Germany Tax Return Home Office That s why in the German Annual Tax Act of 2020 Jahressteuergesetz 2020 parliament passed the so called Home Office Lump Sum Homeoffice

But did you know that if you made the switch to the home office you might be entitled to extra benefits on your tax return Taxfix the tax expert led app explains all Plus submit your return by October With the home office lump sum credit you can claim 6 for every day you work from home for a maximum of 210 days for the 2023 tax return meaning up to 1 260 You

Germany Tax Return Home Office

Germany Tax Return Home Office

https://i.ytimg.com/vi/mMOYDRrbuHQ/maxresdefault.jpg

Tax Return In Germany 2023 English Guide My Life In Germany

https://www.mylifeingermany.com/wp-content/uploads/2020/02/featured-image_tax-return-in-germany_guide-for-expats_my-life-in-germany_hkwomanabroad-min.jpg

Taxes In Germany The Only Free Easy Way To File A Tax Return

https://nomadandinlove.com/wp-content/uploads/taxes-in-germany-768x1152.jpg

Since 2020 you can claim your home office in your tax returns even if it doesn t have a dedicated space thanks to the home office lump sum Homeoffice Pauschale This A large proportion of taxpayers in Germany both expats and German citizens choose to submit an annual income tax return Einkommensteuererkl rung to the Federal Central Tax Office By

