Government Tax Incentives For Homeowners Verkko 29 elok 2022 nbsp 0183 32 Tax Credits for Homeowners One of the key goals of the Inflation Reduction Act is to help businesses boost clean energy

Verkko 29 kes 228 k 2023 nbsp 0183 32 of tax credits or tax deductions In some cases such tax relief is targeted to low income households or other specific groups For instance New Verkko 30 jouluk 2022 nbsp 0183 32 Savings for Homeowners New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Government Tax Incentives For Homeowners

Government Tax Incentives For Homeowners

https://www.oklahoman.com/gcdn/authoring/2016/04/21/NOKL/ghnewsok-OK-5493853-5ca3f0a0.jpeg?crop=3029,1711,x0,y213&width=3029&height=1711&format=pjpg&auto=webp

Tax Incentives For Historic Preservation YouTube

https://i.ytimg.com/vi/tM2ndckOD6Y/maxresdefault.jpg

Government Incentives To Switching Over To Green

https://www.grcooling.com/wp-content/uploads/shutterstock_1299695593_b6afefa5b7ff71b0917b0f1d4fecfaa5_2000.jpg

Verkko 29 jouluk 2023 nbsp 0183 32 Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit Verkko For 2022 the tax code remains focused on providing incentives for homeowners to make the move to renewable energy sources such as the IRS solar tax credit Note Tax credits for home improvements that

Verkko Incentive Type Tax Credit Incentive Amount 30 of the cost paid by the consumer up to 600 per year How to Access Submit IRS Form 5695 when filing your taxes if you Verkko SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates

Download Government Tax Incentives For Homeowners

More picture related to Government Tax Incentives For Homeowners

The Power Of Government Support 5 Funding Schemes For Indian Startup

https://media.licdn.com/dms/image/D4D12AQGjj3G0hyZS3g/article-cover_image-shrink_720_1280/0/1683229633763?e=2147483647&v=beta&t=YeMgzMvV_8UIGHrWVhZXrpGTIpOhDaAnb9mO3qrBjdI

TAX INCENTIVES SA EMPLOYERS NA TATANGGAP NG K 12 GRADUATES The POST

https://the-post-assets.sgp1.digitaloceanspaces.com/2020/10/TAX-INCENTIVES-K-12.jpg

