Health Insurance Medical Loss Ratio The Affordable Care Act requires health insurance issuers to submit data on the proportion of premium revenues spent on clinical services and quality improvement also known as the Medical Loss Ratio MLR It also requires them to issue rebates to enrollees if this percentage does not meet minimum standards

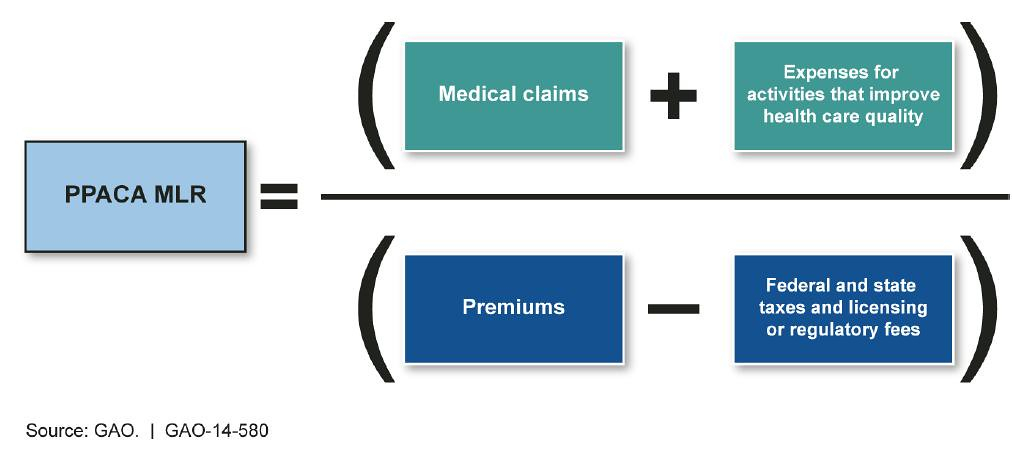

Do Health Insurers Manage Their Medical Cost Ratios At What Cost Journal of Insurance Regulation 2021 The Differential Effects of Medical Loss Ratio Regulation on the Individual Health Insurance Market Journal of Insurance Regulation 2019 U S Health Insurance Industry Analysis Report Medical loss ratio MLR is a measure of the percentage of premium dollars that a health plan spends on medical claims and quality improvements versus administrative costs The Affordable Care Act ACA set minimum MLR standards for health insurance in the US How do medical loss ratio rules work

Health Insurance Medical Loss Ratio

Health Insurance Medical Loss Ratio

https://insurancetrainingcenter.com/wp-content/uploads/2022/11/Loss-ratio.png

Medical Loss Ratio MLR Rebates BAIS Insurance

https://baisins.com/wp-content/uploads/2021/09/Medical-Loss-Ratio-MLR-Rebates.jpg

ACA s 2014 Medical Loss Ratio Rebates Healthinsurance

https://www.healthinsurance.org/wp-content/uploads/2014/09/2014-medical-loss-ratio-returns-rebates.jpg

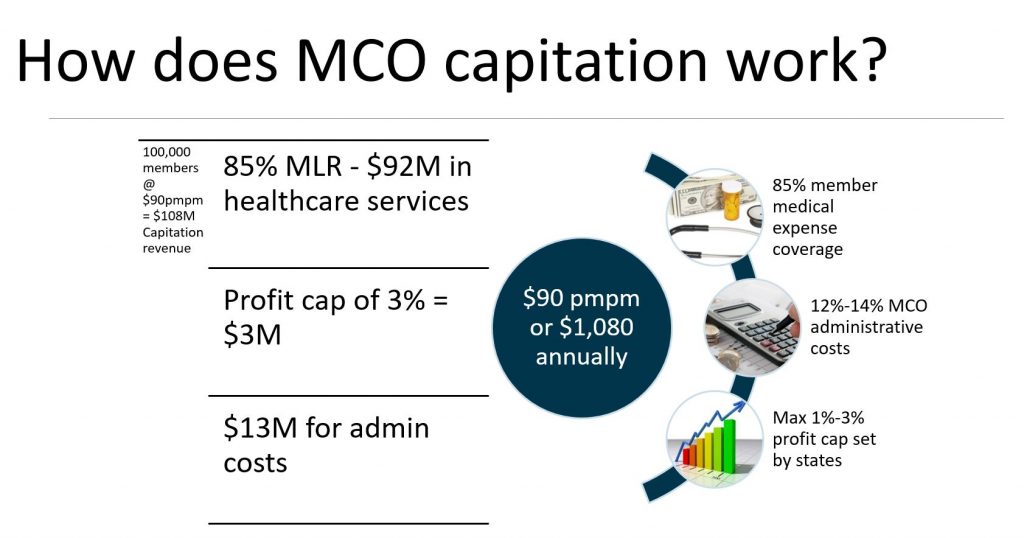

The Medical Loss Ratio provision of the ACA requires most insurance companies that cover individuals and small businesses to spend at least 80 of their premium income on health care A medical loss ratio MLR is calculated by dividing a health insurance provider s claim and healthcare quality improvement costs by net premiums received Insurance companies must reach an MLR of 80 for individual family and small group plans and an MLR of 85 for large group plans

