Handicapped Rebate Income Tax Web 7 d 233 c 2022 nbsp 0183 32 Disability Tax Benefits As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may

Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions Web 20 juil 2019 nbsp 0183 32 What is Section 80DD of income tax Section 80DD is the deduction available to the resident individual or HUF for the medical

Handicapped Rebate Income Tax

Handicapped Rebate Income Tax

https://i.ytimg.com/vi/pV9QhdAvsxg/maxresdefault.jpg

Handicapped Certificate In Mumbai Information About Guidelines To

https://taxguru.in/wp-content/uploads/2018/07/Deducation-Under-Section-80U-of-Income-Tax-Act-1961-For-Disable-Persons-1280x720.jpg

Image Showing Assured Income For The Severely Handicapped Explainer

https://i.pinimg.com/originals/d7/0a/73/d70a731f3a6b0b7158663e79b95c5b6e.jpg

Web 24 juil 2018 nbsp 0183 32 The Income Tax Act 1961 provides deduction u s 80 in pursuance of which an individual Indian citizen and foreign national Web 6 sept 2023 nbsp 0183 32 Section 80U of the Income Tax Act of 1961 states the provisions for tax deductions or tax benefits for individual taxpayers who are suffering from a disability As per the law Indian residents who have

Web 27 juin 2018 nbsp 0183 32 The Income Tax Act 1961 provides deduction u s 80U in pursuance of which an individual Indian citizen and foreign national who is resident of India and who Web 2 d 233 c 2021 nbsp 0183 32 Successful claimants are eligible to receive Rs 75 000 for a disabled dependent with between 40 and 80 disability as defined by the Indian government

Download Handicapped Rebate Income Tax

More picture related to Handicapped Rebate Income Tax

Rebates Worth Thousands Of Dollars However Qualifying For A Refund Is

https://i.pinimg.com/originals/e4/5b/4f/e45b4fa7789b4f01f52ae901604545b2.png

Income Tax Deduction For Handicapped Disable Person Section 80DD

https://i.ytimg.com/vi/x5w74X5ID_o/maxresdefault.jpg

IRS Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca

https://i0.wp.com/www.11rebate.com/wp-content/uploads/2023/08/irs-recovery-rebate-tax-credit-2022-how-to-claim-it-next-year-marca.jpg?fit=1320%2C743&ssl=1

Web In case an individual is suffering from at least 40 disability he or she can claim a deduction of tax of up to Rs 75 000 on the taxable income Person with Severe Web 19 nov 2020 nbsp 0183 32 In this Video You can Know the details of Income tax rebate for handicapped person and their family member Please Like Our Facebook Page https www face

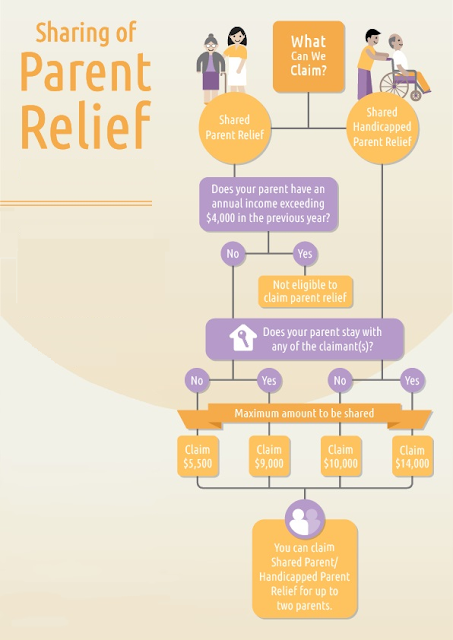

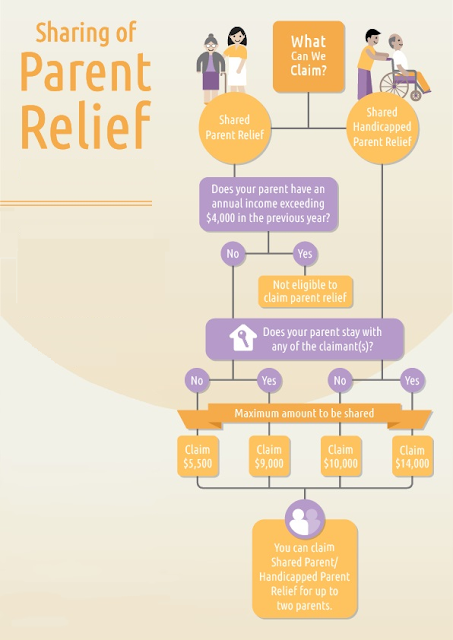

Web Introduction Download Modeling State Tax Rebate Payments in the 2022 CPS ASEC PDF lt 1 0 MB More than twenty states issued special tax rebates in 2022 These payments Web Is this the first time you are claiming the relief Log in with your Singpass or Singpass Foreign user Account SFA at myTax Portal Go to Individuals gt File Income Tax

