Gst Rebate On New Homes Fill out this form to calculate and claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house as part of a renovation of your existing house or converted your house from non residential use to residential use

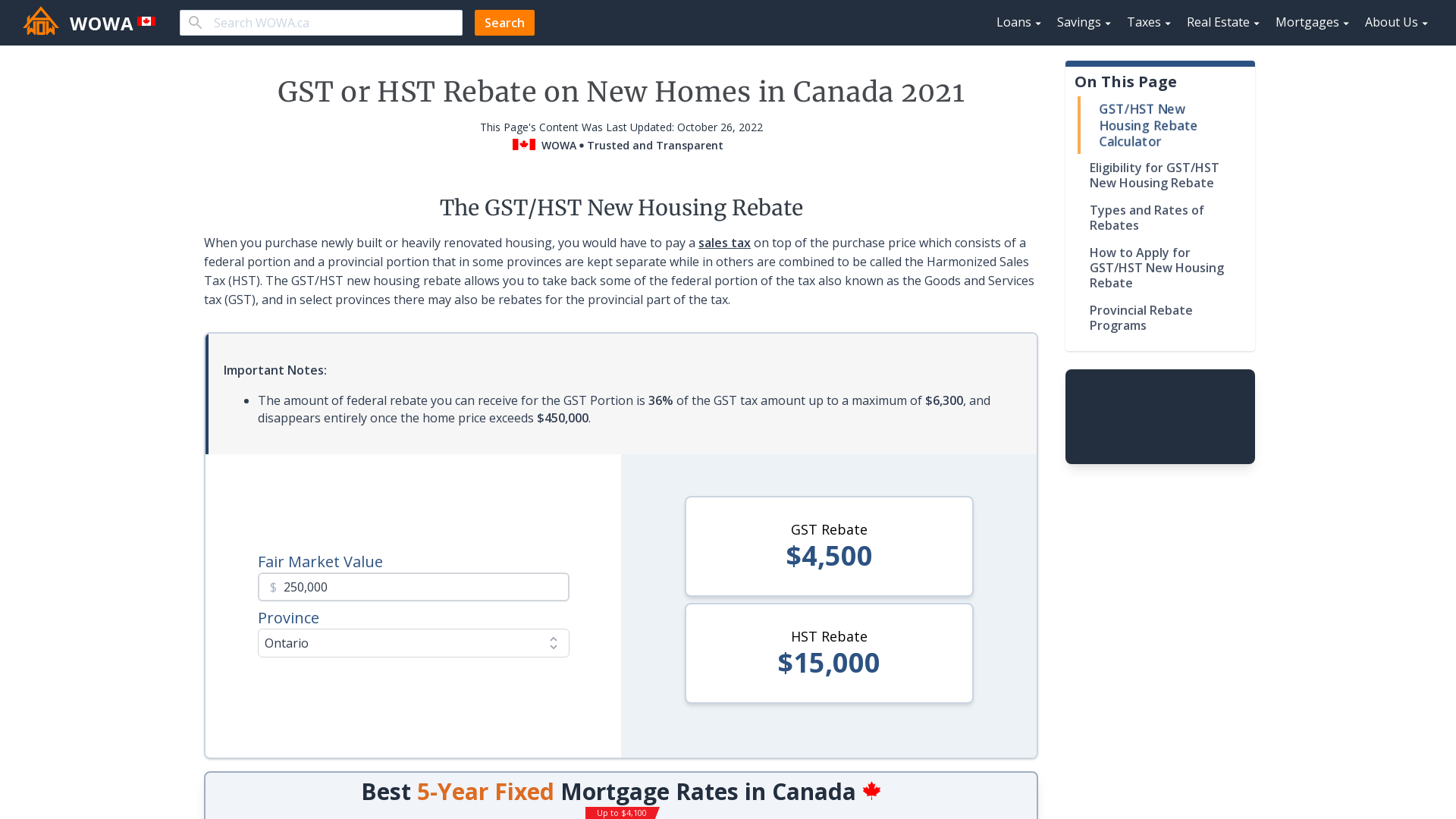

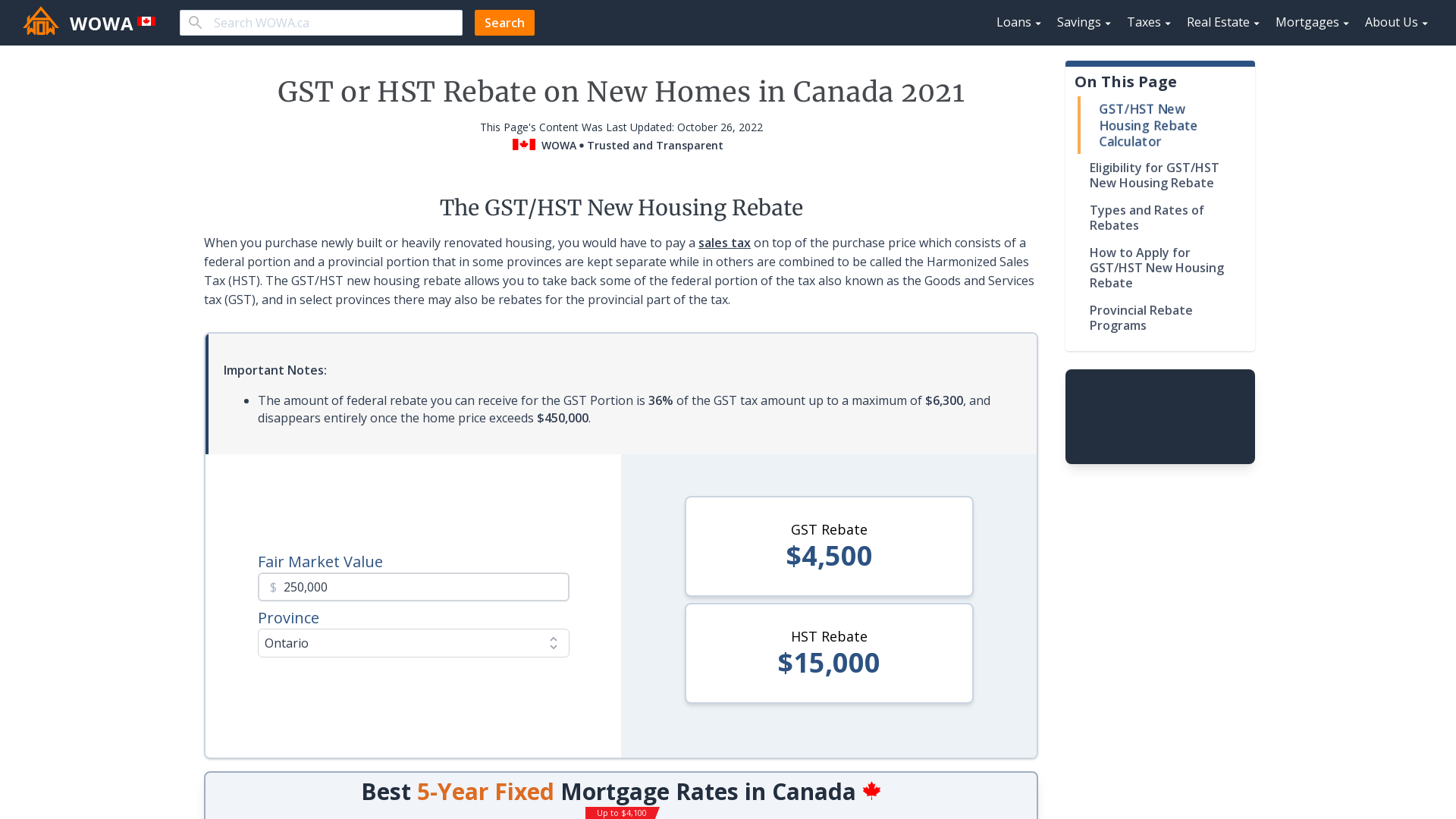

Canada has a new housing rebate known as the GST HST new housing rebate It gives qualifying Canadians up to 6 300 rebate on the federal tax portion of an eligible home purchase or major The property purchase price without tax must be under 450 000 to receive rebate for the GST or the federal portion of HST However if the value is above the threshold you may still be eligible to receive tax rebate for the provincial portion if the province offers it

