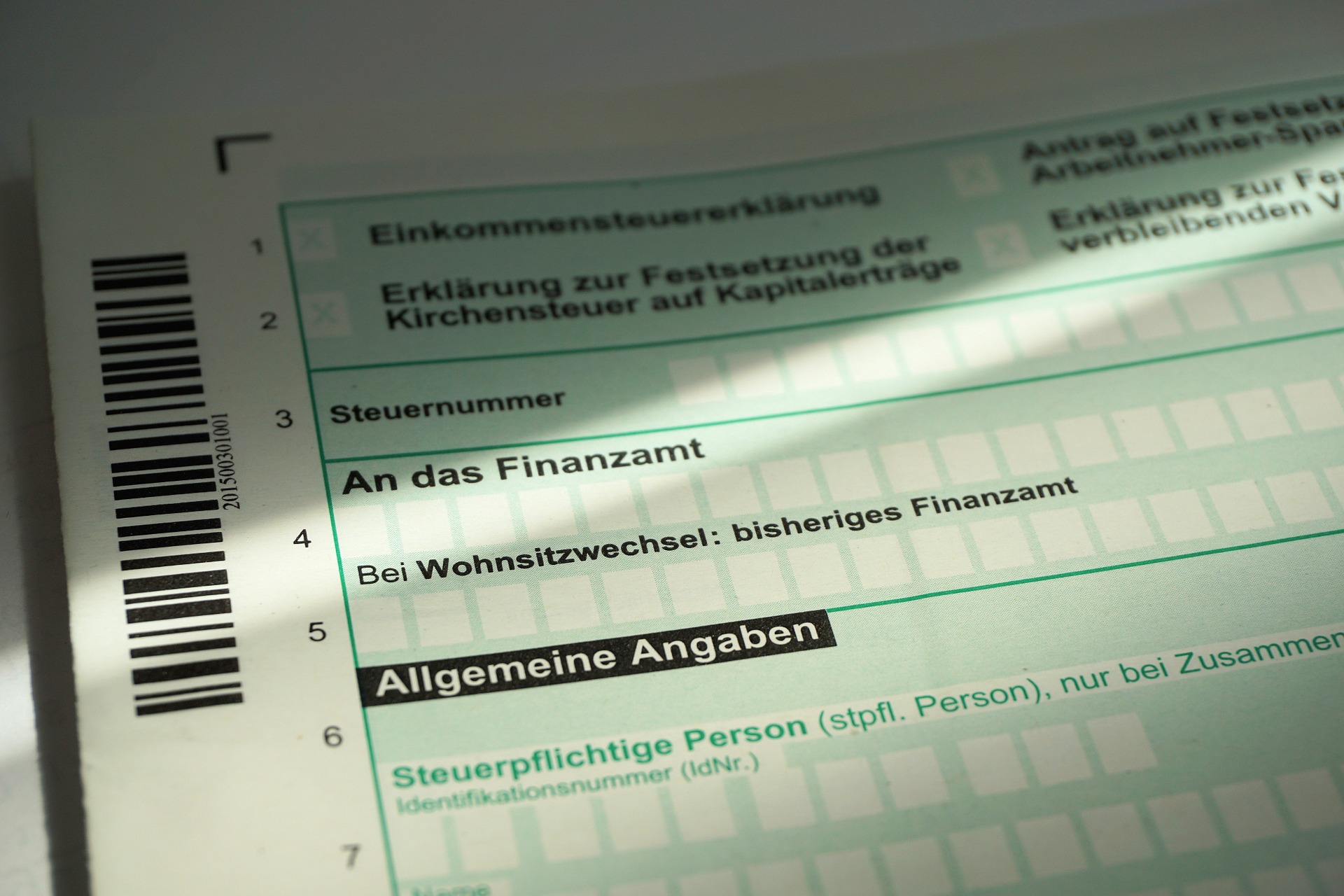

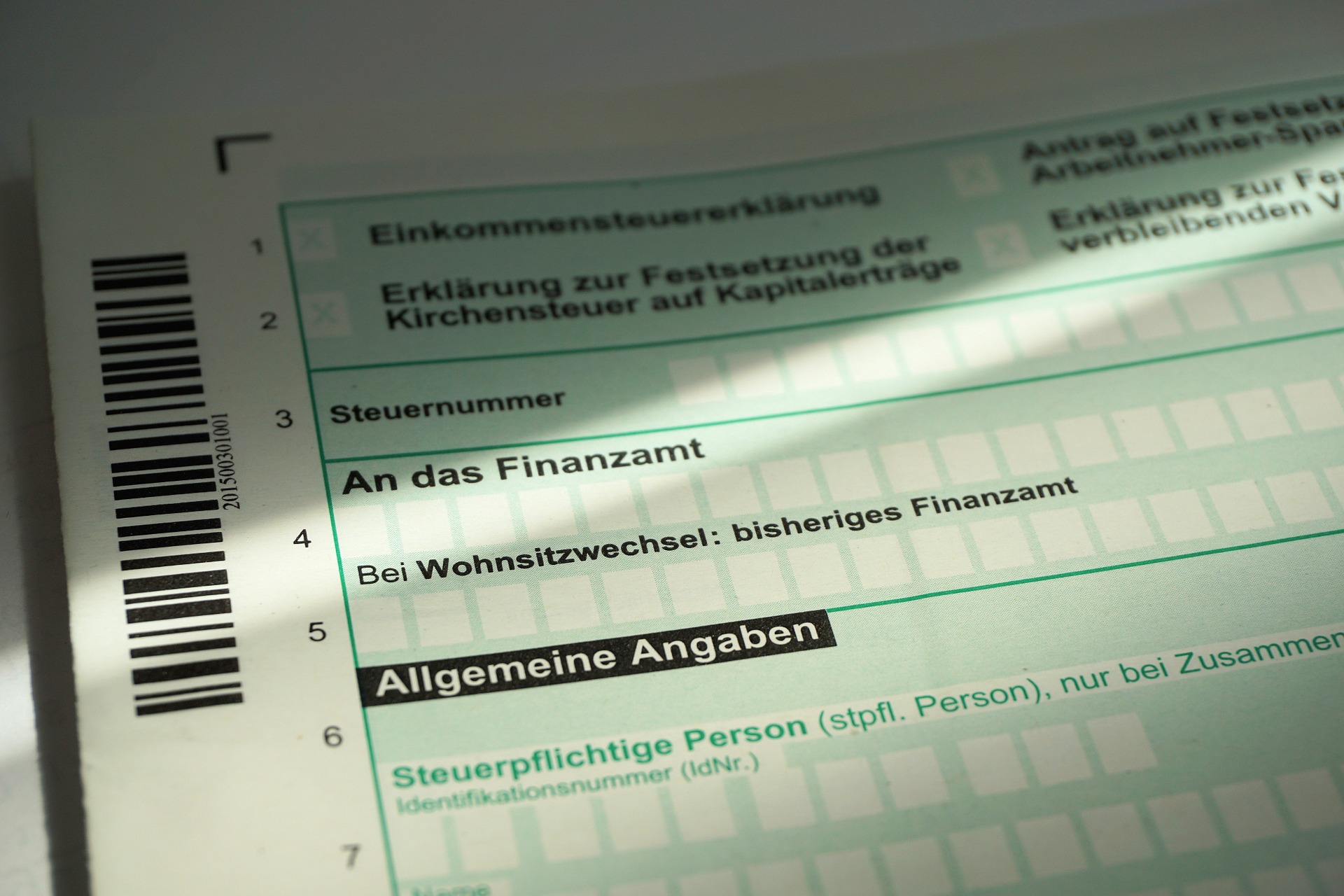

Germany Tax Refund Rate German VAT Refund In Germany the amount paid for merchandise includes 19 value added tax VAT The VAT can be refunded if the merchandise is purchased and exported by a customer whose residence is outside the European Union

