Fuel Tax Credit Rates Dec 2022 Fuel tax credit rates are indexed twice a year in February and August in line with the consumer price index CPI The CPI indexation factor for rates from 5 February 2024 is

Check the fuel tax credit rates for non businesses from 1 July 2022 to 30 June 2023 Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits

Fuel Tax Credit Rates Dec 2022

Fuel Tax Credit Rates Dec 2022

http://atotaxrates.info/wp-content/uploads/2019/06/aug4.jpg

Fuel Tax Credits Explained BOX Advisory Services

https://boxas.com.au/wp-content/uploads/2021/05/Fuel-980x570.jpg

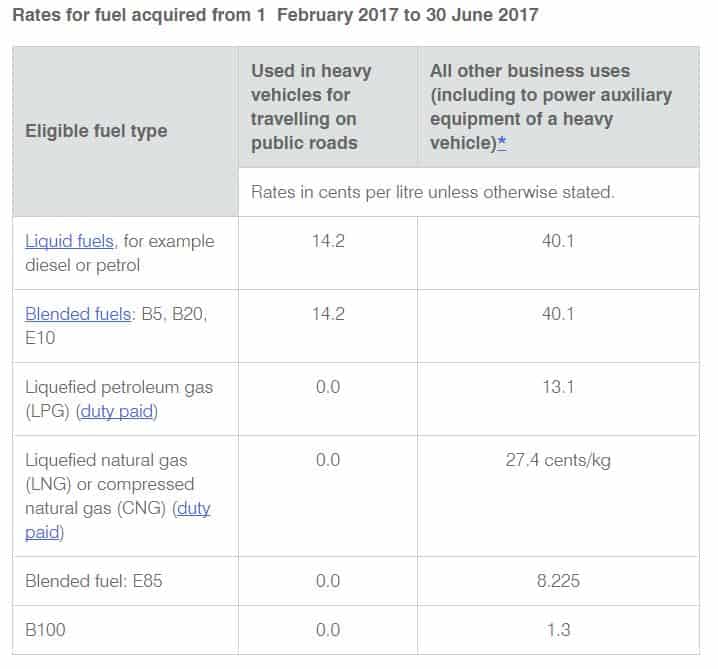

Fuel Tax Credit Rate Increase 1 Feb 2022 DG Business Services

https://images.squarespace-cdn.com/content/v1/613802bb301c037597cbdee3/c03de4be-ff8c-4406-97bc-7147d4829b9f/FTC2021.JPG

