Gaap Accounting For Refunds GAAP requires companies to recognize refund liabilities on the balance sheet when there is a probable and estimable future outflow of resources due to refunds Companies must assess the probability and potential amounts

GAAP Refund Treatment When a business sells products that a customer can return for a refund it must make two accounting decisions First the business must determine A right of return often entitles a customer to a full or partial refund of the amount paid or a credit against the value of previous or future purchases Some return rights only allow a customer to

Gaap Accounting For Refunds

Gaap Accounting For Refunds

https://parttimecfoservices.ca/wp-content/uploads/2023/06/GAAP-Accounting.png

Generally Accepted Accounting Principles GAAP Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/09/Image_-_GAAP_.jpeg.jpg

GAAP And Why It s Important Accounting Resources Inc

https://accountingresourcesinc.com/app/uploads/2022/03/GAAP-Image-1536x986.jpg

Explore how GAAP guidelines shape revenue recognition for reimbursed expenses and their impact on financial statements and tax implications Accurately In some cases a payment to a customer that is not in exchange for a distinct good or service could exceed the transaction price for the current contract Accounting for the excess payment negative revenue could require

Under U S GAAP the accounting for rebates is governed by a framework that emphasizes the recognition measurement and disclosure of rebate transactions in a manner that reflects their Revenue should not be recognised for goods expected to be returned and a liability should be recognised for expected refunds to customers The refund liability should be updated each

Download Gaap Accounting For Refunds

More picture related to Gaap Accounting For Refunds

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

Simple Gaap Accounting For Pass Through Expenses Accor Hotels Financial

https://www.investopedia.com/thmb/bgqqqjp_b3nnkk4XpliMIiXiZuo=/4755x3566/smart/filters:no_upscale()/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg

What Are The Generally Accepted Accounting Principles GAAP

https://learn.financestrategists.com/wp-content/uploads/Generally-Accepted-Accounting-Principles-GAAP-1.jpg

GAAP Importance And Limitation Invyce

https://invyce.com/wp-content/uploads/2022/02/GAAP.png

The Financial Accounting Standards Board FASB has outlined how to account for refunds under the Generally Accepted Accounting Principles GAAP How a purchase was How Should Refunds or Returns Be Recorded to Comply with GAAP Every company s setup and refund policy is different and we recommend working directly with your auditors We find

Accounting standards and compliance are crucial for accurately reporting financial transactions including returns and refunds Key aspects include adherence to GAAP When your small business sells merchandise you might occasionally refund all or a portion of a sale for a defective item or for other reasons In accounting a sales return represents a

Statement Of Retained Earnings GAAP Vs IFRS Differences And

https://financialfalconet.com/wp-content/uploads/2022/11/Statement-of-retained-earnings-GAAP-vs-IFRS-4.jpg

U S GAAP Accounting For PPP Loans Reynolds Rowella LLP

https://www.reynoldsrowella.com/wp-content/uploads/iStock-1222018169-1024x683.jpg

https://gonumeral.com/refund-accounti…

GAAP requires companies to recognize refund liabilities on the balance sheet when there is a probable and estimable future outflow of resources due to refunds Companies must assess the probability and potential amounts

https://smallbusiness.chron.com/gaap-refund-treatment-35435.html

GAAP Refund Treatment When a business sells products that a customer can return for a refund it must make two accounting decisions First the business must determine

Accrual Based GAAP Accounting And Its Importance For Tech Companies

Statement Of Retained Earnings GAAP Vs IFRS Differences And

International Accounting Chart Of Accounts Intangible Asset

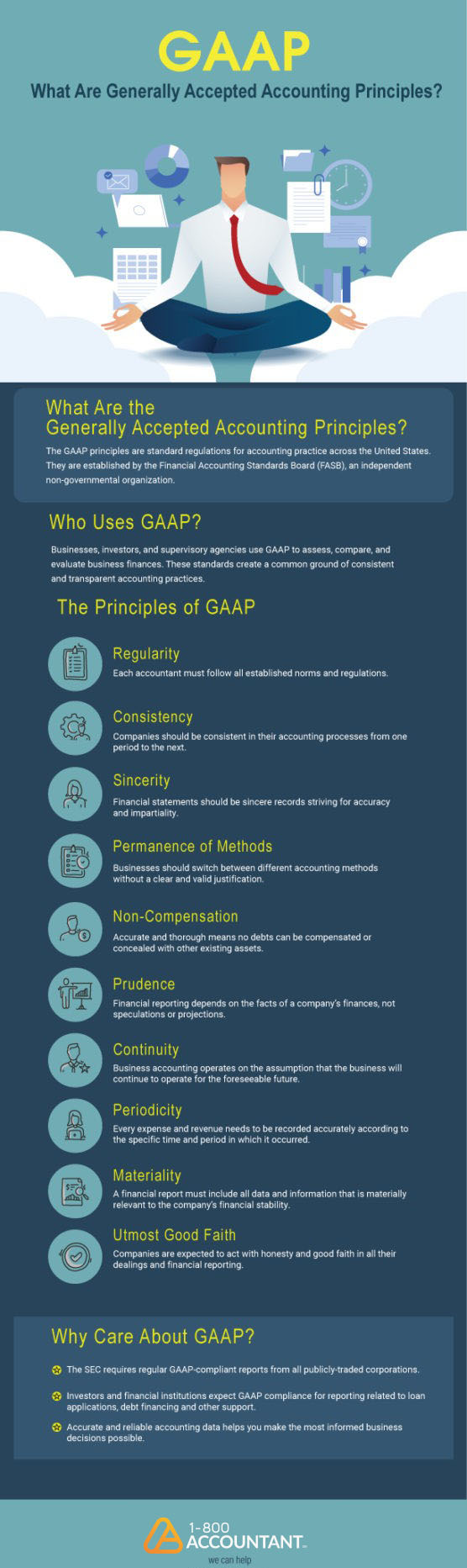

What Are Generally Accepted Accounting Principles GAAP

What Is GAAP Or Generally Accepted Accounting Principles

Accounting For Refunds Received Planergy Software

Accounting For Refunds Received Planergy Software

Big GAAP Vs Little GAAP Generally Accepted Accounting Principles For

The Importance Of GAAP Financial Statements PKF Mueller

Generally Accepted Accounting Principles Or GAAP Are The Set Of

Gaap Accounting For Refunds - When a business issues a refund for a product it must account for this refund on its financial statements Sales returns and allowances is an account on the income statement