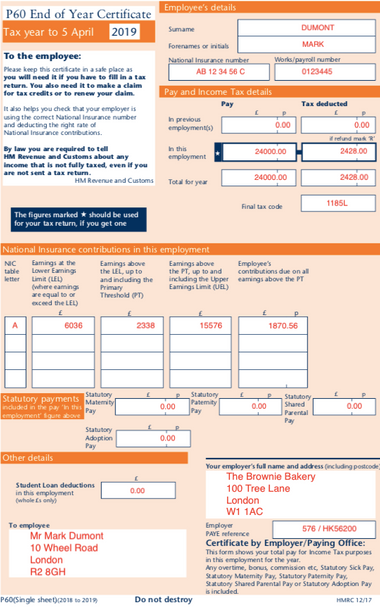

Hmrc Paye Reference Number Format A PAYE reference number or Employer Reference Number consists of a unique set of letters and numbers used by HMRC to identify your employer and their Pay As You Earn PAYE scheme The reference is in two parts

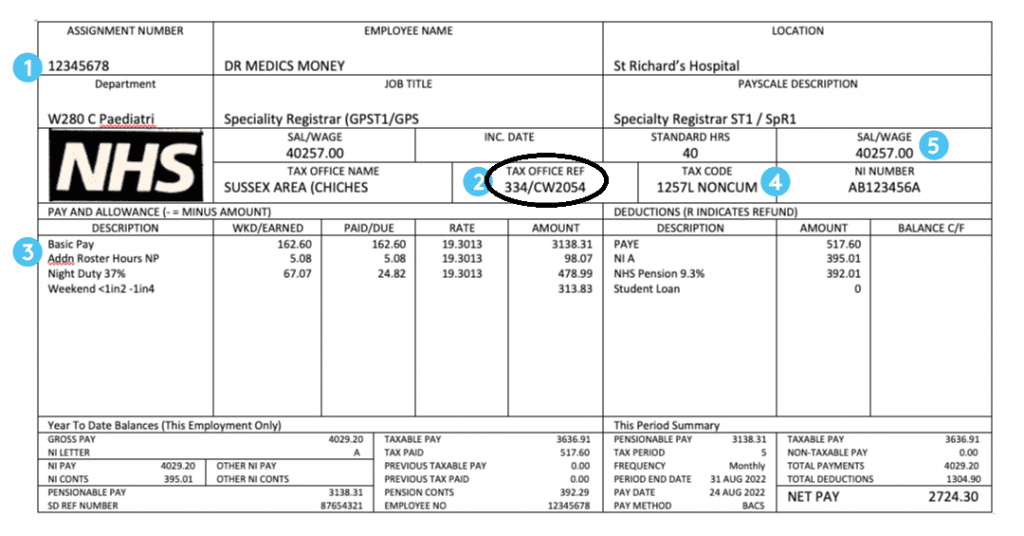

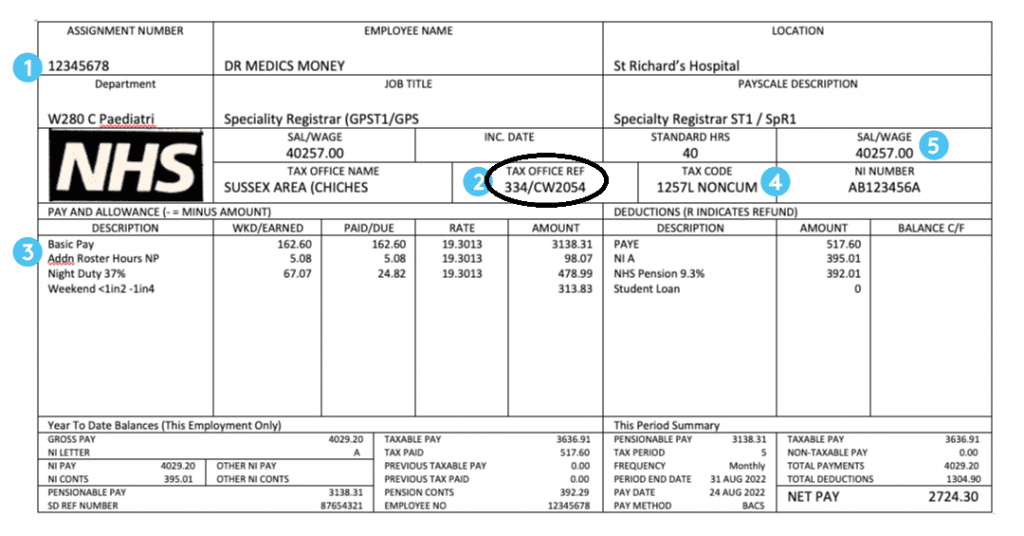

Every organisation operating a Pay As You Earn PAYE scheme is allocated an ERN a unique set of letters and numbers used by HMRC and others to identify each employer consisting of a three digit HMRC office number and a reference number unique to each business HMRC office number The first part of your employer PAYE reference 3 digits this is on the letter HMRC sent you when you registered as an employer You can also find it on P6 or P9 coding

Hmrc Paye Reference Number Format

