Who Can Claim Tax Benefit On Housing Loan Verkko 18 jouluk 2023 nbsp 0183 32 Who is eligible to claim tax deductions on home loans The property owner is eligible to claim tax benefits and if the spouse is a co borrower they can

Verkko 11 tammik 2023 nbsp 0183 32 First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the Verkko 5 helmik 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C

Who Can Claim Tax Benefit On Housing Loan

Who Can Claim Tax Benefit On Housing Loan

https://www.frenchentree.com/wp-content/uploads/2022/01/advertise-g9fb846c5a_1920.jpg

Income Tax Benefit On Second Home Loan Complete Guide

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Verkko 26 hein 228 k 2018 nbsp 0183 32 Yes you can claim income tax exemption if you are a co applicant in a housing loan as long as you are also the owner or co owner of the property in Verkko You must be a co owner in the property To be able to claim tax benefits for a home loan you must be an owner in the property Many a time a loan is taken jointly but

Verkko 26 huhtik 2022 nbsp 0183 32 For home loan repayment each co borrower can claim tax benefits under Section 80C upto Rs 1 50 lakhs every year together with other eligible items So you will get the tax benefits on Verkko 20 lokak 2023 nbsp 0183 32 You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of self occupied as well as vacant residential

Download Who Can Claim Tax Benefit On Housing Loan

More picture related to Who Can Claim Tax Benefit On Housing Loan

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Avail Tax benefit On Personal Loan MY Wicked Armor

https://www.mywickedarmor.com/wp-content/uploads/2021/02/Is-there-any-Tax-Benefit-on-Personal-Loan.jpg

Tax Benefits On Home Loan 2022 2023

https://www.aavas.in/uploads/images/blog/tax-benifits-2022-2023-aavasin-min-195380998.jpg

Verkko Who is eligible to claim tax deductions on housing loans Tax deduction can be claimed by the owner of the property If a home loan is taken jointly such as by a Verkko 10 hein 228 k 2020 nbsp 0183 32 Co own the property To be able to claim tax benefits for a home loan you must be an owner in the property Many times the loan is taken jointly but the borrower is not the owner according to the

Verkko 22 syysk 2023 nbsp 0183 32 Homeowners who bought houses before December 16 2017 can deduct interest on the first 1 million of the mortgage Claiming the mortgage interest deduction requires itemizing on your Verkko 20 elok 2018 nbsp 0183 32 Having done that the co owners of the property can claim deductions individually on the stamp duty amp registration charges interest and principal repayment

How To Claim Tax Benefits On Home Loan Bleu Finance

https://bleu-finance.com/wp-content/uploads/2021/05/Home-Loan0428.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

https://cleartax.in/s/home-loan-tax-benefits

Verkko 18 jouluk 2023 nbsp 0183 32 Who is eligible to claim tax deductions on home loans The property owner is eligible to claim tax benefits and if the spouse is a co borrower they can

https://housing.com/news/home-loans-guide …

Verkko 11 tammik 2023 nbsp 0183 32 First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

How To Claim Tax Benefits On Home Loan Bleu Finance

Who Can Claim Tax Deduction Under Section 80CCC IndianWeb2

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Who Can Claim Tax Deduction Under Section 80CCC

Who Can Claim Tax Deduction Under Section 80CCC

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

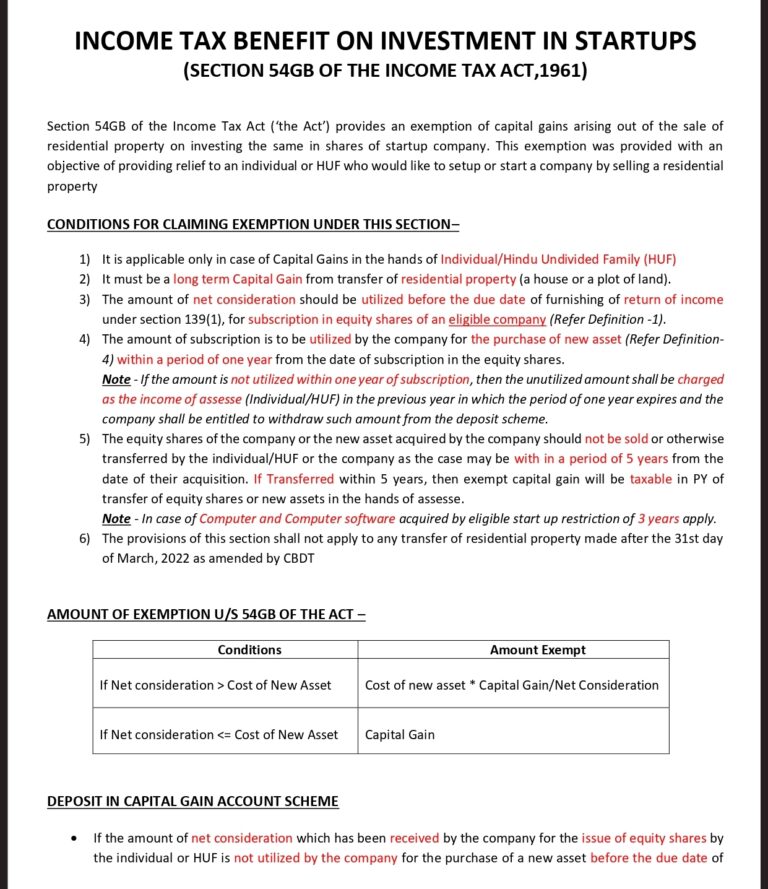

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Income Tax Benefits On Housing Loan In India

Who Can Claim Tax Benefit On Housing Loan - Verkko If you have a joint home loan account with IDFC First Bank each borrower can claim home loan tax benefit on the taxable income The borrowers should be joint owners