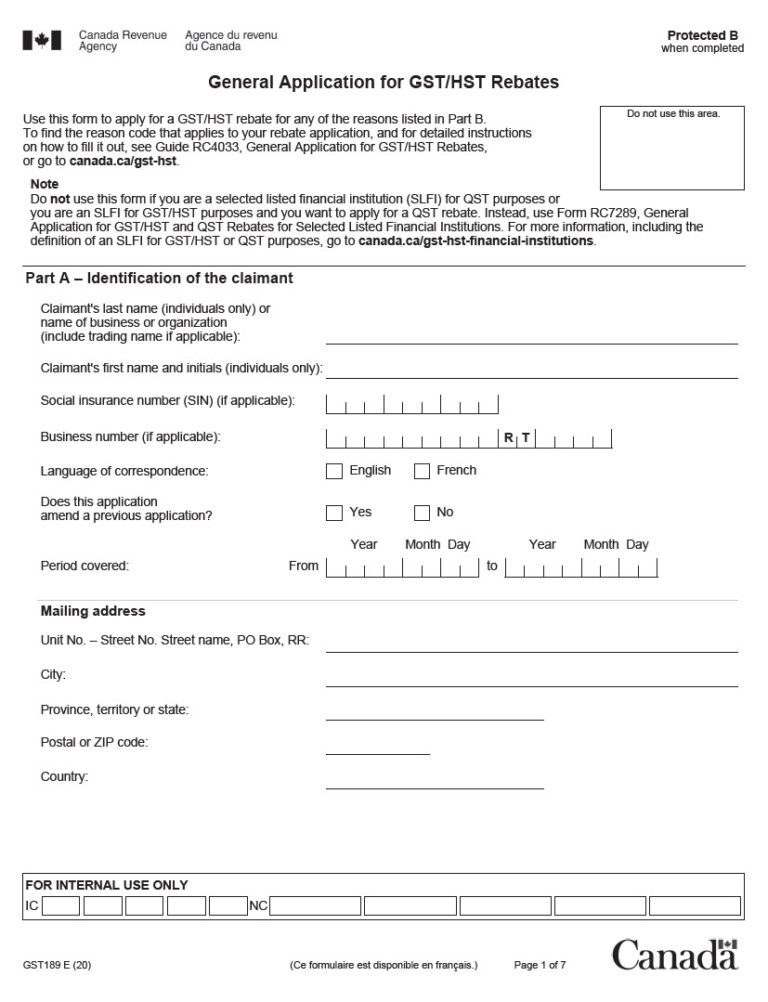

Gst Rebate Amount 2024 Between July 2024 and June 2025 single Canadians without any children could get up to 519 in GST HST credit The October payment will be roughly one

Learn how to get up to 519 extra GST payment in 2024 from the Canada Revenue Agency Find out the eligibility requirements how to apply and the payment amounts and dates for the GST HST credit The GST HST credit is a quarterly payment that goes out to Canadians with low and modest incomes Oct 4 2024 Oct 4 2024 2 min read Save The GST HST

Gst Rebate Amount 2024

Gst Rebate Amount 2024

https://www.nationalobserver.com/sites/nationalobserver.com/files/styles/article_header_xl/public/img/2022/09/14/e28716eec22252892070e8135bdaa05d7d100a22f1922e7264620b1091a4cdbb.jpg?itok=NK8tVZen

Double The Money Your GST Rebate Could Be Twice The Amount Tomorrow

https://www.victoriabuzz.com/wp-content/uploads/2019/06/adultingmoney-e1561581594509.jpg

AY 2022 2023 GST Vouchers Everything You Need To Know

https://res.cloudinary.com/valuechampion/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/GST_Voucher_pic.png

This program provides a non taxable annual amount of 1 516 for a single senior 65 years of age or older at any time during 2024 or a married or common law couple with at least Tax rebate Canadians with low to modest incomes to receive payment Canadian 20 and 50 bills are shown in a display case at the Bank of Canada Museum