Germany will reimburse between 11 4 and 13 6 of the amount you spend during your trip on products subject to standard VAT rates The minimum purchase threshold is 25 EUR On this page by entering the amount you spent you can find out approximately how much of a VAT refund you can get Foreign VAT Refunds Guide from Germany The following information details the requirements needed to be eligible for a VAT refund in Germany These include claimable expense types the Germany VAT rates and deadlines as well as claiming periods Get a Free Assessment Today

Germany Tax Refund Rate

Germany Tax Refund Rate

https://img.money.com/2022/03/News-Check-Your-Tax-Refund-Status.jpg?quality=85

Chart Where Tax Returns Take The Longest In Germany Statista

http://cdn.statcdn.com/Infographic/images/normal/16813.jpeg

Manage Your Tax Refund With Direct Deposit

https://mcguffincpa.com/wp-content/uploads/2016/05/tax-refund.jpg

VAT value added tax must be paid for purchases of goods and services in many countries The input VAT refund procedure offers companies embassies consulates and international organizations the option of being refunded for VAT that they paid outside or Refund calculator After a Tax Free Shopping you can possibly calculate your VAT reimbursement on the refund calculator The refund calculator is updated regularly but it may experience periodic deviations

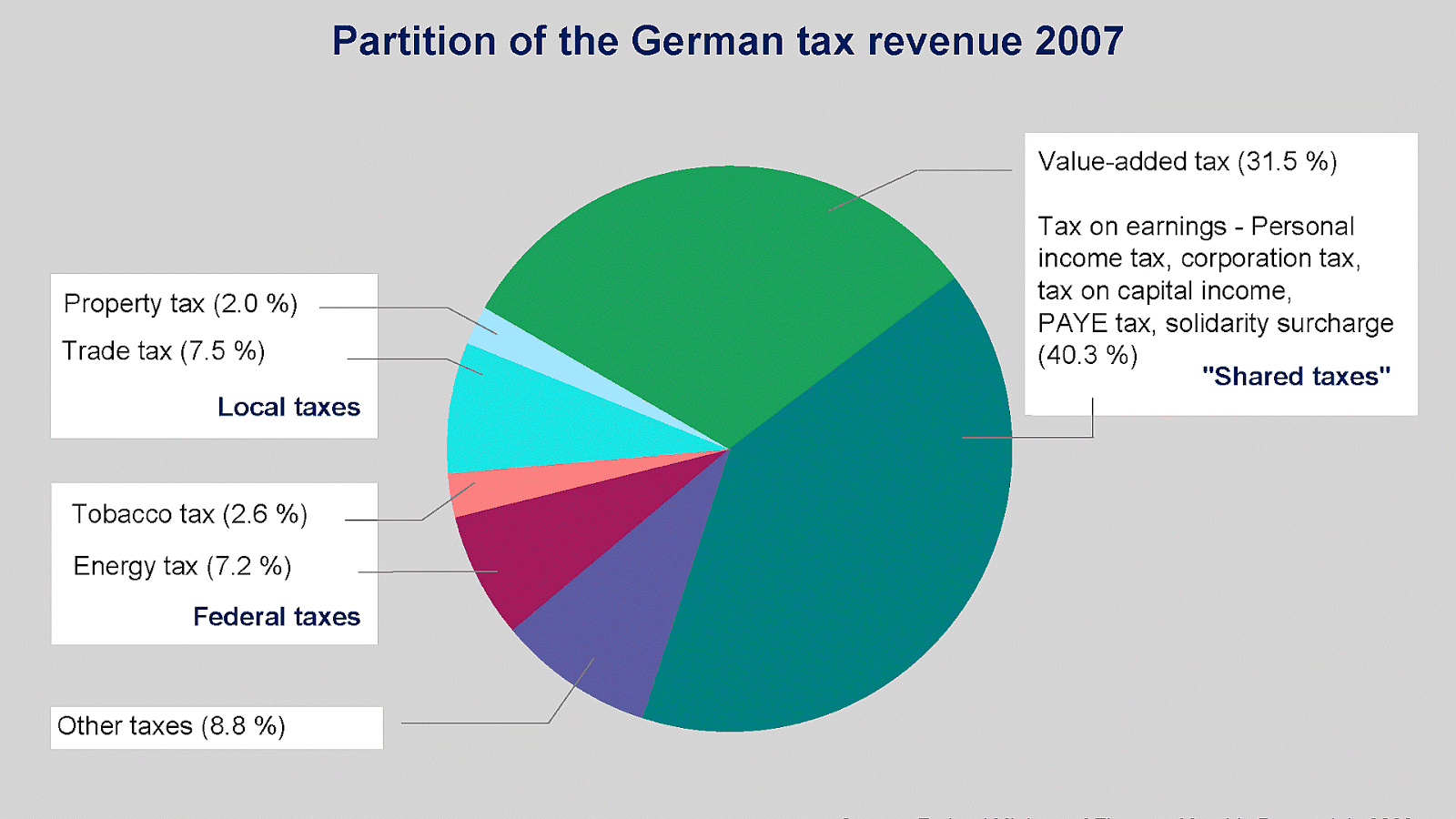

How is my Germany VAT Refund Calculated Your total gross purchase amounts will be summed and rounded down to the nearest 1 00 Euro From this total the total amount of VAT refund will be calculated based on the 19 standard VAT rate in Germany For example 100 euros spent incl 19 VAT 84 00 base price 16 00 VAT paid The German Tax System income in Germany has a progressive rate beginning at 1 percent and gradually increasing to 42 or for wealthy individuals up to 45 Tax rates of 42 are applied to income taxable from EUR 66 761 to 277 825 by

Download Germany Tax Refund Rate

More picture related to Germany Tax Refund Rate

Federal Tax Refund Status Where Is My Federal Tax Refund

https://golookup-live.s3.amazonaws.com/articles/Mip1aDCdp3SHXJtM4fohKs2ckJCPPxV5OzFlsH7Z.jpeg

