Gst Input Tax Credit Form As a GST HST registrant you recover the GST HST paid or payable on your purchases and expenses related to your commercial activities by claiming input tax credits

GST registration allows businesses to claim Input Tax Credit ITC on goods purchased only after registration Form GST ITC 01 must be filed for ITC claim Cut off dates The simplified method for claiming ITCs is another way for eligible registrants to calculate their ITCs when filling out their GST HST return using the regular method of filing You do not have

Gst Input Tax Credit Form

Gst Input Tax Credit Form

https://www.taxmann.com/post/wp-content/uploads/2023/02/Understanding-GST-Input-Tax-Credit-_Feb23.jpg

Input Tax Credit Under Goods And Services Tax Act RJA

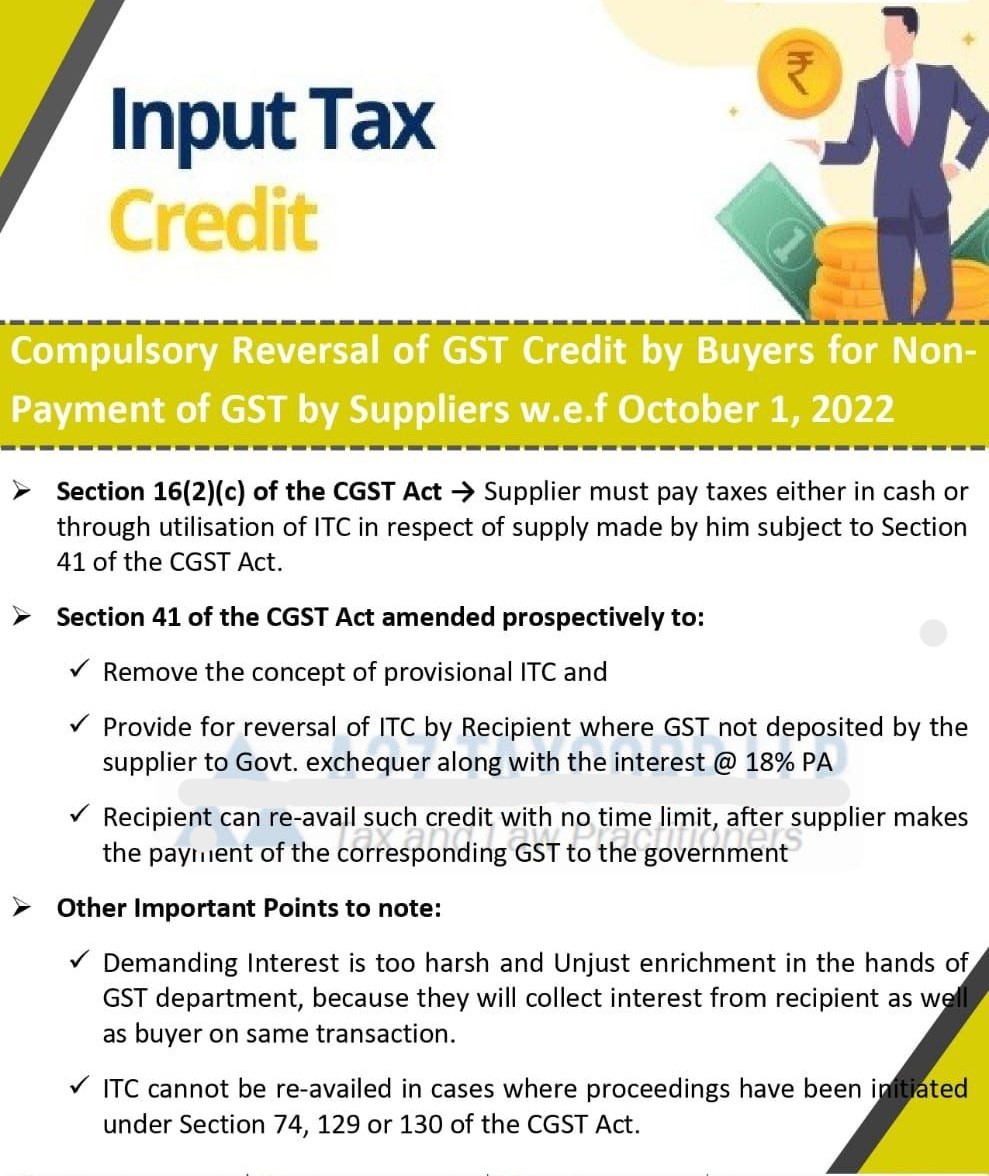

https://carajput.com/blog/wp-content/uploads/2021/09/Compulsory-Reversal-of-GST-Credit-by-Buyers-for-Non-Payment-.jpg

Input Tax Credit On Capital Goods Under GST InstaFiling

https://instafiling.com/wp-content/uploads/2022/11/Your-paragraph-text-21-1080x675.jpg

