Tax Rebate On Housing Loan For Plot Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Web 12 janv 2023 nbsp 0183 32 1 Plot Loan Tax Benefits under Section 80C Section 80C of the Income Tax Act 1961 states a plot owner can claim a tax rebate on a plot loan up to Rs 1 50 Web 30 sept 2022 nbsp 0183 32 Tax benefit under Section 24 for the plot loan After the house is built and occupied you can receive an additional tax

Tax Rebate On Housing Loan For Plot

Tax Rebate On Housing Loan For Plot

https://roofandfloor.thehindu.com/raf/real-estate-blog/wp-content/uploads/sites/14/2017/04/thumbnail_MoU-for-home-loan-rebate_Banner-840x560.jpg

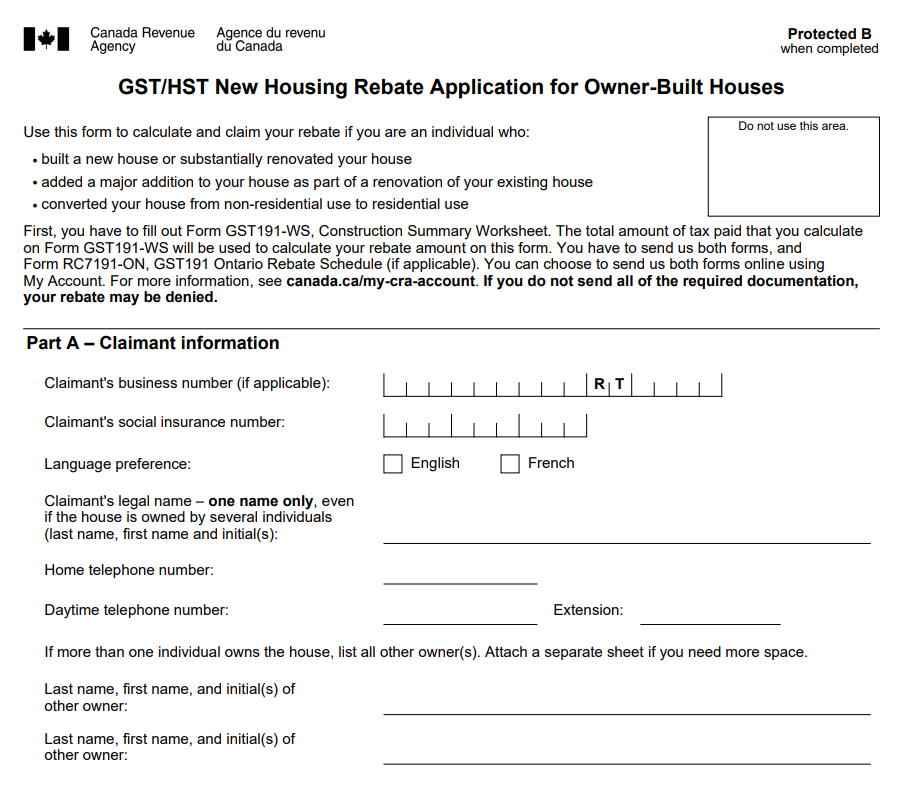

Ontario New Housing Rebate Form 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/Ontario-New-Housing-Rebate-Form-2023.png