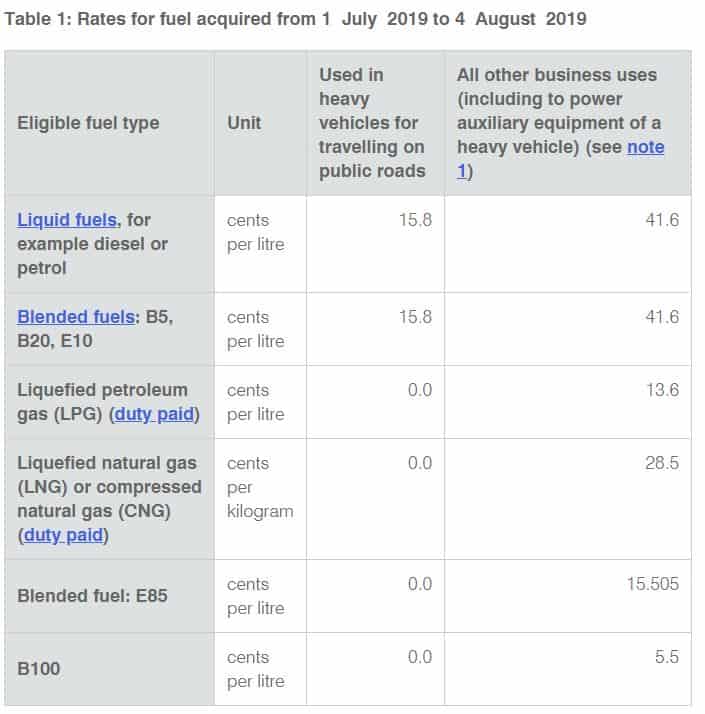

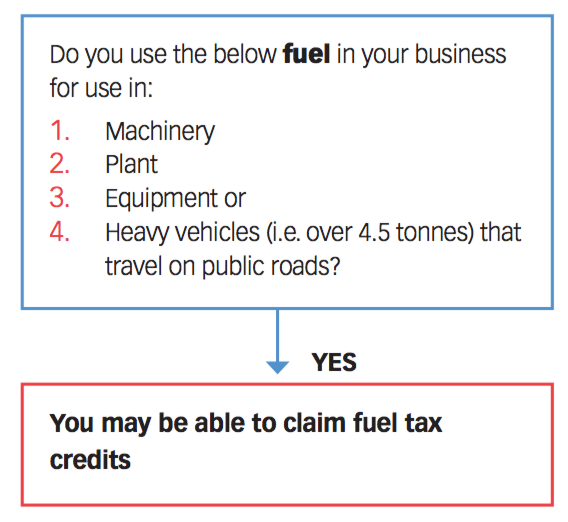

Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business activities You can claim for taxable fuel that you purchase As part of the 2022 23 Budget the Government has temporarily halved the excise and excise equivalent customs duty rates for petrol diesel and all other petroleum based

Fuel tax credits FTC provide businesses with a credit for the excise that is included in the price of fuel if the fuel is used in light vehicles travelling off public roads or on private Fuel used in heavy vehicles for travelling on public roads won t have fuel tax credits for this period because the road user charge exceeds the excise duty paid reducing the fuel

Download Fuel Tax Credit Rates Dec 2022

More picture related to Fuel Tax Credit Rates Dec 2022

Fuel Tax Credits Sand Stone

https://sandandstone.cmpavic.asn.au/wp-content/uploads/2020/02/tax1-595x1024.jpg

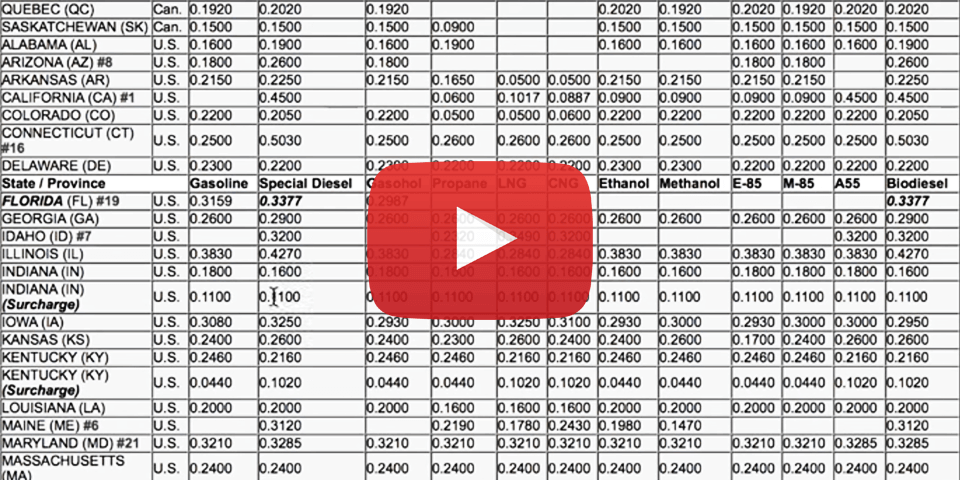

Fuel And Fuel Taxes Learn To Truck

https://www.learntotruck.com/wp-content/uploads/2020/03/IFTA.Rates_2020.2nd.qt-720x617.png

