Federal Rebates For Home Improvements Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web The law includes 391 billion to support clean energy and address climate change including 8 8 billion in rebates for home energy efficiency and electrification projects These

Federal Rebates For Home Improvements

Federal Rebates For Home Improvements

https://help.taxreliefcenter.org/wp-content/uploads/2018/07/Tax-Relief-Center-7-Home-Improvement-Tax-Deductions-For-Your-House-FEATURED.jpg

Home Improvement Tax Credit Energy Saving Tax Credit Utah

https://advancedwindowsusa.com/wp-content/uploads/tax-credit-for-energy-efficient-windows-2021.jpg

Avista Corp Washington Home Improvement Rebates Furnace Hvac

https://imgv2-2-f.scribdassets.com/img/document/136471736/original/bc9ec26061/1587639082?v=1

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home Web As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

Web Learn about government programs that may help with repairing or making improvements to your home Government home repair assistance programs If you plan to repair or Web 22 juin 2023 nbsp 0183 32 Credits are capped at 600 for windows and 500 for two doors Insulation Replacing your old insulation also comes with a 30 credit also up from 10 last year

Download Federal Rebates For Home Improvements

More picture related to Federal Rebates For Home Improvements

Home Efficiency Rebate Get Up To 5 000 Back On Energy saving Home

https://i.pinimg.com/originals/f1/f0/4a/f1f04af5dbd6555037e4aade64380391.png

Home Improvements Encouraged By Government Rebates

https://cdn-0.newinhomes.com/4445e668-eb02-412a-92e8-5c4b04935b0b_i/l/toilet-rebate-program-640x339.jpg

Federal Rebates For Heat Pumps Save Money And Energy USRebate

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/05/Federal-Rebates-For-Heat-Pumps.png?ssl=1

Web 19 ao 251 t 2022 nbsp 0183 32 From 2023 a 1 200 annual tax credit limit will replace the old 500 lifetime limit The tax credit will be equal to 30 of the costs for all eligible home improvements Web 9 ao 251 t 2023 nbsp 0183 32 Coming rebates for energy efficient upgrades can be combined with existing tax credits

Web 17 mars 2023 nbsp 0183 32 By Rocky Mengle last updated March 17 2023 If you re planning a few home improvements that will boost the energy efficiency of your house you may save some money on your projects under the Web 26 juil 2023 nbsp 0183 32 Home Energy Tax Credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and

Guide To Home Improvement Rebates Home Improvement Improve Improve

https://i.pinimg.com/originals/dc/3b/41/dc3b41bdba863971f3948d10d4fcfc24.png

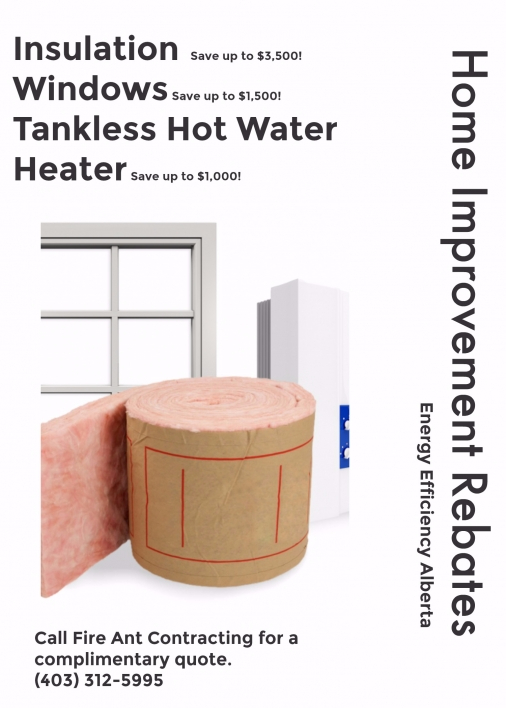

Home Improvement Rebate Program Fire Ant Contracting

https://fireantcontracting.com/uploads/Home_Improvement_Rebates.jpg

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Saskatchewan Home Improvement Grants 20 Grants Rebates Tax Credits

