Fund Manager Rebates Tax Return Investors in mutual fund trusts must report the rebates as income in the taxation year of payment Investors will receive a T3 or Releve 16 Quebec with the fee rebate included in the appropriate boxes Enter the amounts on your tax return

HM Revenue and Customs HMRC has published updated guidance on how it will tax clients receiving rebates from fund managers or platforms The guidance follows HMRC s decision in March 2013 that rebates are an The First tier Tribunal FTT has determined that amounts paid by Hargreaves Lansdown HL an investment platform service provider to its customers representing rebates received from investment fund managers were not annual payments in Hargreaves Lansdown Asset Management Limited v HMRC 2018 UKFTT 127 HL

Fund Manager Rebates Tax Return

Fund Manager Rebates Tax Return

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

Fund Manager Who Outperformed The S P 500 Since 1989 These Are My Best

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1fCyHR.img?w=1910&h=1000&m=4&q=67

Tax Return Free Creative Commons Handwriting Image

http://www.picpedia.org/handwriting/images/tax-return.jpg

Since 6 April 2013 HM Revenue and Customs has expected platform providers to deduct basic rate income tax from fund rebates and adviser commission given up pre RDR that is passed on to investors by platform fund services Rebates explained Fund and commission rebates are both deemed annual payments for taxation purposes and are subject to income tax They should be entered in the other income section of your tax return We will deduct 20 basic rate tax

Prior to that date fund managers would commonly rebate some of the annual management charge to the platform which would pay part of it to investors From 2014 all rebates need to be paid in full to investors and platforms and other advisers must make a separate charge for their services to investors How management fee rebates are taxed Just as the deduction of the management fee at the fund level reduces income that would have been payable to you the rebate increases the amount of income you receive Canada Revenue Agency considers fee rebates received on holdings in non registered accounts to be taxable

Download Fund Manager Rebates Tax Return

More picture related to Fund Manager Rebates Tax Return

Bookkeeper For Tax Return Prep OnlineJobs ph

https://media.onlinejobs.ph/employer_logos/420270/ecdb860546c46880bbbebd9f62239d7a.jpg

