Gst Rate On Hotel Rooms Below 1000 The Goods and Services Tax GST Council on Tuesday agreed to levy a 5 percent goods and services tax GST without input tax credit ITC on hospital rooms with rent above Rs 5 000 excluding ICU

Budget travellers will have to shell out more money now that hotel rooms below Rs 1 000 will be taxed at 12 percent Goods and Services Tax GST a decision which was taken by the GST Council 1 What is the GST on Hotel room 2 What is the GST on Restaurant bill inside the Hotel Analysis 1 Since the GST on hotel room depends on the amount received i e Rs 7 000 this falls under 18 slab

Gst Rate On Hotel Rooms Below 1000

Gst Rate On Hotel Rooms Below 1000

https://gstsafar.com/wp-content/uploads/2022/08/GST-on-accommodation.jpg

New GST Rates From Pre Packaged Food Items To Hotel Rooms List Of

https://kj1bcdn.b-cdn.net/media/74659/gst-7.jpg

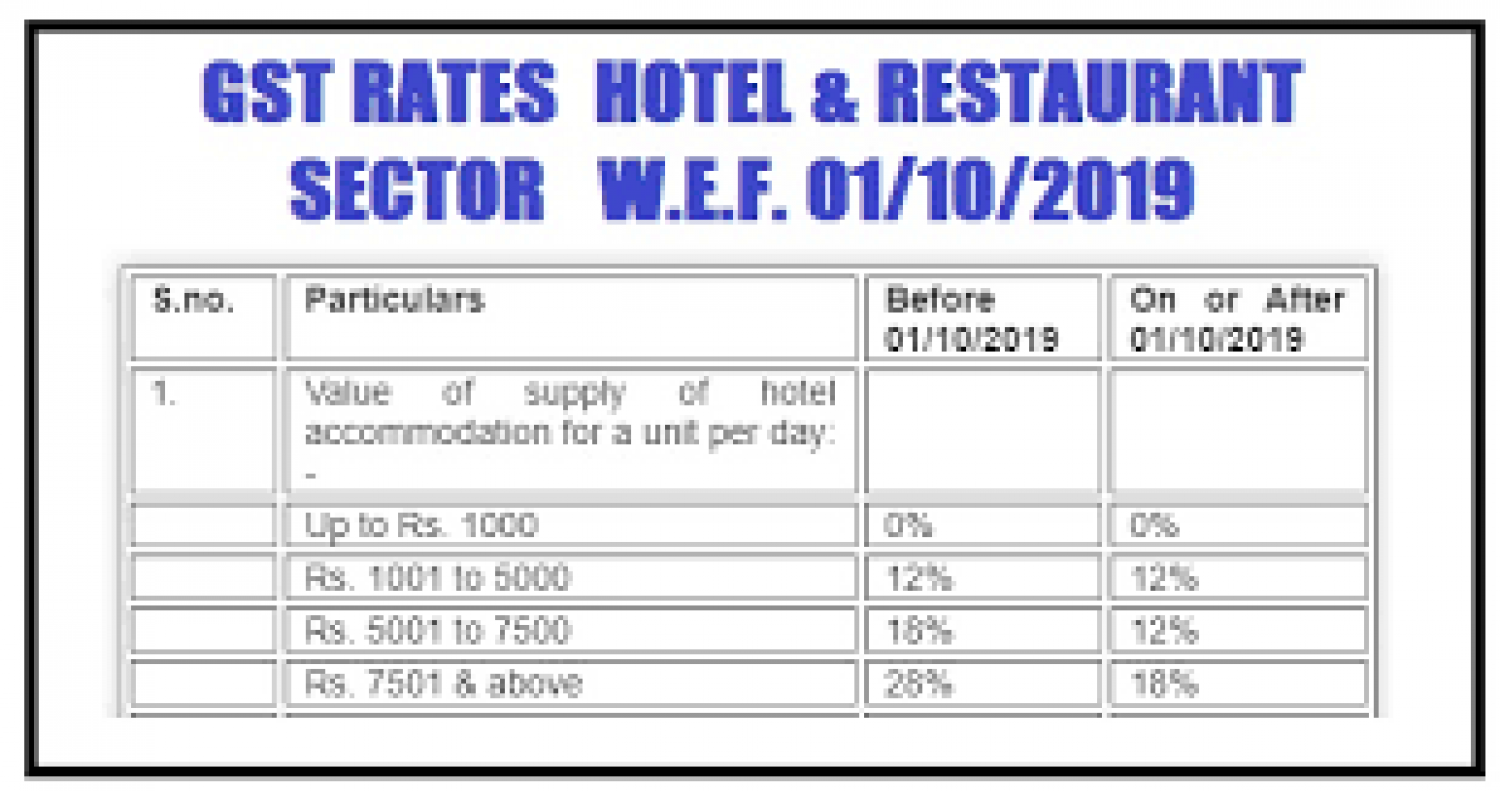

Gst On Hotels Restaurant Industry Gst On Hotel

https://carajput.com/art_imgs/faqs-on-gst-on-hotels-and-restaurant-industry.jpg

Hotel rooms with a tariff below 1 000 are exempt from GST providing relief to budget travellers This exemption aims to make affordable accommodations more accessible and aligns with the As per the communication received by the Federation of hotels rooms below rupees thousand will be taxed at 12 and rooms up to 7500 will be charged at 12 rooms above rs 7500 will be charged at

A hotel was liable for 15 service tax if the room rate exceeded Rs 1 000 The tariff value was subject to a 40 abatement which resulted in a 9 effective The GST rate on hotel rooms depends on the room tariff Rooms with a tariff of less than Rs 1000 per day are exempt from GST Rooms with a tariff between Rs 1000 and Rs 2500 per day are taxed

Download Gst Rate On Hotel Rooms Below 1000

More picture related to Gst Rate On Hotel Rooms Below 1000

Hotel Rooms Below Rs 1 000 To Get Expensive But Industry Divided Over

https://images.moneycontrol.com/static-mcnews/2017/04/hotelnew-770x433.jpg

Save Money On Hotel Rooms Real Simple 4 2013 Cool Rooms Hotels

https://i.pinimg.com/originals/12/c0/5e/12c05ea88e200d6bd9de143f3699014e.jpg

GST New Rule

https://images.news18.com/ibnkhabar/uploads/2022/07/GST-12x9-MC-1.jpg

