Gst Due Dates 2024 If a due date falls on a weekend or public holiday we can receive your return and payment on the next working day without a penalty being applied

Our comprehensive guide to GST due dates covers all balance dates and includes FAQs for SMEs expert tips for smooth GST management and must know considerations If a due date falls on a weekend or public holiday you can file or pay on the next business day without incurring penalties All payment and return filing due dates shown are for people and organisations with a March balance date Due dates for payday filing are not shown on this calendar as they vary For more

Gst Due Dates 2024

Gst Due Dates 2024

https://enterslice.com/learning/wp-content/uploads/2017/06/GST-Returns-enterslice.png

GST Return Due Dates How To File And Revised Return GST Guntur

https://gstguntur.com/wp-content/uploads/2021/04/GST-Return-Due-Date.png

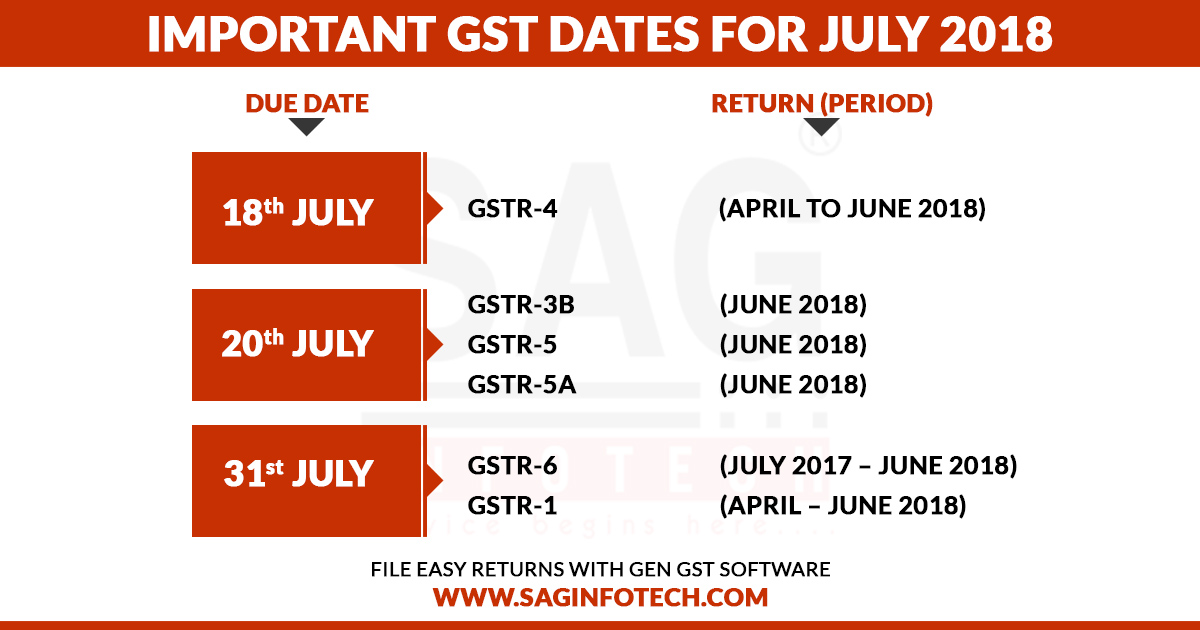

Current GST Return Due Dates For GSTR 1 GSTR 3B GSTR 4 To 9 SAG Infotech

https://blog.saginfotech.com/wp-content/uploads/2017/03/important-gst-dates-for.jpg

