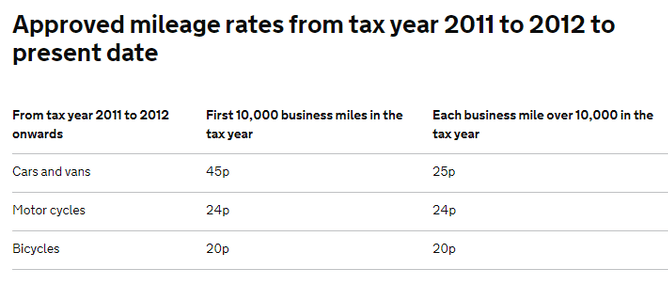

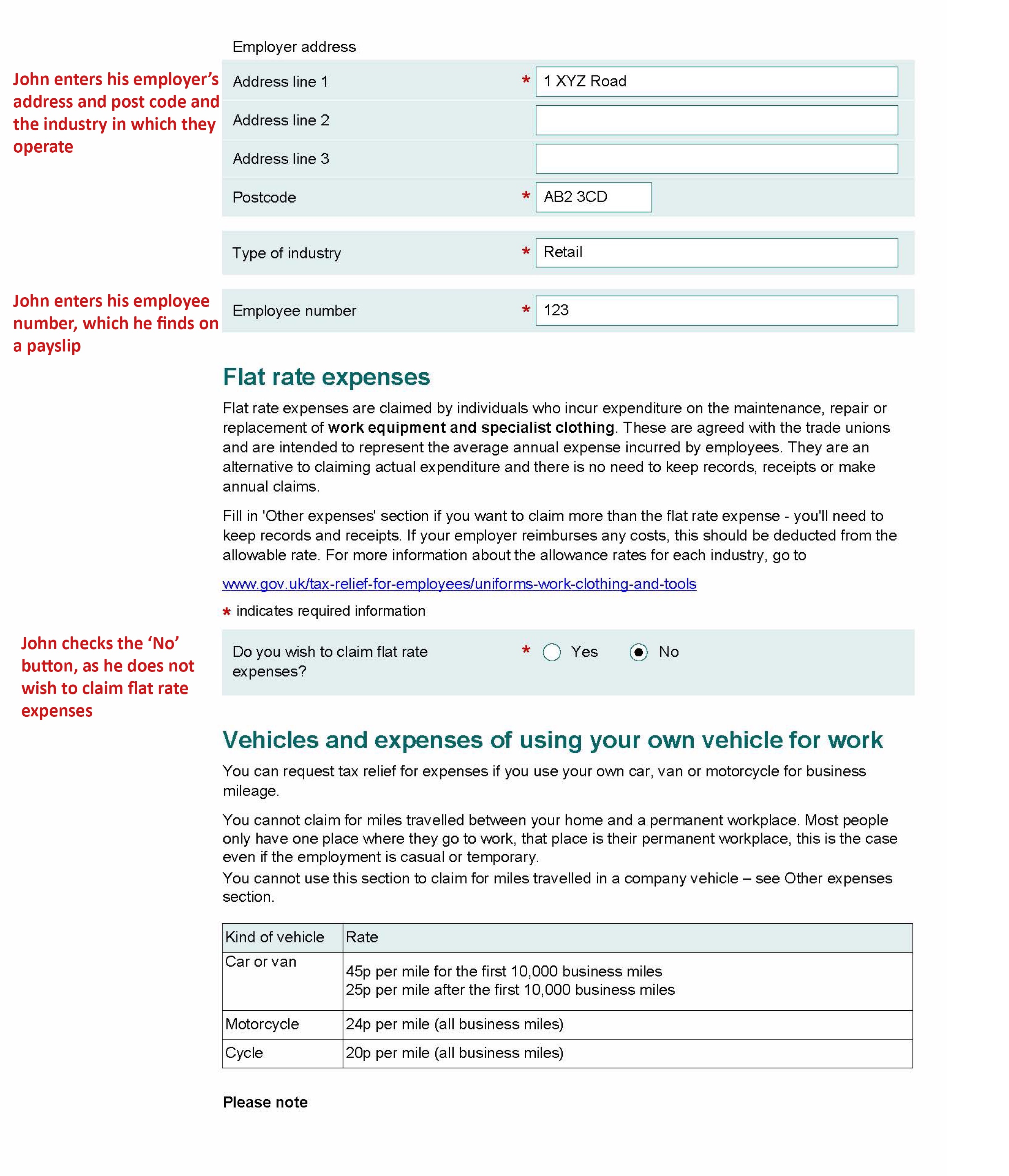

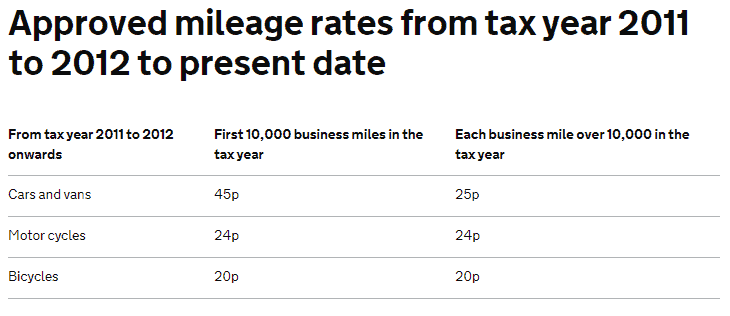

Hmrc Mileage Tax Rebate Web Updated 5 April 2023 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for carrying

Web 1 ao 251 t 2023 nbsp 0183 32 You can claim mileage tax relief at the end of the tax year from HMRC To qualify here s what you need to do Keep accurate records of your business mileage Web The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances Published 13

Hmrc Mileage Tax Rebate

Hmrc Mileage Tax Rebate

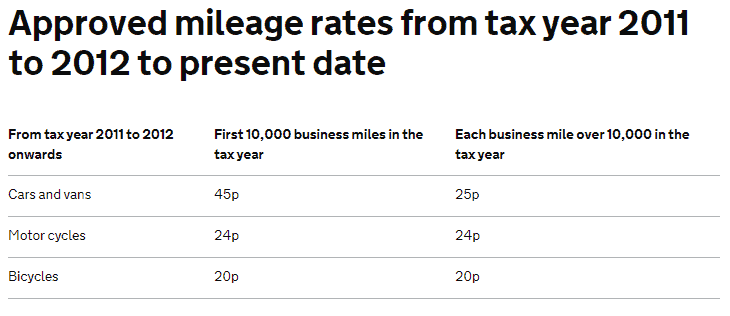

https://printablerebateform.net/wp-content/uploads/2022/09/HMRC-Tax-Rebate-Form.png

