Government Child Care Rebate Web Eligibility How to apply What you ll get The amount you ll get depends on your household income the number of children who are dependent on you 2023 to 2024 academic year

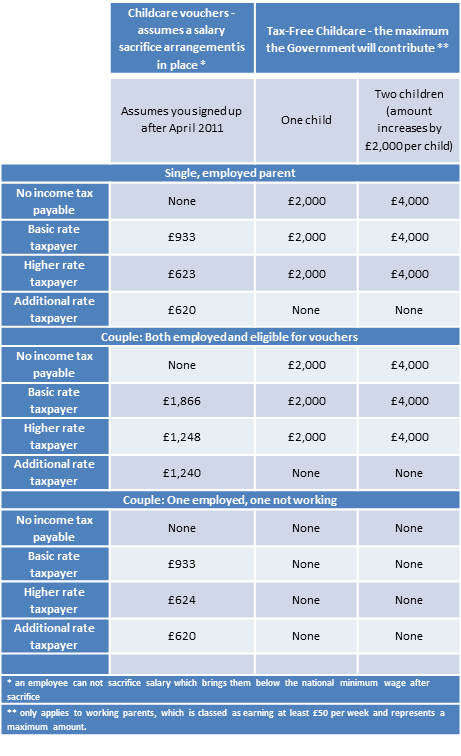

Web Tax credits and childcare If you already claim tax credits you can add an extra amount of Working Tax Credit to help cover the cost of childcare This guide is also available in Web 16 March 2021 Families using their Tax Free Childcare accounts to pay for their childcare costs are benefitting from a government top up worth up to 163 500 every three months

Government Child Care Rebate

Government Child Care Rebate

https://www.mamamia.com.au/wp/wp/wp-content/uploads/gallery/dohs-gallery/ChildCareRebate.jpg

Child Care Subsidy CCS And Rebate Guide Kinder Haven

https://i0.wp.com/www.kinderhaven.com.au/wp-content/uploads/sites/26/2020/09/child-care-subsidy-ccs.jpg?w=1250&ssl=1

How To Keep Receiving Childcare Rebates Under The Government s New System

https://cdn.babyology.com.au/wp-content/uploads/2019/03/childcare-rebate-update.jpg

Web 30 mai 2023 nbsp 0183 32 The government will allow parents on the benefit to claim back 163 951 for childcare costs for one and 163 1 630 for two or more children a 47 increase The policy was announced as part of the 2023 Web 8 mars 2023 nbsp 0183 32 Launched in 2018 this allows working parents to receive up to 500 pounds every three months per child towards the cost of childcare or 1 000 pounds every three months for disabled children

Web 25 nov 2021 nbsp 0183 32 Hundreds of thousands of parents are missing out on help paying for childcare and billions allocated to the government s flagship tax free childcare scheme Web Department for Education Policy paper Early education entitlements and funding update March 2023 Updated 21 July 2023 Applies to England In the government s spring

Download Government Child Care Rebate

More picture related to Government Child Care Rebate

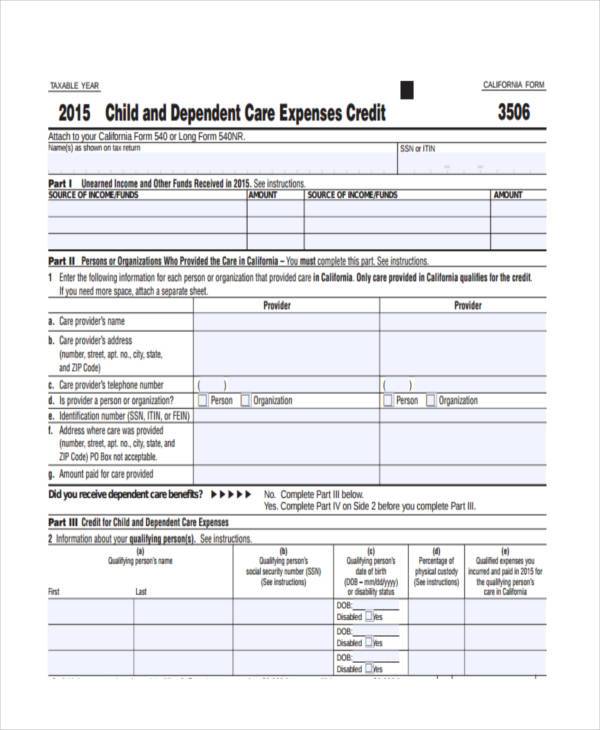

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-care-rebate-application-form-d1.png

FREE 11 Child Care Application Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Child-Care-Rebate-Application-Form.jpg?width=390

Child Care Rebate Application Form Free Download

https://www.formsbirds.com/formimg/child-care-rebate-form/1012/child-care-rebate-application-form-l2.png

Web 11 mars 2023 nbsp 0183 32 At the moment people in England Scotland and Wales who are eligible for the current support pay childcare costs upfront and then claim a refund But the support has also been frozen at 163 646 a Web Eligible parents can get up to 163 2 000 per child per year In total you can use the scheme to help pay for up to 163 10 000 of childcare per child each year giving you an extra 163 2 000 per child or up to 163 4 000 if your child is

Web You may be able to claim back up to 85 of your childcare costs if you re eligible for Universal Credit with up to 163 951 back each month for one child or 163 1 630 for 2 or more Web 24 f 233 vr 2022 nbsp 0183 32 The cap on expenses eligible for the child and dependent care tax credit for 2021 is 8 000 for one child or 16 000 for two or more Be sure you know how the tax

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

New Tax free Childcare Is It The End Of Salary Sacrifice For

https://blogs.mazars.com/letstalktax/files/2015/04/Childcare-table.png

https://www.gov.uk/childcare-grant/what-youll-get

Web Eligibility How to apply What you ll get The amount you ll get depends on your household income the number of children who are dependent on you 2023 to 2024 academic year

https://www.gov.uk/help-with-childcare-costs/tax-credits

Web Tax credits and childcare If you already claim tax credits you can add an extra amount of Working Tax Credit to help cover the cost of childcare This guide is also available in

Doug Ford Child Care Rebate FordRebates

Child Care Rebate Tax Brackets 2023 Carrebate

Ontario Child care Sector Skeptical Rebates Will Start In May CTV News

Ontario Inks Federal Child care Deal Retroactive Rebates To Begin In

Ontario Child care Sector Skeptical Rebates Will Start In May As

Child Care Rebate To Be E

Child Care Rebate To Be E

Child Care Benefit Claim Form Notes Australia Free Download

Ontario Child care Rebates Unlikely To Happen In May Sector Says

FREE 8 Sample Child Care Expense Forms In PDF MS Word

Government Child Care Rebate - Web 10 juil 2023 nbsp 0183 32 Assistance to help you with the cost of child care To get Child Care Subsidy CCS you must care for a child 13 or younger who s not attending secondary school