Solved A Pension Fund Manager Is Considering Three Mutual Funds The

https://www.coursehero.com/qa/attachment/14164339/

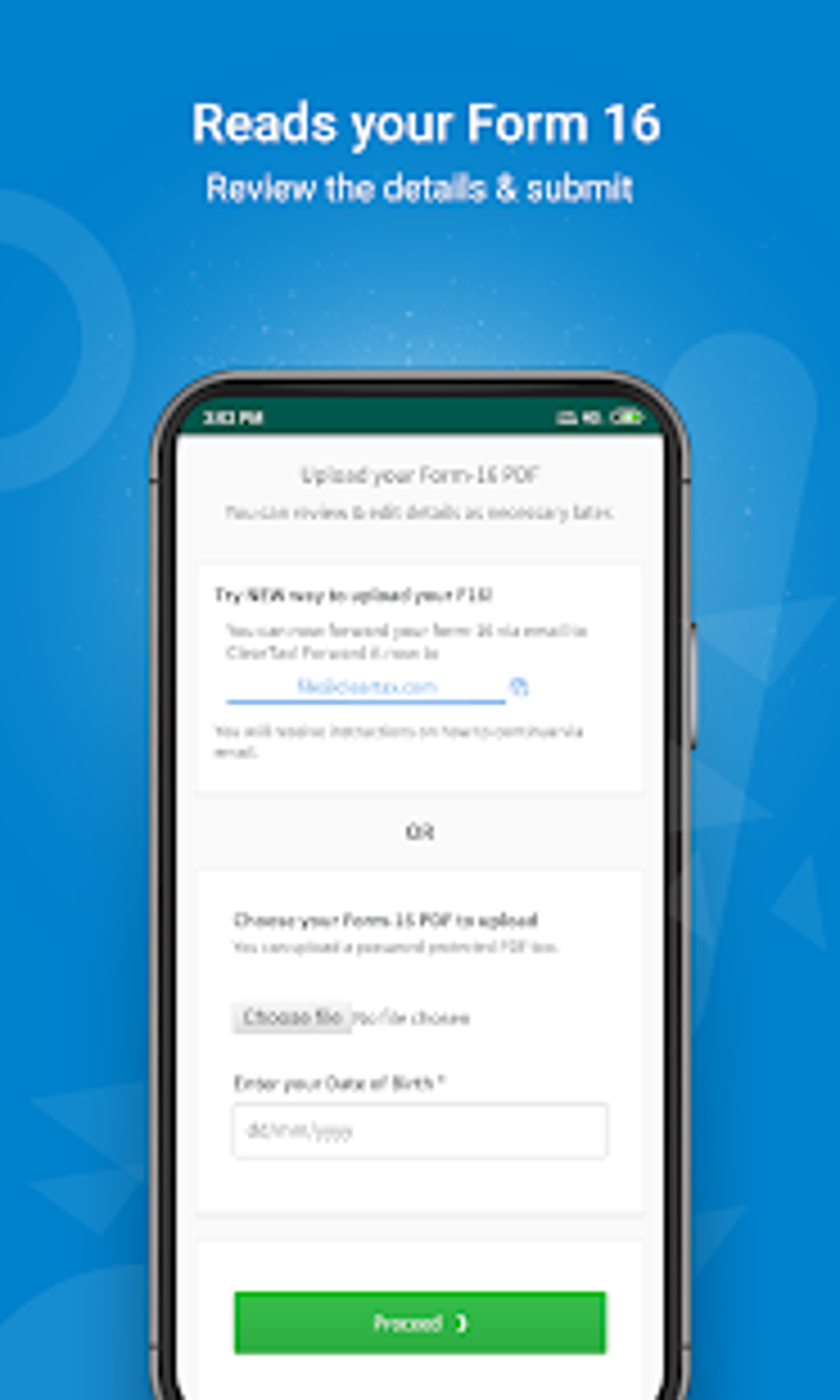

Android File FREE Income Tax Return ClearTax ITR E filing

https://images.sftcdn.net/images/t_app-cover-l,f_auto/p/7db9b7c2-9ff1-41ac-bbee-27dcf1be0514/1391937416/file-free-income-tax-return-cleartax-itr-e-filing-screenshot.png

UK investment managers paying fee rebates loyalty bonuses or similar payments to UK investors and certain non UK investors in collective investment schemes should note recent case law developments regarding the tax treatment of such sums Unit trust and OEIC rebates Some fund managers refund the fund charges back to investors either as cash or additional units in the fund Rebates are taxable as income and Elevate is required by HMRC to deduct 20 income tax from these payments before they are credited to your account These are listed as Fund Manager rebates on the

Refresher on UK taxation of fund managers In recent years HMRC have become concerned that some individuals working for asset management businesses were not paying sufficient or in some cases any taxes on their remuneration namely investment management fees carried interest and performance fees Fund managers will stop offering rebates of charges via online investment platforms analysts have predicted following the introduction of a new tax charge on these buying incentives

Tax Return Deadline Extension

https://i0.wp.com/www.bachesamuels.com/wp-content/uploads/2022/01/Tax-return-red-1.png?fit=6912%2C3456&ssl=1

Fixing Tax Returns The Qualified Amended Return

https://irstaxtrouble.com/wp-content/uploads/sites/5/2022/09/qualified-amended-returns-1568x1176.jpg

https://www.mackenzieinvestments.com/content/dam/...

Investors in mutual fund trusts must report the rebates as income in the taxation year of payment Investors will receive a T3 or Releve 16 Quebec with the fee rebate included in the appropriate boxes Enter the amounts on your tax return

https://citywire.com/new-model-adviser/news/hmrc...

HM Revenue and Customs HMRC has published updated guidance on how it will tax clients receiving rebates from fund managers or platforms The guidance follows HMRC s decision in March 2013 that rebates are an

4 Smart Investments Using Your Tax Return

Tax Return Deadline Extension

Tax Return Employment Self Employment Dividend Rental Property

Income Tax Return Last Date Direct Link To File Itr Other Details Riset

Withholding Tax Return

When Should I File My UK Self Assessment Tax Return For 2022 23 Gold

When Should I File My UK Self Assessment Tax Return For 2022 23 Gold

Fund Manager Bootcamp Strategy Tools

Extension Of Timelines For Filing Of Income tax Returns And Various

Tax Update Tax Credits Income Tax Tax

Fund Manager Rebates Tax Return - How management fee rebates are taxed Just as the deduction of the management fee at the fund level reduces income that would have been payable to you the rebate increases the amount of income you receive Canada Revenue Agency considers fee rebates received on holdings in non registered accounts to be taxable