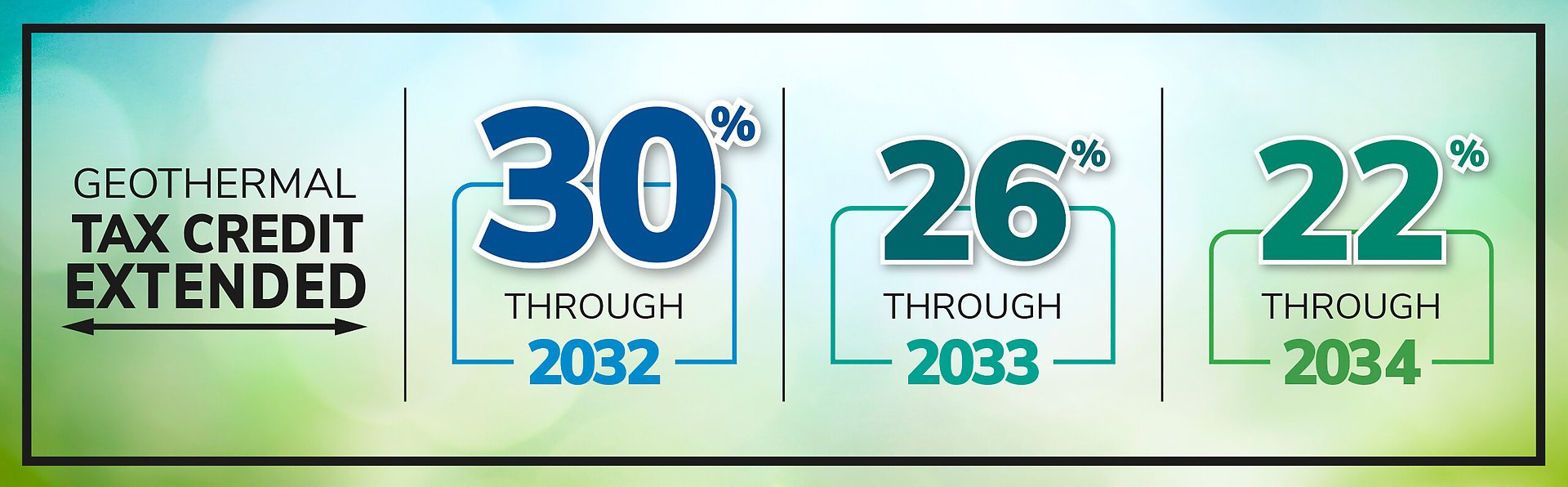

Geothermal Tax Credit 2022 Form Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after

For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property Tax credits and other financial and technical assistance can make installation of new or retrofitted geothermal heat pumps GHPs more achievable Learn where homeowners

