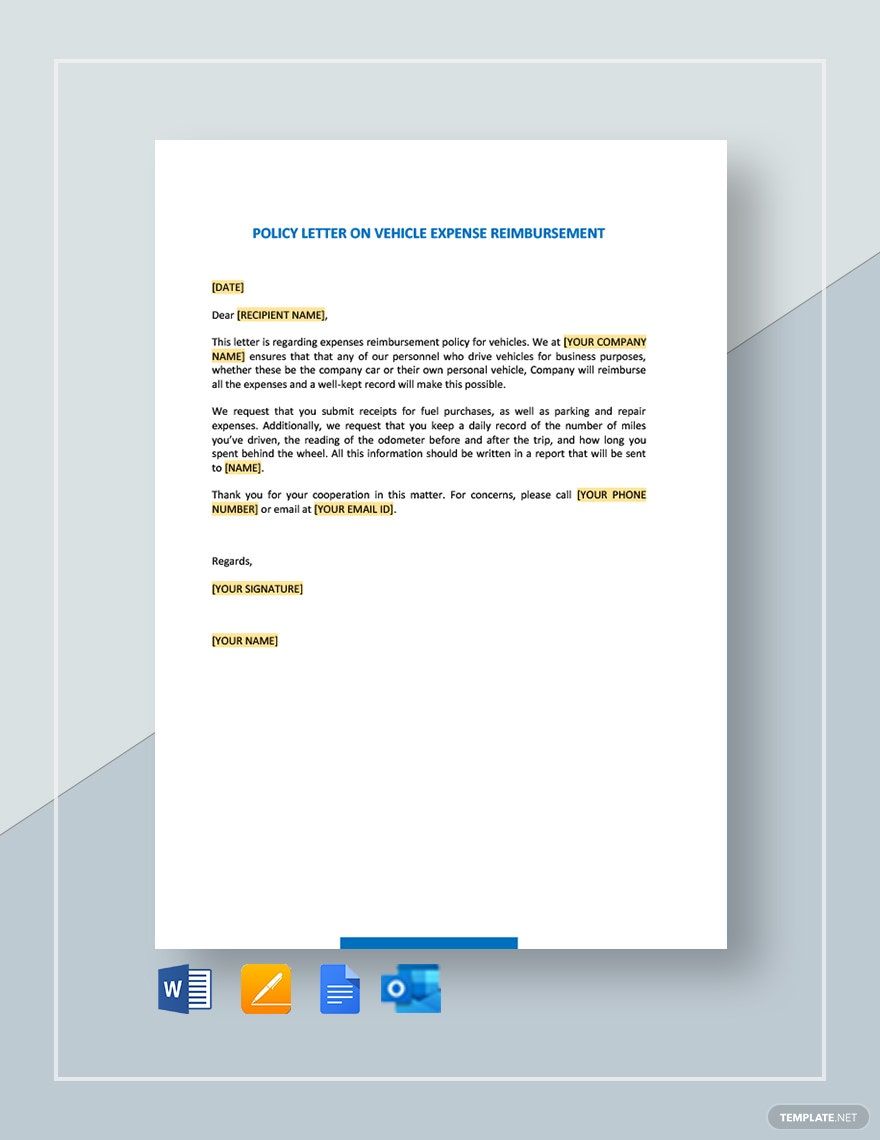

Fuel Reimbursement Policy It is the policy of Company Name to reimburse staff for reasonable and necessary expenses incurred during approved work related travel Employees seeking reimbursement should incur the lowest