Additionally as indicated in Table 2 Atlantic provinces are receiving one year of payment as the federal fuel charge only began applying there in the 2023 24 fuel GST HST credit payments Eligible Canadians could get up to 519 over the course of the four payments While those who are married or have a common law partner could get up to 680

Download Gst Rebate Amount 2024

More picture related to Gst Rebate Amount 2024

Is GST Mandatory For Udyam Registration Compulsory Or Not

https://udyamregistrationform.com/wp-content/uploads/2021/09/is-gst-mandatory-for-udyam-registration.jpg

The 200 Energy Bills Rebate Everything You Need To Know TechRadar

https://cdn.mos.cms.futurecdn.net/YvEFFcJrGg5qJQJAKJYe7W-1920-80.jpg

Consumer Rebates Are You Getting Your Fair Share A Rebate Is An

https://i.pinimg.com/originals/24/2f/eb/242febcbd7f7183a96e09f0202d1b8e1.jpg

The CRA says this year s round of payments calculated using 2023 tax returns will arrive on July 5 and Oct 4 2024 and on Jan 3 and April 4 2025 However Canadians whose total credit is less than 50 How much can you get from the GST HST credit in 2024 The maximum you can receive from the GST HST credit until the end of the payment period June 2024 is 519 if

Until June of 2024 payment amounts are based on your 2022 income Payments made between October 2024 and June 2025 will be based on your 2023 Find out how much the GST credit amount will increase in 2024 based on your family size and income Learn who is eligible how to apply and when to expect

FAQs On E Invoicing Get Set Taxes

https://www.getsettaxes.com/wp-content/uploads/2021/01/GST-Logo-Black-text.png

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

https://globalnews.ca/news/10790074/gst-hst-credit...

Between July 2024 and June 2025 single Canadians without any children could get up to 519 in GST HST credit The October payment will be roughly one

https://www.savvynewcanadians.com/gs…

Learn how to get up to 519 extra GST payment in 2024 from the Canada Revenue Agency Find out the eligibility requirements how to apply and the payment amounts and dates for the GST HST credit

PA Rent Rebate Form Printable Rebate Form

FAQs On E Invoicing Get Set Taxes

Expired 15 Rebate From P G Freebies 4 Mom

Traderider Rebate Program Verify Trade ID

GST Refund Form Rfd 01 Printable Rebate Form

New Home HST GST Rebate By Nadene Milnes Issuu

New Home HST GST Rebate By Nadene Milnes Issuu

The HST GST Rebate And One s Primary Place Of Residence

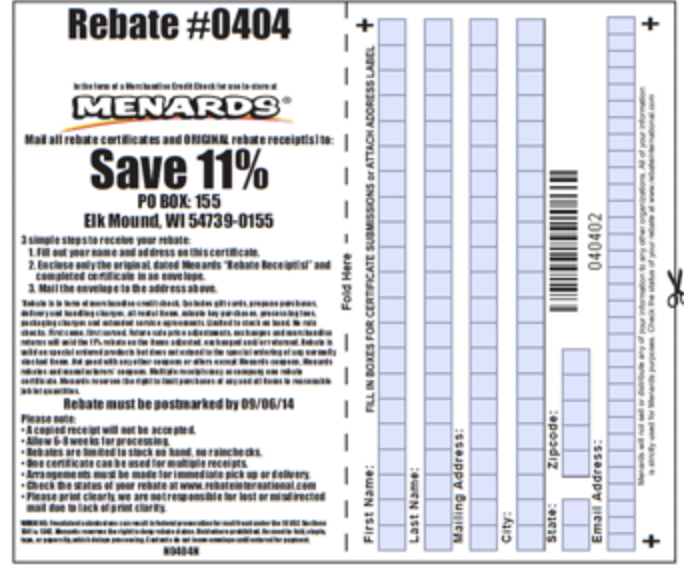

Printable Menards Rebate Form 2024 January Rebates

10 Days GST Return Service Accounts Details Rs 1000 month RCS GST

Gst Rebate Amount 2024 - Additionally as indicated in Table 2 Atlantic provinces are receiving one year of payment as the federal fuel charge only began applying there in the 2023 24 fuel