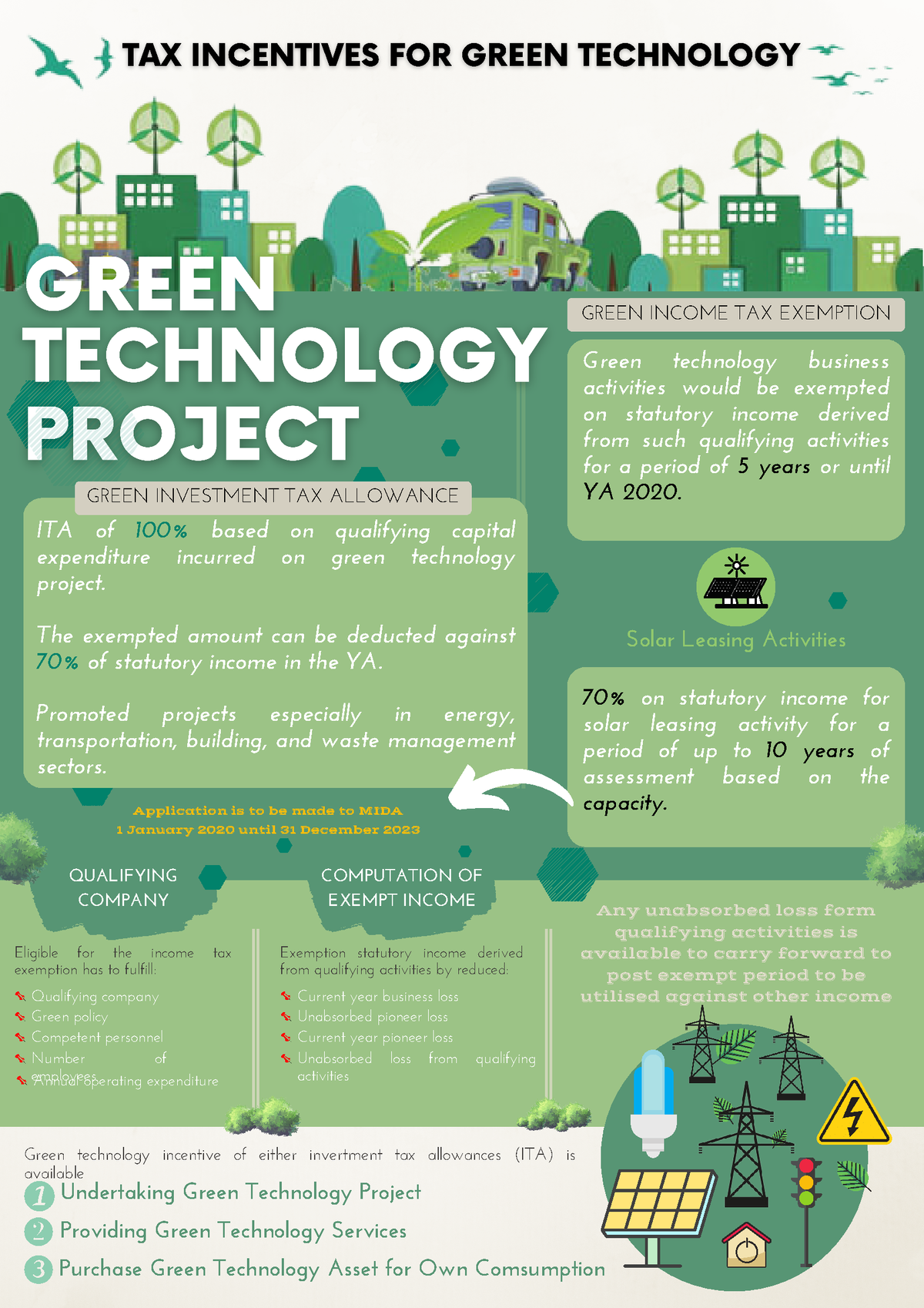

TAX Incentives FOR Green Technology Wan Sharmirizal GREEN INCOME

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6f30e175aad0a59b5d579bd343f10d61/thumb_1200_1698.png

Verkko 4 toukok 2023 nbsp 0183 32 Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the Verkko 23 jouluk 2023 nbsp 0183 32 When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the Verkko The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit

Government Unveils Tax Incentives For Builders Budget 2023 24

https://iqbalgarden.com/wp-content/uploads/2023/06/Government-unveils-tax-incentives-for-builders.jpg

Tax Incentives For Businesses 2021 2022 By North Dakota Office Of State

https://image.isu.pub/220203214451-ca1876b12cbed4f10489137bdf89b562/jpg/page_1.jpg

https://www.investopedia.com/tax-credits-for-…

Verkko 29 elok 2022 nbsp 0183 32 Tax Credits for Homeowners One of the key goals of the Inflation Reduction Act is to help businesses boost clean energy

https://www.oecd.org/els/family/PH2-2-Tax-relief-for-home-…

Verkko 29 kes 228 k 2023 nbsp 0183 32 of tax credits or tax deductions In some cases such tax relief is targeted to low income households or other specific groups For instance New