Hmrc Paye Reference Number Format

https://osome.com/content/images/size/w380/2019/11/find-paye-reference-number-on-p60-1.png

What Is Employer s PAYE Ref Number Claim My Tax Back

https://claimmytaxback.co.uk/wp-content/uploads/2022/12/p60-647x1024.jpg

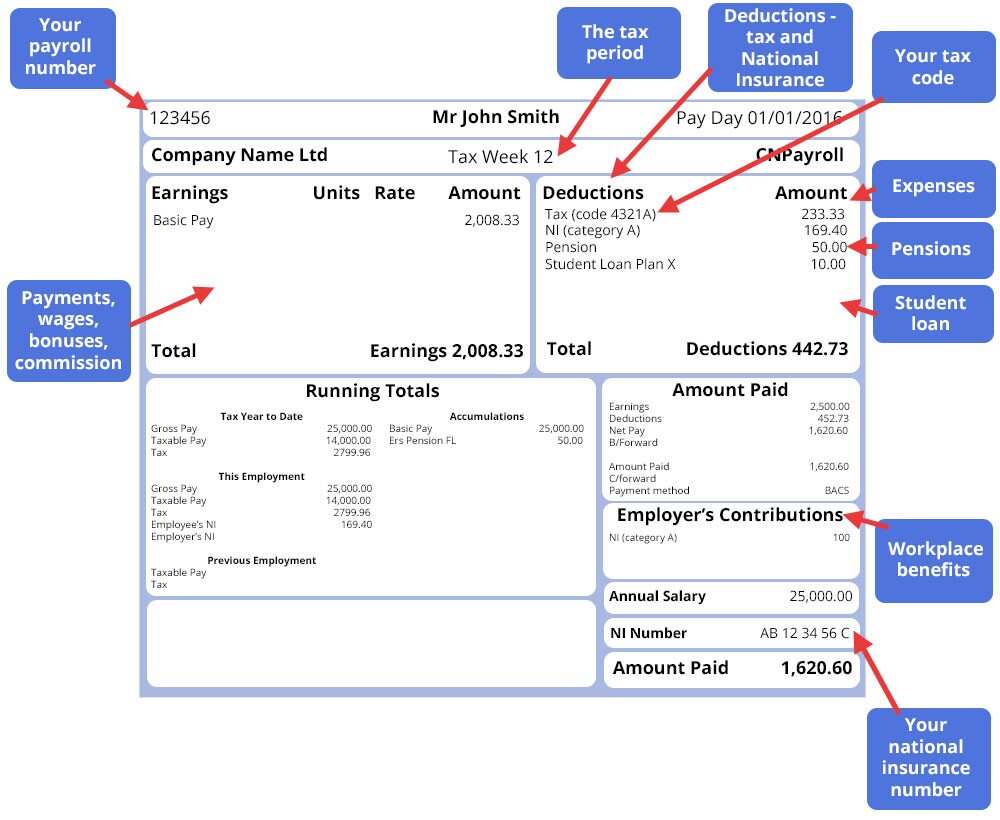

21 Free Payslip Templates Printable Word Excel PDF Templates

https://i.pinimg.com/736x/c4/3f/79/c43f79ccafdf2c286422d7f449423713.jpg

You ll need to use your 13 character accounts office reference number as the payment reference You can find this in your HMRC online account on the letter HMRC sent you when you When you send a payment to HMRC for your tax and national insurance on payroll you should include a reference number which tells HMRC who the payment is from and to which month and year the payment relates to