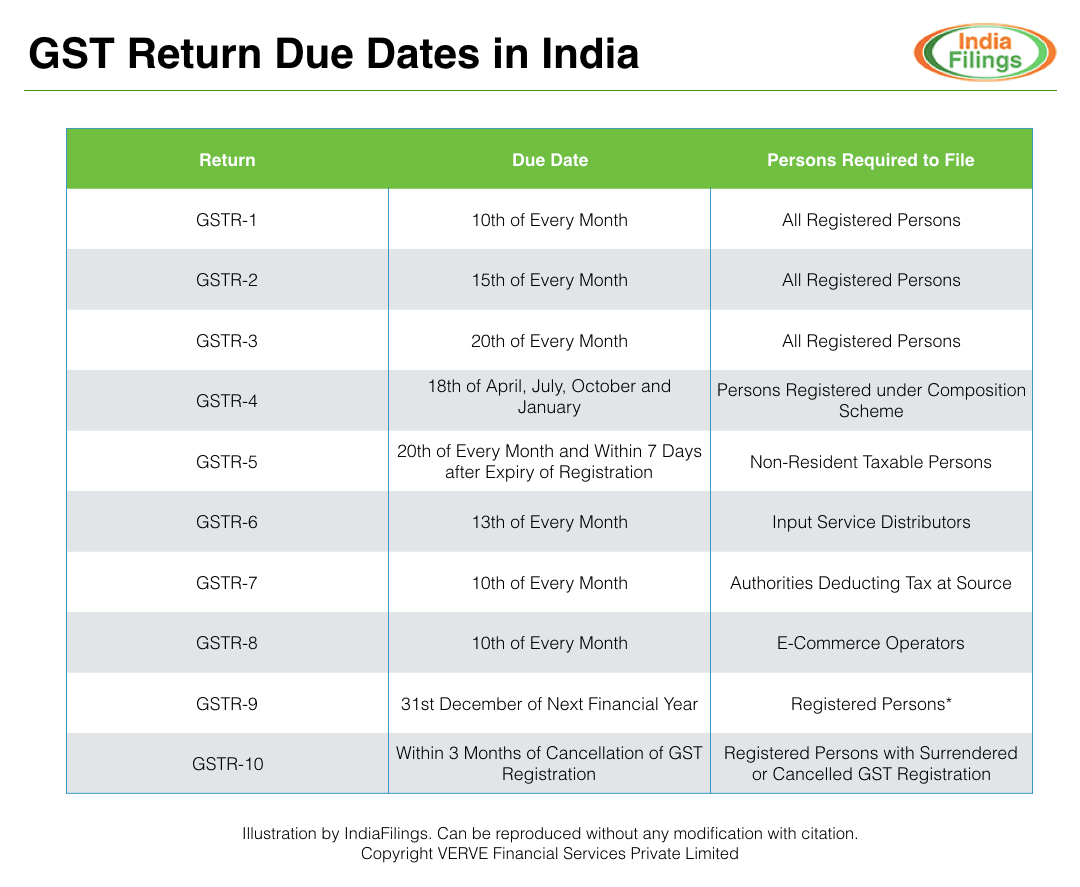

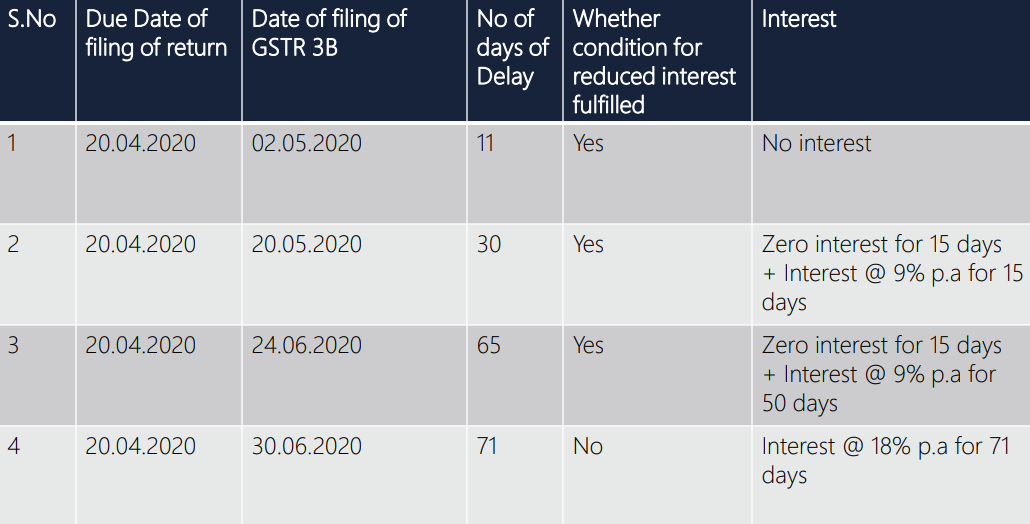

The due date to lodge and pay your monthly BAS is the 21st day of the month following the end of the taxable period For example a July monthly BAS is due on 21 August If your GST turnover is 20 million or more you must report The due date for GSTR 1 for March 2024 stands extended up to 12th April 2024 Note Taxpayers cannot file GSTR 1 beyond three years from the relevant due date of such GSTR 1 for a tax period as per amendment to Section 37 of the CGST Act

The due date to file GSTR 4 for the FY 2023 24 the annual return by composition taxpayers is 30th April 2024 However for the financial year 2024 25 the due date is 30th June 2025 The due date will be revised for Due dates for filing a GST HST return The due date of your return is determined by your reporting period The personalized GST HST return Form GST34 2 will show your due date at the top of the form

