Health Insurance Premium Tax Deduction Rules Health insurance premiums represent the monthly amount paid to maintain an insurance policy but don t include deductibles and co pays You can deduct your health insurance premiums and healthcare

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get heath

Health Insurance Premium Tax Deduction Rules

Health Insurance Premium Tax Deduction Rules

https://www.patriotsoftware.com/wp-content/uploads/2021/06/health-insurance-pre-tax-1.png

Tax Deduction Rules For Self employed Person Ungrounded Thinking

https://ungroundedthinking.com/wp-content/uploads/2021/06/13-1024x683.jpg

Tax Deduction Rules For 529 Plans What Families Need To Know College

https://i.pinimg.com/originals/de/60/7c/de607c8b7bca6d071b488e7be6b27938.jpg

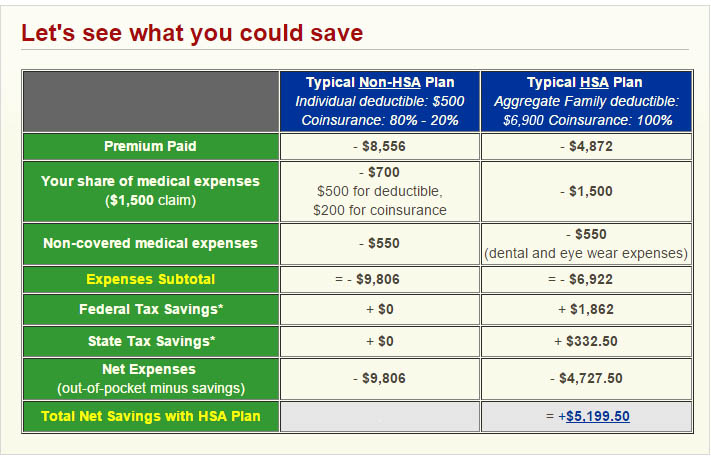

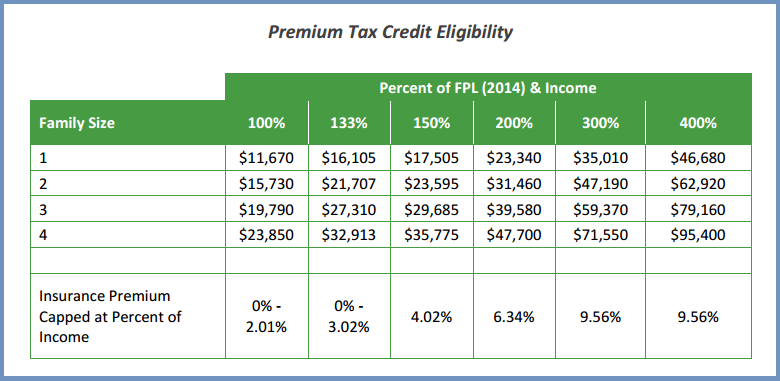

Health insurance premiums can count as a tax deductible medical expense along with other out of pocket medical expenses if you itemize your deductions You can only deduct medical expenses Amounts paid for insurance premiums to cover medical care or qualified long term care Certain costs related to nutrition wellness and general health are considered medical

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains Can you deduct health insurance premiums Learn about pre and post tax deductions for medical expenses and the rules for deducting premiums with H R Block

Download Health Insurance Premium Tax Deduction Rules

More picture related to Health Insurance Premium Tax Deduction Rules

Rules For Business Vehicle Tax Deductions Podcast 131 Do You Know

https://i.pinimg.com/originals/81/20/e5/8120e557da22b89becca204f251ff7ad.png

Is Health Insurance Premium Tax Deductible Health Insurance Premium

http://www.hsaforamerica.com/images/hsa-tax-premium-savings-3.jpg

The HMRC Home Office Tax Deduction Rules

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110caa30ac41d7943be1376_60d8291523d85b36c5631154_Use-of-home-as-office.jpeg

Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few taxpayers Generally you are allowed to deduct health insurance rates on your taxes if you itemize your deductions pay your health insurance premiums directly and your medical expenses totaled more than 7 5 of your income

