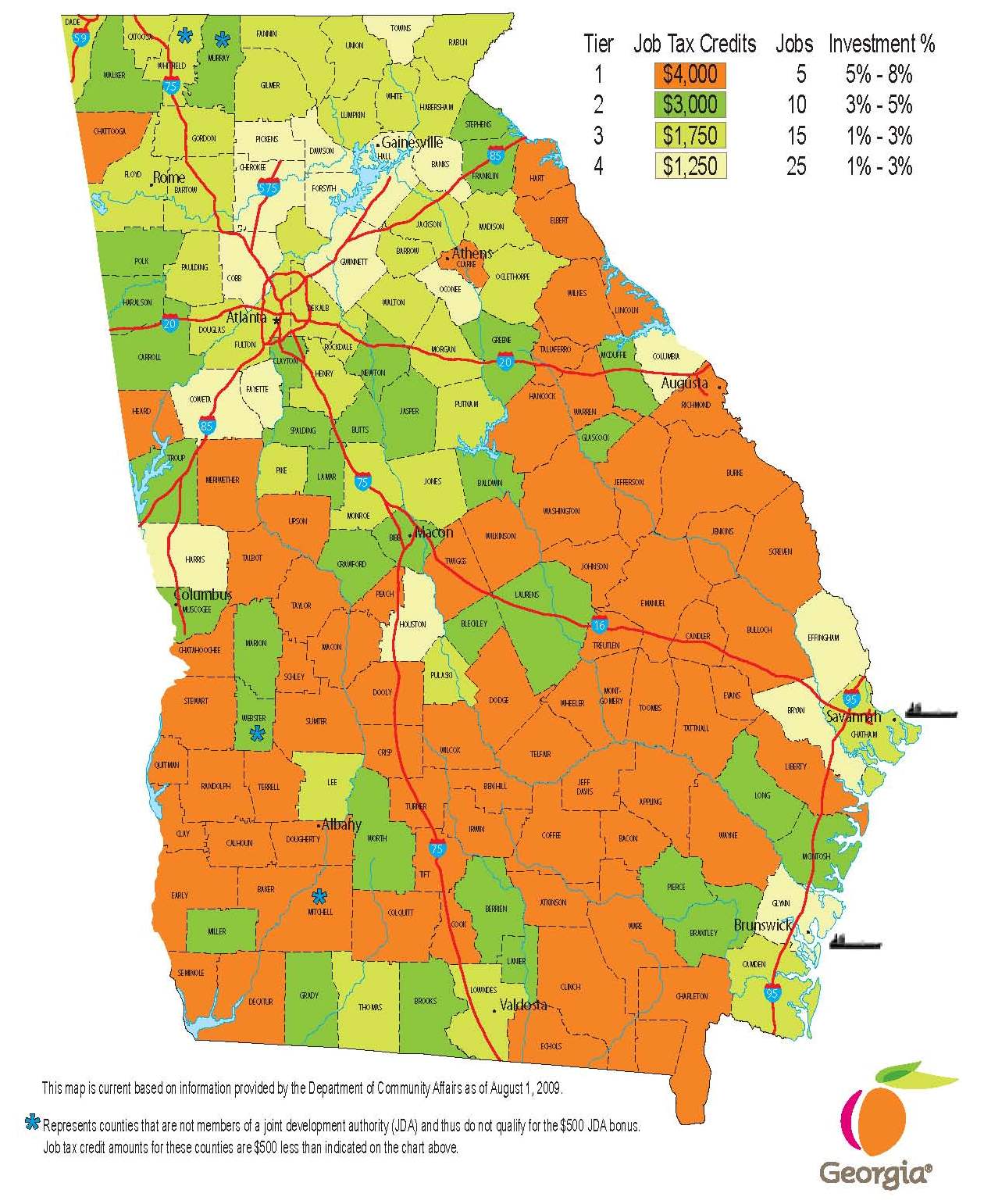

Georgia Tax Credit Certain income tax credits must be claimed by the taxpayer within the one year rule for example the jobs tax credit retraining tax credit and quality jobs tax credit at the time of

Georgia s Job Tax Credit has been in place for 25 years the Quality Jobs Tax Credit has been implemented for 15 years Both are flagship incentives In certain areas your business can apply some tax credits to cover state Tax Credit Summaries The gov means it s official Local state and federal government websites often end in gov State of Georgia government websites and email systems

Georgia Tax Credit

Georgia Tax Credit

https://www.pmba.com/wp-content/uploads/2022/03/georgia-rd-tax-credit-summary.jpg

Georgia Tax Credit YouTube

https://i.ytimg.com/vi/P-2iR2_DnFw/maxresdefault.jpg

Georgia Tax Credit Scholarship YouTube

https://i.ytimg.com/vi/6WW0oDMqJJU/maxresdefault.jpg

The 2023 Georgia tax rebates have come thanks to legislation known as House Bill 162 The bill provides a one time tax credit i e surplus tax refund for individual Georgia taxpayers who People who filed tax returns in both 2021 and 2022 are eligible to receive the money which the Department of Revenue will start issuing in six to eight weeks