Download Gst Due Dates 2024

More picture related to Gst Due Dates 2024

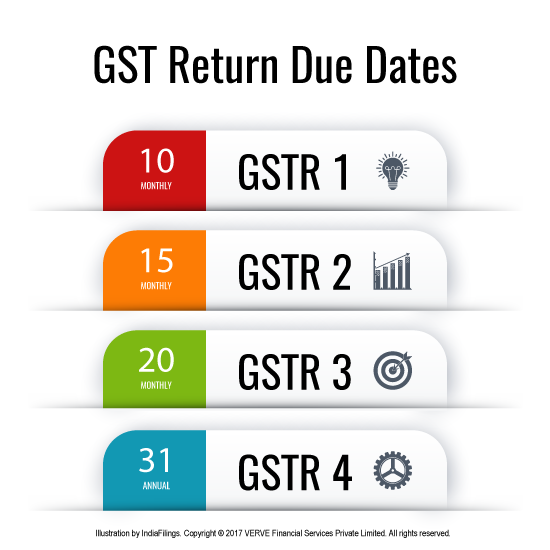

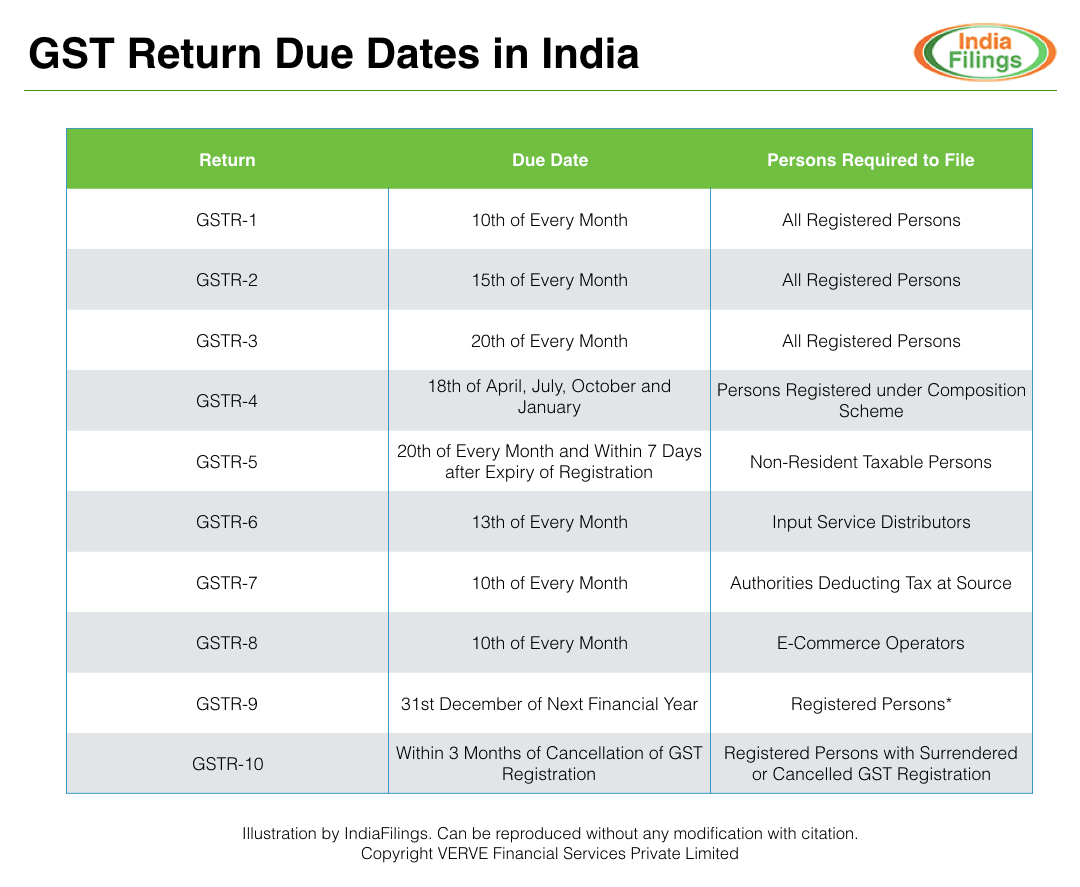

GST Return Due Date IndiaFilings Learning Center

https://www.indiafilings.com/learn/wp-content/uploads/2017/06/GST-Monthly-Due-Dates.png

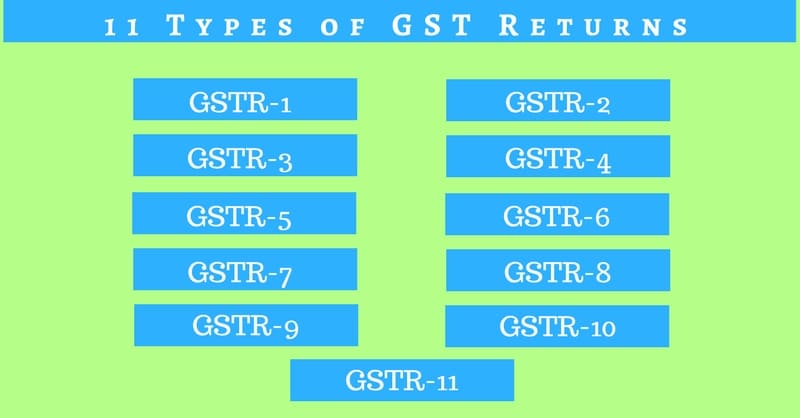

Types Of GST Returns And Their Due Dates ExcelDataPro

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/07/Types-of-GST-Returns.jpg

