Fuel Tax Credit Calculator You can use the fuel tax credits calculation worksheet to help you calculate your fuel tax credits and claim them on your business activity statement BAS You can also use the Fuel tax credit calculator to help you work out your claim online

Use the fuel tax credit calculator online to work out your fuel tax credits and get your claim right Using the calculation worksheet When using the fuel tax credits calculation worksheet follow the three steps below to work out your fuel tax credits Step 1 Work out the eligible quantity Step 2 Check which rate applies for the fuel Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business activities You can claim for taxable fuel that you purchase manufacture or import Just make sure it s used in your business

Fuel Tax Credit Calculator

Fuel Tax Credit Calculator

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

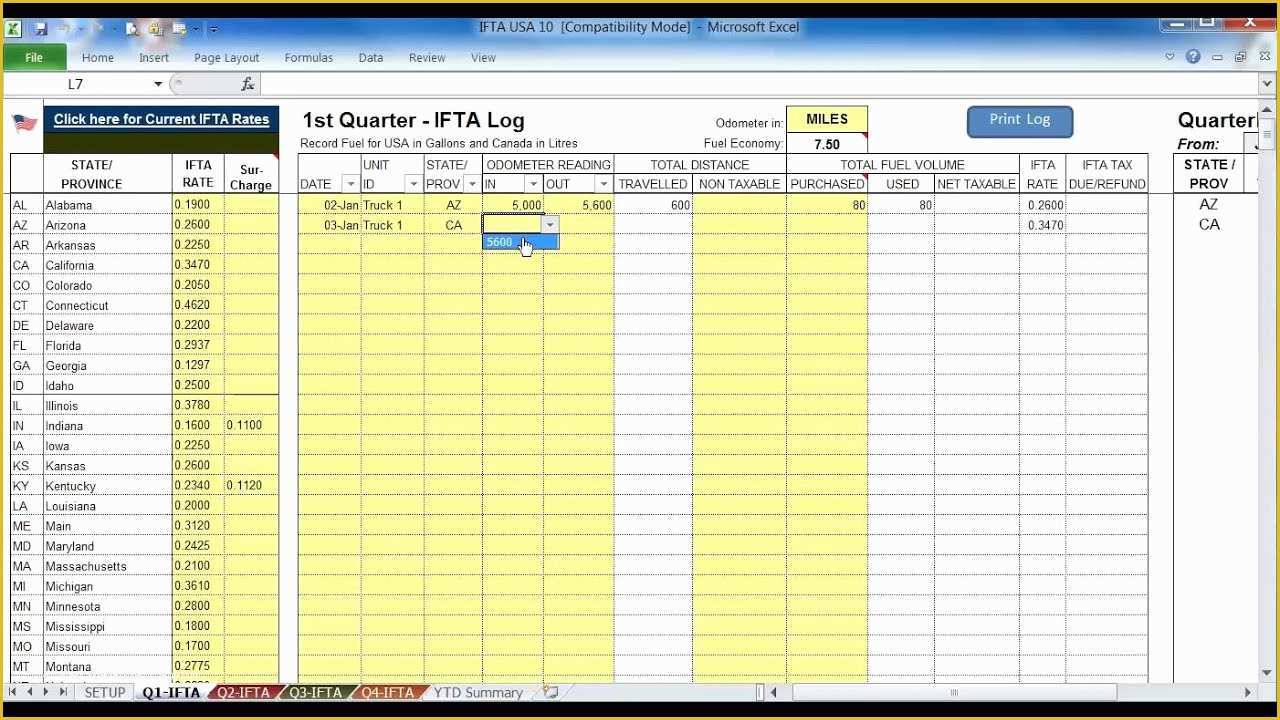

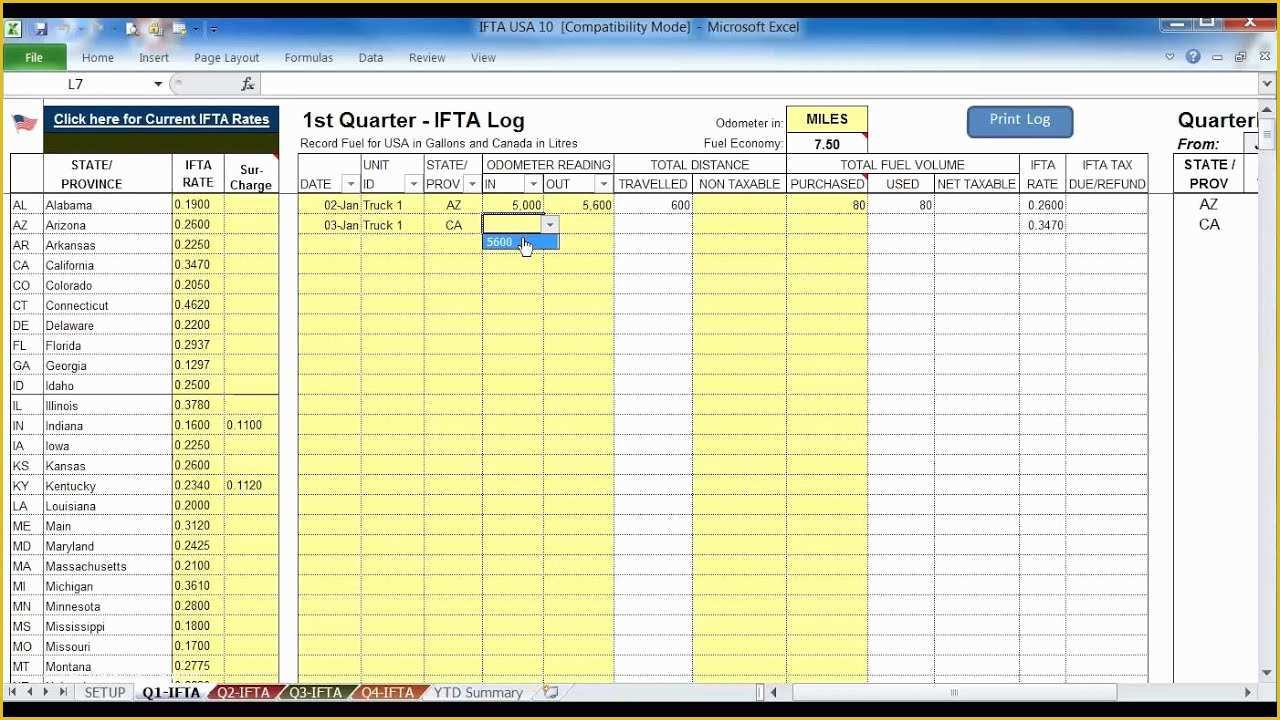