Here s what you need to know about the 250 500 Georgia surplus tax refund payments that have been signed into law by Gov Brian Kemp Listed below are credits that are available on your Georgia tax return Low Emission Credit Only carry over credit amount from a previous year can be claimed Qualified

Download Georgia Tax Credit

More picture related to Georgia Tax Credit

Georgia State R D Tax Credit

https://www.ntgadvantage.com/wp-content/uploads/2019/01/Screen-Shot-2019-01-08-at-2.26.21-PM-1-e1546975693461.png

The Technology Healthcare Real Estate Advisor Georgia s Tax And

http://1.bp.blogspot.com/_Bg01jiE5wRA/TBDxWEV6-EI/AAAAAAAAANs/_Fjl5CEZCFg/s1600/JobTaxCredit+Tier+Map+2009.jpg

Will Georgia s Film Tax Credit Cap Help Conservatives

https://movieguide.b-cdn.net/wp-content/uploads/2014/07/AdobeStock_268786942-scaled.jpeg

Credit is claimed by filing Form IT CA with the Georgia corporation income tax return Credit may be filed on an amended tax return within one year of the original timely filed Georgia State Income Tax Credit Program Fact Sheet Local Government Assistance Providing resources tools and technical assistance to cities counties and local

Georgia offers a small low income tax credit for individuals with an income below 20 000 and does not require filers to have worked or earned income in order to qualify 1 In Submit your 2025 Georgia Tax Credit pledge today Create your Georgia SSO account to pledge and securely manage personal info Submit Your Pledge

Georgia Investment Tax Credit

https://lirp.cdn-website.com/a7c50309/dms3rep/multi/opt/Georgia+Investment+Tax+Credit-1920w.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

https://dor.georgia.gov/credits-faq

Certain income tax credits must be claimed by the taxpayer within the one year rule for example the jobs tax credit retraining tax credit and quality jobs tax credit at the time of

https://www.georgia.org/.../incentives/tax-c…

Georgia s Job Tax Credit has been in place for 25 years the Quality Jobs Tax Credit has been implemented for 15 years Both are flagship incentives In certain areas your business can apply some tax credits to cover state