GST Return Due Dates How To File And Revised Return GST Guntur

https://gstguntur.com/wp-content/uploads/2021/04/GST-Return-1024x576.png

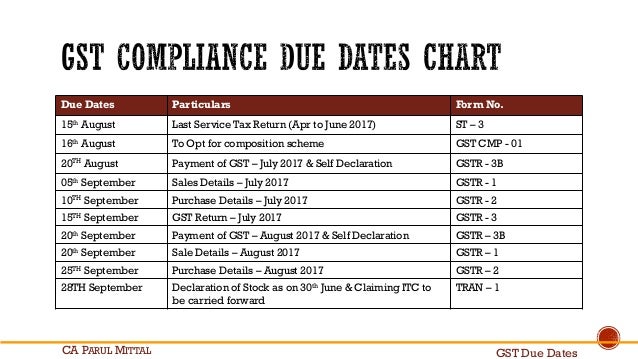

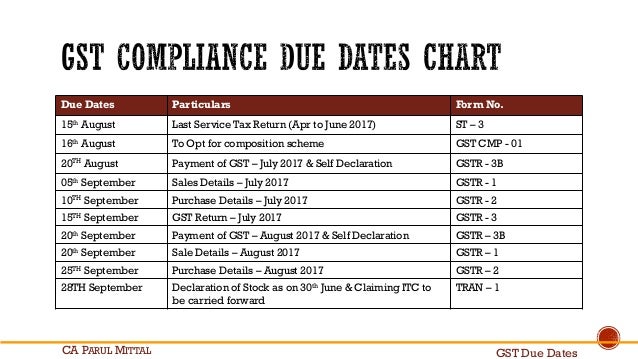

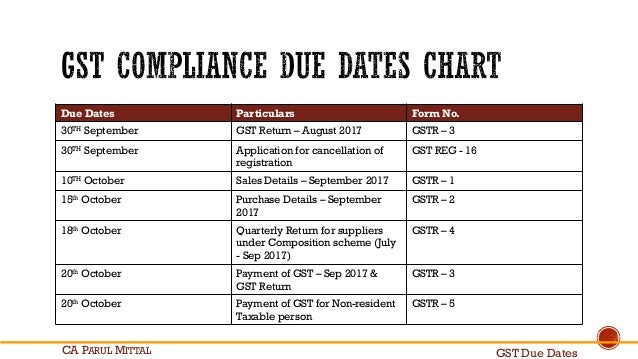

Key lodgment and payment dates for business GST annual returns and instalments 28 July GST instalments Quarter 4 April June instalment notices forms S and T Final date for payment and if varying the instalment amount lodgment 21 August Final date for eligible monthly GST reporters to elect to report GST annually 28 October The GST Compliance Calendar for the financial year 2024 25 outlines essential due dates and responsibilities under the GST Law for various taxpayer categories and compliance types

[desc-10] [desc-11]

GST Return Filing Due Dates IndiaFilings Learning Centre

https://www.indiafilings.com/learn/wp-content/uploads/2017/06/GST-Return-Filing-Due-Dates.png