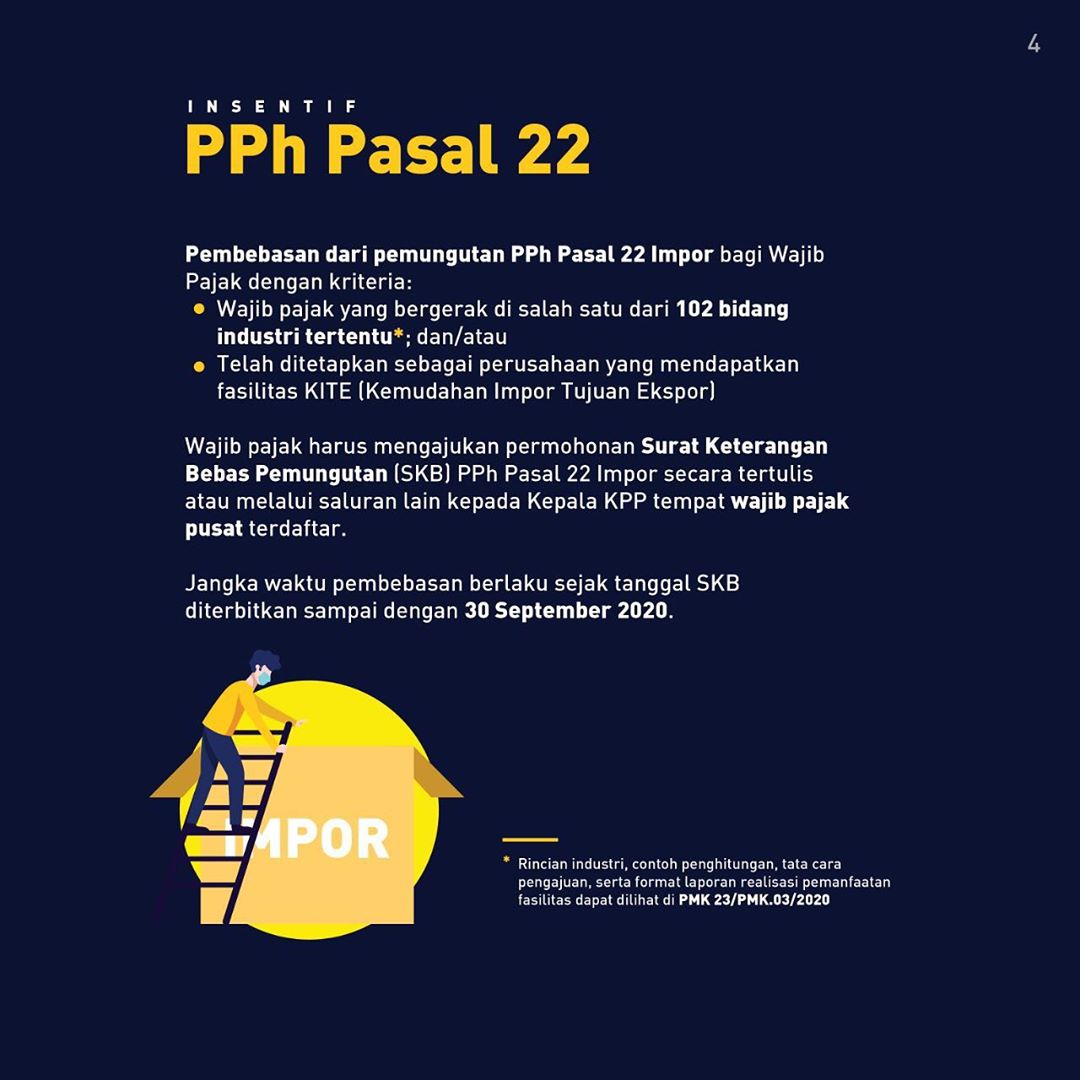

Tax Incentives For Taxpayers Affected By Covid 19 Pandemic GNV

Government Unveils Tax Incentives For Builders Budget 2023 24

Sekretariat Kabinet Republik Indonesia Gov t Provides VAT Income Tax

Tax Incentives For Employers

Government To Keep Tax Incentives For SMEs For Three More Years

PDF The Effectiveness Of Implementing Tax Incentives For Sales Tax On

PDF The Effectiveness Of Implementing Tax Incentives For Sales Tax On

Importance Of Tax Incentives For Prompting R D Activity Download Table

Tax Incentives For Free Legal Assistance PDF Lawyer Practice Of Law

Do Tax Incentives For Big Business Really Spur The Economy The Lars

Government Tax Incentives For Homeowners - Verkko Consumers can find financial incentives and assistance for energy efficient and renewable energy products and improvements in the form of rebates tax credits or