Tax Credits And Rebates For Homeowners Web 20 d 233 c 2022 nbsp 0183 32 The law provides up to 14 000 in rebates and tax credits per household with the goal of lowering Americans carbon footprint Although the act technically takes

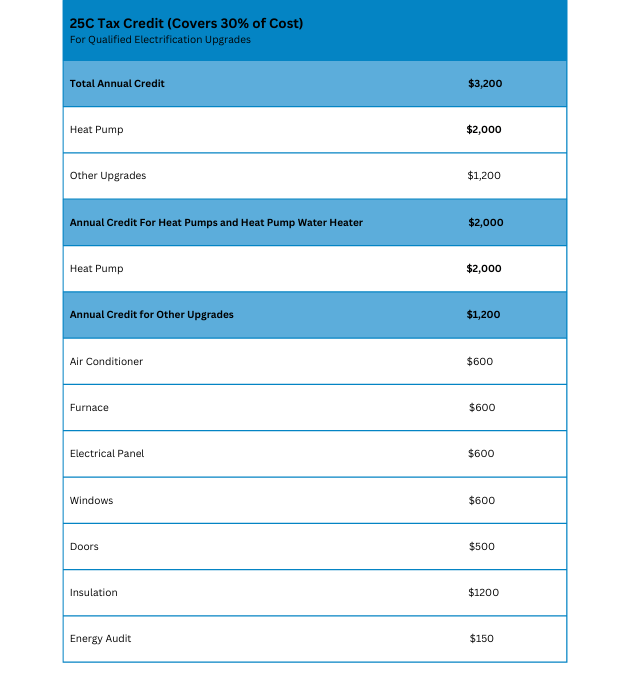

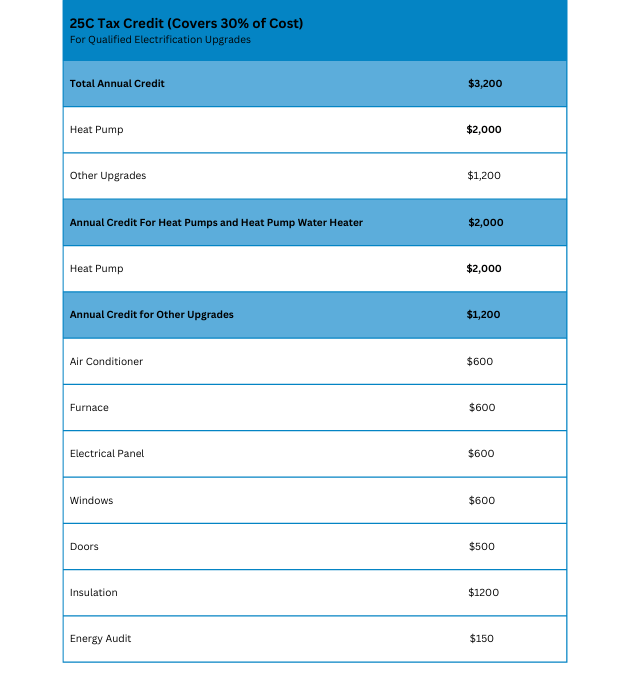

Web 30 d 233 c 2022 nbsp 0183 32 Savings for Homeowners New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements Web Newly passed legislation will cover energy related tax credits and rebates starting in the 2023 tax year so we put together a list of some common home improvement and renewable energy tax credits that

Tax Credits And Rebates For Homeowners

Tax Credits And Rebates For Homeowners

https://pearlcertification.com/images/page_headers/_imageBlockMedium/IRA_Infographic-2022-2.jpg

Constellation s Best Of 2017

https://blog.constellation.com/wp-content/uploads/2017/11/tax-credits-rebates-homeowners-guide.png

10 Rebates And Tax Credits More Homeowners Should Take Advantage Of

https://i.pinimg.com/originals/68/15/d6/6815d688370209e9c2c08f34ea1eb7cd.png

Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of

Web 20 juil 2023 nbsp 0183 32 A Consumer Guide to the Inflation Reduction Act Here s how to save on electric vehicles solar panels heat pumps and more via tax credits and rebates July 20 2023 iStock Web 24 f 233 vr 2023 nbsp 0183 32 Two are tax credits available now for those who can afford to pay for something up front or finance it then reap tax benefits over time The others are state