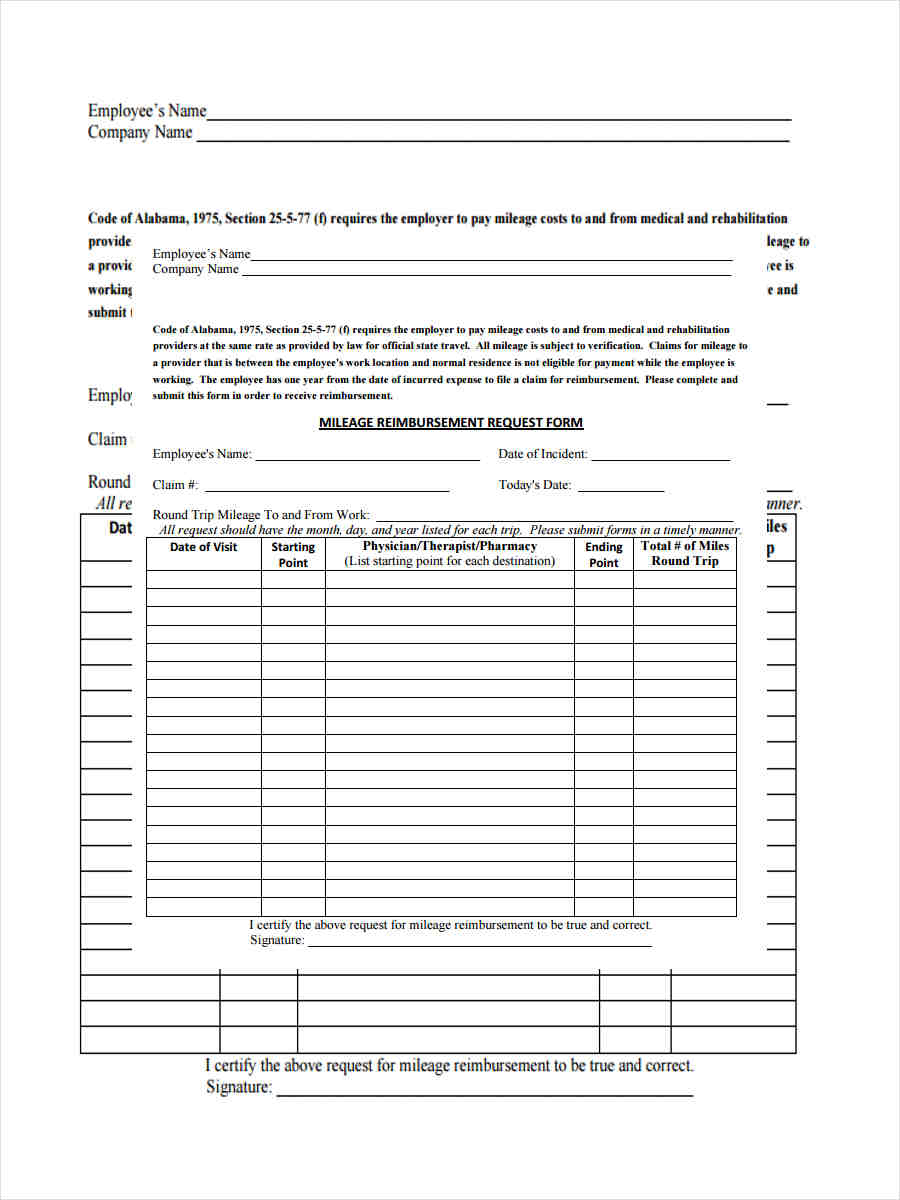

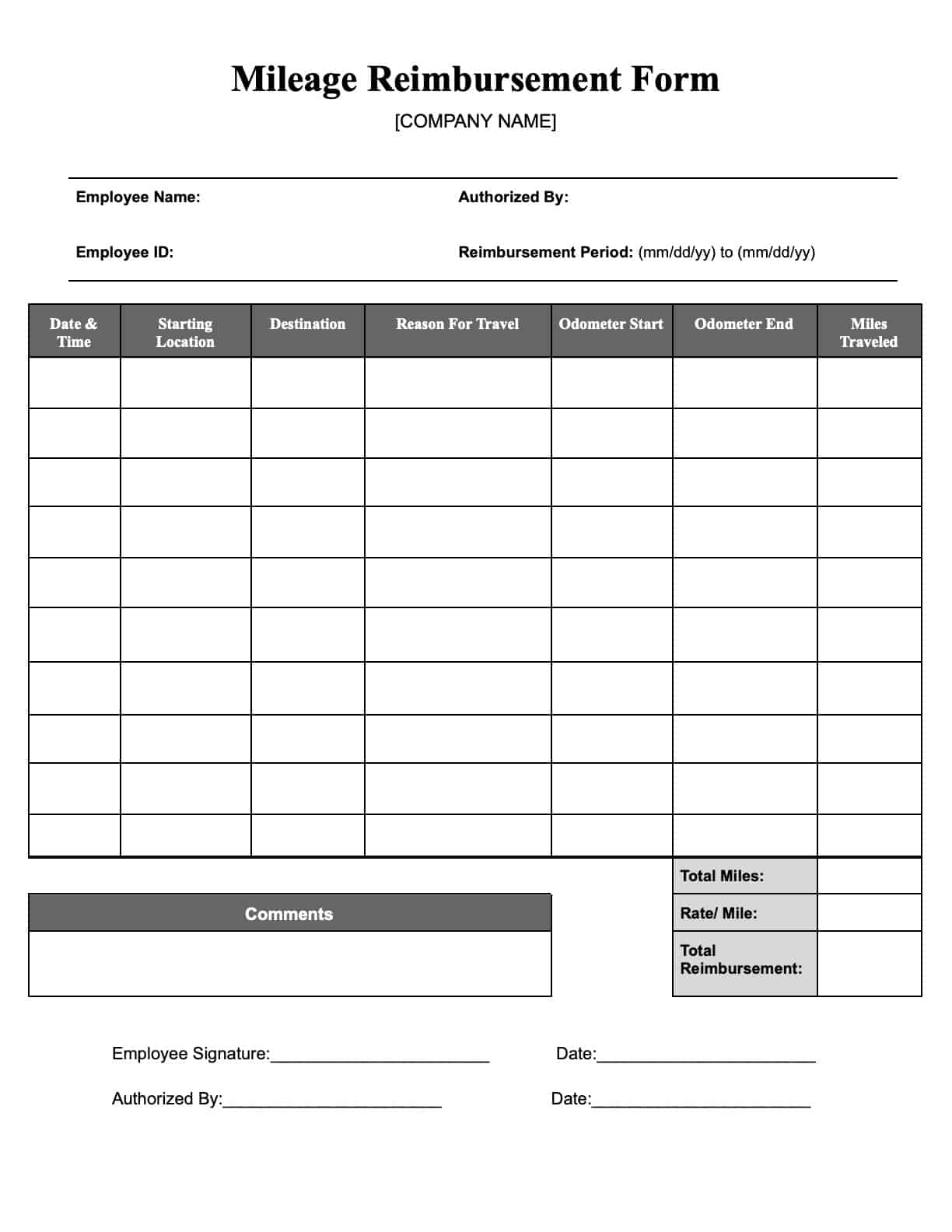

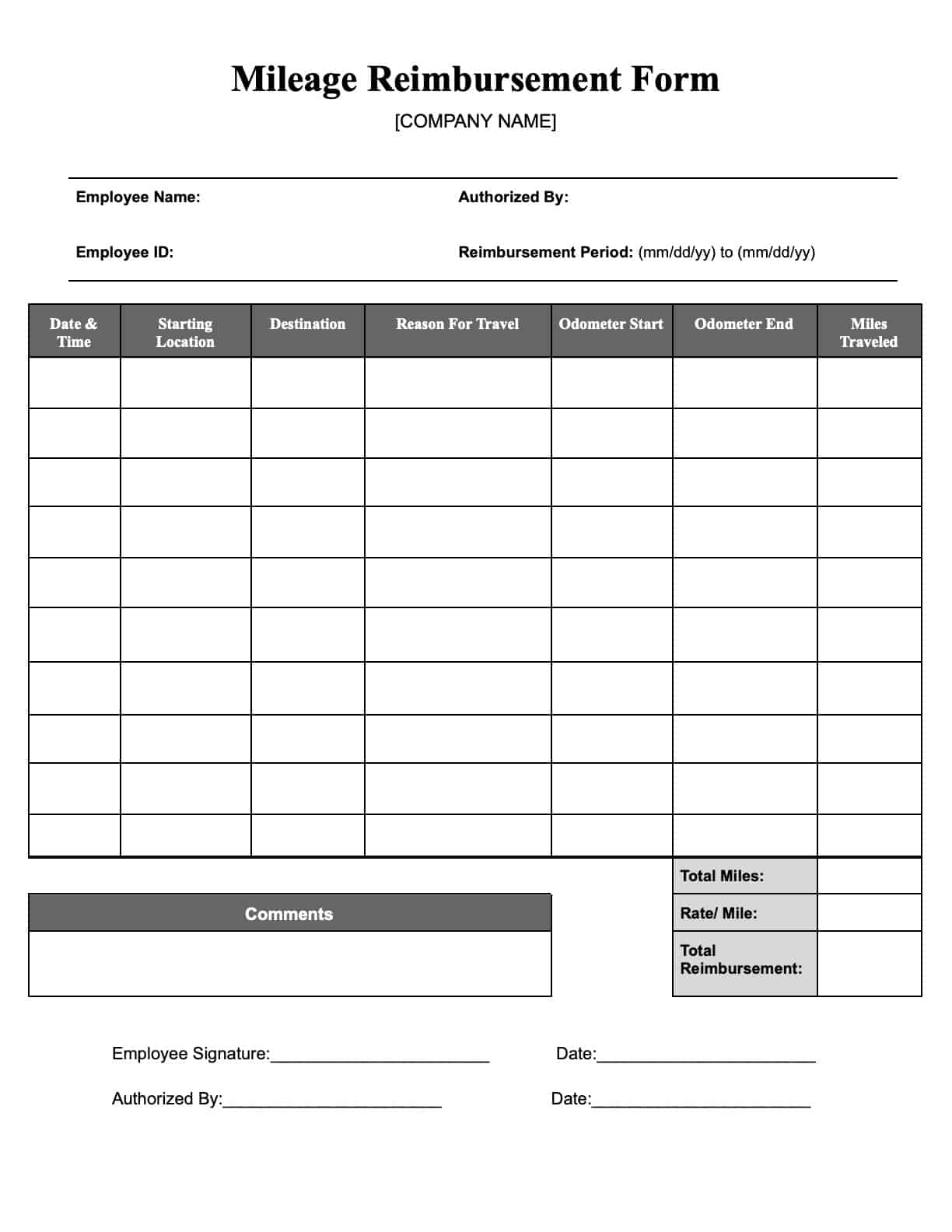

Business mileage rate will be 58 5 cents per mile up from 56 cents On June 9 2022 the IRS announced an increase in the optional standard mileage rate for the final six months of 2022 due to Employees who incur work related expenses are required to submit those expenses for reimbursement as follows Employees must complete the appropriate company form submit the appropriate