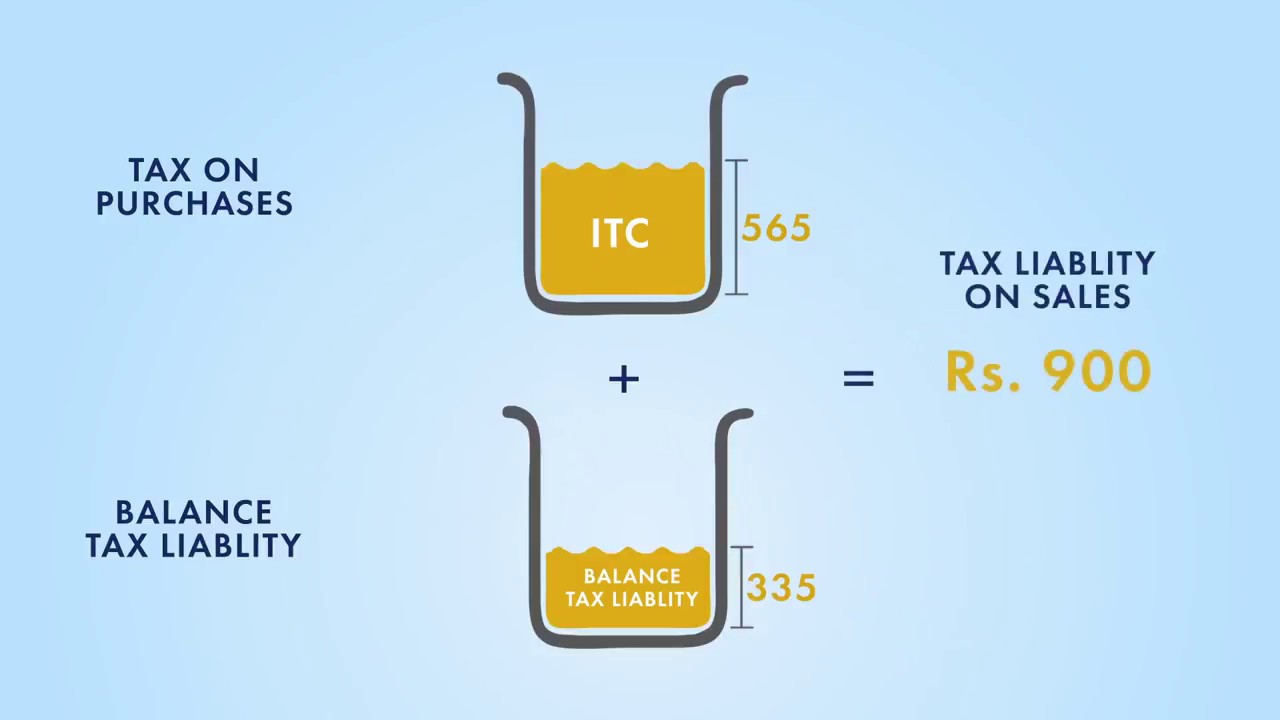

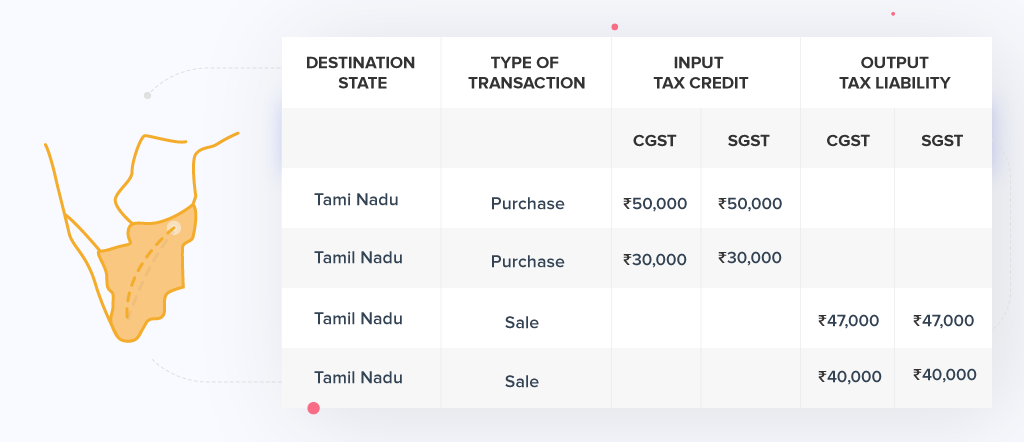

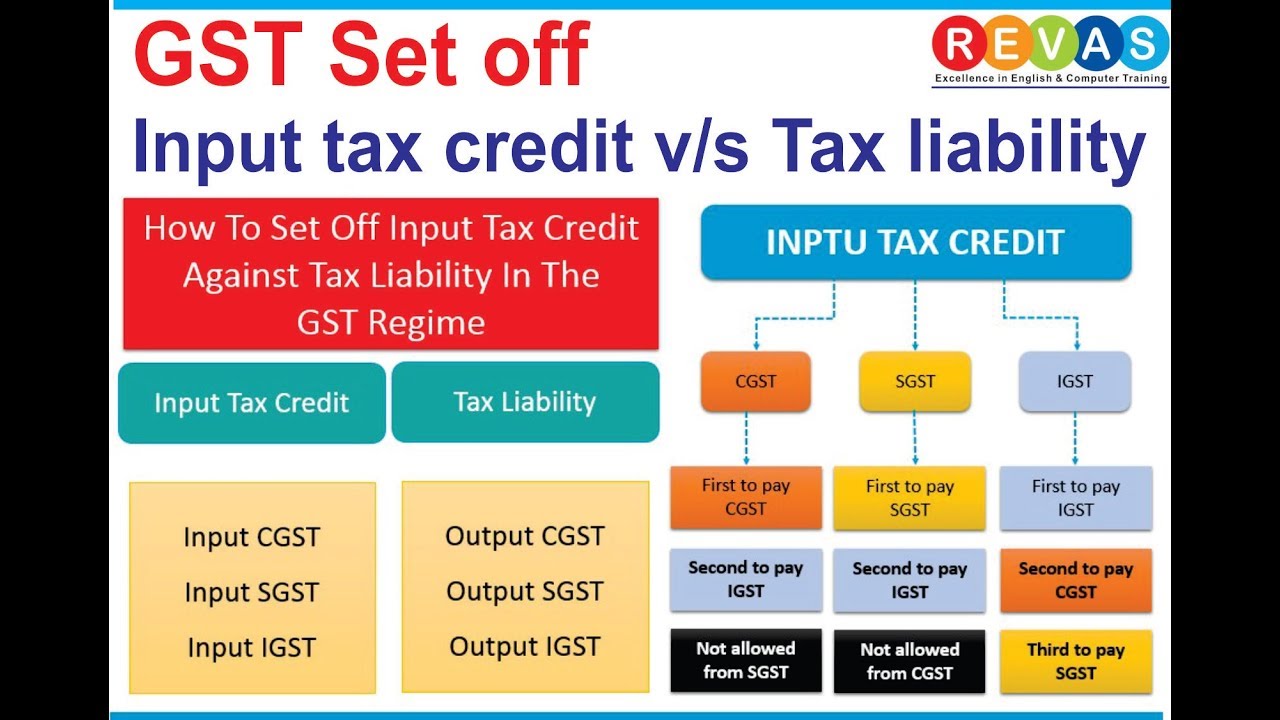

Input Tax Credit ITC in GST allows taxable persons to claim tax paid on goods services used for business Conditions are essential to claim Input Tax Credit Comparison of Liability Declared and ITC Claimed Comparison of Liability Declared and ITC Claimed User Manual FAQs Utilizing Electronic Cash and Input Tax

Include any ITCs you did not claim in an earlier reporting period provided the time limit for claiming the ITCs has not expired For more information see Input tax credits You Input Tax Credit Form ITC 04 on Job Work Section 19 of the CGST Act 2017 defines provisions for input tax credit Form ITC 04 that be claimed on inputs and capital

Download Gst Input Tax Credit Form

More picture related to Gst Input Tax Credit Form

Point wise Guide For GST Input Tax Credit With FAQs

https://www.taxmann.com/post/wp-content/uploads/2022/08/09_Blog-Post-1.jpg

Gst Input Tax Credit Example Input Tax Credit Under Gst All You Want

https://i.ytimg.com/vi/S8OuYsqrwWk/maxresdefault.jpg

GST INPUT TAX CREDIT WHETHER GST CREDIT CAN BE CLAIMED ON EXPENSES MADE

