Sbi Mutual Fund Tax Rebate Web ELSS is a type of Mutual Fund which allows you to claim for income tax deduction You can save up to 1 5 lakhs a year in taxes by investing in ELSS which is covered under

Web Rebate of up to INR 25 000 is available for resident individuals whose total income does not exceed INR 700 000 under the default New Tax Regime u s 115BAC 1A In case such Web 11 oct 2019 nbsp 0183 32 No all mutual funds do not qualify for tax deductions under Section 80C of the income tax Act Only investments in equity linked saving schemes or ELSSs qualify

Sbi Mutual Fund Tax Rebate

Sbi Mutual Fund Tax Rebate

https://myinvestmentideas.com/wp-content/uploads/2018/12/List-of-Best-SIP-Plans-from-SBI-Mutual-Funds-to-invest-in-2019.jpeg

Tax Saving Mutual Funds Top 5 ELSS Funds For 2020 INVESTIFY IN

https://www.investify.in/wp-content/uploads/2020/08/sbi-fund.png

SBI Mutual Funds Latest MF Schemes NAV Performance

https://kuvera.in/blog/wp-content/uploads/2022/11/SBI-Mutual-Funds.png

Web 30 mars 2023 nbsp 0183 32 Though tax saving mutual funds have certain limitations you should consider four factors while picking one They are mode of investment asset allocation Web 12 f 233 vr 2020 nbsp 0183 32 Can mutual fund investments help me get a rebate on income tax Only investments in tax saving mutual funds qualify for tax deduction under Section 80C of

Web How to Claim Tax Benefits on Mutual Funds ELSS ELSS funds qualify for tax exemptions under Section 80C of the Income Tax Act Deductions of up to Rs 1 5 lakh Web 16 sept 2022 nbsp 0183 32 As the name suggests the equity linked savings scheme ELSS is a type of mutual fund scheme that primarily invests in the stock market or equity Investments of

Download Sbi Mutual Fund Tax Rebate

More picture related to Sbi Mutual Fund Tax Rebate

SBI Mutual Fund Recruitment 2021 OUT UG And PG Candidates Can Apply

https://examsdaily.in/wp-content/uploads/2021/09/SBI-Mutual-Fund-Recruitment-2021-OUT-–-For-UG-and-PG-Candidates-Apply-Online.jpg

SBI Mutual Fund Overview Of SBI Mutual Fund Sqrrl

https://wp.sqrrl.in/wp-content/uploads/2020/07/SBI-Mutual-Fund_-Overview-Of-SBI-Mutual-Fund.png

Download SBI Mutual Fund Investments Statement PDF YouTube

https://i.ytimg.com/vi/9PjEniRvH2o/maxresdefault.jpg

Web ELSS funds are open ended equity funds with a lock in of 3 years They invest the majority of their assets in equity These funds are the only mutual funds that qualify for INR 1 5 lakhs tax deduction annually under Web 1 avr 2016 nbsp 0183 32 Under section 80C up to 1 50 000 in premiums paid can be reduced from your total taxable income Apart from this you can claim deduction for premiums paid or

Web quot Want to earn more by saving more tax SBI Long Term Equity Fund is for You It is was previously known as SBI Magnum Taxgain Scheme It is an equity linked s Web Explore our funds by Wealth Creation Funds which offer Long Term Capital Appreciation Retirement Planning For Income Post Retirement Tax Saving Save

Best SBI Mutual Funds For 2023 Invest In SBI Mutual Fund Top SBI MF

https://i.ytimg.com/vi/ibMJMFnhUfw/maxresdefault.jpg

SBI Mutual Funds SIP Become Crorepati By Investing Just Rs 1 500 month

https://cdn.zeebiz.com/sites/default/files/SBIMutualFundSIP.JPG

https://www.sbimf.com/campaign/elss-tax-saving-mutual-fund

Web ELSS is a type of Mutual Fund which allows you to claim for income tax deduction You can save up to 1 5 lakhs a year in taxes by investing in ELSS which is covered under

https://www.sbimf.com/docs/default-source/pdf/sbi-mf-tax-r…

Web Rebate of up to INR 25 000 is available for resident individuals whose total income does not exceed INR 700 000 under the default New Tax Regime u s 115BAC 1A In case such