The decision of the GST Council means the hotel accommodation in the country will only have two GST rates henceforth 12 percent and 18 percent The zero Vide Notification No 04 2022 CT Rate dt 13 07 2022 the exemption hitherto available in respect of the accommodation services by a hotel inn guest house club or campsite having the value of supply

Till 26 07 2018 the GST rates were based on the declared tariff of the hotels W e f 27 07 2018 the GST rate will be based on the value of supply It means Ans The GST rates applicable for accommodation in hotels inns guest houses clubs campsites or other commercial places meant for residential or lodging purposes will

GST For Hotel Industry In India ERPNext Discuss Frappe ERPNext

https://discuss.erpnext.com/uploads/default/original/3X/6/9/69d8ba4fc31fa1cb47fac890745c514908682a35.jpg

GST Rate Hike From Curd And Lassi To Hospital And Hotel Rooms Know

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2022/07/16/2522871-gst-hike.jpg

https://www.cnbctv18.com/economy/gst-co…

The Goods and Services Tax GST Council on Tuesday agreed to levy a 5 percent goods and services tax GST without input tax credit ITC on hospital rooms with rent above Rs 5 000 excluding ICU

https://www.moneycontrol.com/news/busi…

Budget travellers will have to shell out more money now that hotel rooms below Rs 1 000 will be taxed at 12 percent Goods and Services Tax GST a decision which was taken by the GST Council

Hotel Room Booking Sites

GST For Hotel Industry In India ERPNext Discuss Frappe ERPNext

Now Pay 12 Tax On Hotel Rooms Below Rs 1 000 Per Day 5 Gst On

GST Rate Restaurant Service Canteen Composition Scheme Meteorio

A Complete Guide On GST Rate On Food Items Ebizfiling

GST Hotel Industry Welcomes Revised Slab On Hotel Rooms Oneindia

GST Hotel Industry Welcomes Revised Slab On Hotel Rooms Oneindia

Everything You Need To Know On GST On Hotels And Restaurants

GST Rates For Goods Goods And Service Tax Goods And Services Content

GST Revised Rates Come Into Effect From Today Here s What Gets

Gst Rate On Hotel Rooms Below 1000 - The GST rate applicable varies rooms with tariffs below INR 1 000 are exempt those between INR 1 000 and INR 7 500 attract a 12 GST and rooms with