Fuel Reimbursement Policy

Fuel Reimbursement Policy

https://i2.wp.com/eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form.png?fit=1600%2C2070&ssl=1

Hr Policies

https://image.slidesharecdn.com/hrpolicies-111120023656-phpapp02/95/hr-policies-7-728.jpg?cb=1321759138

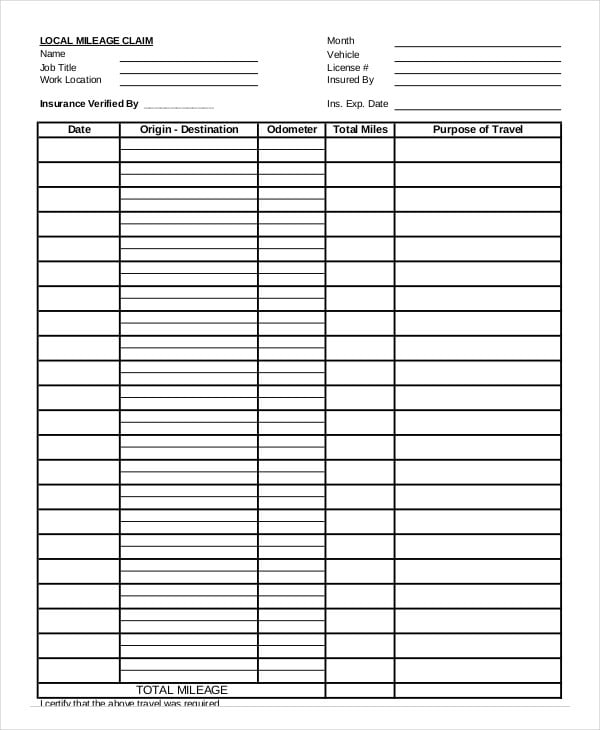

Download Gas Reimbursement Form For Free FormTemplate

https://cdn.formtemplate.org/images/600/gas-reimbursement-form-1.png

Effective July 1 through Dec 31 2022 the standard mileage rate for the business use of employees vehicles will be 62 5 cents per mile the highest rate the IRS has ever published up 4 cents The IRS has announced that the 2023 business standard mileage rate is increasing to 65 5 cents up 3 cents from the 2022 midyear adjustment of 62 5 cents The change took effect Jan 1