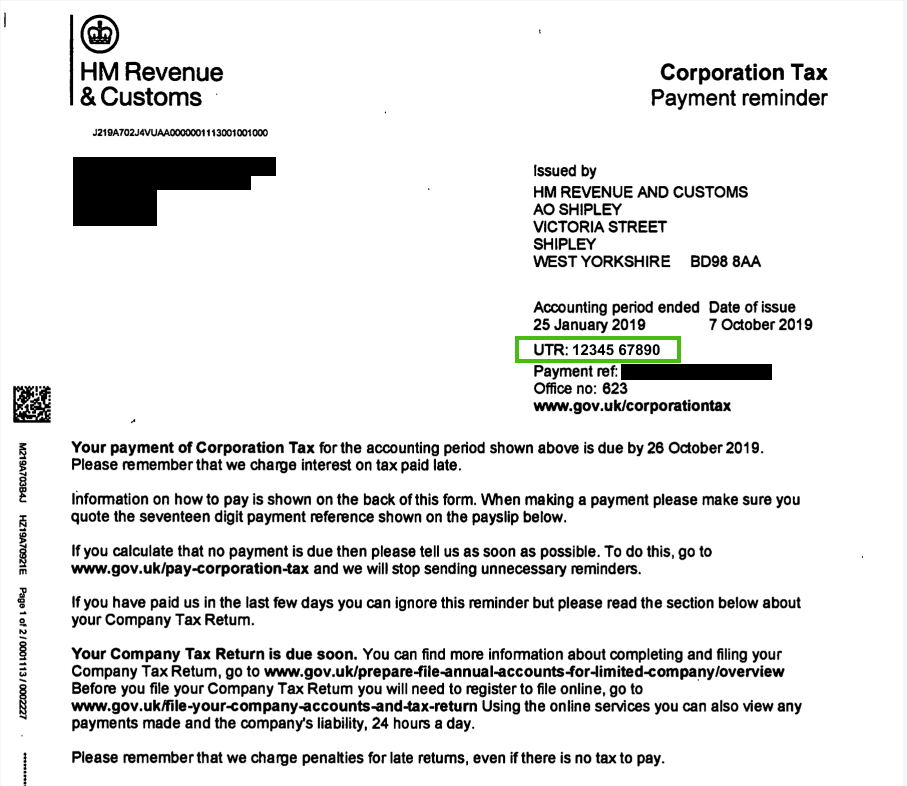

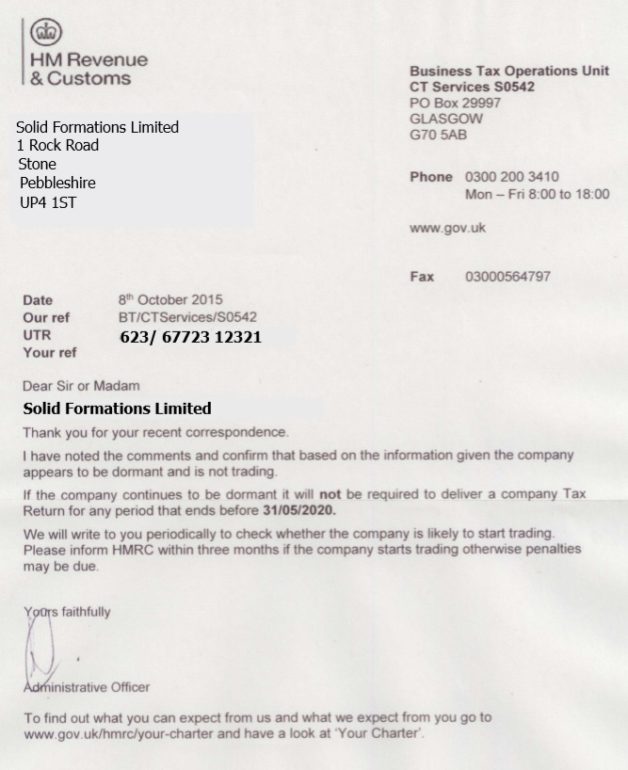

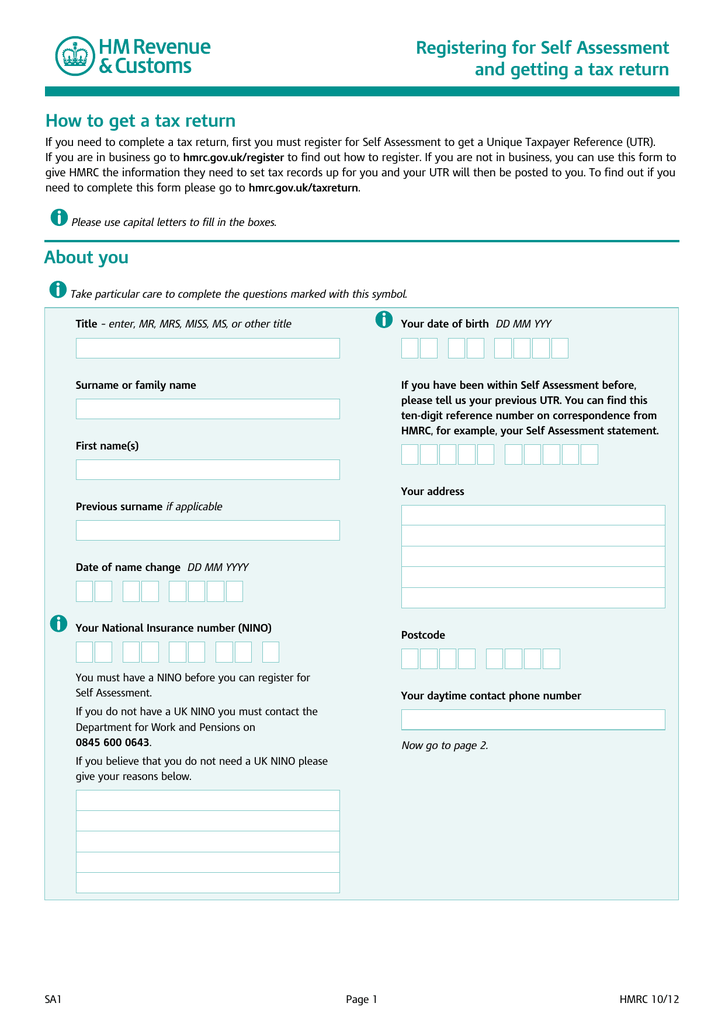

A PAYE Pay As You Earn reference number is a unique identifier that HMRC assigns to every employer It s an 8 digit number in the format of 3 digits a slash and 4 digits e g 123 ABCD Your PAYE reference number is a crucial part of reporting your payroll information to HMRC What is an Accounts Office Reference Number AORN This 13 digit reference number will be shown as a series of letters and numbers usually in the following format 123PA12345678 You ll need to use this reference when you make PAYE payments to

Download Hmrc Paye Reference Number Format

More picture related to Hmrc Paye Reference Number Format

What Is Employer s PAYE Ref Number Claim My Tax Back Employer PAYE

https://vaultarch.com/debc0cb6/https/56f168/claimmytaxback.co.uk/wp-content/uploads/2022/12/p45.png

How To Write A Dispute Letter To Hmrc Amos Writing

https://i2.wp.com/businessadviceservices.co.uk/wp-content/uploads/2017/12/requirement-to-give-security-for-PAYE-redact.jpg

