Georgia Business Personal Property Tax Return Due Date 2023 Web The due date for filing a property tax return with your county tax officials is January 1 and April 1 unless otherwise indicated Your county may have a website to download real and

Web When to File a Return Payment of Taxes Property Tax Forms When are Property Tax Returns Due Property taxes are due on property that was owned on January 1 for Web Georgia filing and tax deadline dates for 2023 tax returns The State of Georgia has issued the following guidance regarding income tax filing deadlines for individuals The

Georgia Business Personal Property Tax Return Due Date 2023

Georgia Business Personal Property Tax Return Due Date 2023

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

Due Date To File Income Tax Return For AY 2023 24 Is 31st Of July 2023

https://taxguru.in/wp-content/uploads/2023/06/Income-tax-return-filing-1.jpg

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

https://www.taxproadvice.com/wp-content/uploads/business-tax-return-due-date-by-company-structure.jpeg

Web Corporate income tax and net worth tax returns Form 600S are due on or before the 15th day of the 3rd month Corporate income and net worth tax returns Form 600 must be Web Tax Bills Issued Due and payable now UNTIL September 30th without interest September 30 Tax Bills Due Last day 1st half installment may be paid without interest March 31

Web Information Business Personal Property Return To avoid a 10 penalty on items not previously returned file this return no later than April 1 of the tax year This return is Web Welcome to DeKalb County s Business Personal Property 2023 eFile Tax Return Procedures 2023 E file closed for processing All returns must be made in paper

Download Georgia Business Personal Property Tax Return Due Date 2023

More picture related to Georgia Business Personal Property Tax Return Due Date 2023