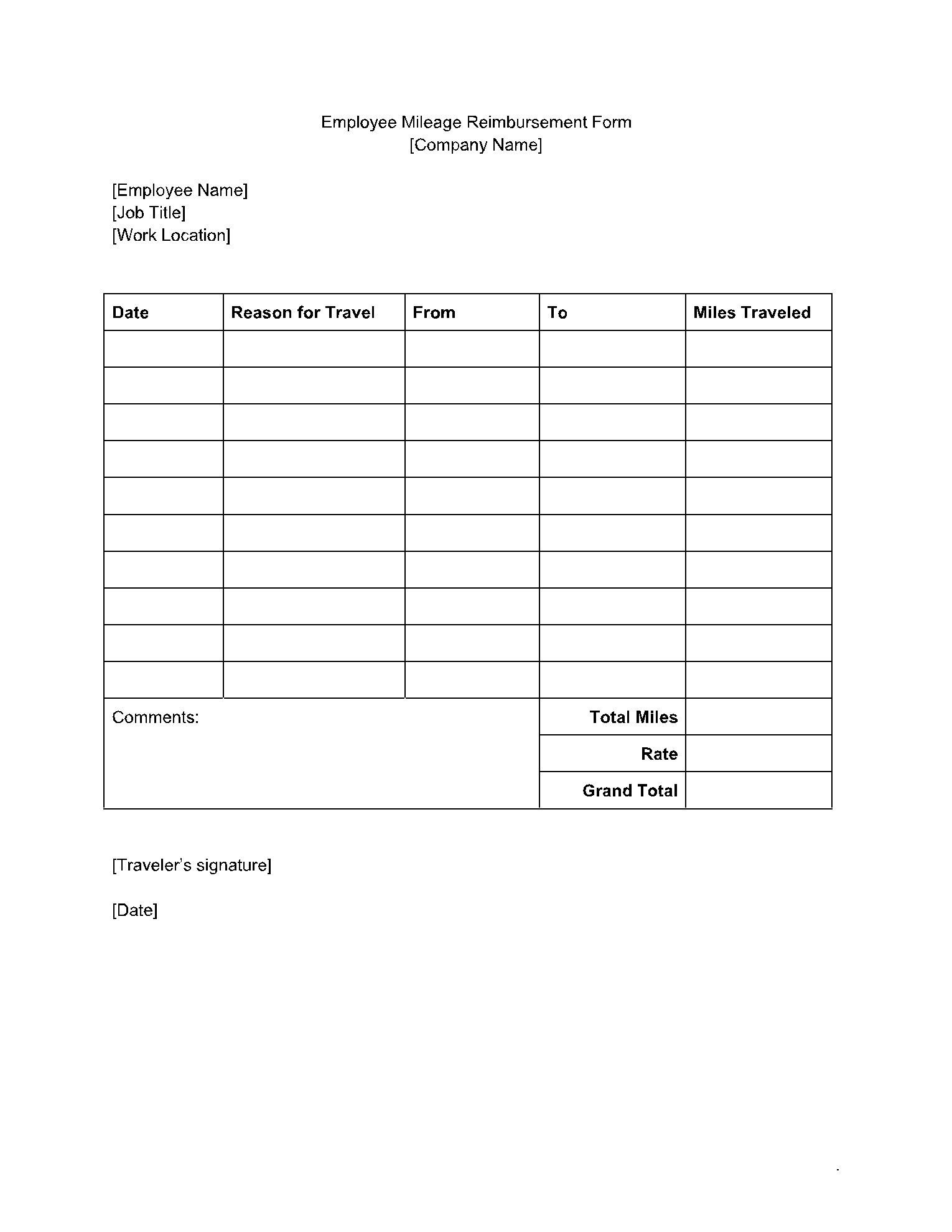

A sample form for an employee to request mileage reimbursement for business related travel 2020 Changes For 2020 standard mileage rates for the use of cars vans pickups or panel trucks will be 57 5 cents per mile driven for business use down from 58 cents in 2019 17 cents per

Download Fuel Reimbursement Policy

More picture related to Fuel Reimbursement Policy

Is The fuel Reimbursement Policy Applicable For Al Fishbowl

https://files.getfishbowl.com/content_preview_images/is-the-fuel-reimbursement-cost-applicable-for-all-levels-of-employees-do-they-cut-that-part-from-our-salary-or-give-us-a-1.jpg

