Government Tax Relief Fuel Verkko You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel If your employer

Verkko 22 kes 228 k 2022 nbsp 0183 32 Right now the federal government charges an 18 cent tax per gallon of gasoline and a 24 cent tax per gallon of diesel Those taxes fund critical highways and public transportation through Verkko Fuel Tax Credits Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit Second generation biofuel producer credit

Government Tax Relief Fuel

Government Tax Relief Fuel

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

Government To Provide Two New Tax Reliefs To Encourage Employee

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/13242/s960_hands960.png

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

Verkko 24 toukok 2023 nbsp 0183 32 Fuel Duty Use the online service or print and post form HO81 to submit your monthly claim for Fuel Duty Relief Verkko 2 huhtik 2021 nbsp 0183 32 Fossil fuel companies have received billions of dollars in tax benefits from the US government as part of coronavirus relief measures only to lay off tens of thousands of their workers

Verkko 25 marrask 2021 nbsp 0183 32 Ring fence oil and gas corporate income tax reliefs subsidise fossil fuel companies allowing them to deduct costs of decommissioning old infrastructure as well as capital expenditure on new plant and machinery from their taxable profits which reduces their taxes and may lead to tax refunds Verkko 15 jouluk 2023 nbsp 0183 32 Treasury IRS issue guidance on Sustainable Aviation Fuel Credit IR 2023 240 Dec 15 2023 WASHINGTON The Treasury Department and Internal Revenue Service today issued Notice 2024 06 PDF for the new Sustainable Aviation Fuel SAF credit created by the Inflation Reduction Act of 2022

Download Government Tax Relief Fuel

More picture related to Government Tax Relief Fuel

Tax Relief Wanted To Compete In Green Economy The Grower

https://thegrower.org/sites/default/files/styles/medium/public/2023-03/e tax relief Cdn flag grapes[62] copy.jpeg?itok=KZHpXTR-

What Is The SEIS Tax Relief Scheme Exporaise

https://exporaise.com/wp-content/uploads/2022/11/Tax.jpg

The Property Tax Credit Provides Relief But You Must Apply For It

https://kubrick.htvapps.com/htv-prod-media.s3.amazonaws.com/images/property-tax-credit-00-00-17-03-still001-1649459092.jpg?crop=1.00xw:1.00xh;0,0&resize=1200:*

Verkko 22 jouluk 2023 nbsp 0183 32 WASHINGTON AP The Biden administration released its highly anticipated proposal for doling out billions of dollars in tax credits to hydrogen producers Friday in a massive effort to build out an industry that some hope can be a cleaner alternative to fossil fueled power The U S credit is the most generous in the world for Verkko 22 jouluk 2023 nbsp 0183 32 Billions of dollars in hydrogen industry subsidies from President Joe Biden s signature climate law will come with stringent environmental safeguards raising concerns that strict rules will

Verkko 19 jouluk 2023 nbsp 0183 32 The move to push ahead with the fuel tax reintroduction has garnered some pushback from Albertans including Alberta s NDP which slammed the reintroduction of the policy saying the move is a clear indication of the government s misplaced priorities The Province says the fuel tax helps fund programs and Verkko 22 jouluk 2023 nbsp 0183 32 WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released proposed regulations on the Clean Hydrogen Production Credit established by the Inflation Reduction Act IRA part of President Biden s Investing in America agenda and a key pillar of Bidenomics which is creating

Balanced Measured Approach Needed For Tax Relief Texas School Coalition

https://www.txsc.org/wp-content/uploads/2022/05/Property-Tax-Relief.png

Tax Benefits Of Flexible Spending Accounts Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2023/06/23-optima-tax-benefits-FSA.png

https://www.gov.uk/tax-relief-for-employees/vehicles-you-use-for-work

Verkko You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel If your employer

https://www.whitehouse.gov/briefing-room/statements-releases/2022/06/...