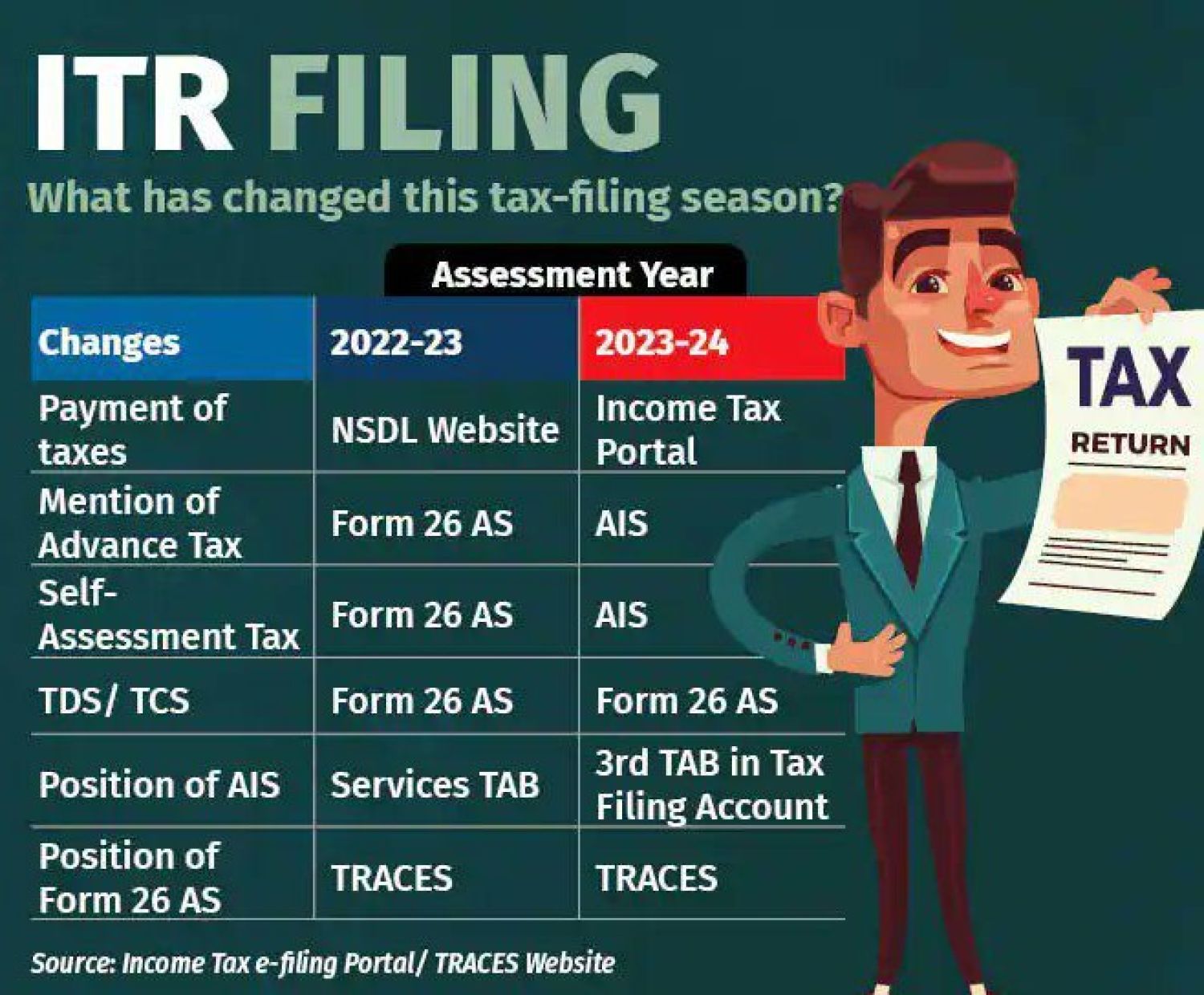

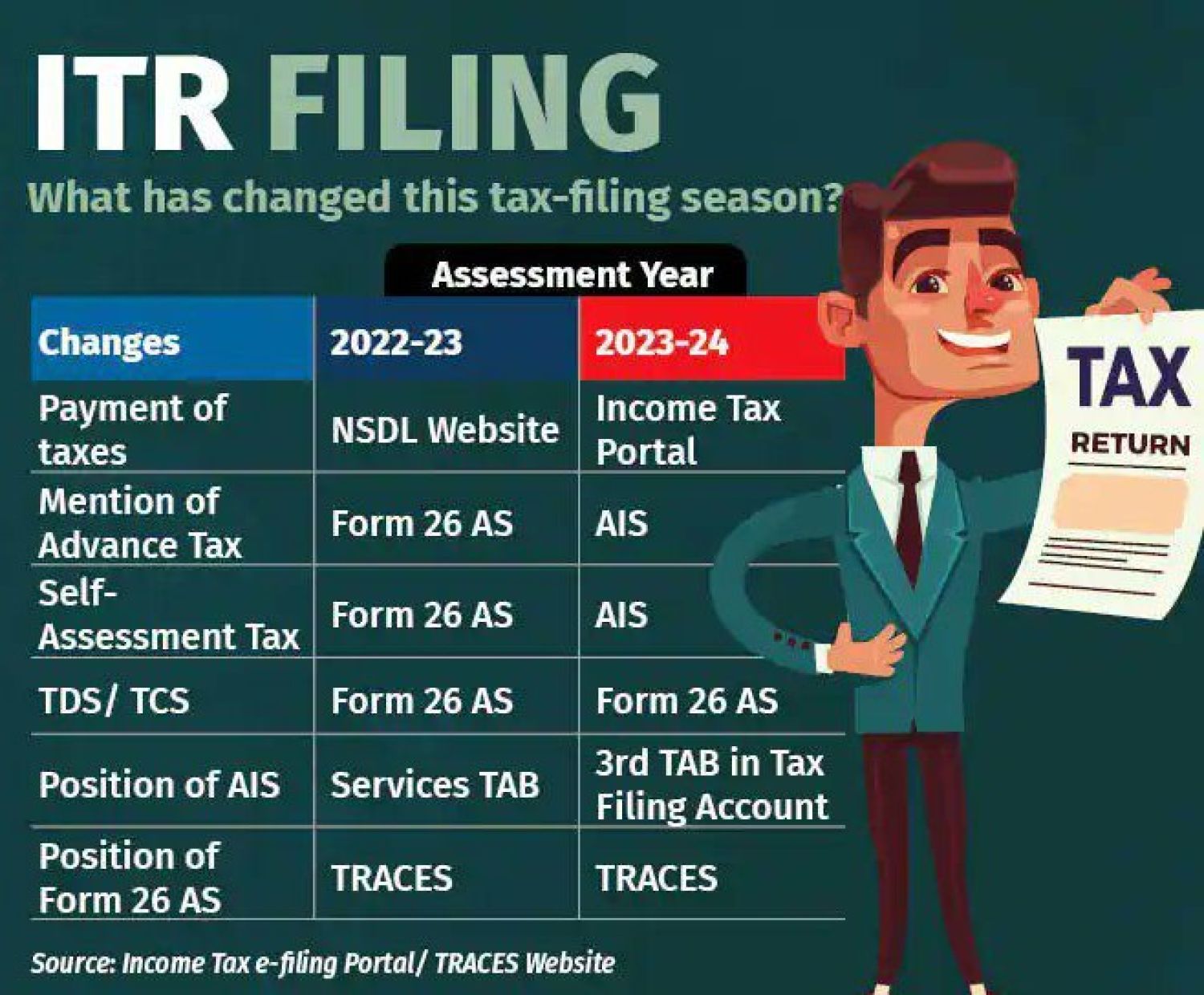

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

https://academy.tax4wealth.com/public/storage/uploads/1681121464-last-date-to-file-income-tax-return-itr-for-fy-2022-23-ay-2023-24.jpg

Due dates For ITR Filing Online For FY 2022 23 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2023/04/Due-dates-ITR-Filing-for-FY-2022-23-AY-2023-24.png