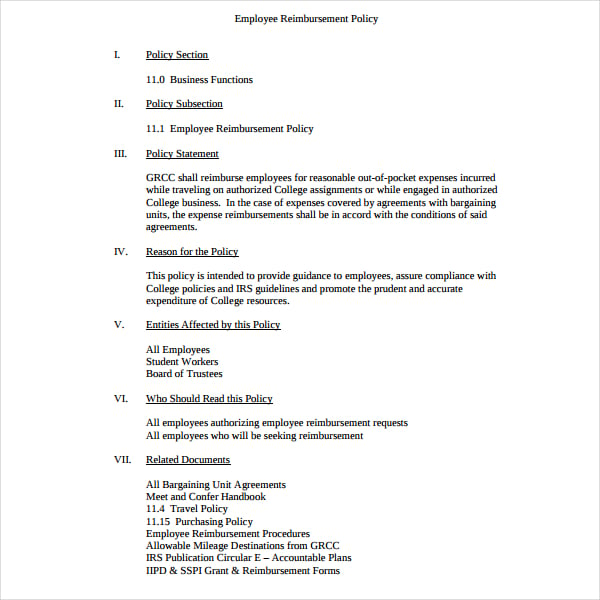

Travel Reimbursement Policy Template TUTORE ORG Master Of Documents

https://images.template.net/wp-content/uploads/2018/03/Sample-Employee-Reimbursement-Policy.jpg

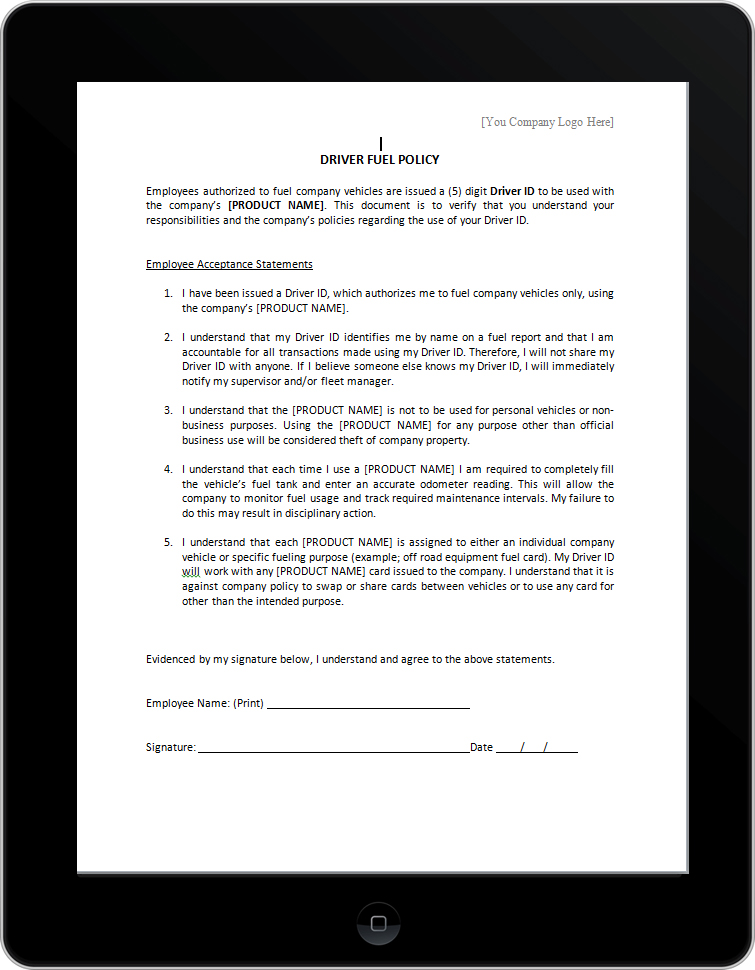

Company Vehicle Use Policy Template

https://cnrgfleet.com/wp-content/uploads/2015/07/driver-fuel-card-policy.jpg

Th use of cell phones including texting while behind the wheel of a moving vehicle being used on company business is strictly prohibited Employees are responsible for any driving infractions or The IRS rate does not include the cost of tolls or parking therefore an employer will need to decide if it will reimburse employees for these expenses separately from the mileage reimbursement

[desc-10] [desc-11]