Medical loss ratio MLR A basic financial measurement used in the Affordable Care Act to encourage health plans to provide value to enrollees If an insurer uses 80 cents out of every premium dollar to pay its customers medical claims and activities that improve the quality of care the company has a medical loss ratio of 80 Medical cost ratio MCR commonly known as medical loss ratio or medical benefit ratio compares a health insurance company s healthcare related costs to its revenue premium The ratio is frequently used to determine the financial strength of an insurance company as it informs the percentage of revenue that goes

Download Health Insurance Medical Loss Ratio

More picture related to Health Insurance Medical Loss Ratio

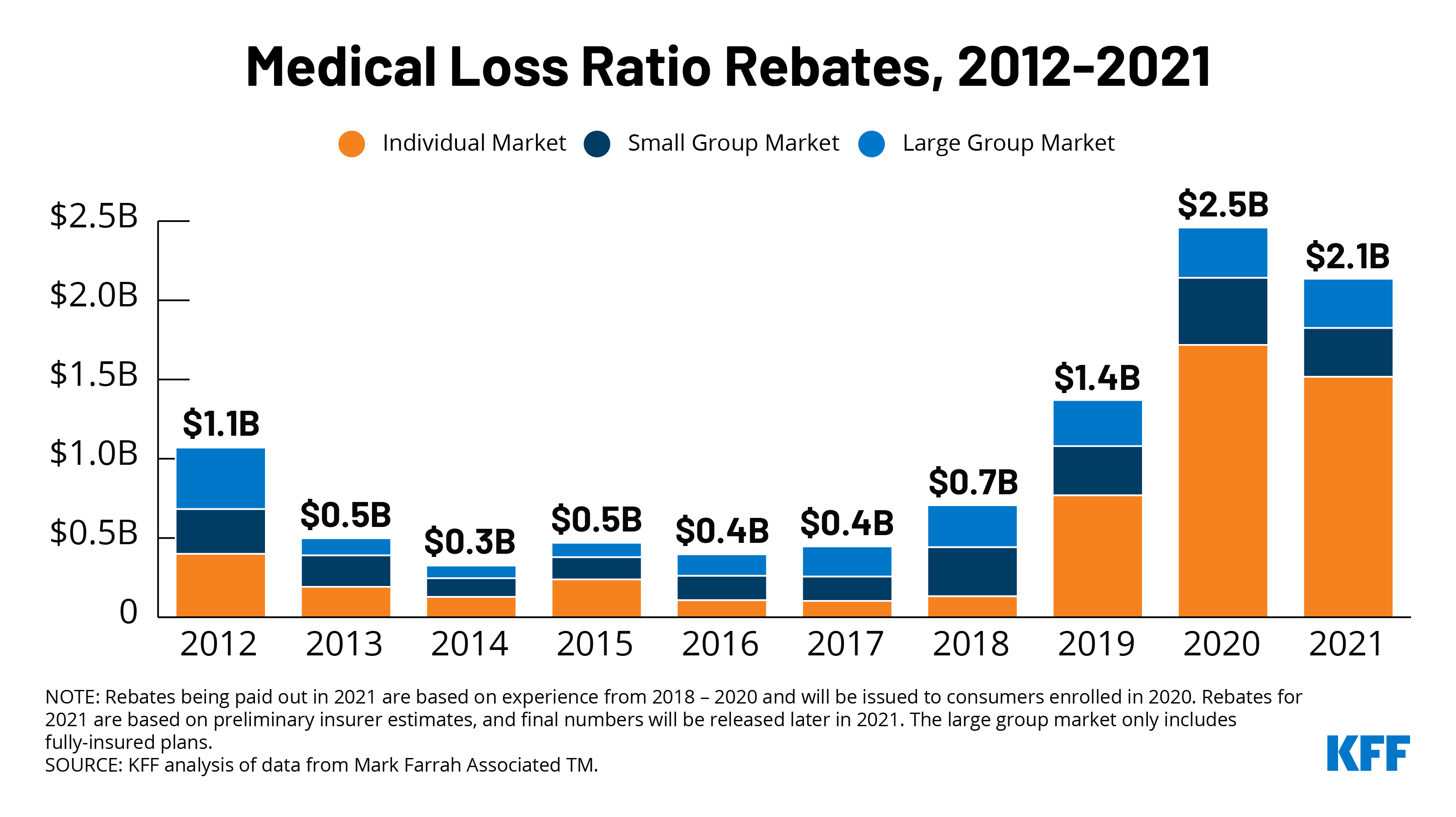

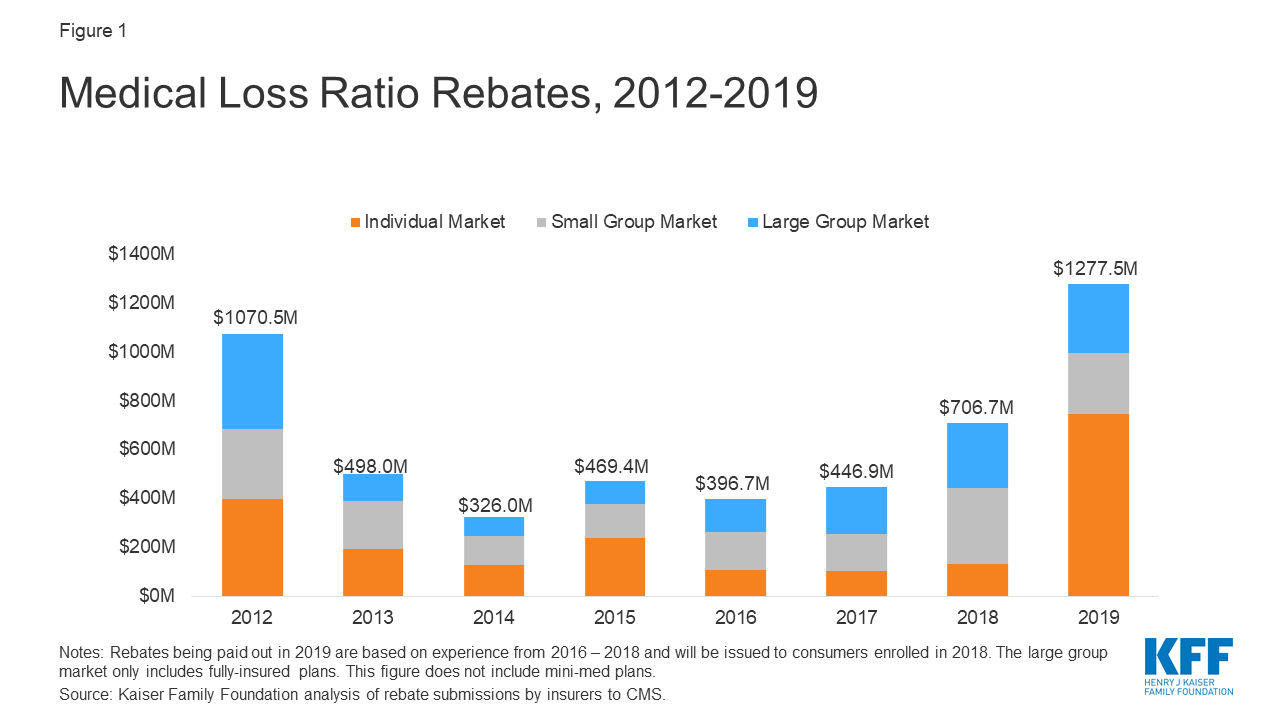

Data Note 2021 Medical Loss Ratio Rebates KFF

https://www.kff.org/wp-content/uploads/2021/04/TWITTER-Medical-Loss-Ratio-Rebates-2012-2021_1.png

The Federal Medical Loss Ratio Rule

https://s3.studylib.net/store/data/007947936_1-45386f90c0d2a3ef4ff24518ae593405-768x994.png