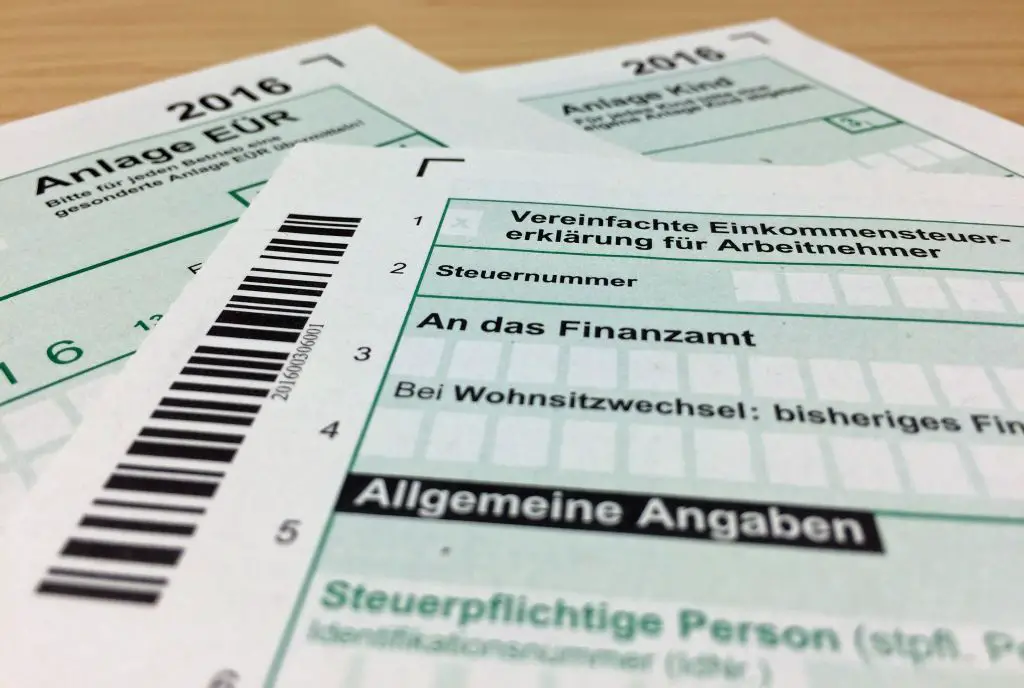

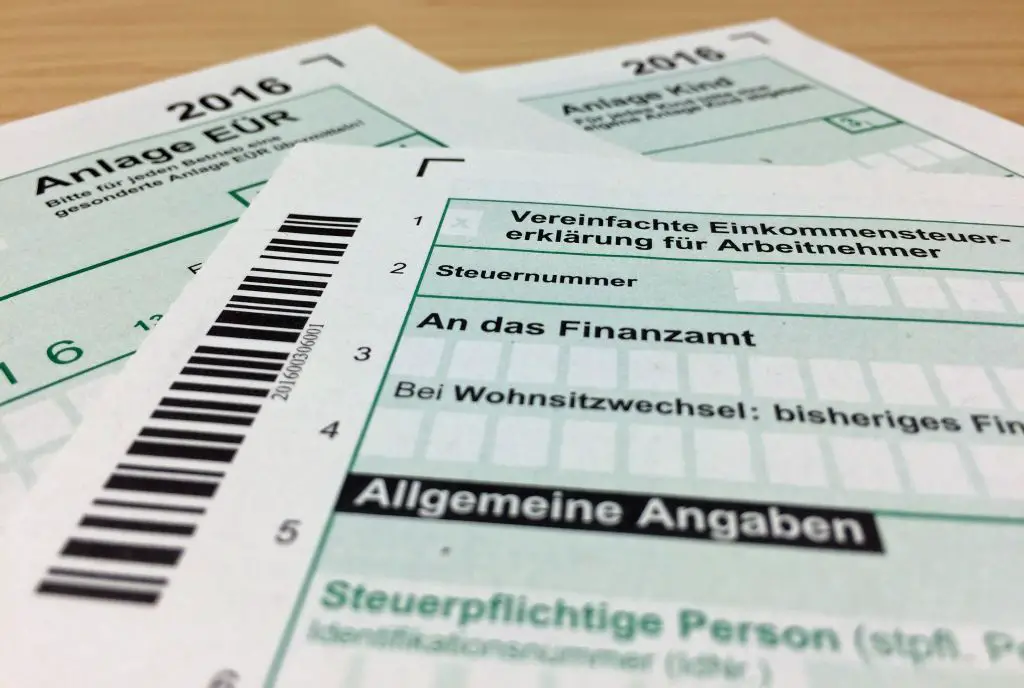

The form of income tax declaration was not changed for home office pauschale for year 2020 So there is no special line for home office It was Home office tax deductions in Germany First things first your home office Generally speaking you can deduct the costs for your home office from tax but you do need to meet some criteria the most

Download Germany Tax Return Home Office

More picture related to Germany Tax Return Home Office

German Tax ID This Is How You Get One Fast How It Works SiB

https://www.settle-in-berlin.com/wp-content/uploads/2022/02/German-tax-ID-steuernummer-meaning.jpg

Tax Calculator Germany NeoTax

https://neotax.eu/images/neotax-carousel/welcome-taxes-in-your-home-country-carousel.jpg