Attention SBI Small And Midcap Fund Is Back How To Start Online SIP

Best SBI Mutual Funds For 2023 Invest In SBI Mutual Fund Top SBI MF

SBI Mutual Funds Recruitment 2022

How SBI Mutual Fund Is Misleading Investors Through Its Advertisements

SBI Mutual Fund Statement Download Online Process 2023 Dreamtrix Finance

SBI Mutual Fund Calculator

SBI Mutual Fund Calculator

SBI Mutual Funds Bharti 2022

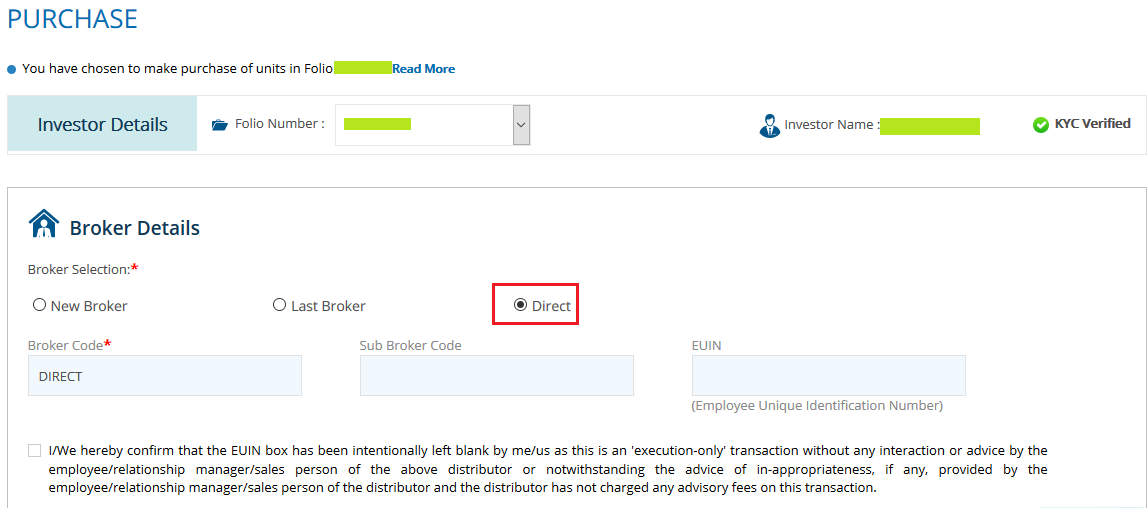

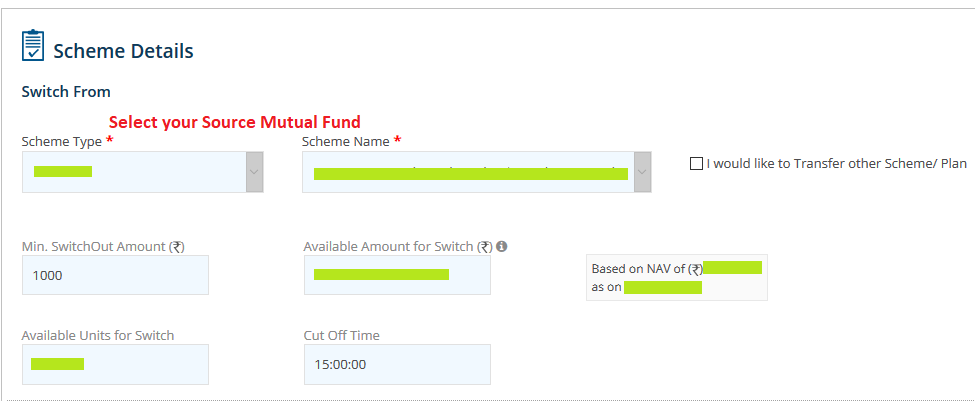

How To Switch Your Funds Online In SBI Mutual Fund FINANCE Guru

Sbi Mutual Fund Common Application Form Equity With Kim

Sbi Mutual Fund Tax Rebate - Web 8 sept 2023 nbsp 0183 32 Current tax rate is 10 if your total long term capital gain exceeds 1 lakh in a financial year Any cess surcharge is not included However you can claim a deduction