Hmrc Number For Tax Rebate Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

Am I eligible for a tax rebate You are eligible for a tax rebate if you ve overpaid any tax or have yet to claim certain tax refunds such as a uniform tax refund To get a rebate on any taxes you have overpaid you can When HMRC has worked out who is owed a tax rebate they send tax calculation letters between June and the end of November How long it takes to get your refund depends

Hmrc Number For Tax Rebate

Hmrc Number For Tax Rebate

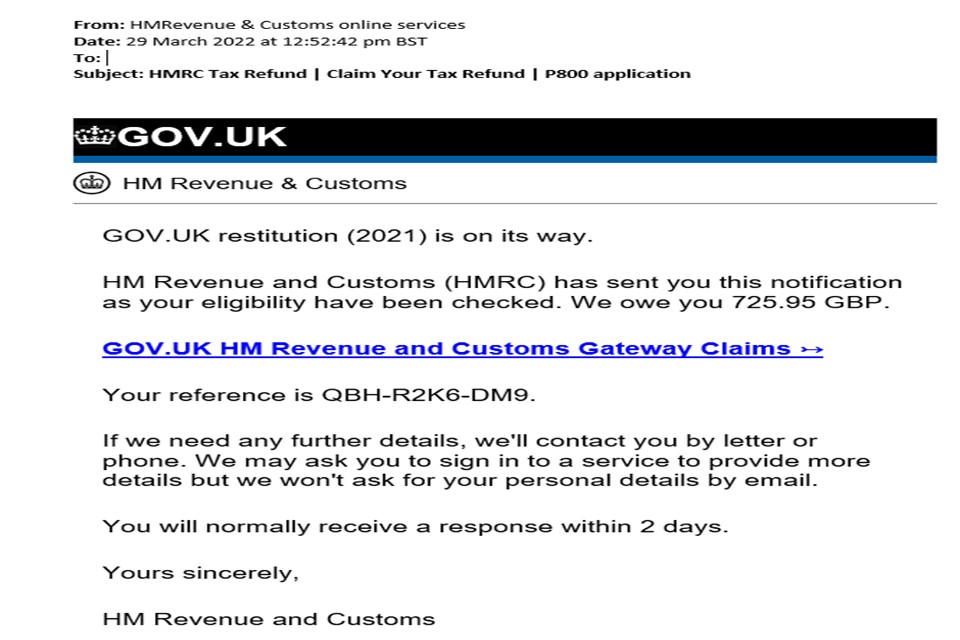

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/149506/Example_of_a_scam_email.jpg