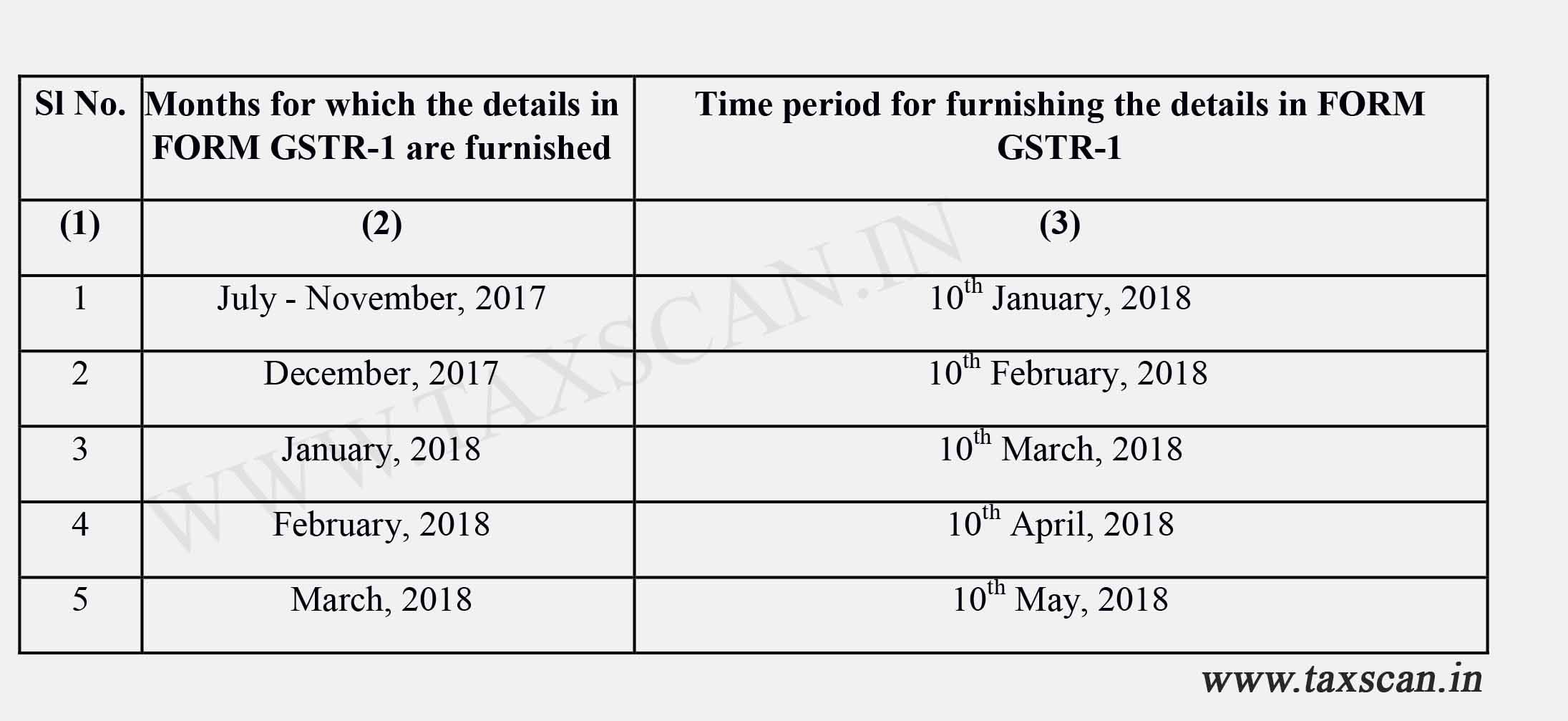

Govt Notifies Due Dates For Filing GST Returns Read Notifications

https://www.taxscan.in/wp-content/uploads/2017/12/2-GSTR-1.jpg

https://www.ird.govt.nz/index/key-dates

If a due date falls on a weekend or public holiday we can receive your return and payment on the next working day without a penalty being applied

https://www.moneyhub.co.nz/gst-due-dates.html

Our comprehensive guide to GST due dates covers all balance dates and includes FAQs for SMEs expert tips for smooth GST management and must know considerations