How To Reduce Your Income Tax In Singapore make Use Of These Tax

https://2.bp.blogspot.com/-N720ls7Vsnw/WsuZ2v9EW9I/AAAAAAAAYsA/5w4Clg9pP4cGP1pUnKBAbpIQgSDZeUhDwCLcBGAs/s640/Parent%2BRelief.png

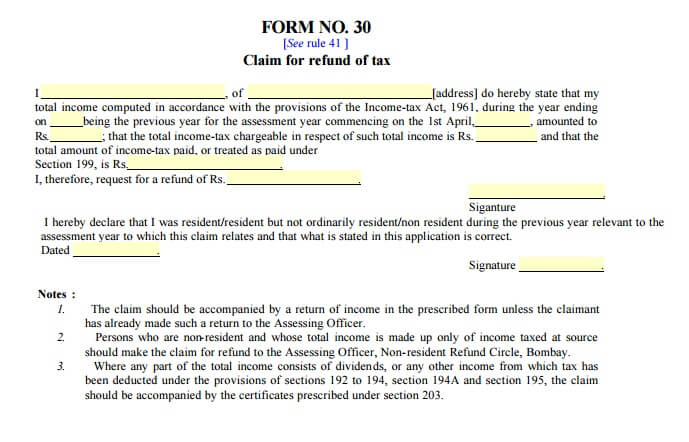

80DD FORM PDF

https://www.allindiaitr.com/App_Root/content/img/form30.jpg

https://www.irs.gov/individuals/more-information-for-people-with...

Web 7 d 233 c 2022 nbsp 0183 32 Disability Tax Benefits As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may

https://cleartax.in/s/section-80u-deduction

Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions

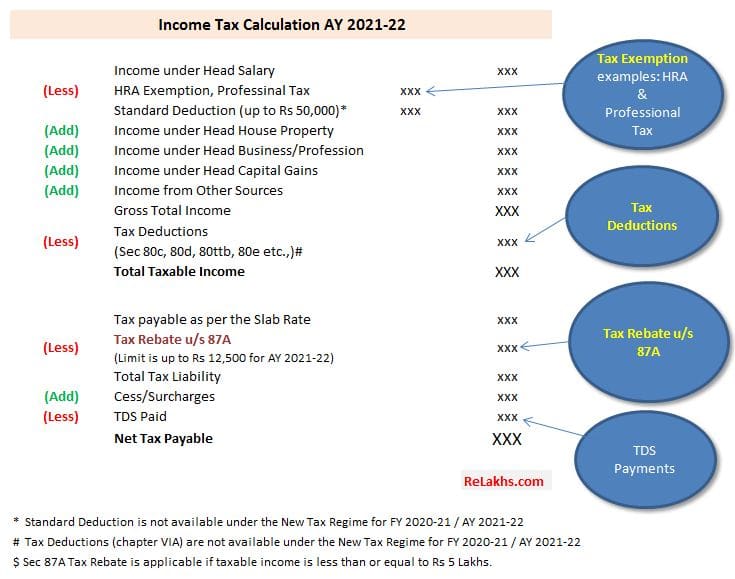

Rebate Under Section 87A AY 2021 22 Old New Tax Regimes

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Handicapped Taxes Tinkleman15 Flickr

Form Et 1 Pa 2019 Fill Out Sign Online DocHub

Income Tax Rules For Senior Citizens Senior Citizens Income Tax Slabs

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Child Care Rebate Income Tax Return 2022 Carrebate

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

Pin On Tigri

Handicapped Rebate Income Tax - Web 1 nov 2022 nbsp 0183 32 Disability and the Earned Income Tax Credit EITC Find out if your disability benefits and the refund you get for the EITC qualify as earned income for the Earned