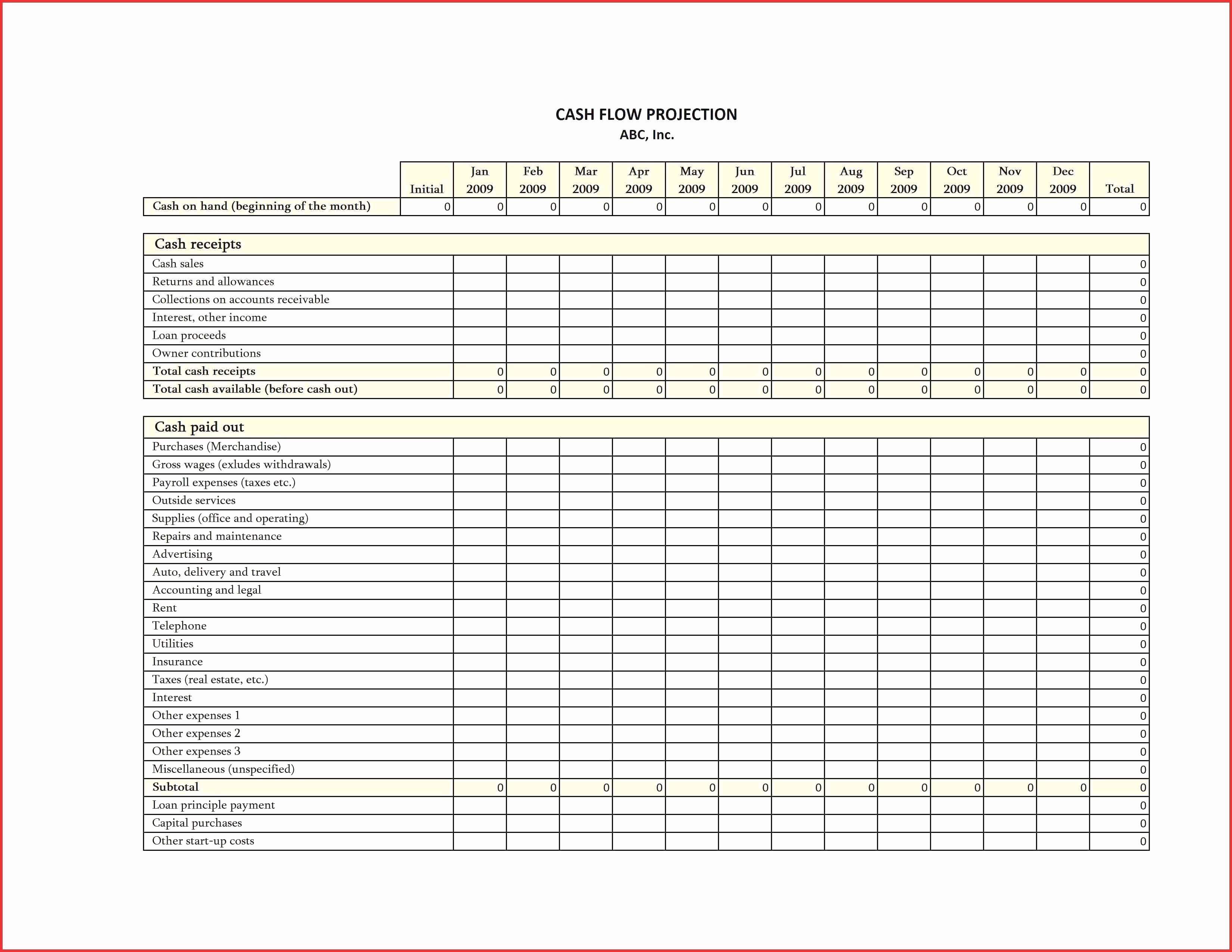

Tax Expenses Template

https://db-excel.com/wp-content/uploads/2019/01/tax-return-spreadsheet-australia-regarding-rental-property-expenses-spreadsheet-template-australia-expense.jpg

Web Who is Legally Responsible for Payment on Real property Real and personal property tax statements are mailed by September 15th each year The due date to pay real and personal property tax is November Web If in the prior year the tangible personal property of a taxpayer was exempt pursuant to O C G A 48 5 42 1 from all ad valorem taxation due to the actual fair market value not

Web BUSINESS PERSONAL PROPERTY TAX RETURN County Name and Return Address DeKalb County Tax Assessors Property Appraisal amp Assessment Admin Maloof Annex Web 2023 Property Tax Relief Grant Click Here Homestead Relief Grant Property Tax Payment Property tax bills are mailed out every year late August early September and

How To File Income Tax Return Online Itr Last Date

https://carajput.com/art_imgs/last-date-approaching-check-here-how-to-file-itr-tax-filling-for-ay.jpg

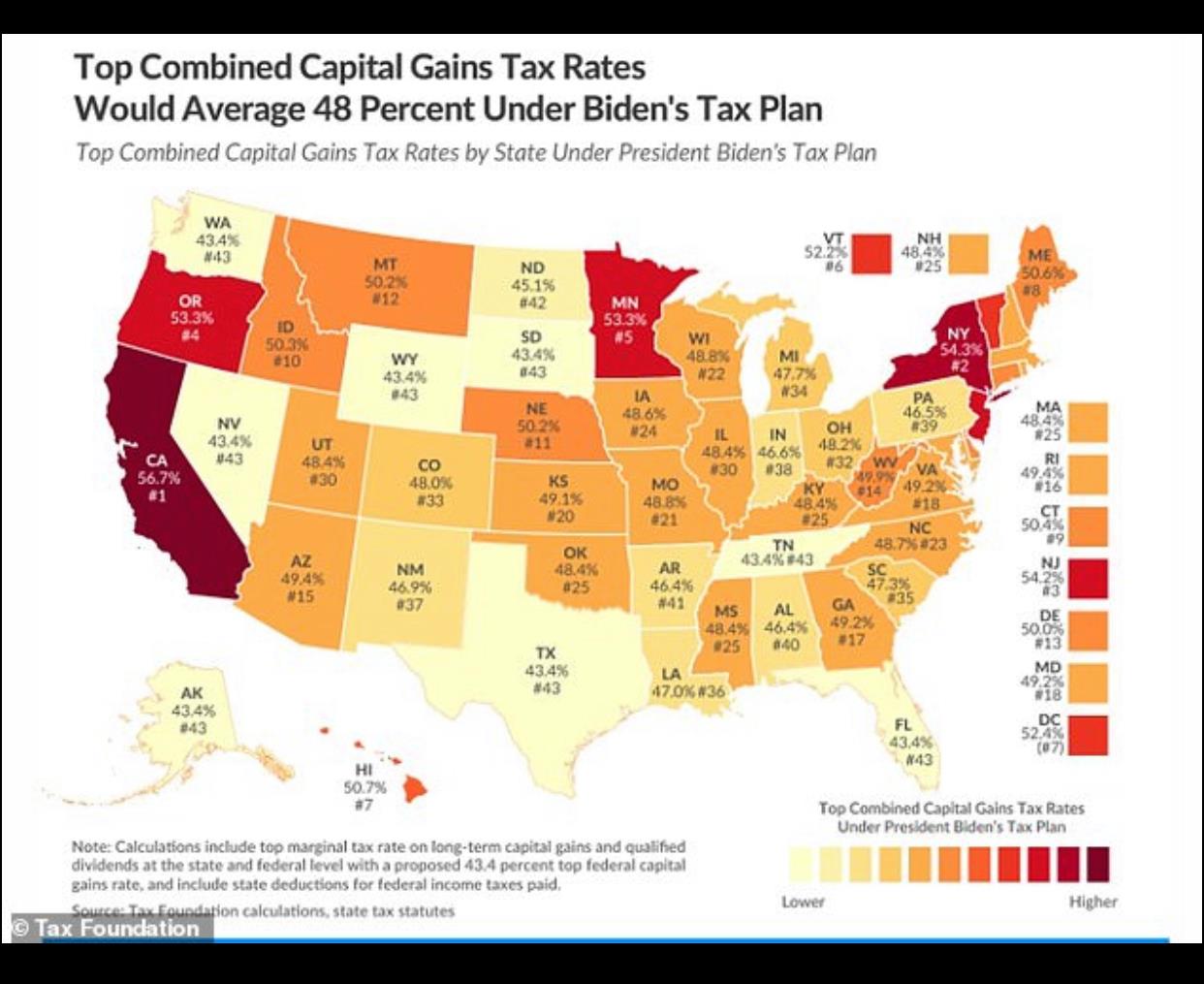

These Are The States That Updated Their 2020 Tax Filing Deadlines

https://loganmartinrealtypros.com/wp-content/uploads/2021/04/177543769_313969630174178_2688524765217555803_n.jpg

https://dor.georgia.gov/.../real-and-personal-property-forms-and

Web The due date for filing a property tax return with your county tax officials is January 1 and April 1 unless otherwise indicated Your county may have a website to download real and

https://dor.georgia.gov/property-tax-returns-and-payment

Web When to File a Return Payment of Taxes Property Tax Forms When are Property Tax Returns Due Property taxes are due on property that was owned on January 1 for

Due Dates For E Filing Of TDS TCS Returns For FY 2022 23

How To File Income Tax Return Online Itr Last Date

Business Personal Property Tax Return Augusta Georgia Property Tax

Personal Property Tax SDG Accountants

Income Tax Returns Filing Due Dates Extended Ebizfiling

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Amelia County Personal Property Tax PROPERTY HJE

Due Dates For Income Tax Returns Archives Ebizfiling

2023 Tax Forms Bc Printable Forms Free Online

Georgia Business Personal Property Tax Return Due Date 2023 - Web Tax Return Deadline Personal property tax returns are due to the Tax Assessor s office by April 1 For more information on the returns please call the Tax Assessor s Office at