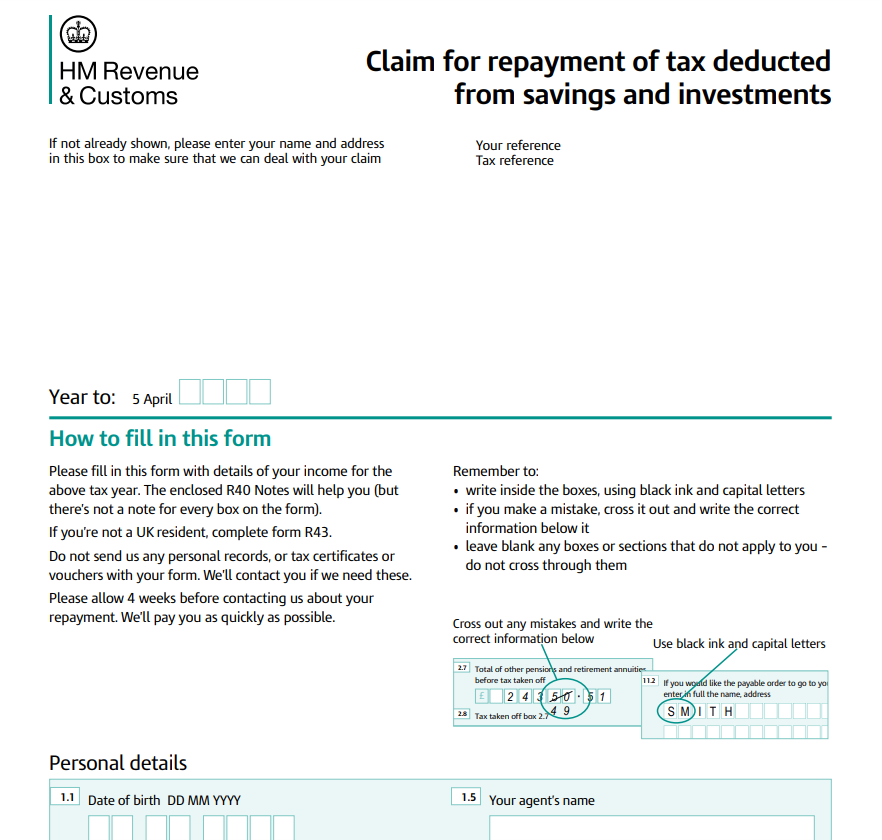

Hmrc Tax Return Self Assessment Form PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/09/HMRC-Tax-Rebate-Form.png

HMRC EoghannAsa

https://forrestbrown.co.uk/wp-content/uploads/2021/03/Example-HMRC-compliance-check-nudge-letter.png

If you believe you have overpaid tax and don t receive a P800 you can initiate the refund process by contacting HMRC directly This can be done either by phone or online through the official In many instances HMRC calculates overpaid tax automatically and sends a P800 form to explain how to claim that money back If this hasn t happened and you think you re owed a refund you can go through HMRC s

You can request your cheque be reissued to a nominee with a UK bank account The cheque would come in their name but it would have no tax implications To allow us to Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300

Download Hmrc Number For Tax Rebate

More picture related to Hmrc Number For Tax Rebate

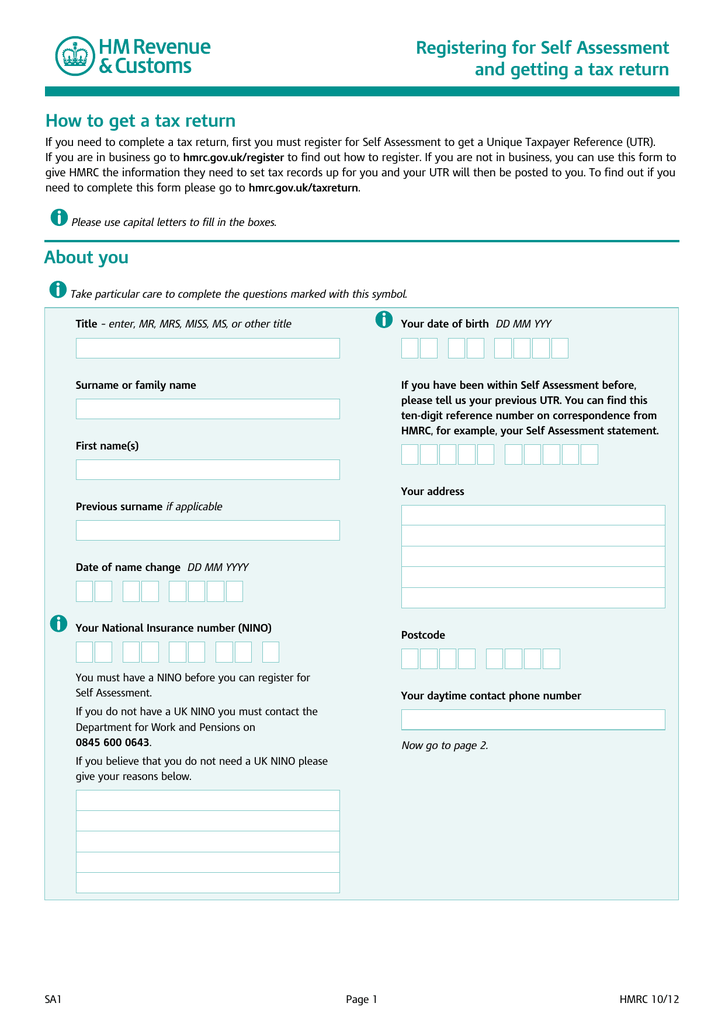

Filing A Paper Self assessment Tax Return You Must Act Now To Avoid A

https://www.moneysavingexpert.com/content/dam/mse/editorial-image-library/homepage/hero-homepage-hmrc-tax-return-income-allowance.jpg