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

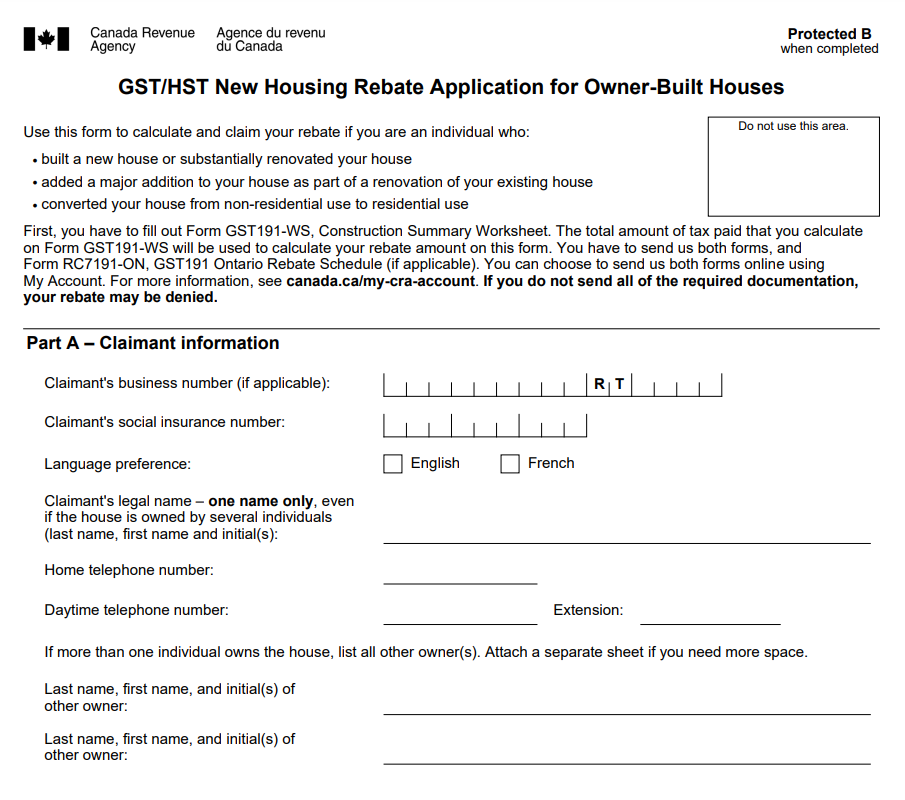

Web Plot loan tax benefit under Section 24 Once the construction is completed and you begin living in your newly constructed home you can also get tax benefits on the interest portion of the loan You are entitled to an annual Web You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only

Web 12 mai 2021 nbsp 0183 32 Loan for plots Yes you can A plot loan is used for buying a piece of land that could be developed later for residential purposes by the borrower for self use Web Home Loan Tax Benefit Income Tax Deduction on Housing Loan in 2022 Owning a house is every individual s dream In order to encourage citizens to invest in a property

Download Tax Rebate On Housing Loan For Plot

More picture related to Tax Rebate On Housing Loan For Plot

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web 1 sept 2014 nbsp 0183 32 Taux de la r 233 duction Investissement 12 pour les investissements r 233 alis 233 s en m 233 tropole et 23 pour les investissements r 233 alis 233 s dans les DOM Web 27 nov 2020 nbsp 0183 32 You may claim tax benefit on HRA and home loan simultaneously Rental accommodation and house property can be in same or different cities HRA tax benefit

Web 26 juil 2018 nbsp 0183 32 Q 1 What are Income tax benefits of taking and repaying a housing loan under EMI Plan You will be eligible to claim both the interest and principal components Web 28 juil 2023 nbsp 0183 32 The Income Tax Act 1961 has certain clauses that allow exemptions on LTCG Section 54 and Section 54F offer tax exemption on LTCG if the following

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

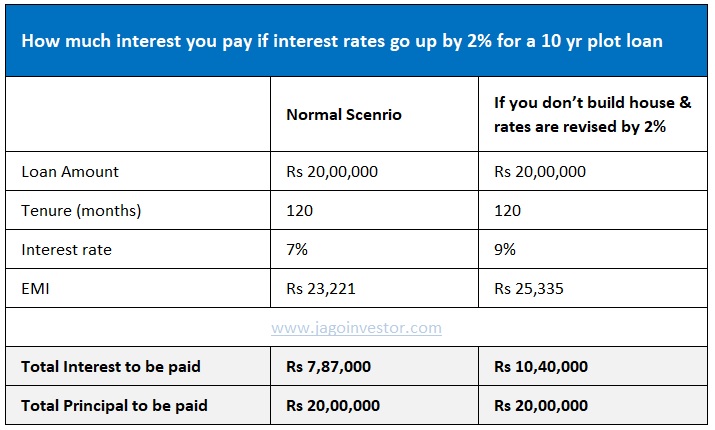

Ontario New Housing Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

https://www.tatacapital.com/blog/loan-for-home/all-about-plot-loan-tax...

Web 12 janv 2023 nbsp 0183 32 1 Plot Loan Tax Benefits under Section 80C Section 80C of the Income Tax Act 1961 states a plot owner can claim a tax rebate on a plot loan up to Rs 1 50

Property Tax Rebate Application Printable Pdf Download

Home Loan Tax Benefit Calculator FrankiSoumya

Can You Get A Plot Loan If You Don t Want To Construct A House

FREE 8 Loan Receipt Templates Examples In MS Word PDF

84 Can You Apply For Housing Benefit Online Page 3 Free To Edit

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Gst New Housing Rebate Application Form Printable Rebate Form

Microfinance Loan Application Form

Tax Rebate On Housing Loan For Plot - Web 12 mai 2021 nbsp 0183 32 Loan for plots Yes you can A plot loan is used for buying a piece of land that could be developed later for residential purposes by the borrower for self use