Guide To Home Improvement Rebates Home Improvement Improve Improve

Incentives And Rebates For Residential Energy Efficiency Improvements

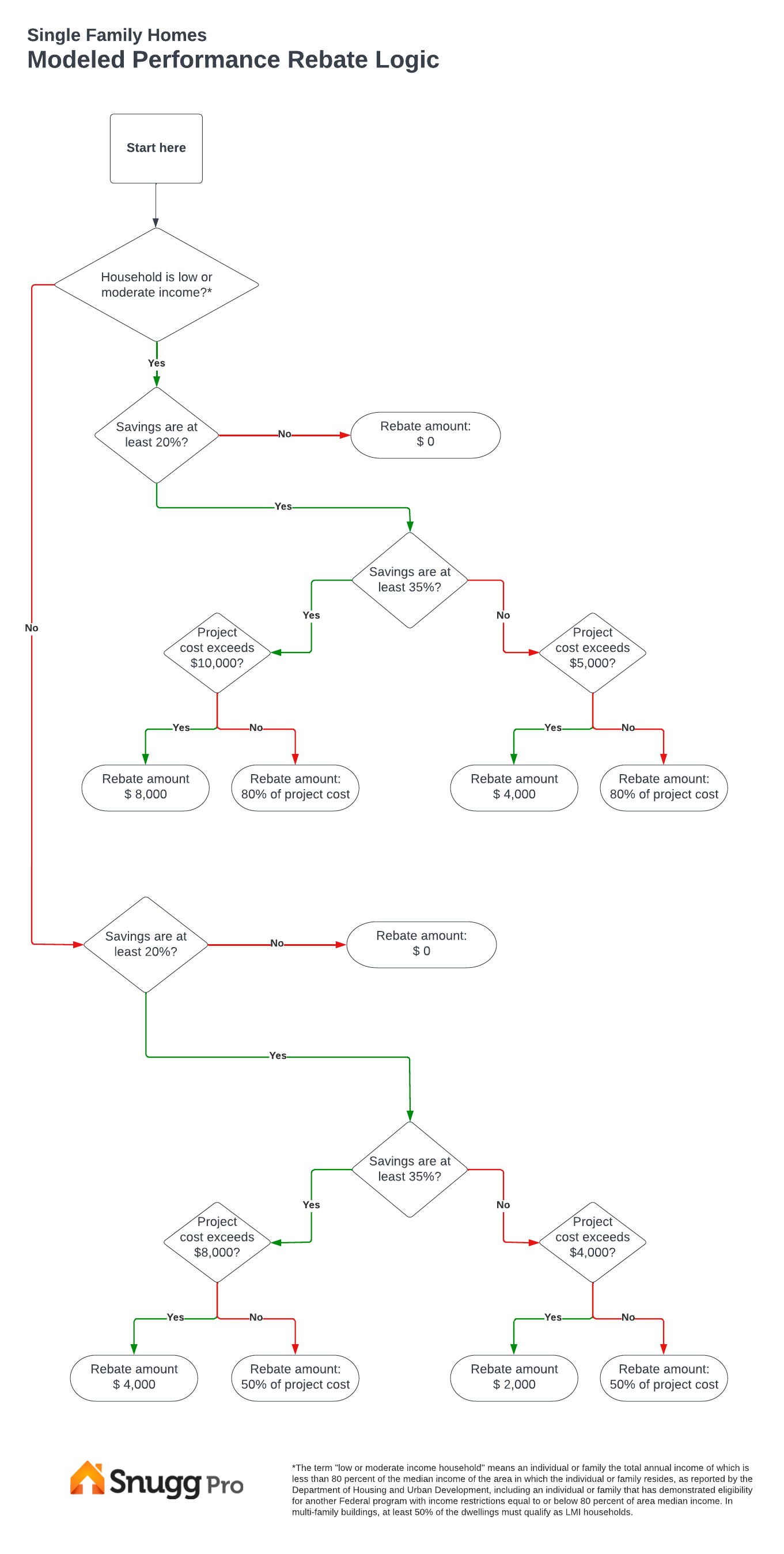

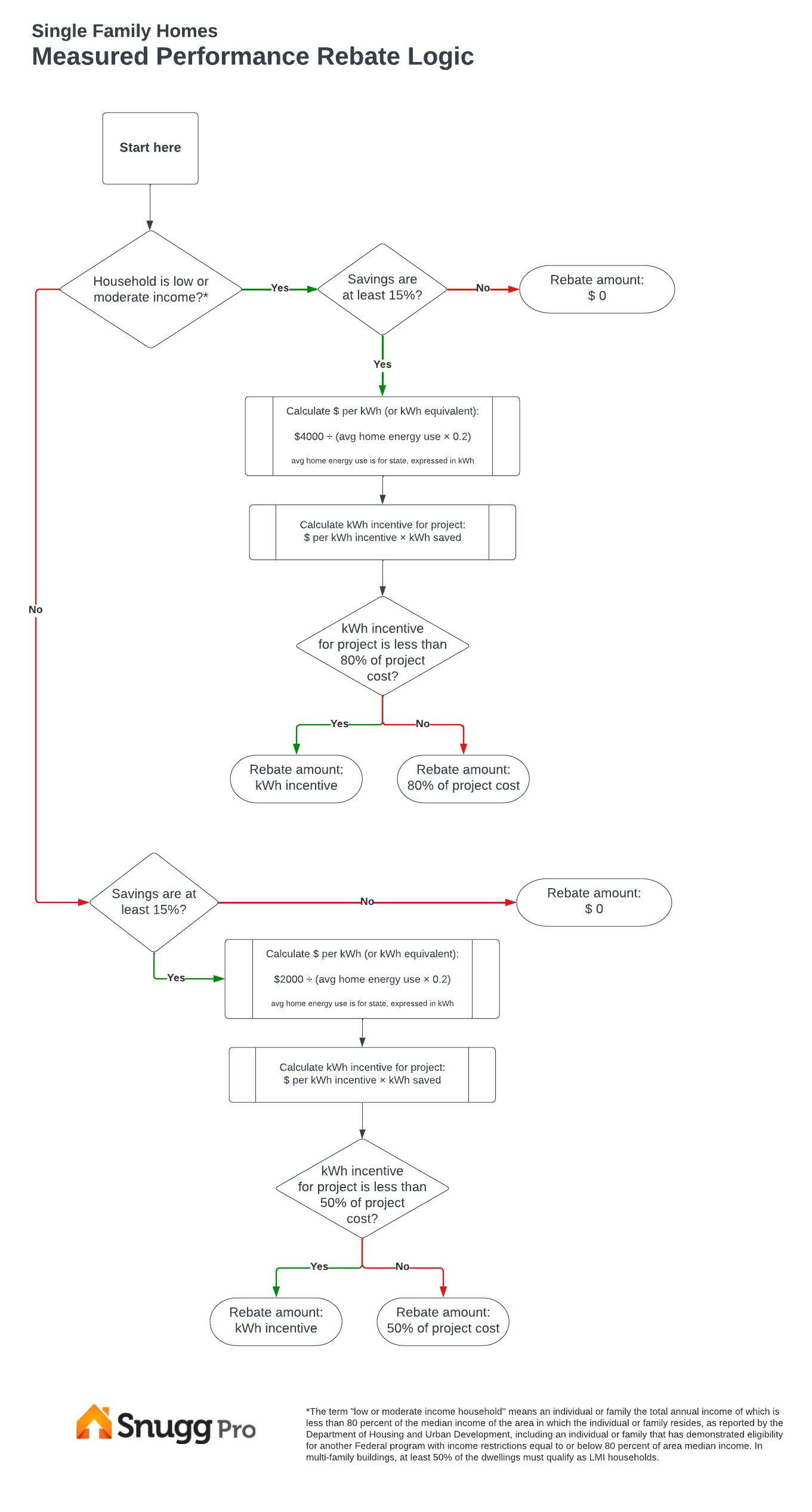

What The Climate Bill s HOMES Rebates Program Means For States Energy

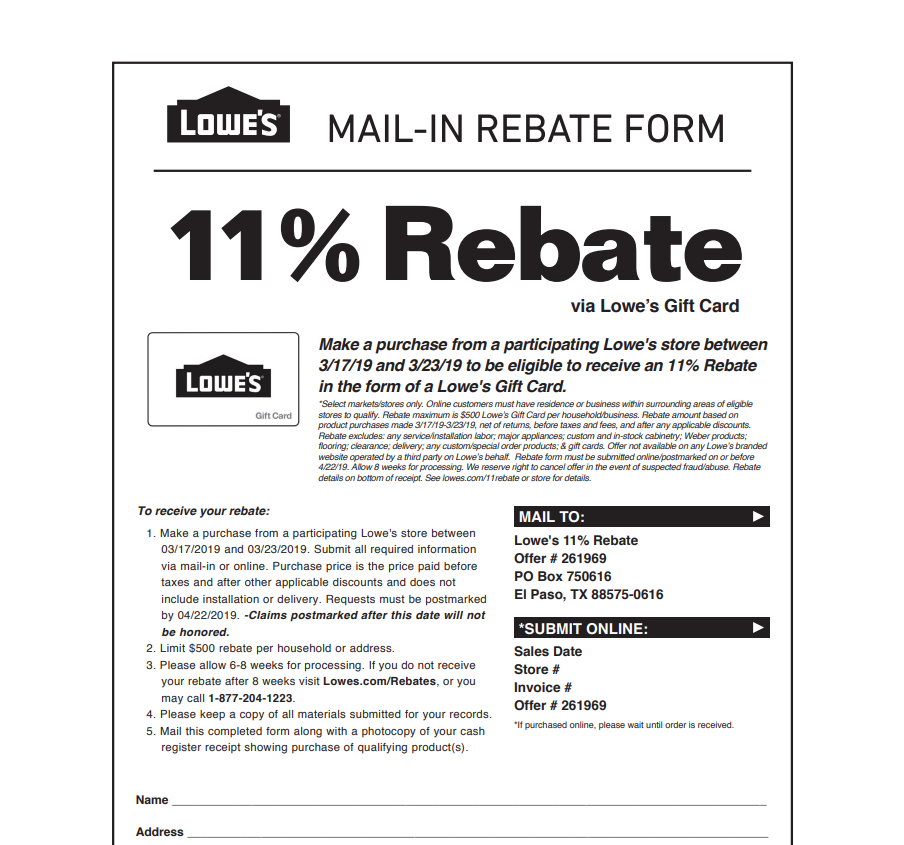

Lowes Printable Rebate Form

What The Climate Bill s HOMES Rebates Program Means For States Energy

What The Climate Bill s HOMES Rebates Program Means For States Energy

You Can Earn Rebates From KCP L And Federal Tax Credits For Home

Avista Corp Idaho Home Improvement Rebates PDF Hvac Water Heating

How To Determine If Energy Efficiency Upgrades Are Right For Your Home

Federal Rebates For Home Improvements - Web As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200