Gst Rebate On New Homes

Gst Rebate On New Homes

https://bridgewellgroup.ca/wp-content/uploads/2020/04/gst-rebate-for-new-homes-bank-pic.jpg

HST Rebate Ontario Services New Custom Homes Condos Rentals

https://hstrebatehub.ca/wp-content/uploads/2020/10/hst-rebate-custom-home.jpg

Understanding The HST Rebate On New Homes HuffPost Life

https://img.huffingtonpost.com/asset/5cd655b92100003100c4f7cc.jpeg?ops=1200_630

On September 21 2023 Bill C 56 the Affordable Housing and Groceries Act was introduced to increase the GST Rental Rebate on new rental housing from 36 to 100 The rebate increase is subject to the passage of Bill C 56 and is effective for projects that begin construction on or after September 14 2023 and before December 31 2030 and First the new housing rebate equals 36 of the GST that all buyers need to pay when buying a new home in Canada This rebate is up to 6 300 and valid on homes with a fair market value of 350 000 or less If you re buying a home priced above this amount but still less than 450 000 don t fret There s still a partial rebate that can be

If you have recently purchased a new home or renovated your home extensively and have question about your GST HST rebate check out our FAQs You may be eligible for a GST HST Tax rebate on your Property The GST is a Federal tax of 5 on the purchase price of a new home or a substantially renovated home New home buyers can apply for a rebate of up to a maximum of 36 of the tax if the purchase price is 350 000 or less A partial GST rebate is available for new homes costing between 350 000 and 450 000 Does GST apply to renovated homes

Download Gst Rebate On New Homes

More picture related to Gst Rebate On New Homes

What Is The GST HST Rebate On New Homes In Canada

https://www.savvynewcanadians.com/wp-content/uploads/2023/04/What-is-the-GSTHST-Rebate-On-New-Homes-in-Canada-img.png

New Home HST GST Rebate By Nadene Milnes Issuu

https://image.isu.pub/130131143253-b171a3397fa948ceb10c5a961451c8bc/jpg/page_2.jpg

Best HST Tax Rebate On New Homes In Canada WeFin

https://wefin.ca/wp-content/uploads/2023/02/hst-tax-rebate-on-new-homes-in-canada-4.jpg

The new housing rebate is worth 36 of the GST or federal portion of the HST paid on a newly constructed home up to a maximum of 6 300 The rebate is valid on homes that are considered fair to the market with a value of 350 000 or less The GST HST New Housing Rebate is a valuable tax relief program for Canadians purchasing or constructing a new home This rebate helps reduce the financial burden by refunding a portion of the GST or HST paid on new homes ensuring more Canadians can achieve their dream of homeownership

[desc-10] [desc-11]

GST Or HST Rebate On New Homes In Canada 2023 WOWA ca

https://wowa.ca/static/img/opengraph/calculators/gst-hst-rebate-new-home-canada.png

What Is The GST Rebate On Homes And How Does It Work TroiWest Builders

https://troiwestbuilders.com/wp-content/uploads/2021/10/04-DSC_0776.jpg

https://www.canada.ca/.../forms-publications/forms/gst191.html

Fill out this form to calculate and claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house as part of a renovation of your existing house or converted your house from non residential use to residential use

https://money.ca/real-estate/gst-hst-new-housing-rebate

Canada has a new housing rebate known as the GST HST new housing rebate It gives qualifying Canadians up to 6 300 rebate on the federal tax portion of an eligible home purchase or major

Govt Considering GST Rebate On New Home Builds Sky News Australia

GST Or HST Rebate On New Homes In Canada 2023 WOWA ca

What Is The Maximum HST Rebate On New Homes My Rebate

Ontario New Housing Rebate Form By State Printable Rebate Form

Del Webb Carolina Arbors A 55 Retirement Community In Durham NC Earn

Top 5 Questions About The GST HST Housing Rebate

Top 5 Questions About The GST HST Housing Rebate

GST New Home Rebate Calculation And Examples YouTube

GST HST New Housing Rebate And New Residential Rental Property Rebate

The GST HST Housing Rebate WEFIN Financial Tools

Gst Rebate On New Homes - [desc-14]