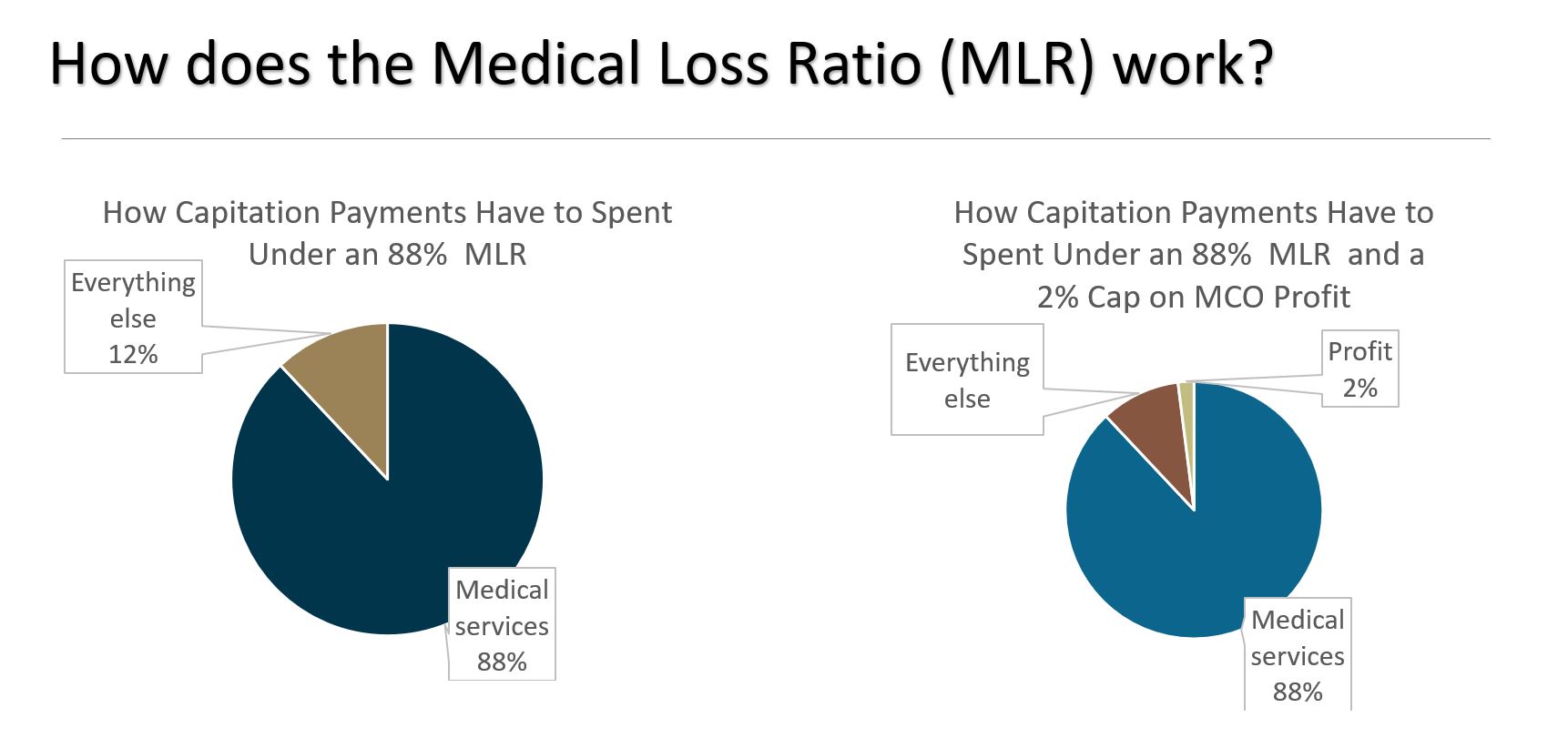

Medicaid Concepts Medical Loss Ratio Mostly Medicaid

http://www.mostlymedicaid.com/wp-content/uploads/2021/01/MLR.jpg

The medical loss ratio regulation outlines disclosure and reporting requirements how insurance companies will calculate their medical loss ratio and provide rebates and how adjustments could be made to the medical loss ratio standard to guard against market destabilization Medical Loss Ratio MLR FAQs On December 7 2011 the Department of Health and Human Services HHS issued final rules on the calculation and payment of medical loss ratio MLR rebates to health insurance policyholders Rebates are scheduled to begin being paid during 2012

Medical care ratio MCR also known as medical cost ratio medical loss ratio and medical benefit ratio is a metric used in managed health care and health insurance to measure medical costs as a percentage of premium revenues 1 What is the required Medical Loss Ratio as outlined under the regulation Individual and Small Group Market 80 percent Large Group 85 percent What defines the small and large group markets The Act defines Small Group as plans having 1 50 total average employees based on the preceding calendar year

/GettyImages-587169055-5abbd92e1d64040036eb83c2.jpg)

What Is The Medical Loss Ratio And Why Does It Matter

https://www.verywellhealth.com/thmb/rN3fy_i_tFhld5q1pT5pVQfzOgs=/5163x3480/filters:fill(87E3EF,1)/GettyImages-587169055-5abbd92e1d64040036eb83c2.jpg

