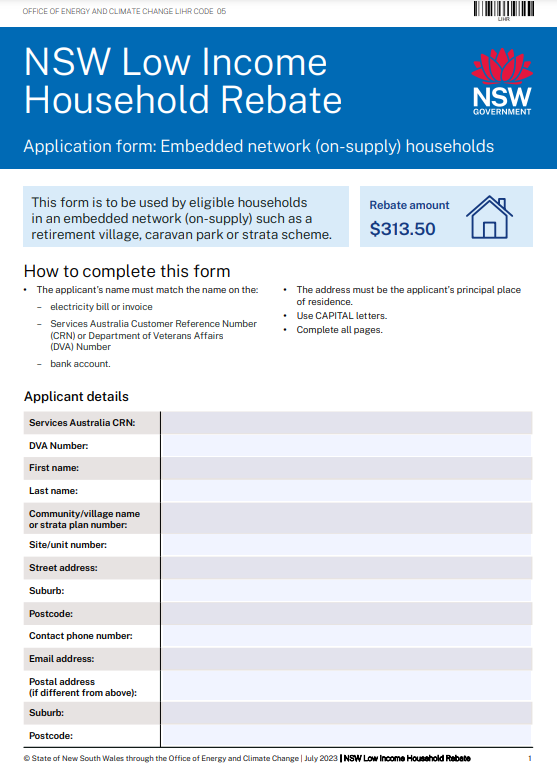

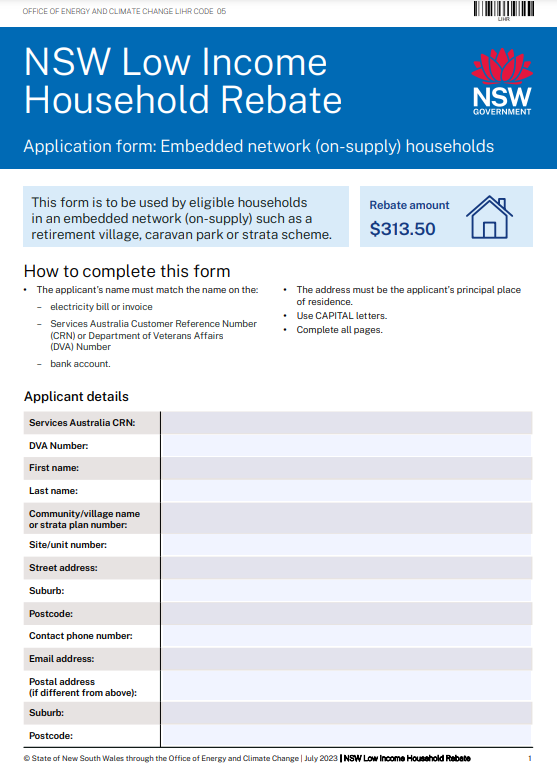

Gst Rebate Low Income This credit is a non taxable amount paid to provide relief for Ontario residents with low and modest incomes for the sales tax they pay The program provides a maximum annual credit of