Verkko 22 kes 228 k 2022 nbsp 0183 32 Right now the federal government charges an 18 cent tax per gallon of gasoline and a 24 cent tax per gallon of diesel Those taxes fund critical highways and public transportation through

Tax Tip How To Know If You Qualify For A Tax Relief Program Tax Help

Balanced Measured Approach Needed For Tax Relief Texas School Coalition

Is Your Company Missing Out On Tax Relief For Goodwill Tax Tips

Autofile News Fuel Tax Relief Extended

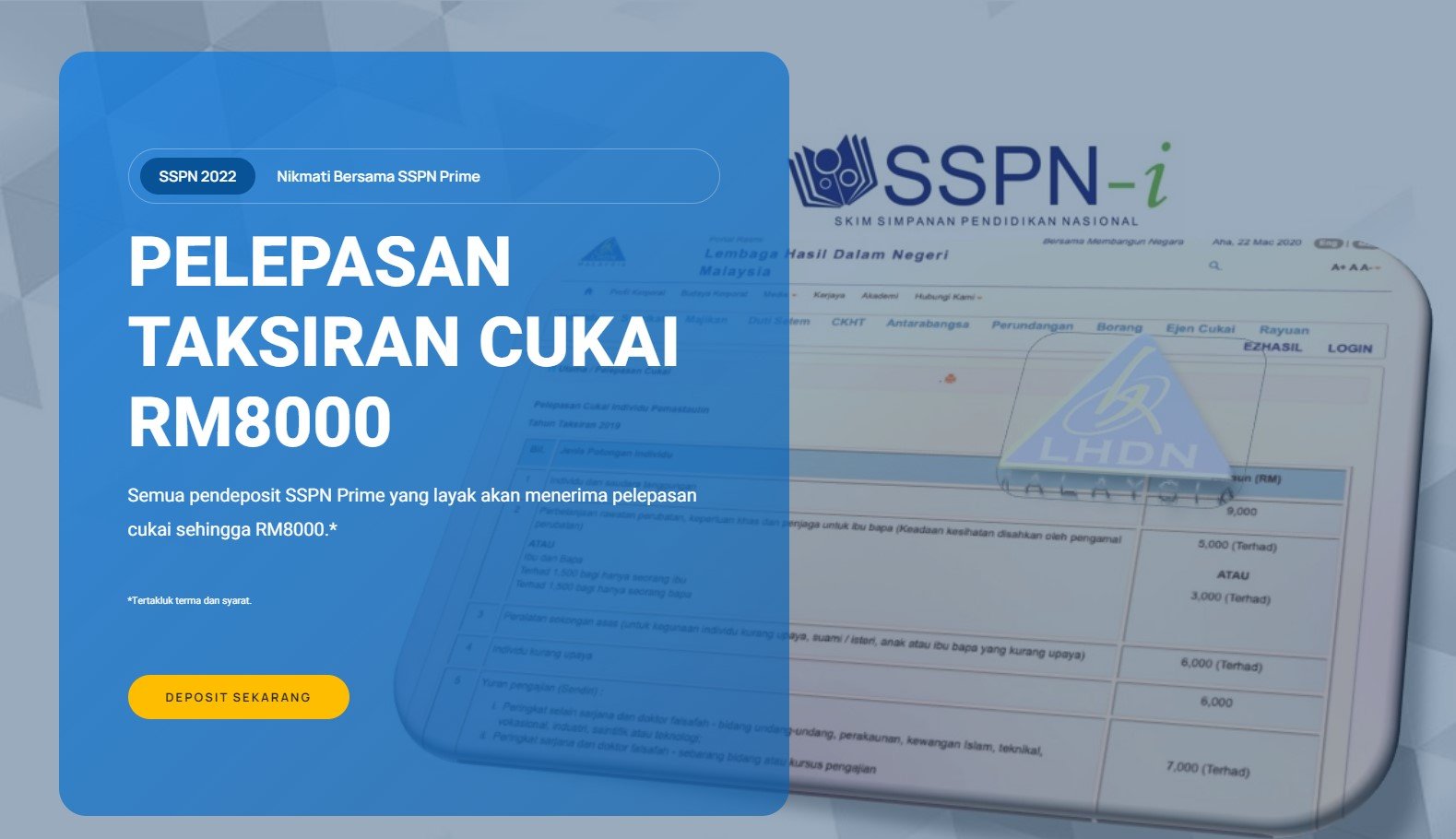

No More Tax Relief For SSPN Deposits From This Year Onwards

Reimagining Fundraising Generic Submission Automating Tax Benefits

Reimagining Fundraising Generic Submission Automating Tax Benefits

Benchmark Your Claim Against Other Sectors R D Tax Relief How Does

Tax Relief Why We Should Lobby For Lower Taxesnqfgv pdf pdf DocDroid

Freelance Accounting Personal Tax Services

Government Tax Relief Fuel - Verkko The Renewable Energy Sources Act levy EEG levy is currently set at 3 72 cent per kilowatt hour It will be abolished from 1 July 2022 The Federal Government has brought forward the planned