Ifta Spreadsheet Template Free Free Printable Templates

https://www.heritagechristiancollege.com/wp-content/uploads/2019/05/ifta-spreadsheet-template-free-of-ifta-fuel-tax-software-usa-truckers-for-up-to-10-trucks-of-ifta-spreadsheet-template-free.jpg

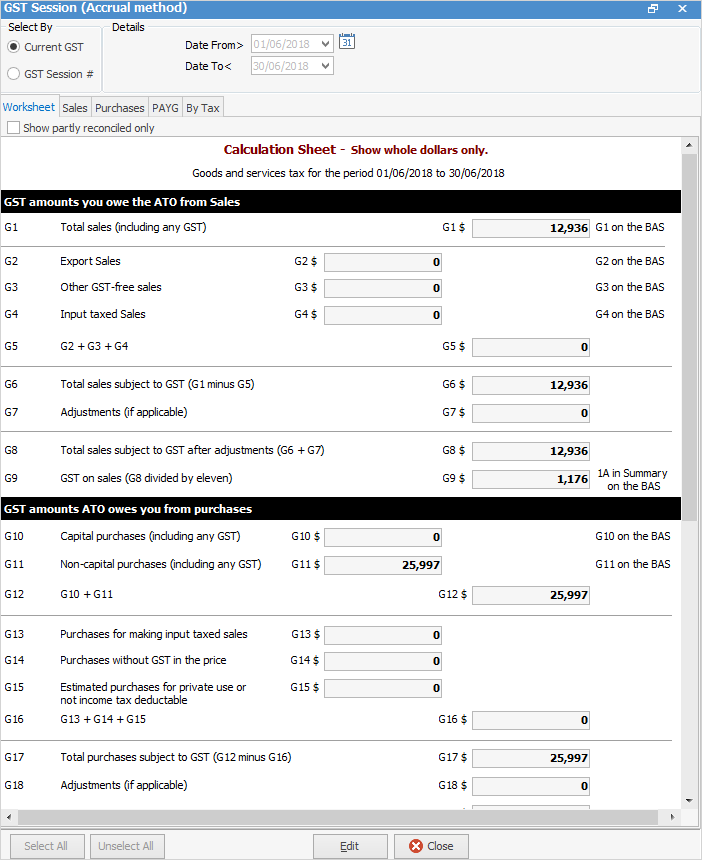

Fuel Tax Credit Calculator AccountKit Support Center

https://support.account-kit.com/hc/article_attachments/16272526113689

If your business is registered for fuel tax credits you can use the fuel tax credit calculator to check the fuel tax credits for the fuel acquired for use in your business and any adjustments or corrections for fuel tax credits from a previous business activity statement BAS The ATO Fuel tax credit calculator gives you options to calculate claims on an original BAS calculate claims using simplified fuel tax credits calculate an adjustment or correction for a previous BAS The tool helps you to report amounts at label 7D Fuel tax credit and 7C Fuel tax credit overclaim on your BAS