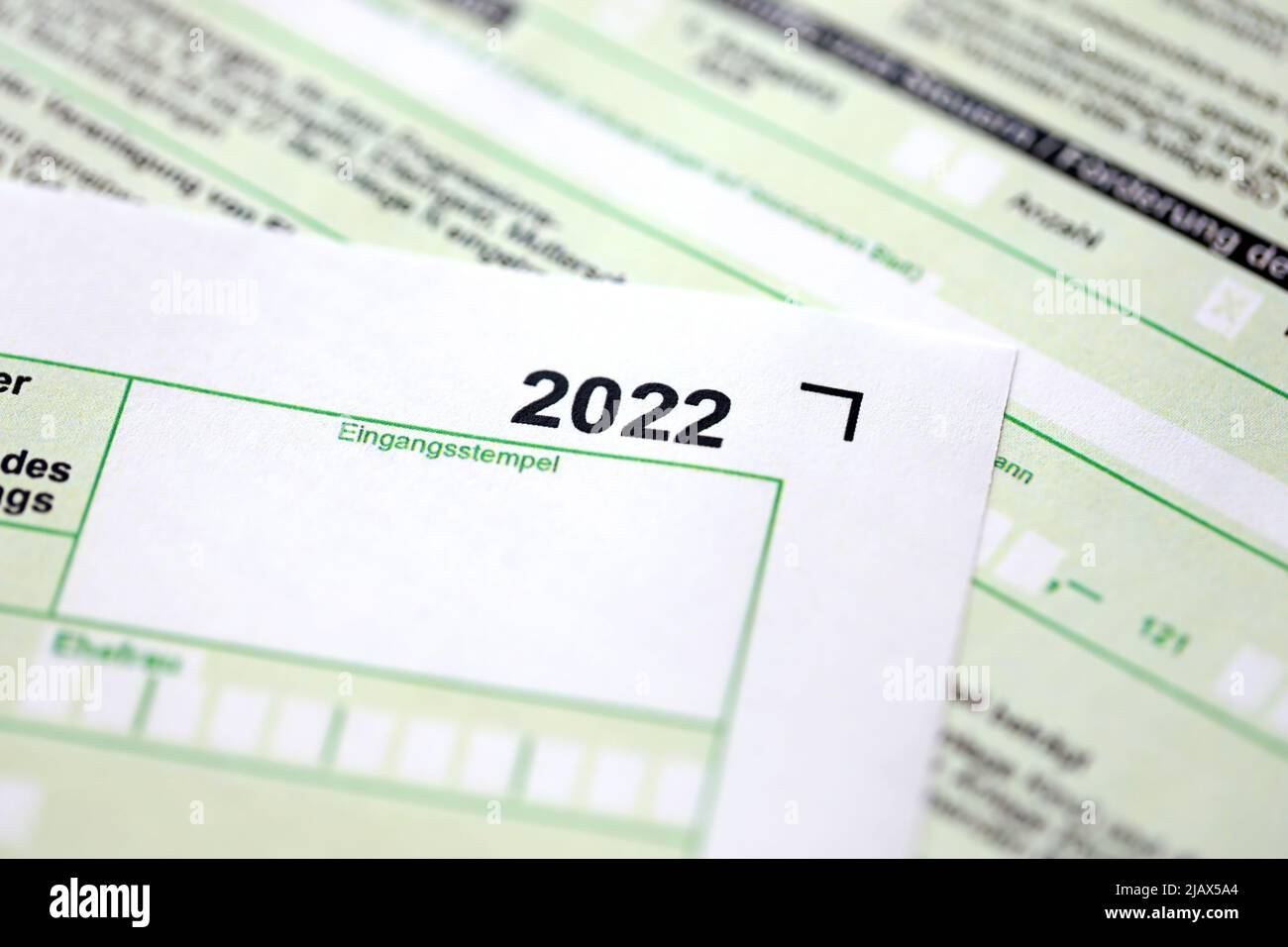

German Annual Income Tax Return Declaration Form For 2022 Year Close Up

https://c8.alamy.com/comp/2JAX5A4/german-annual-income-tax-return-declaration-form-for-2022-year-close-up-the-concept-of-tax-reporting-in-germany-and-europe-2JAX5A4.jpg

The basic rule is that anyone who received more than 410 via the scheme in 2021 is obliged to file an income tax return this year Incidentally this applies to all of According to the Federal Statistical Office there is an average tax refund of 1 095 euros for voluntarily tax returns Secure your tax refund File now When am I

The coalition passed a new home office allowance for salaried employees working from the home office in Germany With this Home Office Lump Sum allowance you can deduct 5 for every day The local tax offices are responsible for all questions relating to income tax This includes among other things filing the tax return determining the tax and its settlement You can

Everything You Need To Know About Claiming Home Office Expenses On Your

https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2022/02/vw0210expenses.jpg

Tax Rates On Income In Germany Expat Tax

https://www.expattax.de/wp-content/uploads/2016/08/pexels-photo-87485.jpg

https://germantaxes.de/tax-tips/home-office-lump-sum

That s why in the German Annual Tax Act of 2020 Jahressteuergesetz 2020 parliament passed the so called Home Office Lump Sum Homeoffice

https://www.iamexpat.de/expat-info/german-e…

But did you know that if you made the switch to the home office you might be entitled to extra benefits on your tax return Taxfix the tax expert led app explains all Plus submit your return by October