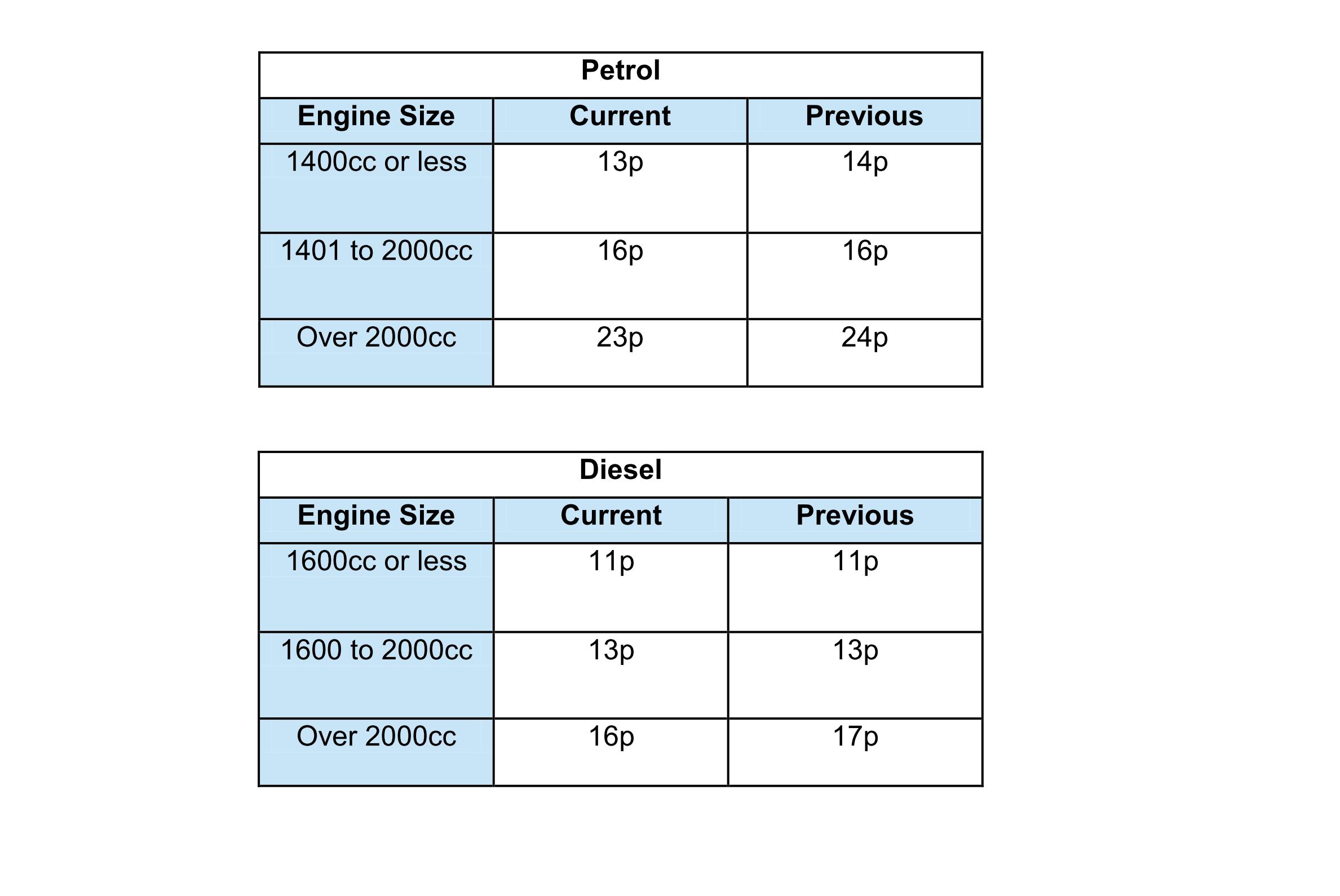

Hmrc Business Mileage Rates 2016 17

http://www.sappscarpetcare.com/wp-content/uploads/2019/06/hmrc-business-mileage-rates-2016-17.jpg

