Gov Website Tax Relief Working From Home How you claim depends on what you re claiming for Find out if you re eligible to claim tax relief if you work from home on uniforms work clothing and tools for vehicles you use

Tax relief linked to working from home predates the pandemic it was introduced almost 20 years ago However in 2020 the Important information Tax treatment depends on your individual circumstances and may be subject to future change Were you told by your employer to

Gov Website Tax Relief Working From Home

Gov Website Tax Relief Working From Home

https://static.wixstatic.com/media/nsplsh_3618d7aed895435fb6ac1cb913906003~mv2.jpg/v1/fill/w_980,h_854,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/nsplsh_3618d7aed895435fb6ac1cb913906003~mv2.jpg

What To Look For In The Best Tax Relief Services

https://getassist.net/wp-content/uploads/2022/03/tax.jpg

Tax Relief While Working From Home Mathews Comfort Financial Planning

https://mathewscomfort.co.uk/wp-content/uploads/2021/11/tax-relief-home-working-mathews-comfort-large.jpg

A higher or 40 per cent rate taxpayer can get 2 40 worth of tax relief a week if they claim for the 6 a week worth of extra costs incurred by working from home So for the entire 2021 22 From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self

Last October HMRC launched an online portal offering employees a hassle free way to claim the relief worth 6 a week without the need to provide receipts or to Working from home relief rules are much stricter now for 2022 23 tax year While you can still claim for the prior two tax years for this tax year the one that started 6 April 2022 and likely for future tax years HMRC

Download Gov Website Tax Relief Working From Home

More picture related to Gov Website Tax Relief Working From Home

Tax Relief Are You Missing Out On Up To 2 000 A Year Towards The

https://blog.mcgills.co.uk/wp-content/uploads/2022/01/shutterstock_1690362274.jpg

Tax Relief Working From Home Get YourMoneyBack

https://yourmoneyback.ie/wp-content/uploads/2021/08/Taxd-Relief-Working-From-Home.jpg

Tax Relief When Working From Home Re accounts Stevenage

https://re-accounts.co.uk/wp-content/uploads/2020/04/partnership-2750197_1280.jpg

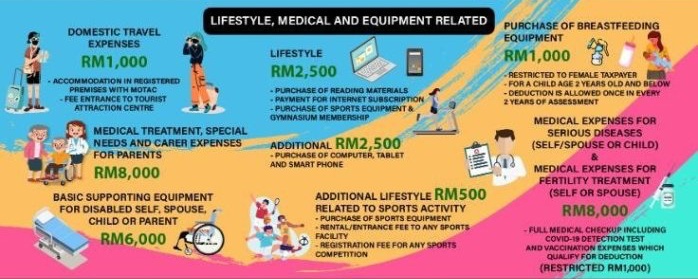

If you re self employed If you work from home rather than from a business premises you can either add work related expenses when you file your 2022 23 tax return or you may be able to claim by using If you work from home for substantial periods either full time or part time you may be able to claim tax relief on the extra costs including Electricity Heating Broadband The cost

This can be paid by your employer but given many are struggling right now they might tell you to claim tax relief on this payment via HM Revenue Customs Higher rate taxpayers those earning 50 000 plus can claim 40 or 2 40 a week If you end up working the whole tax year at home from 6 April 2020 onwards

Tax Relief For Working From Home What You Need To Know Work From

https://wfh.studio/wp-content/uploads/2021/07/tax-relief-wfh.jpeg

Working From Home What Tax Relief Can You Claim Tax Advice For

https://i.ytimg.com/vi/N6jWmqzaA7g/maxresdefault.jpg

https://www.gov.uk/tax-relief-for-employees

How you claim depends on what you re claiming for Find out if you re eligible to claim tax relief if you work from home on uniforms work clothing and tools for vehicles you use

https://www.theguardian.com/business/2022…

Tax relief linked to working from home predates the pandemic it was introduced almost 20 years ago However in 2020 the

Property Tax Relief 5 Ways To Reduce Tax Load In 2022 SuperMoney

Tax Relief For Working From Home What You Need To Know Work From

How To Easily Claim The Working From Home Tax Relief

Working From Home Tax Relief LHP

Tax Preparation Specialist Issues Tax Relief Guidance For Employees Who

Working From Home Tax Relief Warning DH Business Support

Working From Home Tax Relief Warning DH Business Support

Working From Home Tax Relief CRASL Accounting Services

Self Discovery Quotes In The Alchemist

Working From Home Tax Relief UK Claim 140 Back In 5 Mins YouTube

Gov Website Tax Relief Working From Home - A higher or 40 per cent rate taxpayer can get 2 40 worth of tax relief a week if they claim for the 6 a week worth of extra costs incurred by working from home So for the entire 2021 22