Health Savings Account Tax Advantages A health savings account HSA is a tax advantaged savings account for medical expenses like doctor visits prescription drugs and dental care

Health savings accounts HSAs offer triple tax advantages 1 tax deductible contributions tax deferred growth and tax free withdrawals for qualified medical expenses You can use an HSA account for a wide variety of qualified medical expenses including dental and vision care as well as over the counter medications A Health Savings Account HSA is a tax advantaged account to help you save for medical expenses that are not reimbursed by high deductible health plans HDHPs

Health Savings Account Tax Advantages

Health Savings Account Tax Advantages

https://i.insider.com/5e0a5eeb855cc20c6233052c?width=1200&format=jpeg

Poll Older Adults Are Missing Out On Health Savings Account Benefits

https://www.futurity.org/wp/wp-content/uploads/2021/09/health-savings-account-tax-advantages-older-adults-1600.jpg

What Is An HSA Health Savings Account Tax Advantages Draw Fans

https://s.yimg.com/ny/api/res/1.2/ogh12bXJ.tgwNvNYPnO1UQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en-US/video/video.ibd.com/002aa51f499467dd611890bf0e46bbfd

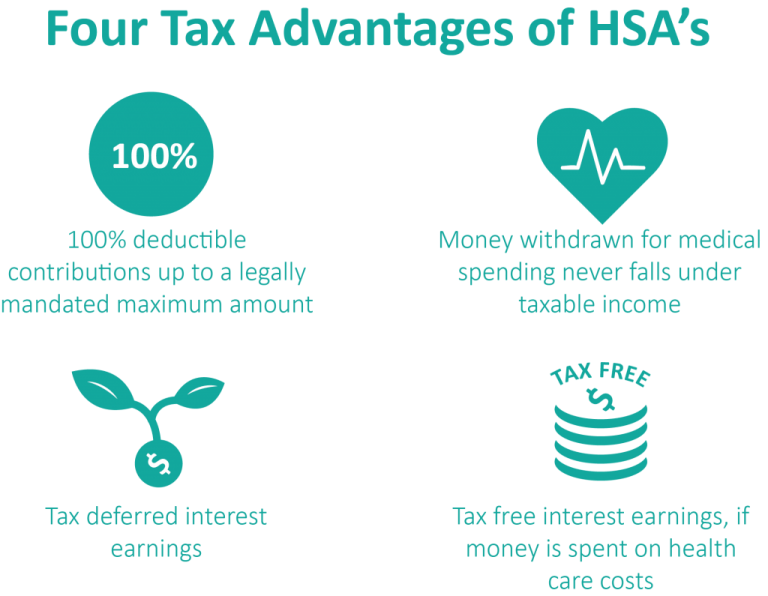

HSA tax deductions can have powerful benefits For instance someone in the 22 federal income tax bracket could potentially save nearly 30 in taxes federal income FICA potentially state income on every dollar contributed to the HSA That helps increase the amount of money you have for medical spending HSAs offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability If you contribute to an HSA or take a distribution you need to complete and file IRS Form 8889 with your tax return You have until April 15 2024 to make contributions to your HSA for 2023 up to the applicable annual limit

Health Savings Accounts offer a triple tax advantage deposits are tax deductible growth is tax deferred and spending is tax free All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income A health savings account is a tax advantaged savings account combined with a high deductible health insurance policy to provide an investment and health coverage Deposits to the HSA are tax deductible and grow tax free

Download Health Savings Account Tax Advantages

More picture related to Health Savings Account Tax Advantages

Health Savings Accounts Infographic Health Savings Account Savings

https://i.pinimg.com/736x/85/ac/ed/85acedd452ac1b06b2820902bcc45cbc--health-savings-account-savings-accounts.jpg

Discover The Tax Advantages Of Health Savings Accounts

https://www.marinerwealthadvisors.com/wp-content/uploads/2021/09/Discover-the-Tax-Advantages-of-Health-Savings-Accounts.jpg

The Best Health Savings Accounts HSA Providers Fidelity And Lively

https://www.mymoneyblog.com/wordpress/wp-content/uploads/2021/11/hsa_better.jpg

Contributions to HSAs offer valuable tax benefits Under U S tax law they are tax deductible even for those who do not itemize deductions reducing adjusted gross income AGI and potentially lowering tax liability Maximize the benefits of your Health Savings Account HSA with this comprehensive guide Learn about tax advantages eligibility contributions and how to make the most of your HSA for healthcare savings and retirement planning

[desc-10] [desc-11]

Tax Benefits Of Health Savings Accounts Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2023/06/23-optima-tax-benefits-HSA.png

Why You Should Create A Health Savings Account The Family Credit Union

https://www.familycu.com/wp-content/uploads/2018/10/HSA-min.jpg

https://www.investopedia.com › articles › personal...

A health savings account HSA is a tax advantaged savings account for medical expenses like doctor visits prescription drugs and dental care

https://www.fidelity.com › learning-center › smart...

Health savings accounts HSAs offer triple tax advantages 1 tax deductible contributions tax deferred growth and tax free withdrawals for qualified medical expenses You can use an HSA account for a wide variety of qualified medical expenses including dental and vision care as well as over the counter medications

Health Savings Accounts How HSAs Work And The Tax Advantages

Tax Benefits Of Health Savings Accounts Optima Tax Relief

Benefits Of Having A Health Savings Account Tax Savings Investment

The Under Utilized Benefits Of A Health Savings Account Why To Use

What Is A Health Savings Account HSA SavingsOak

Top 7 HSA Benefits Health Savings Account Advantages Health Savings

Top 7 HSA Benefits Health Savings Account Advantages Health Savings

How Medicare Affects Your Health Savings Account Health Savings

How A Health Savings Account Can Lower Tax CowderyTax

What Is A Health Savings Account Money

Health Savings Account Tax Advantages - Health Savings Accounts offer a triple tax advantage deposits are tax deductible growth is tax deferred and spending is tax free All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income