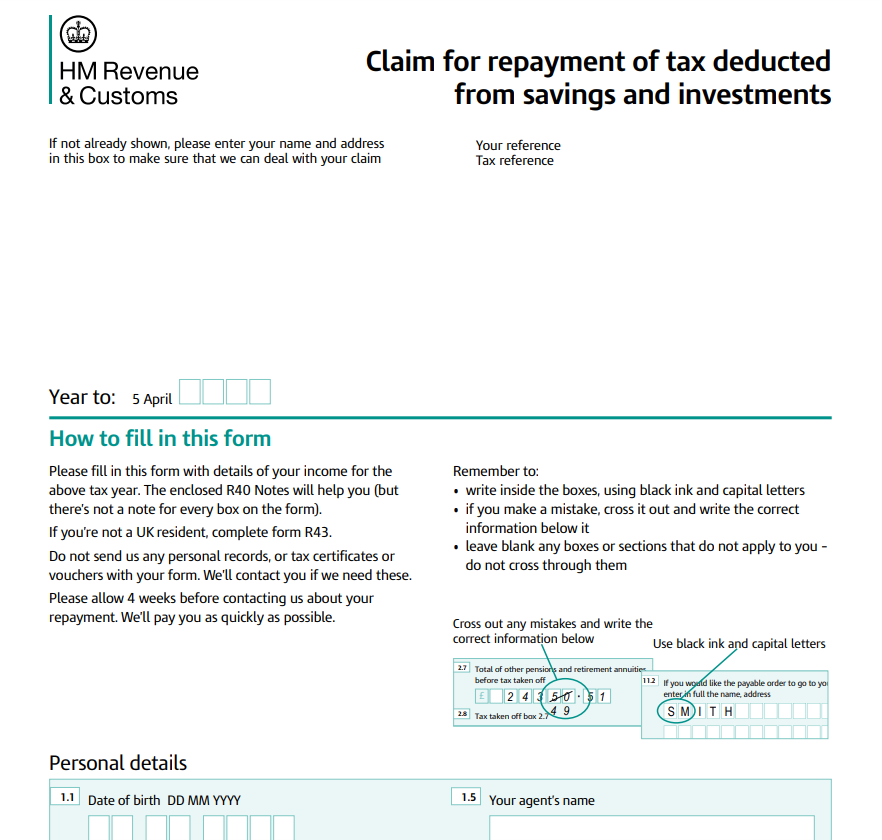

2011 Form UK HMRC P87 Fill Online Printable Fillable Blank PDFfiller

https://www.pdffiller.com/preview/100/57/100057253/large.png

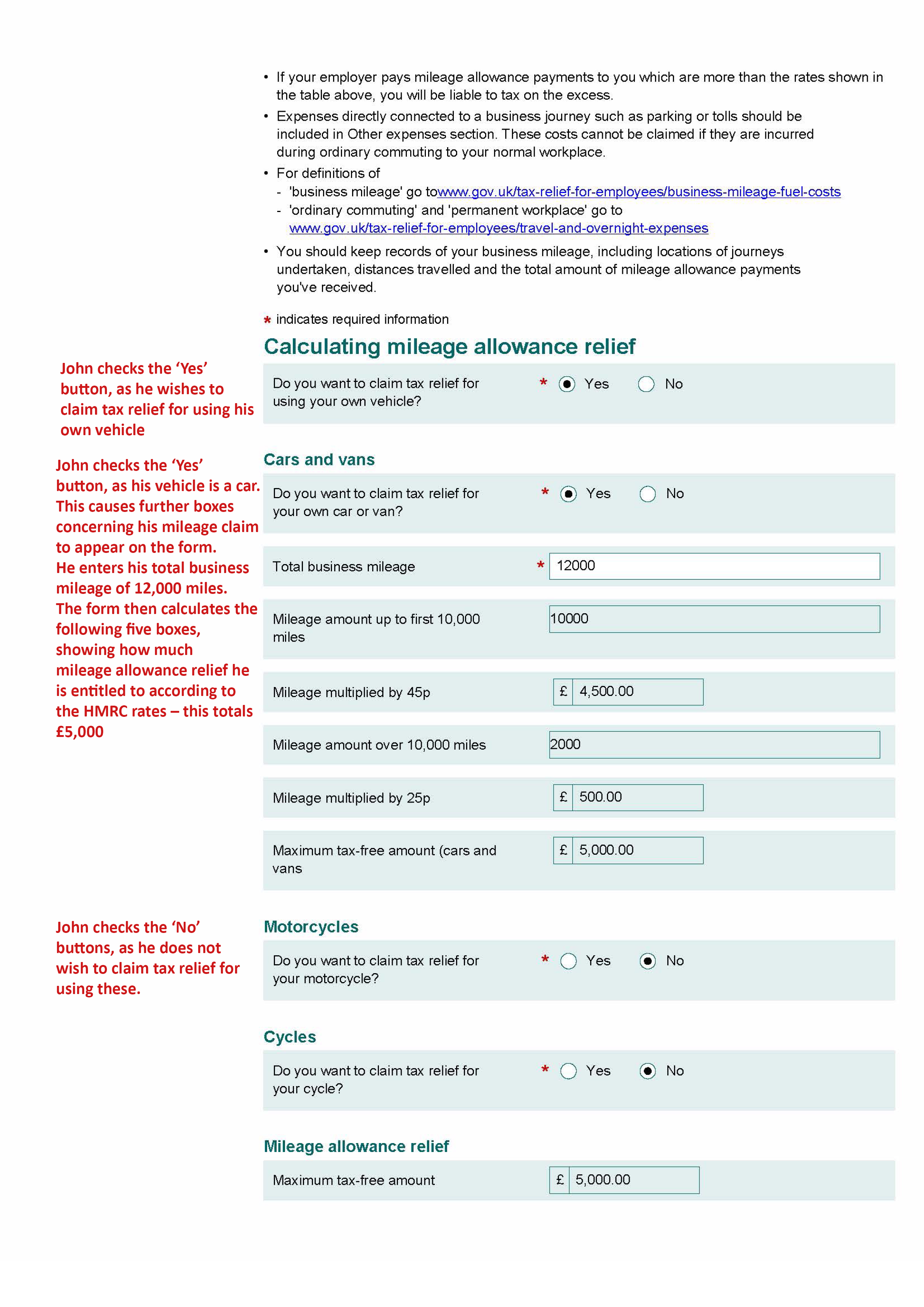

Web 11 oct 2021 nbsp 0183 32 How Do I Claim Tax Relief from HMRC Mileage tax relief isn t automatically added to your annual return You have to file a claim with HMRC and you have up to four years from the end of the tax year to Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

Web You can claim tax relief if you have to work from home for example because your job requires you to live far away from your office your employer does not have an office Web 9 juin 2023 nbsp 0183 32 You can claim over 45p tax free as a business mileage allowance if you use your own car for a business journey UK mileage rates can differ however HMRC

Download Hmrc Mileage Tax Rebate

More picture related to Hmrc Mileage Tax Rebate

PSA HMRC Will Not E mail Or Call You About Tax Rebates CasualUK

https://i.imgur.com/NPT0C0n.png

HMRC Give Tax Relief Pre approval Save The Thorold Arms