What To Know About Medical Loss Ratios EBW Financial Planning

http://static.fmgsuite.com/media/CustomEmailImage/originalSize/aea83d73-0f36-4f8f-b01b-e9ce0c7d979c.png

https://www.cms.gov/.../medical-loss-ratio

The Affordable Care Act requires health insurance issuers to submit data on the proportion of premium revenues spent on clinical services and quality improvement also known as the Medical Loss Ratio MLR It also requires them to issue rebates to enrollees if this percentage does not meet minimum standards

https://content.naic.org/cipr-topics/medical-loss-ratio

Do Health Insurers Manage Their Medical Cost Ratios At What Cost Journal of Insurance Regulation 2021 The Differential Effects of Medical Loss Ratio Regulation on the Individual Health Insurance Market Journal of Insurance Regulation 2019 U S Health Insurance Industry Analysis Report

Medical Loss Ratio Rebate 2023 Rebate2022

/GettyImages-587169055-5abbd92e1d64040036eb83c2.jpg)

What Is The Medical Loss Ratio And Why Does It Matter

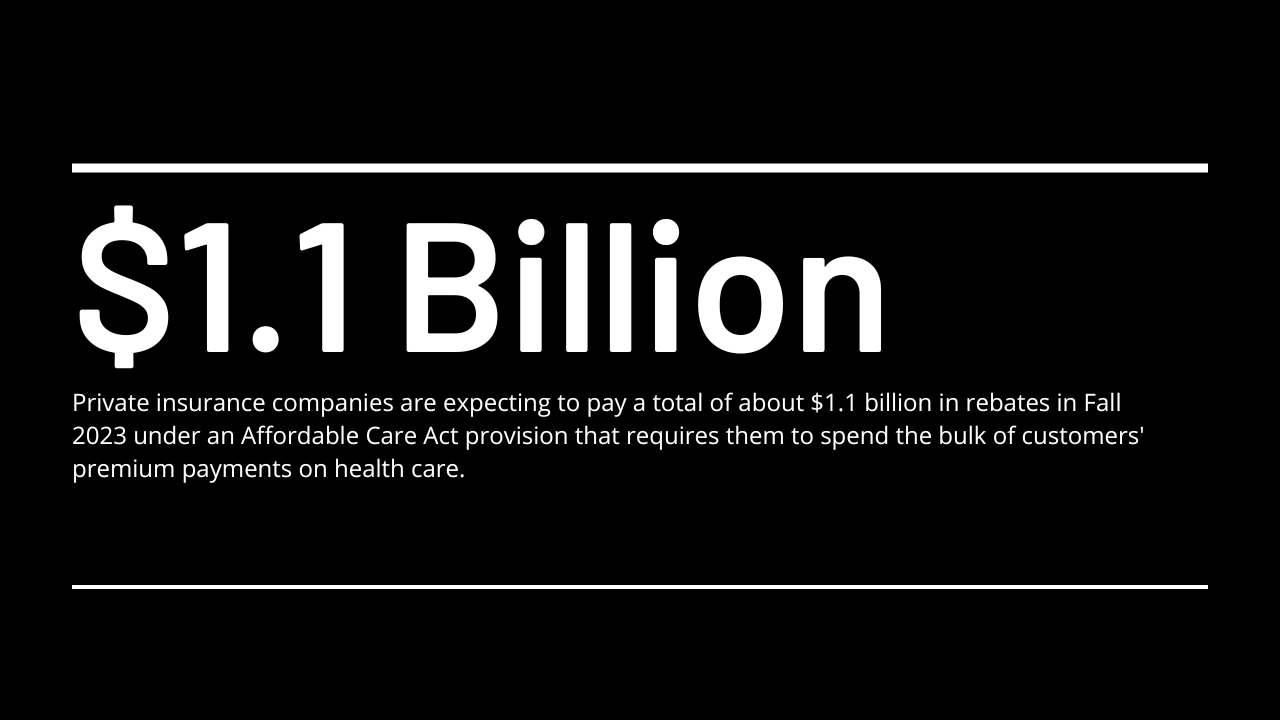

2023 Medical Loss Ratio Rebates Prescription Savings Card

Medicaid Concepts Medical Loss Ratio Mostly Medicaid

Medical Loss Ratio What It Is And How It Works

Don t Spend That Medical Loss Ratio Rebate Yet

Don t Spend That Medical Loss Ratio Rebate Yet

Medical Plans With Stop Loss RMC Group Insurance

How To Choose The Right Health Insurance Cover Medical Health

How The Medical Loss Ratio Impacts Mississippi Center For Mississippi

Health Insurance Medical Loss Ratio - In broad terms a medical loss ratio MLR measures the share of enrollee premiums that health insurance companies spend on medical claims as opposed to other non claims expenses such as administration or profits Many states as the primary regulators of health insurance have their own MLR requirements