Fuel Tax Credit UPDATED JUNE 2022

https://telematics-australia.com/wp-content/uploads/2020/06/Fuel-Tax-Credits.png

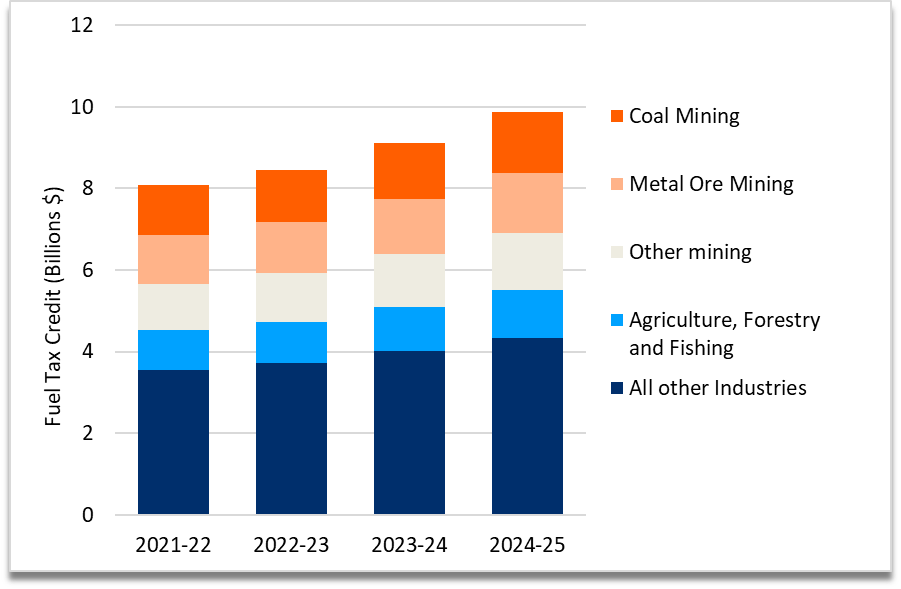

Fuel tax credits FTCs which are an expenditure that refunds some or all of the excise included in the price of fuel purchased by eligible businesses and which are used for a Recent changes to Fuel Tax Credits In July of 2022 the rates for biodiesel B100 were changed due to increased excise tax rates The tax rates excise and excise

The fuel tax credit rate has been temporarily reduced from 30 March to 28 September resulting in 0c per litre for heavy vehicles travelling on public roads This is because the Check the fuel tax credit rates for businesses from 1 July 2022 to 30 June 2023 Last updated 26 June 2024 Print or Download Fuel tax credit rates You need to use the

Fuel Tax Credit Eligibility Form 4136 How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEijO1qAMs_napos3v0ETHe96cx_283MPXVZQXocehgFGkIZ6xTYr0RfHfLiwzClgt1pNmbyCoGSW95DXvx_9PPk5WwQI6RomoDtBDcEFIVgflW04uIRTkMDrLhIZsWQ-upuVniwQQasrHnIe-nOvNw5SD0rXmfOFwsR1N0ob2tG3q6cavZuiSNBND-j/s762/ftc.jpg

And The Award For Biggest Fossil Fuel Subsidy Goes To The Fuel Tax

https://australiainstitute.org.au/wp-content/uploads/2021/05/FFS-1.png

https://www.ato.gov.au/.../rates-business

Fuel tax credit rates are indexed twice a year in February and August in line with the consumer price index CPI The CPI indexation factor for rates from 5 February 2024 is

https://www.ato.gov.au/businesses-and...

Check the fuel tax credit rates for non businesses from 1 July 2022 to 30 June 2023

Understanding IFTA Fuel Tax Trucking Blogs ExpeditersOnline

Fuel Tax Credit Eligibility Form 4136 How To Claim

Fuel Tax Credit Atotaxrates info

.png#keepProtocol)