https://i0.wp.com/save.thethoroldarms.co.uk/wp-content/uploads/2016/06/20160525-EIS-Tax-Rebate-Letter-from-HMRC.jpg?w=2368&ssl=1

HMRC Approved Mileage Rates From 2011 12 Onwards

https://www.sexaccountants.co.uk/images/blog/4c0d4a7e67711dc551daf16d7d8b3955__5cb1/zoom668x284z100000cw668.png?etag=41d541899f8597af103bf7f6f59b437b

Web We provide a easy and quick way for claiming your mileage allowance rebate We only need a few details from you in order for our accountants to review your claim and Web 8 mars 2023 nbsp 0183 32 In this post you can find our HMRC mileage claim calculator which calculates your mileage allowance using the mileage rate for 2022 and 2023 provided by HMRC The mileage claim calculator can be used

Web If you are required to use your own vehicle for work you may be able to claim Mileage Allowance Relief from HMRC based on the number of business miles you travel This tax Web 1 oct 2020 nbsp 0183 32 If an employer pays less than this or no cycle mileage rate at all which is not a good thing of course an employee can still claim tax relief by contacting HMRC Her

Mileage Allowance A Simple Guide UK

https://triplogmileage.com/wp-content/uploads/2021/04/hmrc-Approved-mileage-rates.png