The FTC Calculator form below will calculate your fuel tax credit based on the ATO s current rates Simply enter the number of litres your operation uses per year the amount used for on road vs off road purposes and the proportion that can actually be reconciled to the machine that consumed it Fuel Tax Credit FTC calculator The following ATO tool will help you check if you re eligible for FTC and work out the amount of FTC you can claim Eligibility tool check if you can claim FTCs Calculator work out the amount you can claim

Download Fuel Tax Credit Calculator

More picture related to Fuel Tax Credit Calculator

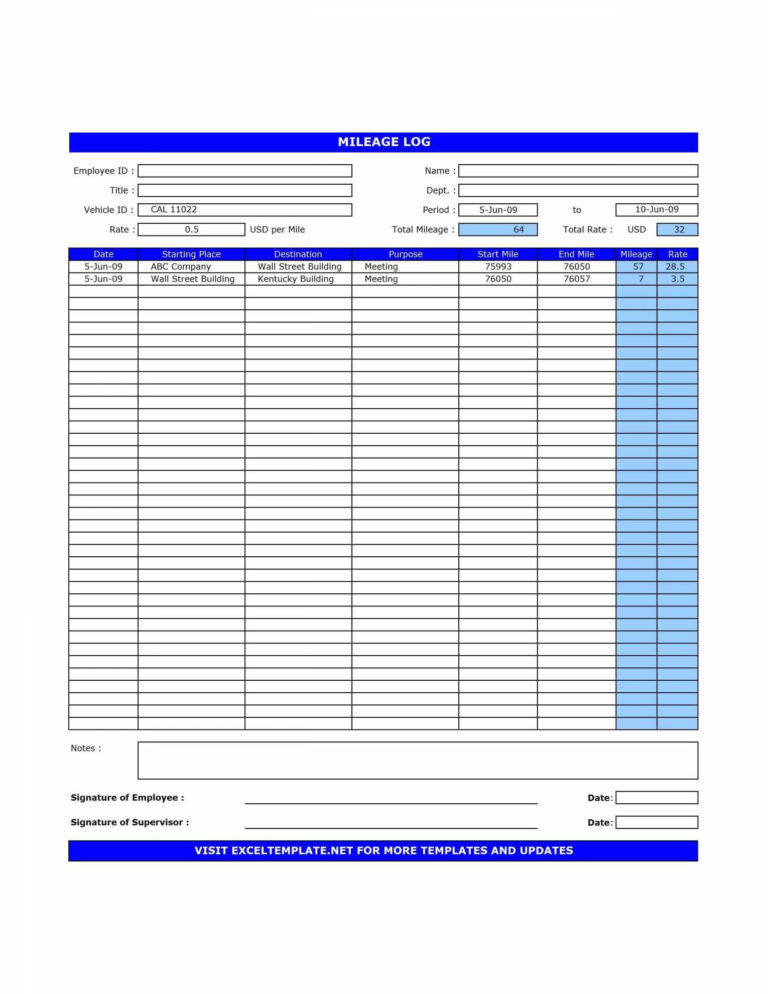

Fuel Tax Credit Calculator FarkhundaAmos

https://i.pinimg.com/736x/1b/3d/9b/1b3d9b2bbe0b08a55d06b98ce3f7177e.jpg

Ifta Fuel Tax Spreadsheet For Tax Worksheet Excel New Fuel Tax

https://db-excel.com/wp-content/uploads/2019/01/ifta-fuel-tax-spreadsheet-for-tax-worksheet-excel-new-fuel-tax-reporting-worksheet-new-ifta-768x994.jpg

Fuel Tax Credit Calculator FarkhundaAmos

https://i.pinimg.com/originals/f2/94/ed/f294ed8b971b42147f3d186b5ebca7a7.jpg

Fuel tax credits when you lodge your claim You can claim fuel tax credits for fuel you purchase manufacture or import for business use Work out if you are eligible for fuel tax credits with the ATO s fuel tax credit eligibility tool Use the fuel tax credit calculator to easily work out the amount to report on your business activity statement BAS Note 1 From 1 November 2019 this rate includes fuel used to power passenger air conditioning of buses and coaches

[desc-10] [desc-11]

Fuel Tax Credit Calculator CairenAbsalat

https://i.pinimg.com/736x/89/79/57/89795702af255dbba2d134a53e547353.jpg

Fuel Tax Credit Calculator CairenAbsalat

https://i.pinimg.com/736x/cc/2b/ea/cc2bea3dd827022142fd32c2dff57b62.jpg

https://www.ato.gov.au/forms-and-instructions/fuel...

You can use the fuel tax credits calculation worksheet to help you calculate your fuel tax credits and claim them on your business activity statement BAS You can also use the Fuel tax credit calculator to help you work out your claim online

https://www.ato.gov.au/businesses-and...

