Utility Rebates 2024 We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments Here are the most recent IRA developments and opportunities for

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes The U S Department of Energy has opened applications for 8 5 billion in rebate programs for energy efficiency upgrades in the nation s homes according to a recent Reuters news release The money for the two programs comes from last year s Inflation Reduction Act and could save up to 1 billion a year in energy costs

Utility Rebates 2024

Utility Rebates 2024

https://i.ytimg.com/vi/pePwQJfBq7k/maxresdefault.jpg

Utility Rebates Available By State QuietCool

https://quietcoolsystems.com/wp-content/uploads/2020/06/Rebates_694x635.jpg

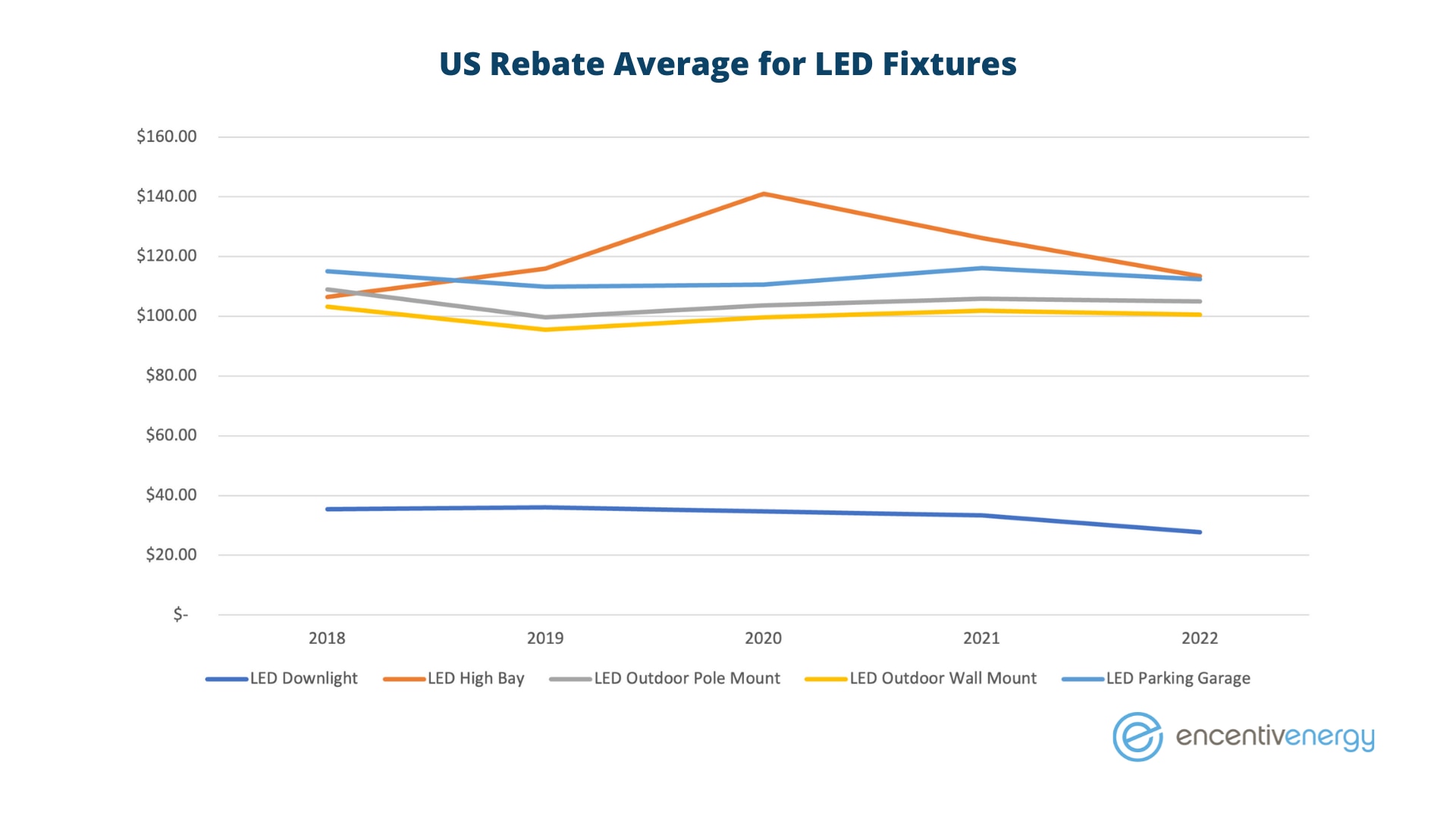

Lighting Utility Rebates Analysis Lumenal Lighting

https://www.lumenal.com/wp-content/uploads/2020/01/lighting-utility-rebates-1920x550-1.jpg

The Home Efficiency Rebates program provides up to 4 3 billion in formula grants to state energy offices to fund whole home energy efficiency upgrades in single and multi family houses Meanwhile 5 Turn the thermostat down a few degrees Heating your home makes up a big chunk of your monthly energy bill According to the Department of Energy you can save as much as 10 a year on heating and cooling by turning your thermostat down 7 F 10 F for 8 hours a day in the fall and winter

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

Download Utility Rebates 2024

More picture related to Utility Rebates 2024

Utility Rebates Whats New In 2023 YouTube

https://i.ytimg.com/vi/O4jsYZBiNb0/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGEsgZShUMA8=&rs=AOn4CLANFgfTUNQ5ndggkO2bAU0O_pa0yQ

Utility Rebates ICS Tax LLC

https://ics-tax.com/wp-content/uploads/2016/09/Utility-Rebates.jpg

Utility Rebates Can Help Offset The Rising Cost Of Energy CUB Minnesota

https://cubminnesota.org/wp-content/uploads/2022/02/rebates-768x553.png