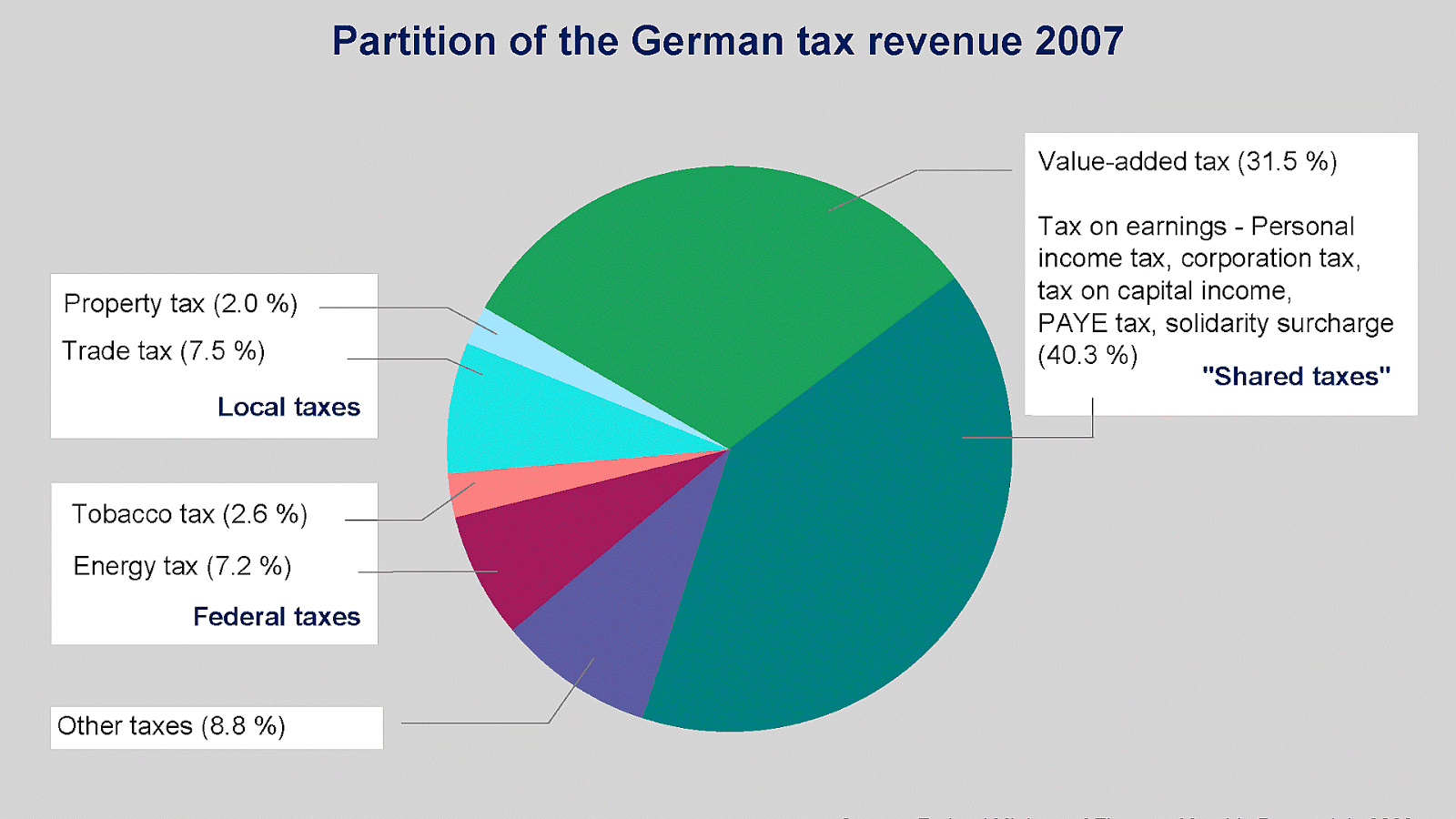

Taxation In Germany German Choices

Everything You Need To Know About Claiming Home Office Expenses On Your

German Annual Income Tax Return Declaration Form With Pen On Flag Close

Work In Germany Versus Tax Return

Tax Return In Germany Submission Preparation

The Ultimate German Tax Return Guide For Expats Johnny Africa

The Ultimate German Tax Return Guide For Expats Johnny Africa

11 Best Tax Return Software In Germany 2023 Suitable For Anyone

Printable Federal 1040 Form Printable Forms Free Online

What You Need To Know Before Moving To The US Quintessential Tax

Germany Tax Return Home Office - Processing time for tax refunds on German income Date 2023 12 01 CESOP The validation module with the corresponding user manual of the European Commission has