Use the fuel tax credit calculator online to work out your fuel tax credits and get your claim right Using the calculation worksheet When using the fuel tax credits calculation worksheet follow the three steps below to work out your fuel tax credits Step 1 Work out the eligible quantity Step 2 Check which rate applies for the fuel

Fuel Tax Credit Calculator AccountKit Support Center

Fuel Tax Credit Calculator CairenAbsalat

Click On Add Select Enter The Following Details

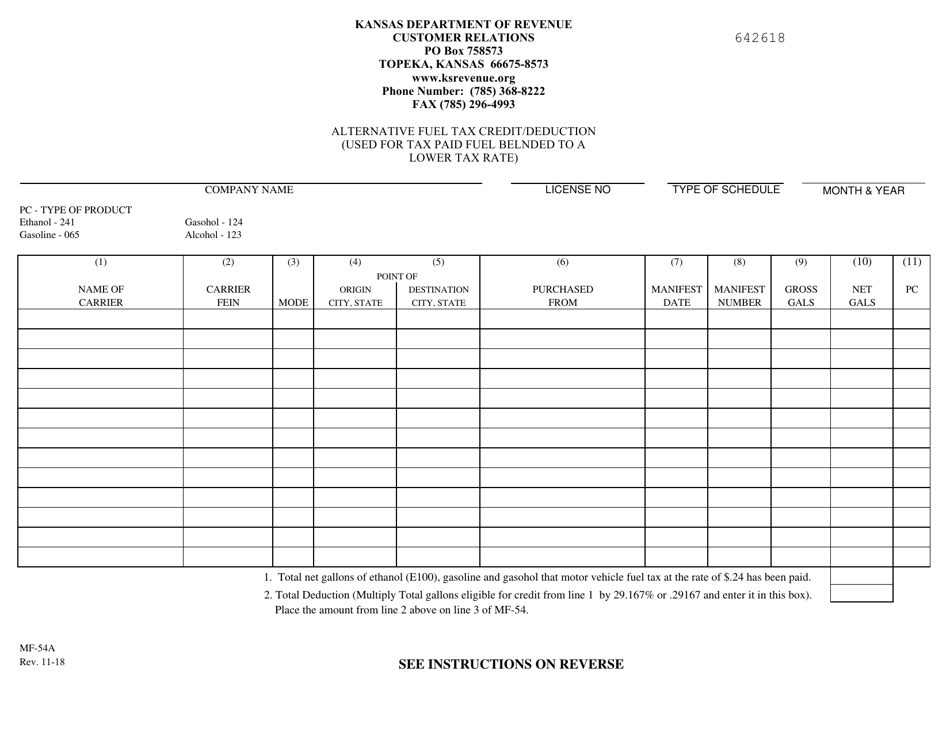

Form MF 54A Fill Out Sign Online And Download Fillable PDF Kansas

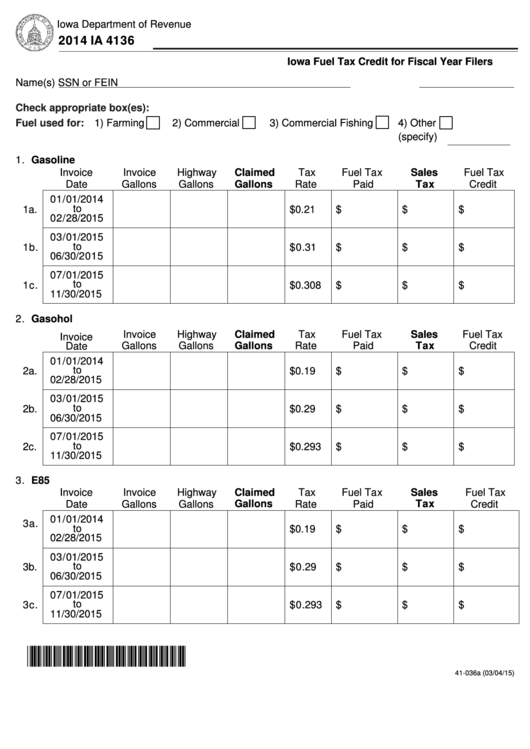

Fuel Tax Credit Calculation Worksheet

Fuel Tax Credit Calculation Worksheet

Fuel Tax Credit Calculation Worksheet

Fuel Tax Credit Calculation Worksheet

Lorry Fuel Consumption Calculator CALCULATORUK HJW

Fuel Tax Credit Calculation

Fuel Tax Credit Calculator - If your business is registered for fuel tax credits you can use the fuel tax credit calculator to check the fuel tax credits for the fuel acquired for use in your business and any adjustments or corrections for fuel tax credits from a previous business activity statement BAS