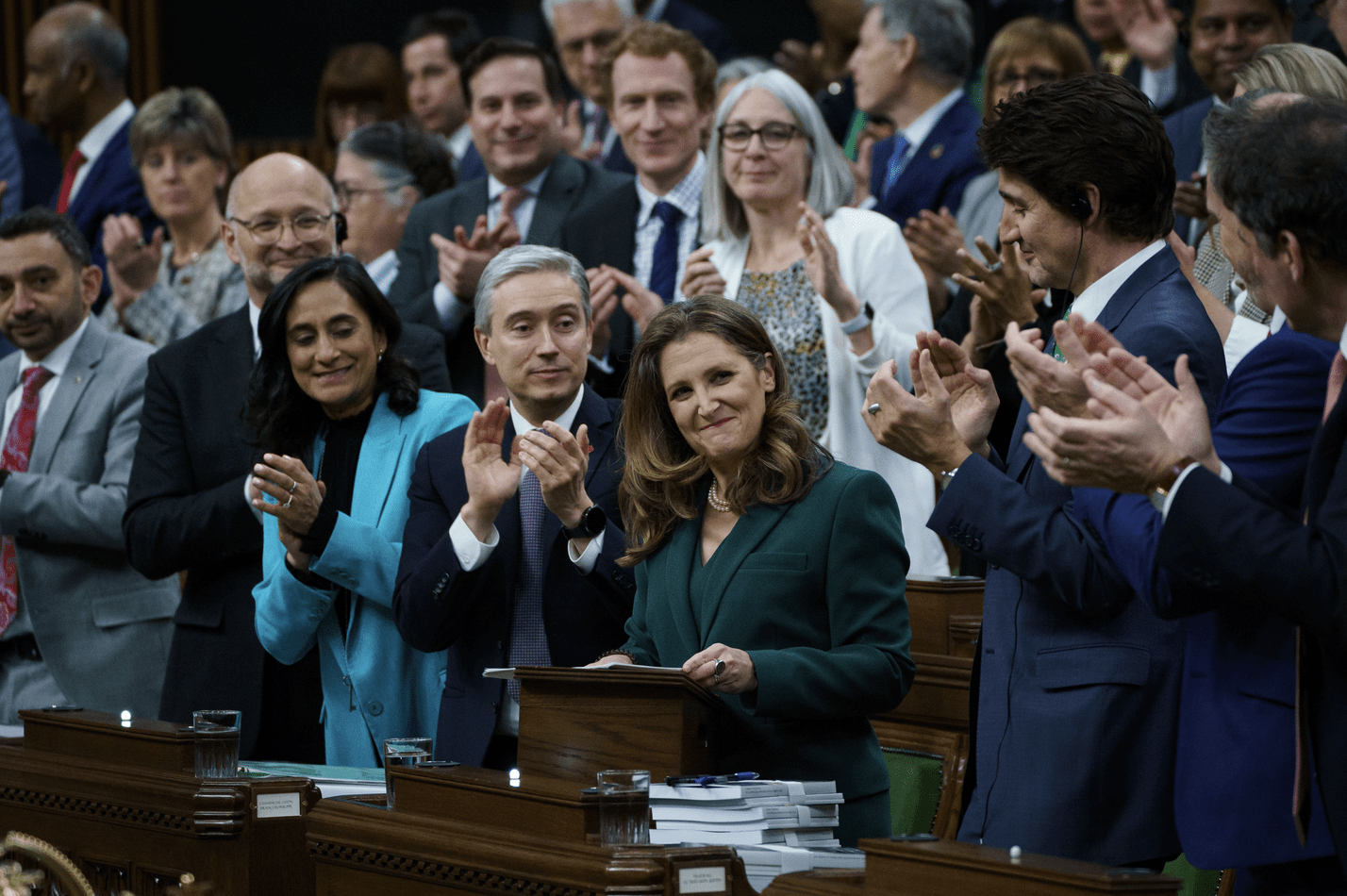

The goods and services tax harmonized sales tax GST HST credit is a tax free quarterly payment that helps individuals and families with low and modest incomes offset the GST or The announcement by Prime Minister Justin Trudeau in September is intended as a short term boost of the GST rebate for low to modest income Canadians The government says the additional GST

Gst Rebate Low Income

Gst Rebate Low Income

https://b2148460.smushcdn.com/2148460/wp-content/uploads/2019/06/adultingmoney.jpg?size=417x270&lossy=1&strip=1&webp=1

Canadians Begin To Receive Temporary Boost To GST Rebate Today

https://cdn.cheknews.ca/wp-content/uploads/2021/09/27134706/CRA-Canada-Revenue-Agency-Sign-Victoria-002-CHEK-scaled.jpg

Feds Temporary Boost To GST Rebate Will Help During High Inflation

https://www.nationalobserver.com/sites/nationalobserver.com/files/styles/article_header_xl/public/img/2022/09/14/e28716eec22252892070e8135bdaa05d7d100a22f1922e7264620b1091a4cdbb.jpg?itok=NK8tVZen

