rates and Credits December 17 2023 Superfund Tax The Superfund tax was reinstated beginning 1 01 23 and is adjusted annually for inflation The inflation adjusted rate for 2024 is 0 26 cents per barrel of crude beginning 01 01 2024 The tax is paid by refiners and crude oil importers WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released additional guidance under President Biden s Inflation Reduction Act IRA to lower Americans energy bills by providing clarity on eligibility for incentives to install electric vehicle charging stations and other alternative fuel refueling stations The Department of Energy is also

The act which President Joe Biden signed into law on Aug 16 2022 intends to facilitate the administration s commitment to reducing economy wide greenhouse gas emissions by 50 52 of 2005 levels by 2030 Subtitle D of the Act contains 29 energy related tax and credit provisions with a historic 271 billion of tax incentives on climate 386 in Alberta 264 in Manitoba 184 in New Brunswick 328 in Newfoundland and Labrador 248 in Nova Scotia 244 in Ontario 240 in Prince Edward Island 340 in Saskatchewan

Download Fuel Rebate Calculator 2024

More picture related to Fuel Rebate Calculator 2024

National Fuel Furnace Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/get-the-rebate-application-for-homeowners-national-fuel-s-conservation.jpg

National Fuel Rebate Form 2023 How To Fill Out The Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/07/National-Fuel-Rebate-Form-2023-1024x514.png

National Fuel Rebate Form 2022 Government Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/National-Fuel-Rebate-Form-2022.png

Last year the average tax refund was 3 167 or almost 3 less than the prior year according to IRS statistics By comparison the typical refund check jumped 15 5 to almost 3 300 in 2022 In our January Short Term Energy Outlook STEO we expect average U S retail gasoline prices to decrease in 2024 because of increased inventories related to increased refinery capacity In 2025 we expect slightly reduced gasoline consumption to further decrease prices We expect similar supply side factors to lower retail diesel prices in 2024 and 2025 although U S diesel consumption will

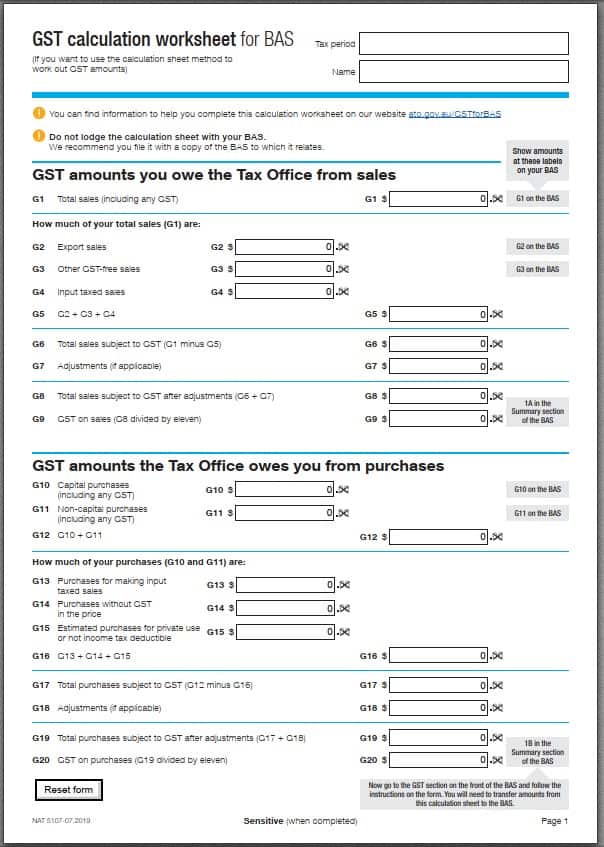

The federal government imposes taxes on a variety of fuels The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136 You can also use the fuel tax credit calculator to work out the amount to report on your business activity statement BAS It has the latest rates and is simple quick and easy to use Note 1 From 1 November 2019 this rate includes fuel used to power passenger air conditioning of buses and coaches

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/468/470/468470575/large.png

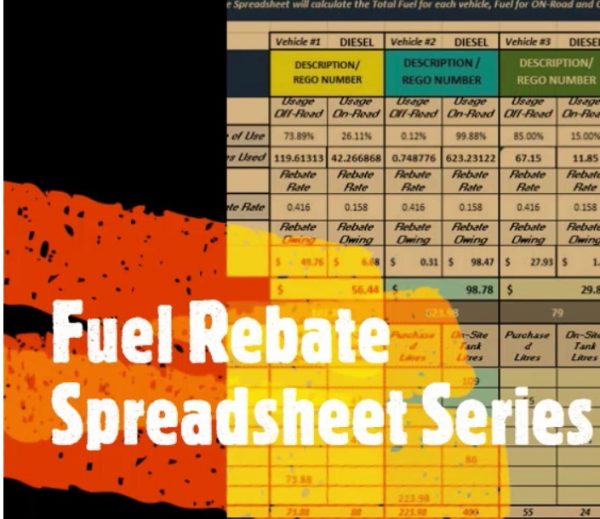

Fuel Rebate Spreadsheet Series Chews Learning Space

https://chewslearningspace.com/wp-content/uploads/2020/05/Fuel-Rebate-Series-Spreadsheet-600x519.jpg

https://www.irs.gov/newsroom/irs-issues-standard-mileage-rates-for-2024-mileage-rate-increases-to-67-cents-a-mile-up-1-point-5-cents-from-2023

Home IRS issues standard mileage rates for 2024 mileage rate increases to 67 cents a mile up 1 5 cents from 2023 IR 2023 239 Dec 14 2023

https://www.irs.gov/businesses/small-businesses-self-employed/fuel-tax-credits

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit Second generation biofuel producer credit

Fuel Maintenance Management In One Place Fuelman

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

HST Rebate Calculator GST HST Rebate Experts Sproule Associates

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell County News

CIS Rebate Calculator Canalitix Accountants

Pilot Fuel Rebate Scandal Spurs Unusual Legal Fight Over Racism Long Haul Crime Log FreightWaves

Pilot Fuel Rebate Scandal Spurs Unusual Legal Fight Over Racism Long Haul Crime Log FreightWaves

What Are The Best Ways To Manage Tax Rebates

Tip 90 About Gst Australia Calculator Latest NEC

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

Fuel Rebate Calculator 2024 - The 2023 rebate program offers at least 500 million in rebate funding for clean school buses and zero emission school buses with the potential to modify this figure based on the application pool and other factors Applications for the program are due by 4 p m Eastern on January 31 2024