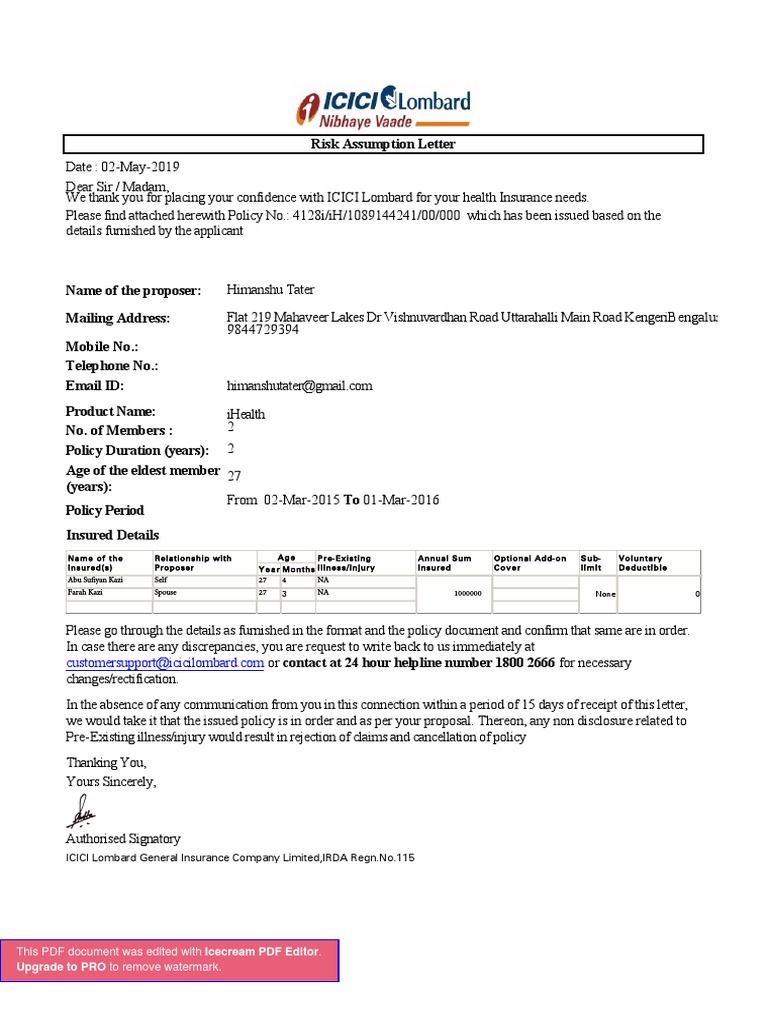

This article will explain how tax deductibility works for health insurance premiums including how the rules differ depending on whether you re self employed and how much you You can claim certain tax deductions for paying premiums of health insurance plans for yourself and your family You need to pay the health insurance premiums by March

Insurance Premium Tax Deduction Financial Health Blog

https://financialhealthblog.com/wp-content/uploads/2021/09/tax-calculation-big.jpg

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

https://i1.wp.com/goneonfire.com/wp-content/uploads/2019/12/014b_Which-is-Better_-Paying-Health-Insurance-Premiums-Pre-Tax-or-Post-Tax_.png?fit=1200%2C800&ssl=1

https://www.investopedia.com

Health insurance premiums represent the monthly amount paid to maintain an insurance policy but don t include deductibles and co pays You can deduct your health insurance premiums and healthcare

https://blog.turbotax.intuit.com › health-c…

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the

Anything To Everything Income Tax Guide For Individuals Including

Insurance Premium Tax Deduction Financial Health Blog

Charitable Contributions Tax Deduction Rules And Suggestions The

A Guide To Insurance Premium Tax Increase 2016 YouTube

Medical Insurance Premium Receipt 2019 20 Deductible Insurance

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Tax Deduction Rules For 529 Plans What Families Need To Know College

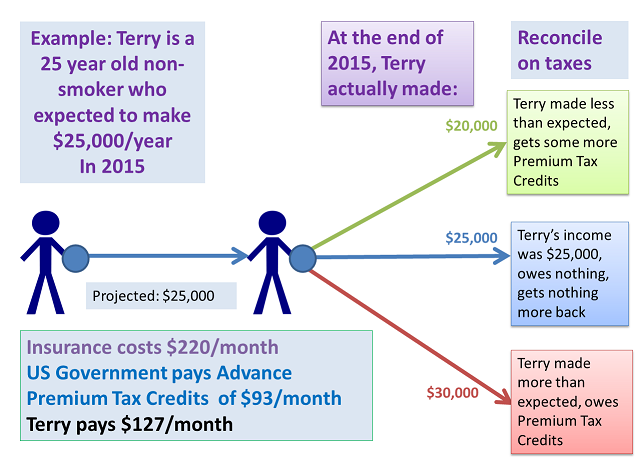

FAQs Health Insurance Premium Tax Credits

Filing Taxes And Marketplace Health Insurance Form 8962 Healthcare

Health Insurance Premium Tax Deduction Rules - Can you deduct health insurance premiums Learn about pre and post tax deductions for medical expenses and the rules for deducting premiums with H R Block