https://i.ytimg.com/vi/SfcbfjVDZ6o/maxresdefault.jpg

Manual GST ITC 01 Claim made under Section 18 1 a How can I declare claim under Section 18 1 a of ITC in Form GST ITC 01 To de clare and file claim of ITC under Download GST ITC 01 Declaration for claim of input tax credit under sub section 1 of section 18 GST ITC 02 Declaration for transfer of ITC in case of sale merger demerger

You can check input tax credit available for you in GST portal in the auto drafted form GSTR 2B How to claim input tax credit You can claim ITC by first reconciling data between purchase register IMS GSTR 2B and draft To claim an input tax credit ITC under GST follow these systematic steps File Monthly GST Returns Submit Form GSTR 3B monthly detailing your output tax liabilities and

Input Tax Credit Guide Under GST Calculation With Examples

https://blog.saginfotech.com/wp-content/uploads/2017/06/input-tax-1024x555.jpg

.jpg)

GST Offering Its Taxpayers Input Tax Credit Statement

https://www.rajstartup.com/productImage/GST (1).jpg

https://www.canada.ca/en/revenue-agency/services/...

As a GST HST registrant you recover the GST HST paid or payable on your purchases and expenses related to your commercial activities by claiming input tax credits

https://cleartax.in/s/gst-itc-01-form-new-registration

GST registration allows businesses to claim Input Tax Credit ITC on goods purchased only after registration Form GST ITC 01 must be filed for ITC claim Cut off dates

Guide To Maximizing The Utilization Of GST Input Tax Credit

Input Tax Credit Guide Under GST Calculation With Examples

What Is Input Tax Credit ITC Under GST How To Claim ITC In GST

Input Tax Credit Utilisation Changes Through GST Amendment 2019

GST Input Tax Credit Section 16 YouTube

Input Tax Credit Under GST Section 16 ITC Explained GST Classes In

Input Tax Credit Under GST Section 16 ITC Explained GST Classes In

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

Gst Input And Output GST Input Tax Credit Under Revised Model GST Law

Input Tax Credit ITC On Capital Goods Under GST With Example

Gst Input Tax Credit Form - In order to satisfy the requirements of subsection 169 1 of the Act the person who imports the goods and by whom the tax is paid or payable must import the goods for the purpose of