Download Tax Credits And Rebates For Homeowners

More picture related to Tax Credits And Rebates For Homeowners

10 Rebates And Tax Credits More Homeowners Should Take Advantage Of

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/10-rebates-and-tax-credits-more-homeowners-should-take-advantage-of.jpg

Tampa Homeowners take Advantage Of The Inflation Reduction Act s Tax

https://www.homeofintegrity.com/wp-content/uploads/2023/03/Image-2-2-768x576.png

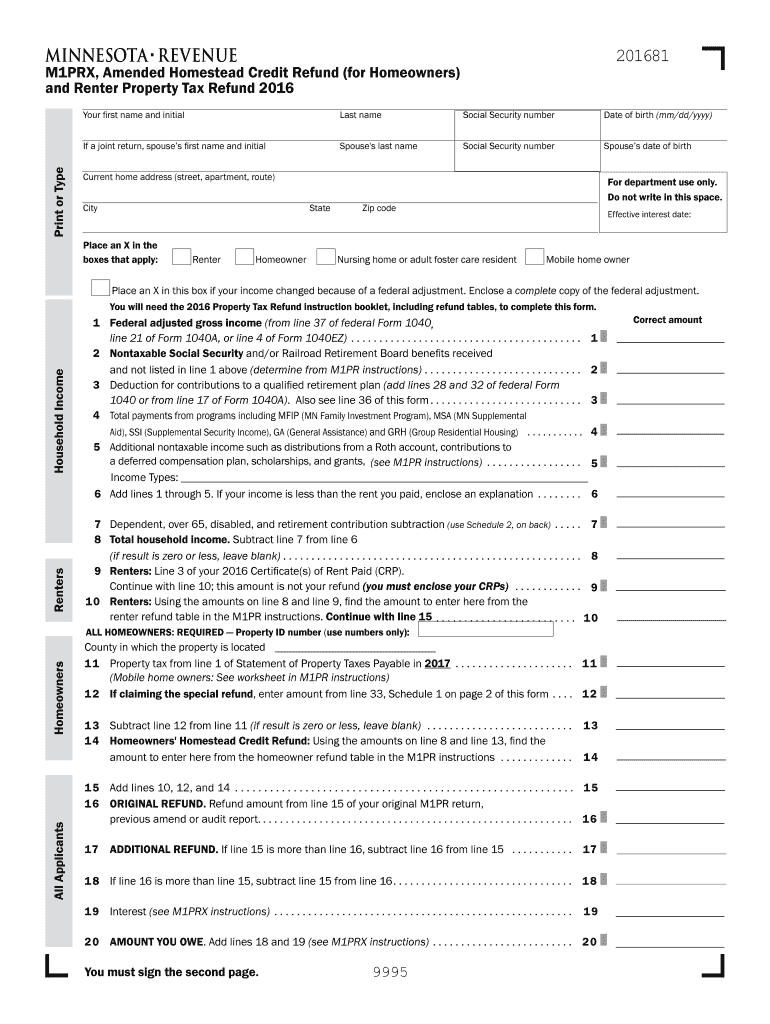

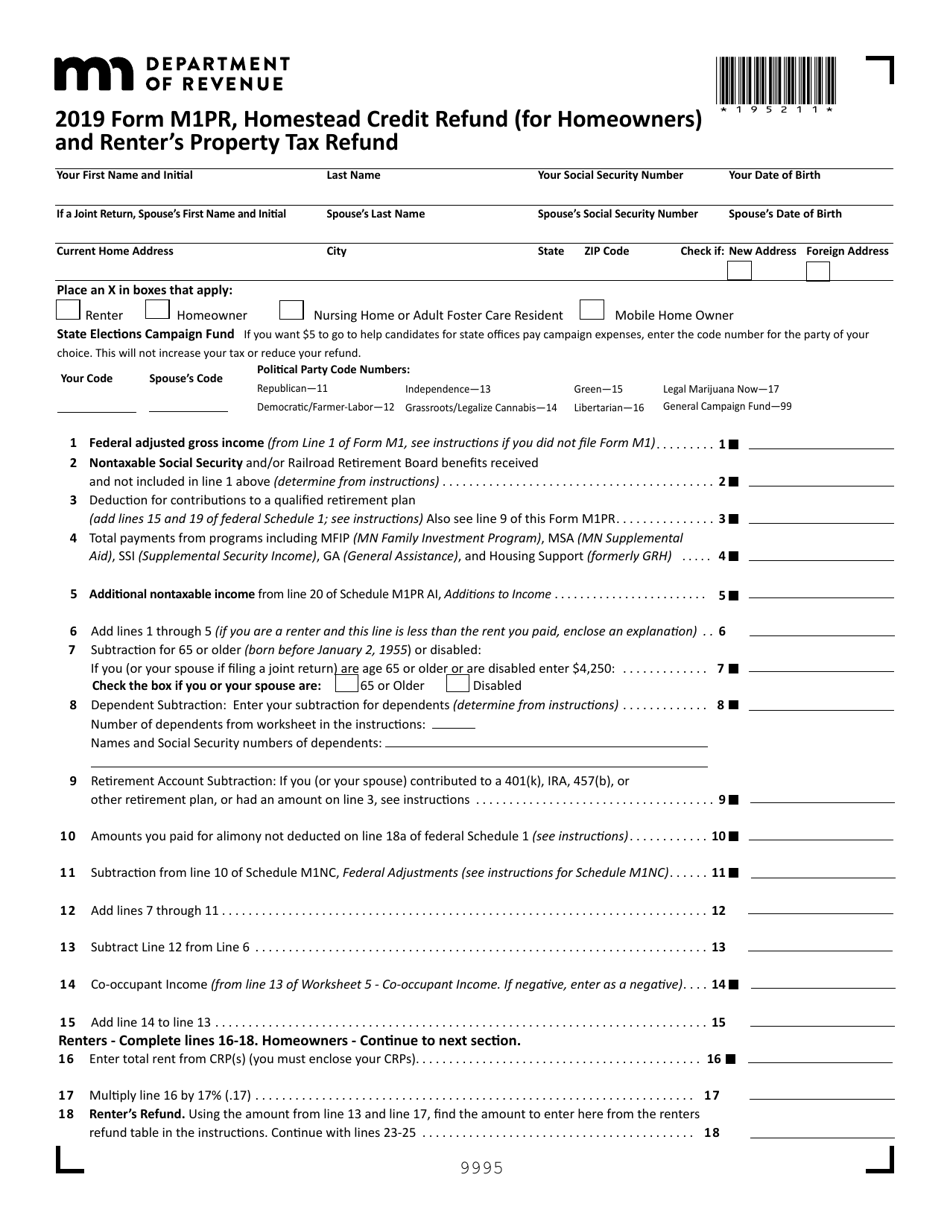

M1PRX Amended Homestead Credit Refund For Homeowners Fill Out And

https://www.signnow.com/preview/397/780/397780212/large.png

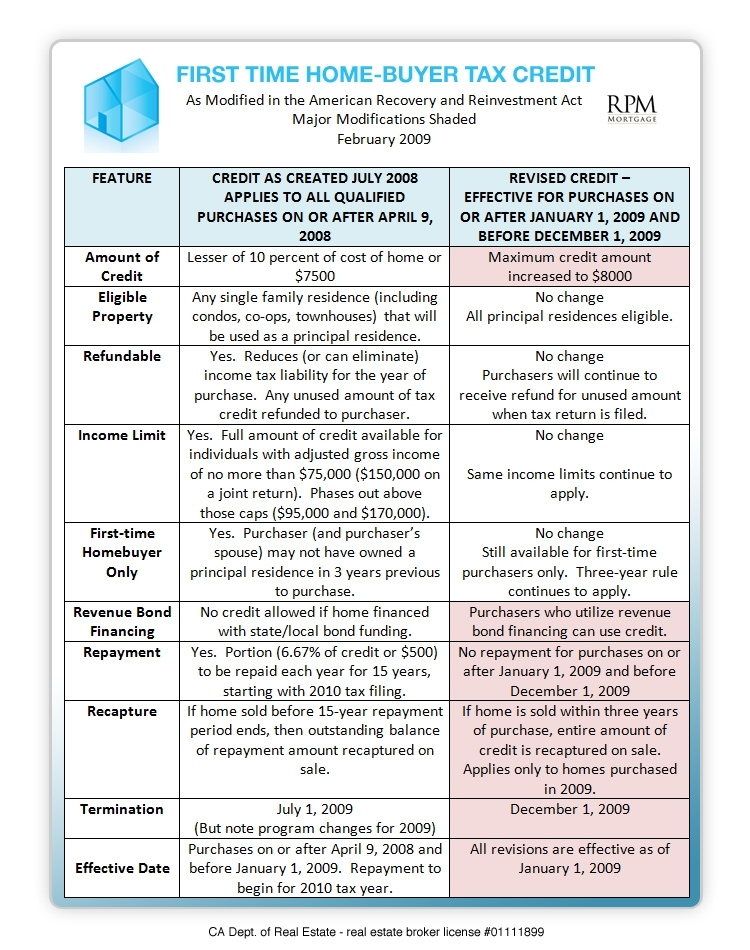

Web 17 mars 2023 nbsp 0183 32 One of the tax credits that homeowners may be familiar with the Nonbusiness Energy Property Credit initially expired at the end of 2021 