Western New York Get information on the money saving rebates available with National Fuel s energy efficiency rebate program 2024 Rebate Levels for 2024 Program Year Check out the rebate information for those appliances installed between January 1 2024 and December 31 2024 1 Installed between January 1 and December 31 2024 2 Annual Fuel Utilization Efficiency 3 Electronically Commutated Motor 4 One tune up service per furnace boiler per year 5 Uniform Energy Factor 6 In order to qualify for the enhanced furnace rebate the furnace w ECM must be installed with a heat pump with a SEER of at least 15 be AHRI certified A furnace installed with a traditional air

For example Richardson says the average homeowner in Denver who installs a heat pump qualifies for an additional 8 000 in incentives 4 500 in rebates from the city 2 200 in rebates from the Federal Government Visit website to learn more The federal government offers a tax credit of 30 of the cost and up to 600 on the purchase of residential windows that meet the ENERGY STAR Most Efficient criteria There is also a tax credit of up to 250 for one or 500 for two residential doors and skylights

Local Utility Rebates ABCO HVACR Supply Solutions

https://abcohvacr.com/wp-content/uploads/2021/03/daikin-local-rebates-email-header-2.jpg

HVAC Specials And Rebate Offers Pacific Heat And Air Inc

https://pacificheatandair.com/wp-content/uploads/2021/04/rebate.png

https://www.clearesult.com/insights/january-updates-on-inflation-reduction-act-home-energy-rebates

We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments Here are the most recent IRA developments and opportunities for

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

Rebates Kissimmee Utility Authority

Local Utility Rebates ABCO HVACR Supply Solutions

Save Energy With Lighting Utility Rebates Signify

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

Rebates Kissimmee Utility Authority

New 2020 JEEP Grand Cherokee Altitude 4 4 Sport Utility

New 2020 JEEP Grand Cherokee Altitude 4 4 Sport Utility

Rebates For Seniors Mark Coure MP

CAT Rebates W L Inc

2024 IRP

Utility Rebates 2024 - The federal Inflation Reduction Act will provide funding for whole house energy efficiency For households with low or moderate income LMI it will also fund point of sale rebates for panel upgrades and qualified high efficiency electric appliances such as heat pumps for space heating cooling The act includes funding for contractor training