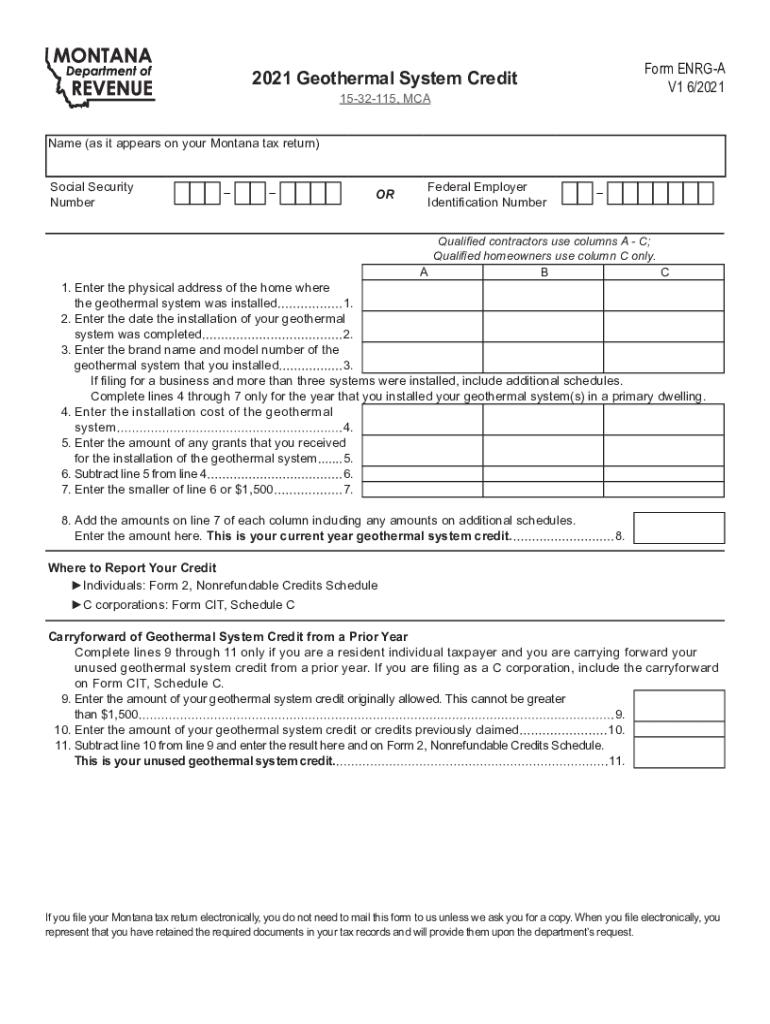

Geothermal Tax Credit 2022 Form

Geothermal Tax Credit 2022 Form

https://geothermal.climatemaster.com/wp-content/uploads/2021/01/2021-geothermal-tax-credits-1536x862.jpg

Federal Energy Saving Incentives Thermal Resource Solutions

https://trs-hvac.com/wp-content/uploads/Geothermal-Tax-Credit-Hero.jpg

Geothermal Tax Credits Are Back

https://static.wixstatic.com/media/245a47_6063b427c5ee4dea89f244fdcfb5da2e~mv2.png/v1/fill/w_1000,h_714,al_c,usm_0.66_1.00_0.01/245a47_6063b427c5ee4dea89f244fdcfb5da2e~mv2.png

Elective payment and credit transfer The Inflation Reduction Act of 2022 allows new ways for ensuring eligible taxpayers receive their credits Elective payment and applicable If you re installing geothermal all you have to do is fill out a form instructions here stating the amount you spent when you file the year s income taxes If the system installation is

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a

Download Geothermal Tax Credit 2022 Form

More picture related to Geothermal Tax Credit 2022 Form

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

https://www.signnow.com/preview/594/860/594860947/large.png

Geothermal Tax Credit Instructions Buffalo Geothermal Heating

https://www.buffalogeothermalheating.com/wp-content/uploads/2018/05/pexels-photo-544117-768x512.jpeg

The Geothermal Tax Credit Is Back

https://www.elderheatingandair.com/wp-content/uploads/2020/03/geothermal-illustration.jpg

The Residential Clean Energy Property Credit is a 30 percent tax credit for certain qualified expenditures made by a taxpayer for residential energy eficient property eligible Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit and there s no limit on the credit amount The tax credit can be used to offset both regular income

Homeowners can now receive 30 on the installation of new geothermal systems with federal tax credits offered because of the Inflation Reduction Act legislation passed in In August 2022 the tax credit for geothermal heat pump installations was extended through 2034 Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets

What Is The 2021 Geothermal Tax Credit ClimateMaster Geothermal HVAC

https://geothermal.climatemaster.com/wp-content/uploads/2021/01/geothermal-tax-credit.jpg

Geothermal Wins With New IRA Tax Credits HVAC Distributors

https://www.climatemaster.com/images/18.4965ec86185e30c7df5eae/1677095040452/x1920p/Infographic-Geothermal-Tax-Credit-Extended.jpg

https://www.energystar.gov/about/federal-tax...

Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after

https://www.irs.gov/instructions/i5695

For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property

How To Apply For The Geothermal Federal Tax Credit

What Is The 2021 Geothermal Tax Credit ClimateMaster Geothermal HVAC

Heat Pump Geothermal Tax Credit PumpRebate

Is A Geothermal Heat Pump Right For You Colorado Country Life Magazine

Geothermal Tax Incentives 2022 Geothermal Heating And Cooling

30 Federal Geothermal Tax Credit

30 Federal Geothermal Tax Credit

Bipartisan Bill Would Reinstate Geothermal Tax Credits 2017 06 15

2022 Form IRS 1040 Schedule 8812 Instructions Fill Online Printable

Agnus Good

Geothermal Tax Credit 2022 Form - Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products