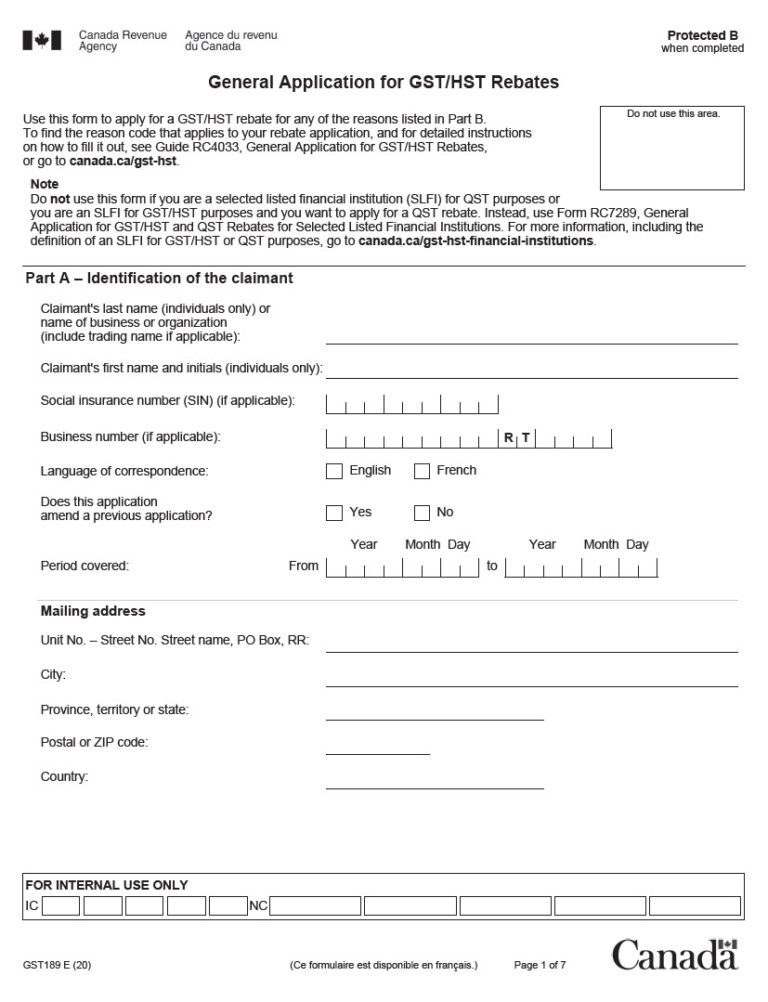

These tax free quarterly payments will go out to eligible Canadians who earn low and modest incomes on Friday They are meant to help individuals and families offset the GST Eligible Canadian citizens and residents can get up to 519 for the year if they are single 680 if they are married or have a common law partner and an additional 179 for each child under

The GST HST credit is a quarterly payment for individuals and families with low to modest incomes meant to help offset the goods and services tax harmonized sales tax GST HST they pay In The GST HST credit provides relief for low to modest income Canadians by mitigating the tax burden associated with paying taxes on consumer goods and services and

Download Gst Rebate Low Income

More picture related to Gst Rebate Low Income

Temporary Boost To GST Rebate Appropriate Amid High Inflation

https://www.talentcanada.ca/wp-content/uploads/2020/11/Ottawa-AdobeStock_299790306-2048x1279.jpeg

MPs Unanimously Vote To Temporarily Double GST Rebate For Lower income

https://www.cp24.com/polopoly_fs/1.6099360.1665087534!/httpImage/image.jpg_gen/derivatives/landscape_620/image.jpg

Temporary Boost To GST Rebate Would Cost 2 6 Billion PBO Brandon Sun

https://www.brandonsun.com/wp-content/uploads/sites/3/2022/09/20220929110932-6335baff2b5000acf6fcc3dajpeg.jpg?w=1000

The GST credit paid to individuals and families with low or modest income is non taxable Who is Eligible for the GST Credit Generally Canadian residents age 19 or older are eligible to receive the federal GST credit which is paid MPs unanimously passed legislation to help temporarily provide targeted tax relief to low and modest income Canadians on Thursday meaning the bill will now be sent to the Senate

But what was new in the package of measures Prime Minister Justin Trudeau announced here Tuesday was a short term boost of the GST rebate for low income Canadians The Goods and Services Tax GST Credit helps offset the financial impact of the GST for low and modest income people and families The credit is paid quarterly in January

Tesla California Clean Vehicle Rebate Low Income LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/clean-vehicle-policy-ucla-luskin-center-for-innovation-768x384.jpg

AY 2022 2023 GST Vouchers Everything You Need To Know

https://res.cloudinary.com/valuechampion/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/GST_Voucher_pic.png

https://www.canada.ca/.../rc4210/gst-hst-credit.html

This credit is a non taxable amount paid to provide relief for Ontario residents with low and modest incomes for the sales tax they pay The program provides a maximum annual credit of

https://www.canada.ca/en/revenue-agency/services...

The goods and services tax harmonized sales tax GST HST credit is a tax free quarterly payment that helps individuals and families with low and modest incomes offset the GST or

A 9 Rebate Low income Mass Residents Won t See Much From Tax Credit

Tesla California Clean Vehicle Rebate Low Income LatestRebate

Budget 2023 An Ironic GST Rebate And A Happy NDP Policy Magazine

New Home HST GST Rebate By Nadene Milnes Issuu

GST Refund Form Rfd 01 Printable Rebate Form

Cvrp Low Income Rebate PrintableRebateForm

Cvrp Low Income Rebate PrintableRebateForm

The HST GST Rebate And One s Primary Place Of Residence

One time GST Rebate Hike Approved By Parliament

Feds Temporarily Double GST Rebate Reveal Launch Of Dental Care Plan

Gst Rebate Low Income - GST HST credit payments Eligible Canadians could get up to 519 over the course of the four payments While those who are married or have a common law partner could get