Taxes Are Due July 15 Experts Say Save 90 Money

https://img.money.com/2020/03/mm_ds_33_income_tax_refund-2.gif

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

If you have paid VAT for a transaction in an EU Member State where you do not reside you may be eligible for a VAT refund in certain circumstances Note This page deals only with refunds for cross border transactions Filing a German tax return can lead to tax refunds when you declare various expenses In this guide you ll learn when it s necessary to file a tax return the potential savings and important considerations during the process Updated on 27 August 2024

[desc-10] [desc-11]

Germany Slashes Tax On Ebooks While UK Lags Behind With High VAT Rate

https://rogerpacker.com/wp-content/uploads/2019/12/Germanymap-1024x684.jpg

Your Tax Refund Is The Key To Homeownership

https://i2.wp.com/files.mykcm.com/2019/03/14094540/20190325-MEM-ENG2.jpeg?ssl=1

https://www.germany.info › us-en › service › vat-refund

German VAT Refund In Germany the amount paid for merchandise includes 19 value added tax VAT The VAT can be refunded if the merchandise is purchased and exported by a customer whose residence is outside the European Union

https://glocalzone.com › vat-refund-calculator › germany

Germany will reimburse between 11 4 and 13 6 of the amount you spend during your trip on products subject to standard VAT rates The minimum purchase threshold is 25 EUR On this page by entering the amount you spent you can find out approximately how much of a VAT refund you can get

Taxation In Germany German Choices

Germany Slashes Tax On Ebooks While UK Lags Behind With High VAT Rate

Average Tax Refund In Every U S State Vivid Maps

Where s My Refund Virginia Tax

Germany Corporate Tax Rate 2024 Take profit

Germany Taxes 2023 Germany Income Tax Germany Tax Rates Germany Economy

Germany Taxes 2023 Germany Income Tax Germany Tax Rates Germany Economy

Work With A Top CPA To Get Your Tax Refund

Germany Sales Tax Rate VAT 2000 2021 Data 2022 2023 Forecast

It s Official Today The IRS Announced The Tax Season 2015 Start Date

Germany Tax Refund Rate - [desc-14]