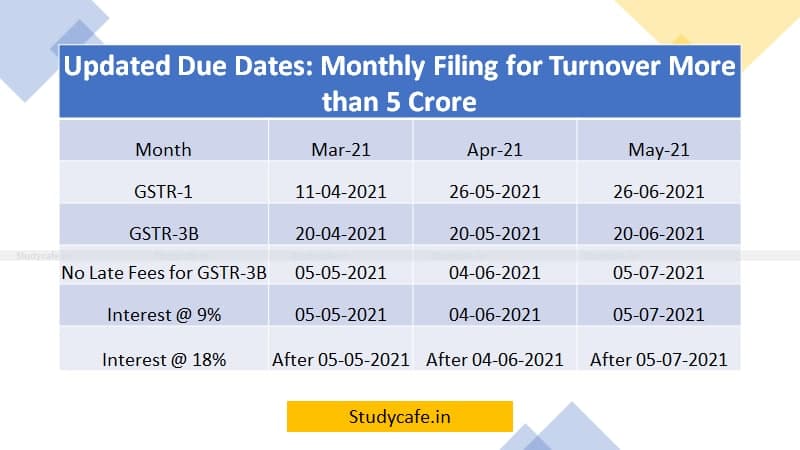

Updated GST Return Due Dates As Announced In GST Council Meeting

GST Return Filing Due Dates IndiaFilings Learning Centre

GST Returns And Due Dates GST Service And Support Bangalore

GSTR 9 Meaning Due Date And Details In GST Annual Return

GST Due Dates And Other Changes

Gst Due Dates

Gst Due Dates

Gst Due Dates

GST Return And Its Applicable Due Dates

GST Returns New Due Dates YouTube

Gst Due Dates 2024 - [desc-14]