Gst Rebate For Registered Charities As a charity that receives municipal designation for the purposes of the PSB rebate you may be eligible to claim a 100 rebate of the GST and the federal part of the HST paid or payable on eligible purchases and expenses that relate to your designated activities for which you could not claim ITCs or any other rebate refund or remission

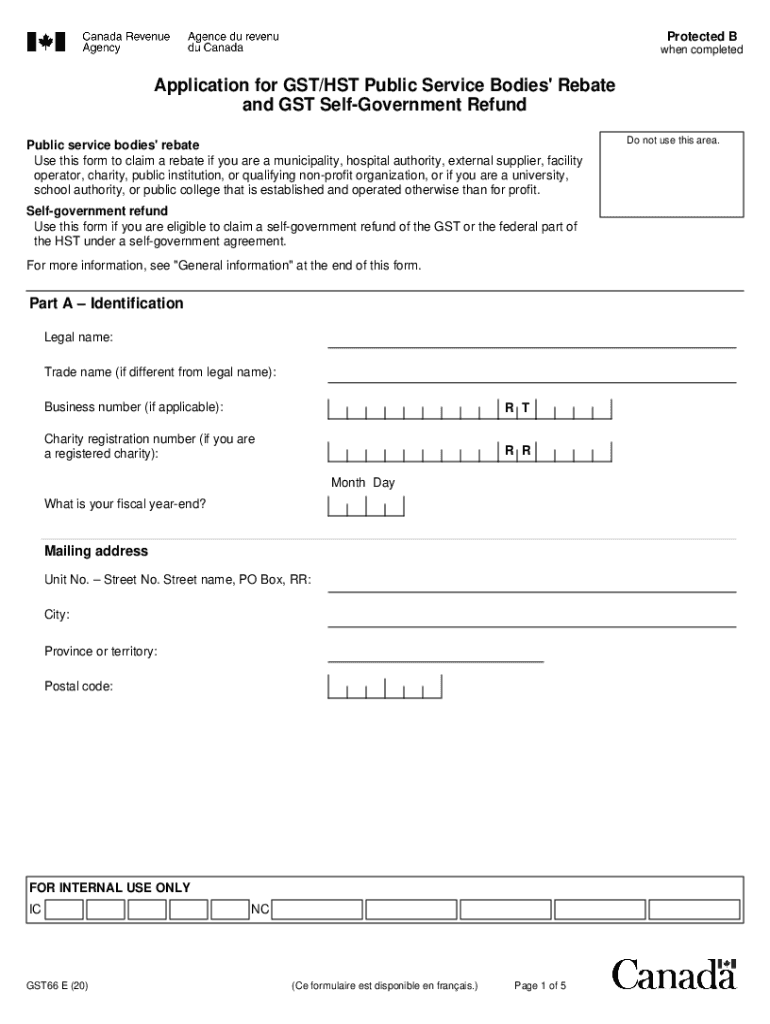

All charities registered as tax exempt for charitable purposes may reclaim GST directly from the taxes office If your charity hasn t already been issued a GST Reference number you should apply to the tax department in writing For more information see Guide RC4034 GST HST Public Service Bodies Rebate If a charity that is a registrant wants to use its PSB rebate to reduce any amount it owes on a GST HST return or to increase any refund it must file its

Gst Rebate For Registered Charities

Gst Rebate For Registered Charities

https://calgarycommunities.com/wp-content/uploads/2020/08/GST-for-Registered-Charities_2021-1024x791.png