Paye reference sole trader limited company InvoiceBerry Blog

https://i0.wp.com/www.invoiceberry.com/blog/wp-content/uploads/2018/09/paye-reference-sole-trader-limited-company.gif

An ERN Employer Reference Number is issued to every UK company that registers as an employer It is also referred to as a PAYE reference number because it is used as a unique identifier by HMRC when processing payroll information such as income tax and National Insurance Ensuring the correct format of the PAYE reference number is vital for accurate processing of payroll and tax submissions Errors in the reference number can lead to delays in processing payments and submissions and may result in penalties or fines from HMRC

The reference number consists of two parts a three digit HMRC office number and a reference number unique to your business Usually it looks something like 123 A56789 or 123 AB56789 with some exceptions You will need your employer Employers should use the PAYE Settlement Agreement PSA reference number as the payment reference It starts with an X and is on the payslip sent by HMRC Employers who cannot find their PSA number should contact the office dealing with the application

What Is Employer s PAYE Ref Number Claim My Tax Back

https://claimmytaxback.co.uk/wp-content/uploads/2022/12/wage-slip-1024x536.png

How Can I Work Out My Payment Reference When Paying PAYE To HMRC

https://static.wixstatic.com/media/cee7ec_2bdff07222ec411588edb64600dd6007~mv2.png/v1/fill/w_980,h_980,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/cee7ec_2bdff07222ec411588edb64600dd6007~mv2.png

https://www.litrg.org.uk/news/how-find-your-employer-paye-reference

A PAYE reference number or Employer Reference Number consists of a unique set of letters and numbers used by HMRC to identify your employer and their Pay As You Earn PAYE scheme The reference is in two parts

https://en.wikipedia.org/wiki/Employer_Reference_Number

Every organisation operating a Pay As You Earn PAYE scheme is allocated an ERN a unique set of letters and numbers used by HMRC and others to identify each employer consisting of a three digit HMRC office number and a reference number unique to each business