HMRC Mileage Rates UK 2021 2022 Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2021/08/Screenshot-2021-08-12-at-19.38.46-2048x884.png

https://www.gov.uk/.../travel-mileage-and-fuel-rates-and-allowances

Web Updated 5 April 2023 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for carrying

https://www.driversnote.co.uk/hmrc-mileage-guide/mileage-allowance-relief

Web 1 ao 251 t 2023 nbsp 0183 32 You can claim mileage tax relief at the end of the tax year from HMRC To qualify here s what you need to do Keep accurate records of your business mileage

Hmrc P87 Printable Form Printable Forms Free Online

Mileage Allowance A Simple Guide UK

Hmrc Mileage Rates 2021 Own Car

HMRC Tax Return Get The Information You Need

Hmrc P87 Printable Form Printable Forms Free Online

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance Blog

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance Blog

HMRC P60 FORM PDF

Business Mileage Reimbursement Hmrc Ethel Hernandez s Templates

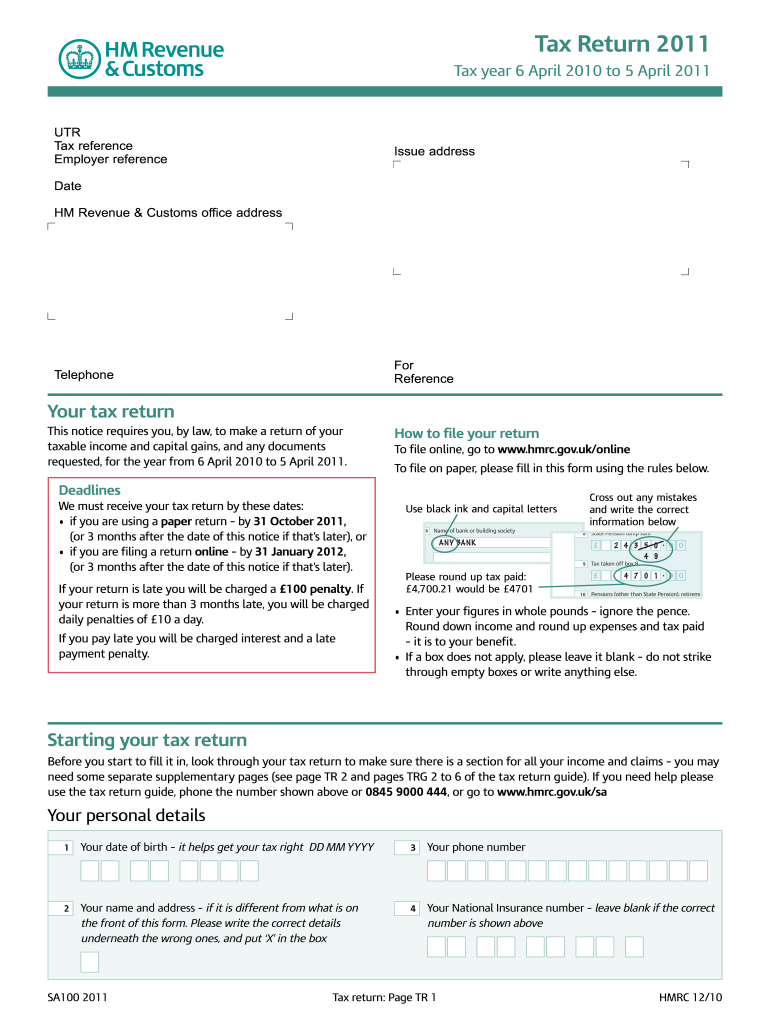

UK HMRC SA100 2011 Fill And Sign Printable Template Online US Legal

Hmrc Mileage Tax Rebate - Web The work mileage tax rebate is a tax refund given when employees use their personal vehicles for work reasons but their employers pay them below the HMRC standard