GST New Home Rebate Calculation And Examples YouTube

https://i.ytimg.com/vi/2-0zuKt4bBk/maxresdefault.jpg

GST Rebates Abio Systems

https://abiosystems.ca/wp-content/uploads/2020/06/image-475.png

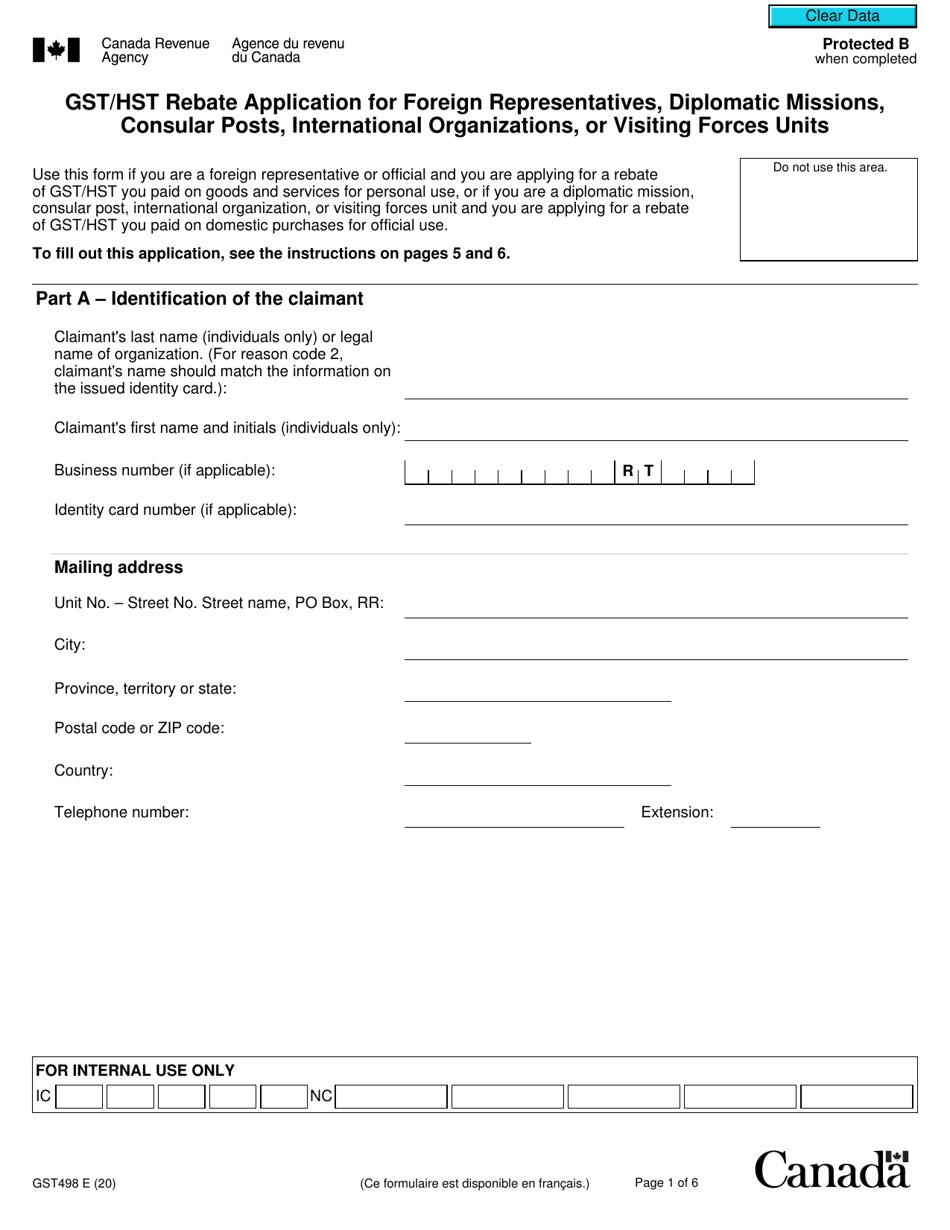

Charities claiming a tax repayment On this page Donations made using the Jersey Gift Support scheme Donations from online giving Deed of covenant donations The claim for the tax repayment must be made by the charity not the person making the donation Donations made using the Jersey Gift Support scheme You may be able to claim the public service bodies rebate PSB rebate of the GST or the federal part of the HST paid or payable on eligible purchases and expenses if you are any of the following a charity a qualifying non profit organization qualifying NPO a selected public service body

As from 1 January 2019 a charity was required to be registered with the Jersey Charity Commissioner to benefit from income tax exemption Certain transitional rules were in force during 2019 and 2020 for those charities that were granted tax exemption prior to 1 January 2019 Under Jersey s GST laws charities can also claim the GST back when they pay for goods and services Through Jersey s charity tax rebate schemes 2 97 million was returned to charitable causes over the last tax year

Download Gst Rebate For Registered Charities

More picture related to Gst Rebate For Registered Charities

Gst66 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/536/268/536268698/large.png

GST State Code List Jurisdiction State Central FlexiLoans

https://cdn.flexiloans.com/wp-content/uploads/2019/01/11165846/gst-state-code.jpg

PW1009 PRE RECORDED WEBINAR GST HST ISSUES FOR CHARITIES AND NON

https://simplysalestax.com/wp-content/uploads/2020/07/2019-05-CHARITIES-AND-NPOS-1024x768.jpg

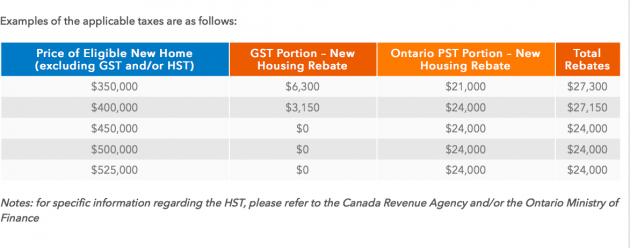

NFP organisations and concessions Additional goods and services GST concessions are available to Australian Charities and Not for profits Commission ACNC registered charities that are endorsed to access GST The PSB rebate allows charities to recover 50 of the federal portion of the GST HST paid on eligible purchases and expenses and a percentage of the provincial portion if the charity is resident in a participating province provincial rates vary by province

[desc-10] [desc-11]

What Is GST GST Item Rate PDF GST Tax Rate Revised GST Tax Slab

https://i.ytimg.com/vi/VD_X3coIUVc/maxresdefault.jpg

What Is GST How It Works Expalied GST

https://i.ytimg.com/vi/esntHpCcJcI/maxresdefault.jpg

https://www.canada.ca/en/revenue-agency/services/...

As a charity that receives municipal designation for the purposes of the PSB rebate you may be eligible to claim a 100 rebate of the GST and the federal part of the HST paid or payable on eligible purchases and expenses that relate to your designated activities for which you could not claim ITCs or any other rebate refund or remission

https://www.jerseycharities.org/help-and-guidance/reclaiming-tax

All charities registered as tax exempt for charitable purposes may reclaim GST directly from the taxes office If your charity hasn t already been issued a GST Reference number you should apply to the tax department in writing

Gst Gujarat HC Denies Integrated GST Rebate To Advance Authorisation

What Is GST GST Item Rate PDF GST Tax Rate Revised GST Tax Slab

GST Registration

Why GST Registration Is Important For Every Business In India Finserving

New Home HST Rebate Calculator Ontario Ontario Home Builders

Registered Charity Tick Women Lawyers Association Of NSW

Registered Charity Tick Women Lawyers Association Of NSW

Gas Rebate Act Of 2022 How To Apply Fill Out Sign Online DocHub

Registered Charities And Ineligible Individuals CPLEA CA

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Gst Rebate For Registered Charities - As from 1 January 2019 a charity was required to be registered with the Jersey Charity Commissioner to benefit from income tax exemption Certain transitional rules were in force during 2019 and 2020 for those charities that were granted tax exemption prior to 1 January 2019