New National Insurance Number Letter Aspiring Training

https://www.aspiringtraining.co.uk/wp-content/uploads/2015/01/HMRC-Tax-code.jpg

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

Please use the income tax calculator Estimate your Income Tax for the current year to include your total income and calculate tax due If you believe you are due a What to do if you need to pay more tax or you re due a refund including P800 tax calculations from HM Revenue and Customs HMRC

When will I receive my tax rebate You can use HMRC s online checker to see when you are due a payment or response After applying for a rebate you should be sent the I had a notification I was due a tax refund so logged in and claimed it with my bank details I ve checked this morning and it says that the refund was issued yesterday but no

HMRC Still Suspects QROPS Are Breaking Pension Rules IExpats

https://www.iexpats.com/wp-content/uploads/2015/11/HMRC.jpg

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

https://www.depledgeswm.com/wp-content/uploads/2018/04/HMRC-scaled-1024x683.jpeg

https://www.gov.uk/government/organisations/hm...

Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

https://www.unbiased.co.uk/discover/ta…

Am I eligible for a tax rebate You are eligible for a tax rebate if you ve overpaid any tax or have yet to claim certain tax refunds such as a uniform tax refund To get a rebate on any taxes you have overpaid you can

Find Your Personal UTR Number 2024

HMRC Still Suspects QROPS Are Breaking Pension Rules IExpats

Hmrc Tax Return

Malaysian Customs Declaration Forms DeclarationForm

HMRC Tax Archives Huston And Co

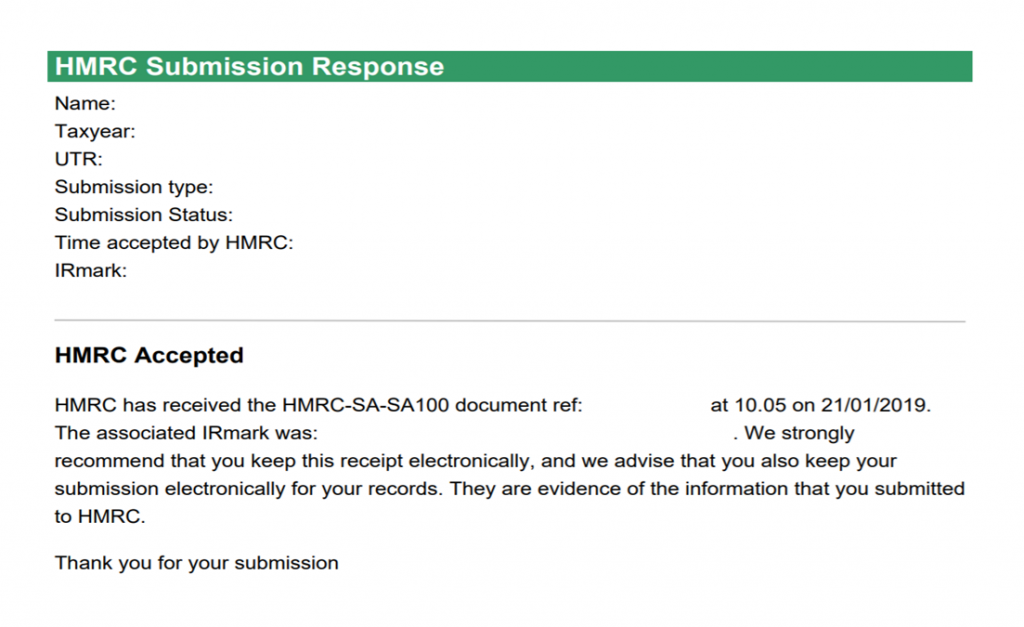

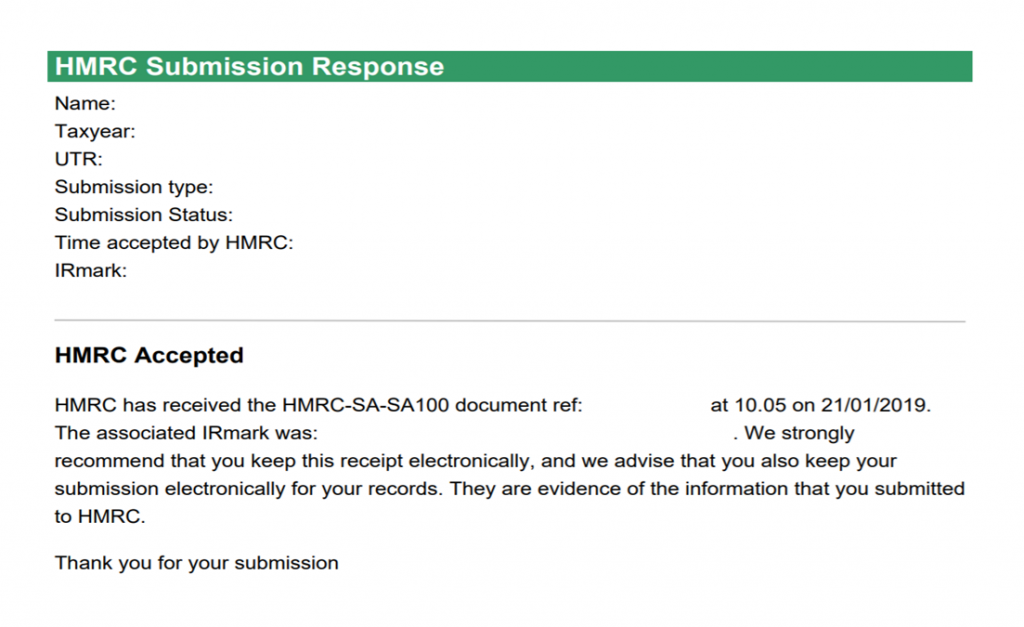

How To Check If Tax Return Was Accepted Tax Walls

How To Check If Tax Return Was Accepted Tax Walls

Hmrc Customs Contact Number

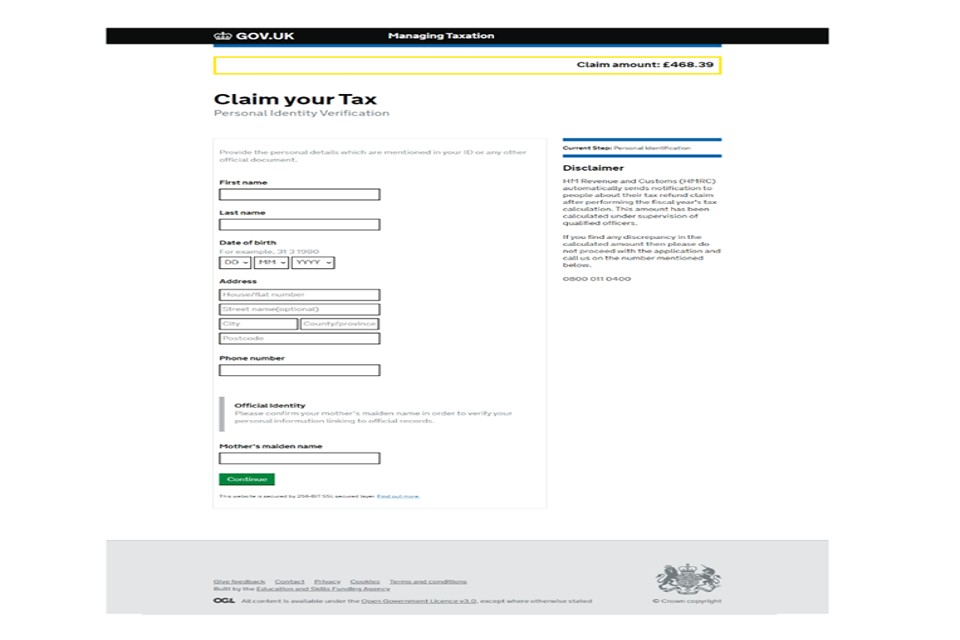

Examples Of HMRC Related Phishing Emails Suspicious Phone Calls And

HMRC Letter Action Required Before 8 April 2021 Alterledger

Hmrc Number For Tax Rebate - If you put your bank details in the tax return in theory HMRC should refund you the money directly by using that information within two to four weeks However most people don t put