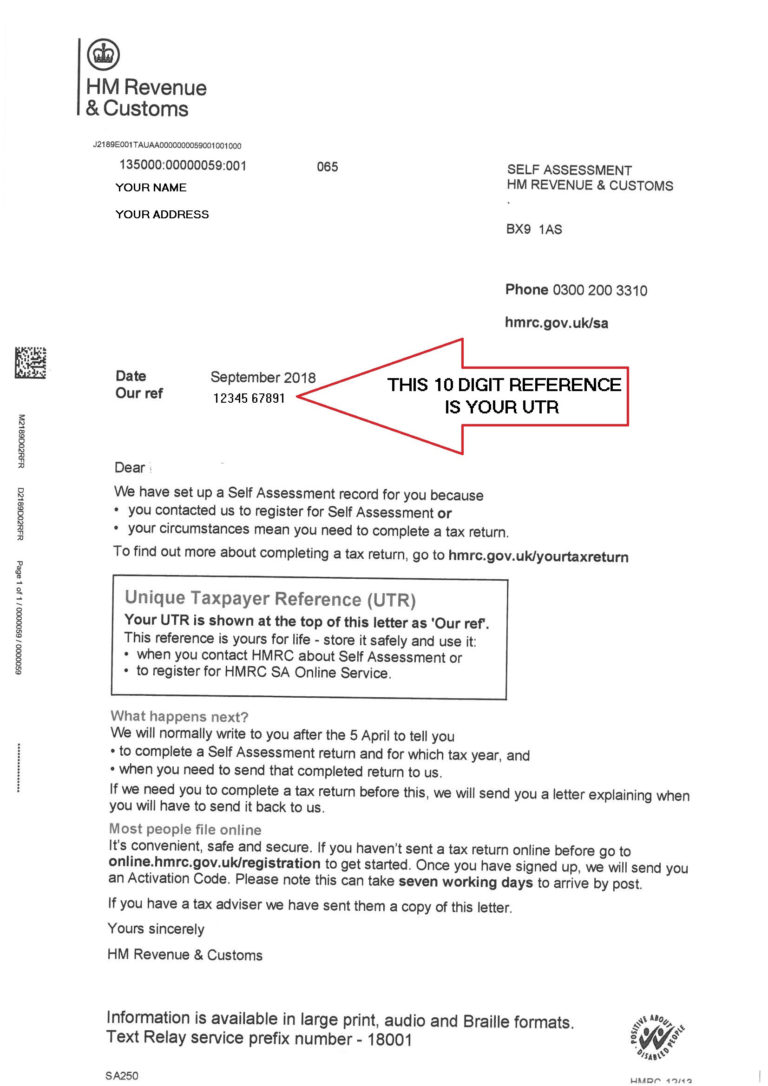

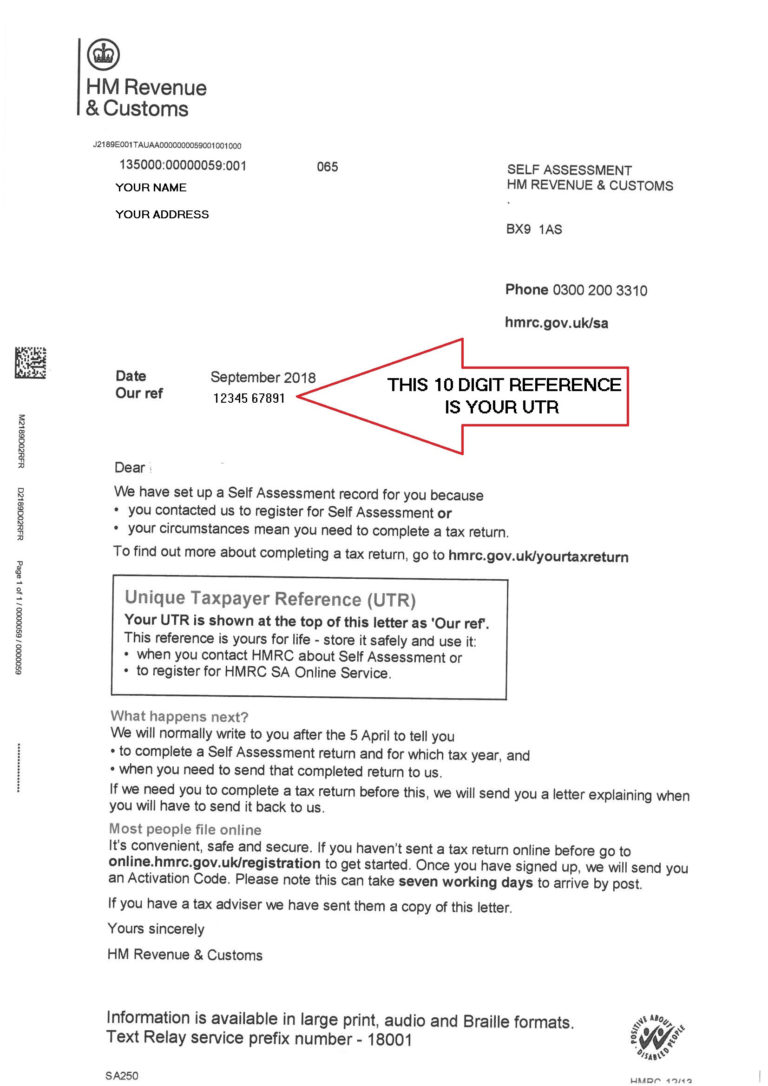

What Are PAYE UTR And Tax Payroll Reference Numbers

What Is Employer s PAYE Ref Number Claim My Tax Back

UTR UTR JapaneseClass jp

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

Exp Code On Invoice Hybridlasopa

Information Guide For Unique Tax Reference Numbers

Information Guide For Unique Tax Reference Numbers

Understanding Your Salary Pay Slip In Ghana YEN COM GH

Dormant Account Activation Request Letter Cricketgawer

Hmrc X Rates Management And Leadership

Hmrc Paye Reference Number Format - Using the correct payment reference when paying HMRC for PAYE is vital By ensuring the right combination of your Accounts Office Reference Number and the relevant tax year and month you can make certain that your payment is credited accurately