However the Inflation Reduction Act brings it Web 13 f 233 vr 2023 nbsp 0183 32 Homeowners can get a tax credit for 30 of the cost to buy and install solar panels up from the previous 26 And there s no dollar limit If you pay 15 000 to put solar panels on your

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

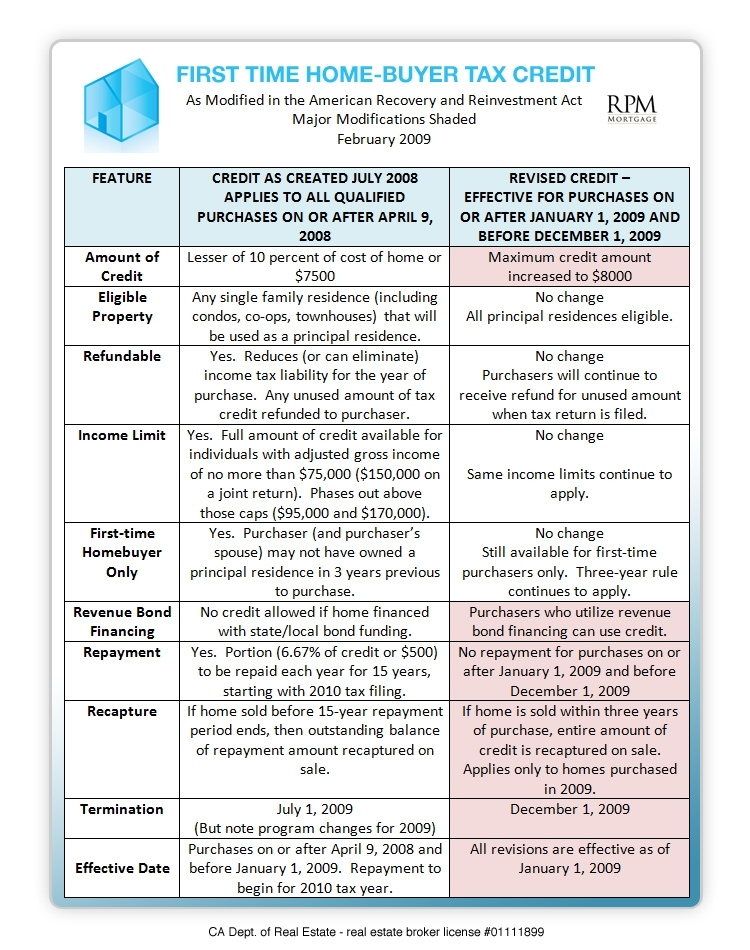

Homeowners Tax Credit Overview The Basis Point

https://thebasispoint.com/wp-content/uploads/2009/03/tax-credit-overview.jpg

The Homeowners Guide To Energy Tax Credits And Rebates Constellation

https://www.constellation.com/content/constellation/en/energy-101/homeowners-guide-tax-credits-and-rebates/_jcr_content/secondaryPar/banner_section_1356666582/par/banner_section/par/image.img.gif/1552068722681.gif

https://www.bobvila.com/articles/home-improvement-tax-credits

Web 20 d 233 c 2022 nbsp 0183 32 The law provides up to 14 000 in rebates and tax credits per household with the goal of lowering Americans carbon footprint Although the act technically takes

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 Savings for Homeowners New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements

Fillable Form M1pr Minnesota Homestead Credit Refund For Homeowners

Homeowners Tax Credit Overview The Basis Point

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

Energystar gov Offers A Treasure Chest Of Goodies And Information For

Texas Solar Power For Your House Rebates Tax Credits Savings

Tax Credits And Rebates Mauzy

Tax Credits And Rebates Mauzy

Mass Tax Rebate Check

Homeowners Can Use Rebates Tax Credits To Cut Emissions But Does

HVAC Equipment Tax Credits For Homeowners

Tax Credits And Rebates For Homeowners - Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy