Georgia Electric Car Tax Credit The Georgia Department of Revenue is responsible for administering the electric vehicle charger and converted vehicle tax credits EPD s certification is required to apply for

Use this tool to find Georgia generally available and qualifying tax credits incentives and rebates that may apply to your purchase or lease of an electric vehicle Georgia Power offers a time of use plug in electric vehicle rate to help PEV owners save money The federal government offers income tax credits of 7 500 for a battery electric vehicle and

Georgia Electric Car Tax Credit

Georgia Electric Car Tax Credit

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Why Georgia May End Its Electric Car Tax Credit Georgia Public

http://www.gpb.org/sites/www.gpb.org/files/support/georgia-number-2.png

Electric Car Tax Credit Everything That You Have To Know Get

https://getelectricvehicle.com/wp-content/uploads/2020/03/20200323_222104_0000-2137228502-683x1024.png

The credit is up to 7 500 for vehicles with a gross vehicle weight rating of less than 14 000 pounds and up to 40 000 for vehicles with a gross vehicle weight rating of more than 14 000 pounds The credit starts on A guide with everything Georgia residents need to know about electric vehicle EV charging at home including available EV tax credits rebates incentives and TOU electricity

All electric and plug in hybrid cars purchased in or after 2010 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle Visit FuelEconomy gov Claim an Alternative Fuel Tax Credits on GTC Under Georgia law certain Alternative Fuel Vehicles are subject to annual licensing fees These fees must be adjusted each year

Download Georgia Electric Car Tax Credit

More picture related to Georgia Electric Car Tax Credit

Learn The Steps To Claim Your Electric Vehicle Tax Credit

https://andersonadvisors.com/wp-content/uploads/2023/04/Electric-vechiles.jpg

Summary Of The Electric Vehicle Tax Credit

https://www.troutcpa.com/hubfs/Electric-Car-Tax-Credit.jpg

2023 Electric Vehicle Tax Credit BenefitsFinder

https://benefitsfinder.com/wp-content/uploads/sites/4/2023/02/electric-vehicle-tax-credits-1024x684.jpg

Electric Vehicle Charger EVC Tax Credit An eligible business may claim an income tax credit for the purchase lease and installation of a qualified EVC in Georgia up to 10 of the cost or 2 500 whichever is less The credit is not That s because if you buy a used electric vehicle for 2024 from model year 2022 or earlier there s a tax credit for you too It s worth 30 of the sales price up to

Alternative Fuel Vehicle AFV Conversion Tax Credit An income tax credit is available for 10 of the cost to convert a vehicle to natural gas electricity propane and hydrogen up to 2 500 The Georgia EV tax credit is 10 of the station s cost with a maximum credit of 2 500 When purchasing leasing or installing an approved EV charging station in Georgia a

Electric Vehicle Tax Credit Explained Rhythm

https://www.gotrhythm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F81o0exmdkv18%2F1Ih7Xkv6V29tej0lozgZnI%2F69087ff2f2f4a2c9e28b5d50b26157fa%2FEVBlog_TaxCredit.jpg&w=3840&q=100

Complete List Of New Cars Trucks SUVs Qualifying For Federal

http://static1.squarespace.com/static/61b95688b192145bb020eac7/t/63f55239dcc2773dc352238e/1677021757528/Do+you+qualify+for+electric+vehicle+benefits.jpg?format=1500w

https://epd.georgia.gov/.../clean-vehicle-related-tax-credits

The Georgia Department of Revenue is responsible for administering the electric vehicle charger and converted vehicle tax credits EPD s certification is required to apply for

https://www.edmunds.com/electric-car/tax-credits...

Use this tool to find Georgia generally available and qualifying tax credits incentives and rebates that may apply to your purchase or lease of an electric vehicle

Audi MINI Toyota Prius Models Added To IRS Electric Vehicle Tax

Electric Vehicle Tax Credit Explained Rhythm

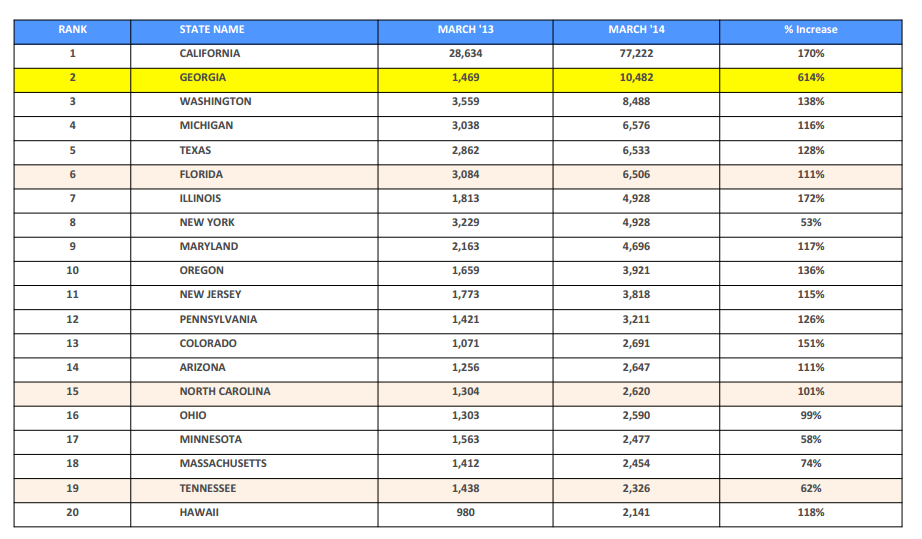

Some Fun With Heatmaps And EV Related Data GM Volt Forum

Facts About Electric Car Tax Credits Signature Auto Group NYC

7500

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit 2014

Tax Credits For Electric Vehicles Are About To Get Confusing The New

EVtaxcredit MEME Koch Vs Clean

Georgia Electric Car Tax Credit - All electric and plug in hybrid cars purchased in or after 2010 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle Visit FuelEconomy gov