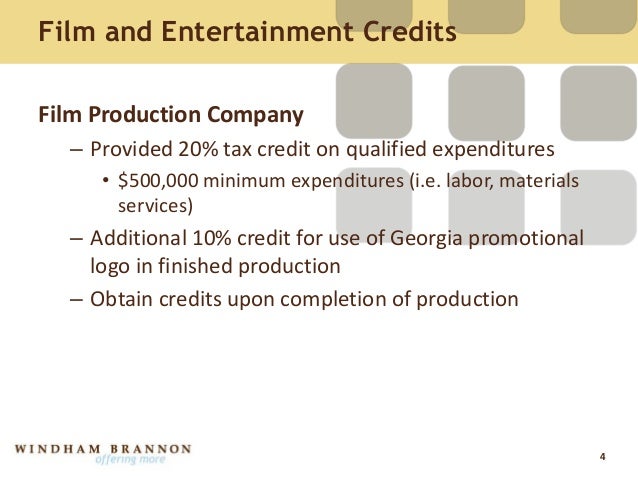

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Investment Tax Credit

Lee Left The Gate Open Tax Revenues Hoofed It Agraynation

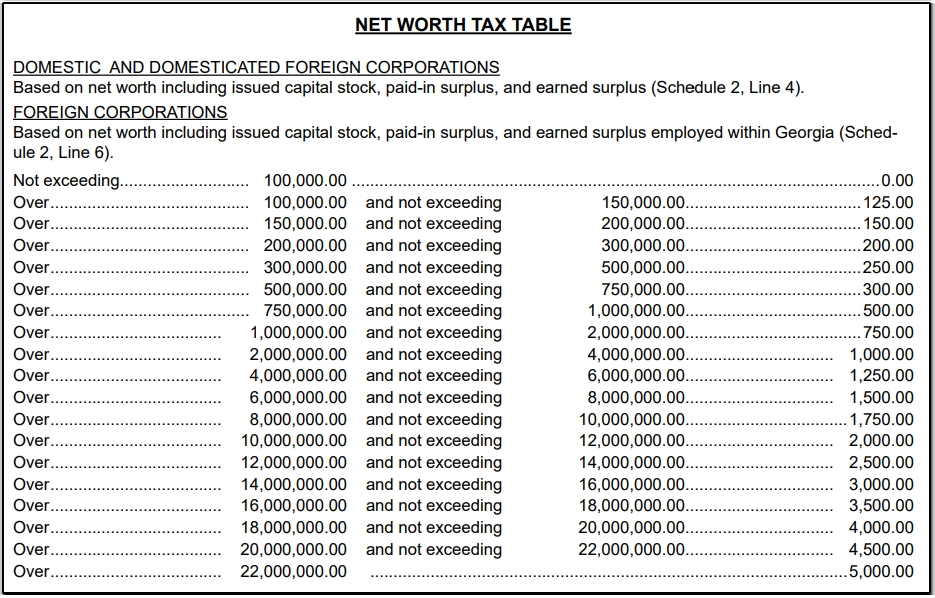

GA Corporate Net Worth Tax

Tax Credit Universal Credit Impact Of Announced Changes House Of

Tax Credit Universal Credit Impact Of Announced Changes House Of

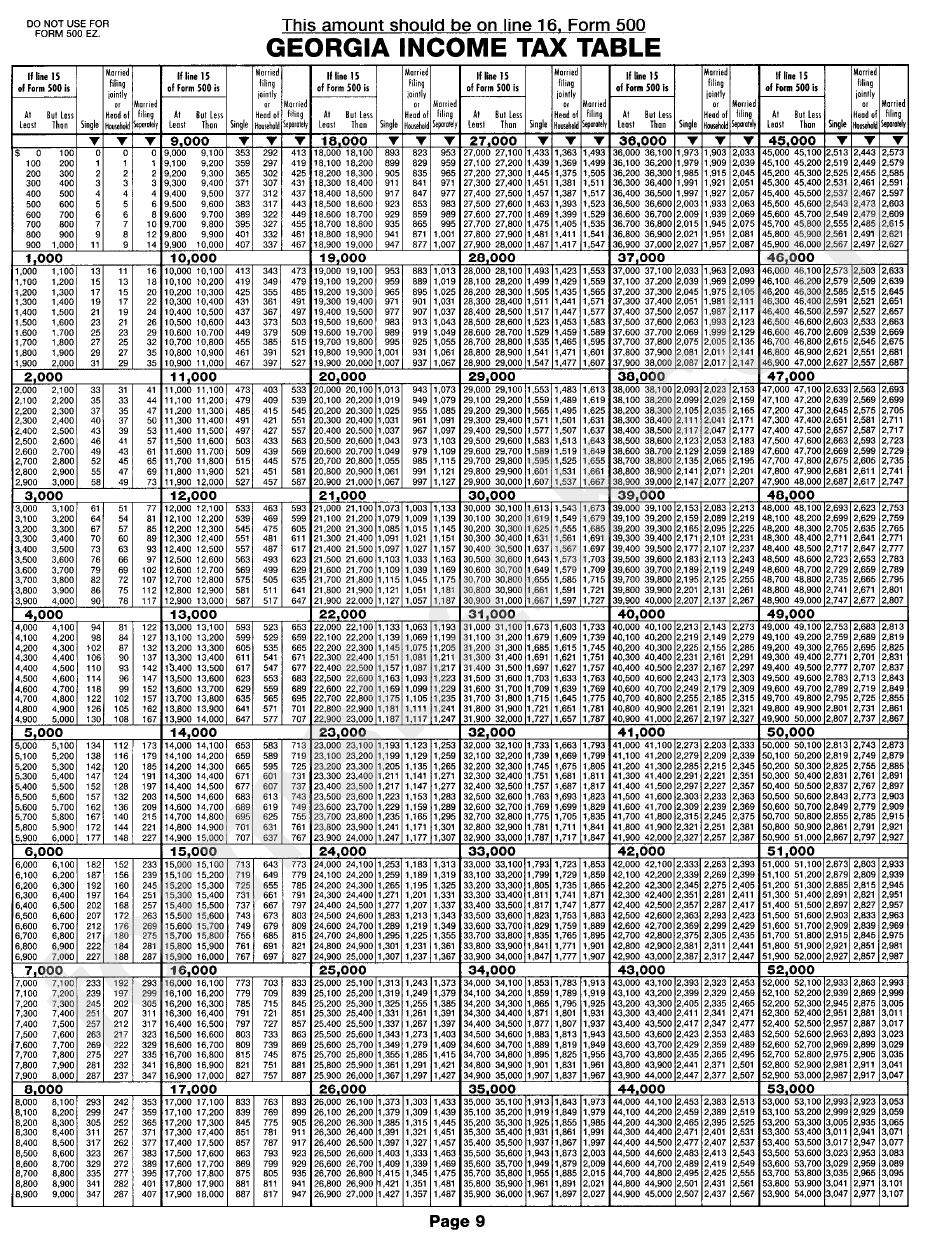

Form 500 Georgia Income Tax Table Printable Pdf Download

Georgia Tax Credits Tim Clancy

/do0bihdskp9dy.cloudfront.net/05-28-2021/t_56c9b132a22647b1a8a2286b425cc6e1_name_t_702f6235588b4853b1da8edb36892fcd_name_file_1280x720_2000_v3_1_.jpg)

Study Examines Georgia Film Tax Credit

Georgia Tax Credit - GA 2024 08 Oct 1 2024 The Internal Revenue Service announced today tax relief for individuals and businesses in the entire state of Georgia that were affected