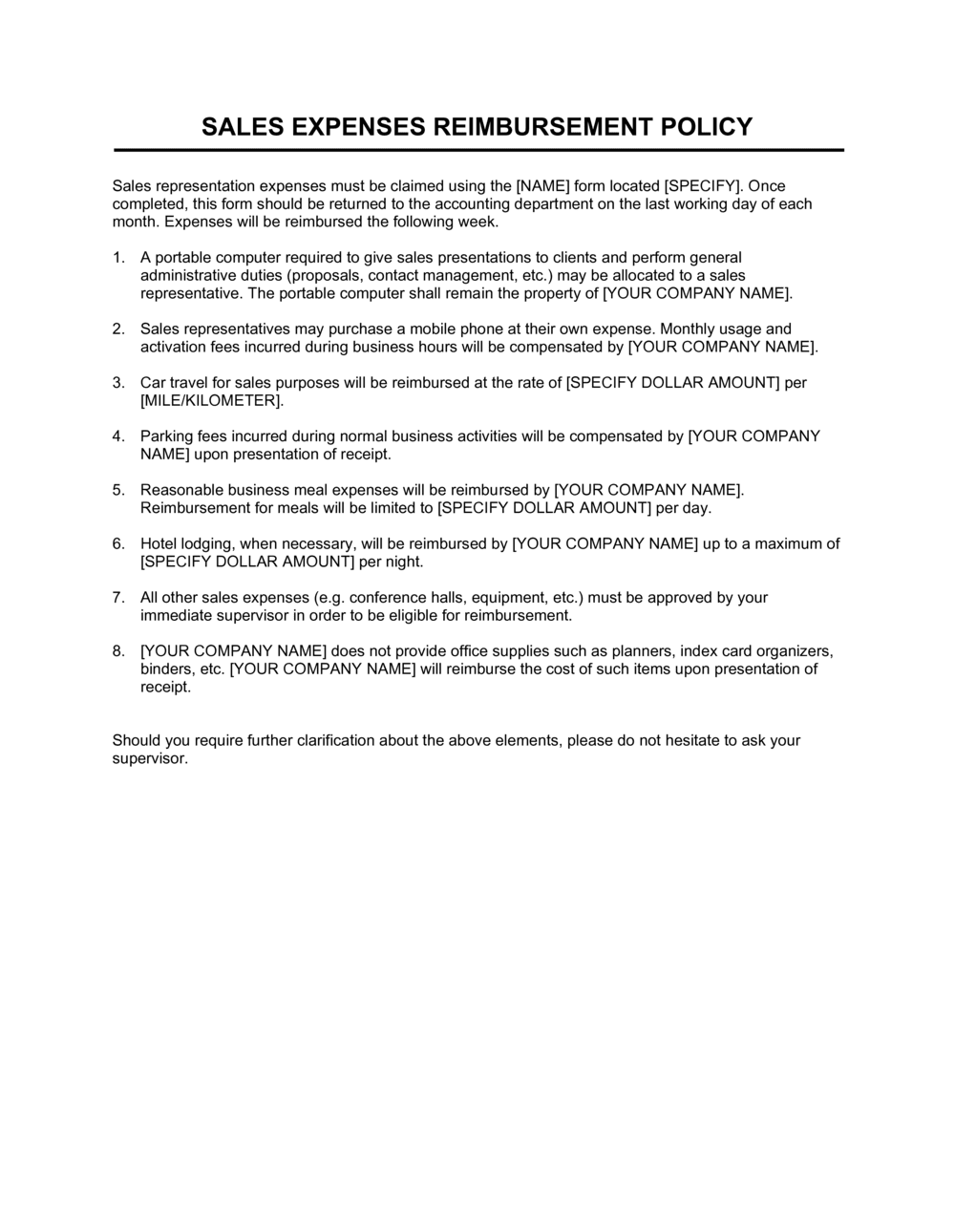

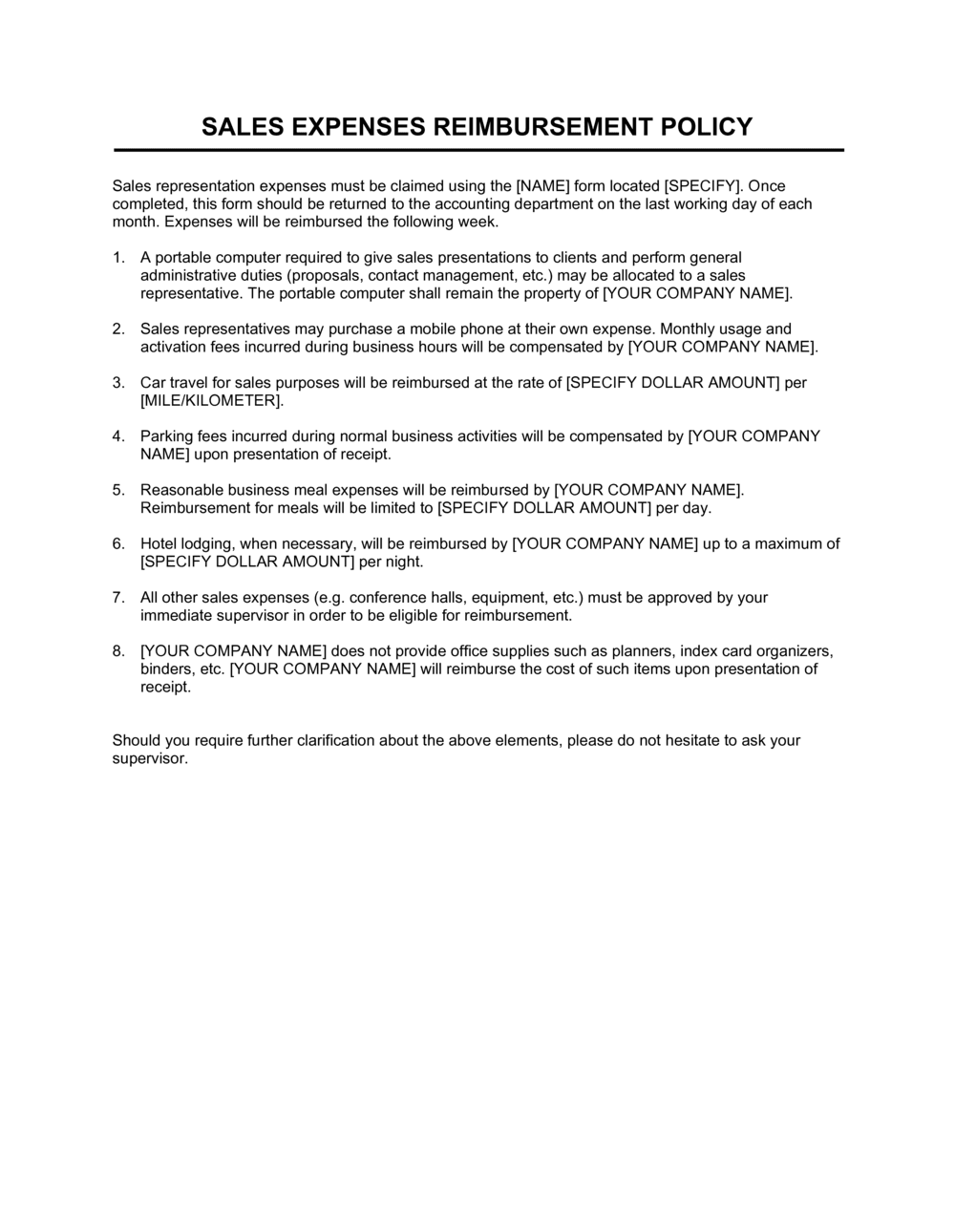

Sales Expenses Reimbursement Policy Template By Business in a Box

https://templates.business-in-a-box.com/imgs/1000px/sales-expenses-reimbursement-policy-D731.png

Hr Policies

https://image.slidesharecdn.com/hrpolicies-111120023656-phpapp02/95/hr-policies-8-728.jpg?cb=1321759138

https://www.shrm.org/topics-tools/tools/policies/travel-expense-policy

It is the policy of Company Name to reimburse staff for reasonable and necessary expenses incurred during approved work related travel Employees seeking reimbursement should incur the lowest

https://www.shrm.org/topics-tools/news/benefits-compensation/irs-rai…

Business mileage rate will be 58 5 cents per mile up from 56 cents On June 9 2022 the IRS announced an increase in the optional standard mileage rate for the final six months of 2022 due to

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

Sales Expenses Reimbursement Policy Template By Business in a Box

Vehicle Mileage Log With Reimbursement Form Word Excel Templates

Mileage Reimbursement 2023 Form Printable Forms Free Online

Mileage Reimbursement Form Excel Excel Templates

2023 Mileage Reimbursement Form Printable Forms Free Online

2023 Mileage Reimbursement Form Printable Forms Free Online

Free IRS Mileage Reimbursement Form PDF Word Legal Templates

Download Gas Mileage Reimbursement Form For Free FormTemplate

Simple Policy Word Templates Design Free Download Template

Fuel Reimbursement Policy - Effective July 1 through Dec 31 2022 the standard mileage rate for the business use of employees vehicles will be 62 5 cents per mile the highest rate the IRS has ever published up 4 cents