Fuel Tax Credits New Credit Rates Update February 2023

Fuel Tax Credit Changes Element Accountants Advisors

Gasoline And Diesel Tax Rates Rose In 13 States In 2023 Oklahoma

Gasoline And Diesel Tax Rates Rose In 13 States In 2023 Oklahoma

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

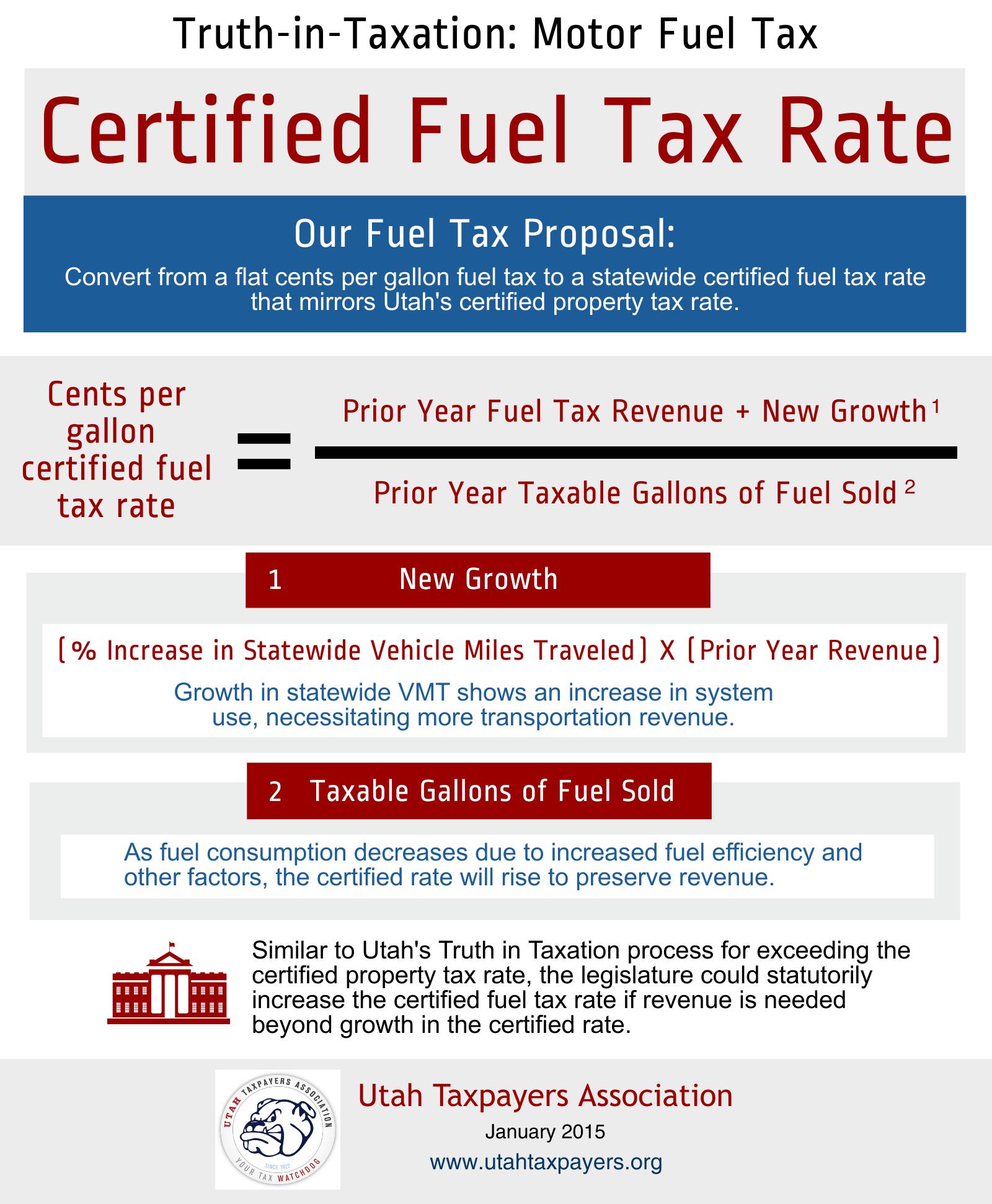

Truth in Taxation For The Motor Fuel Tax Utah Taxpayers

Are You Maximising Your Fuel Tax Credit Claim Nexia A NZ

Fuel Tax Credit Rates Dec 2022 - As part of the 2022 23 Budget the Government has temporarily halved the excise and excise equivalent customs duty rates for petrol diesel and all other petroleum based